AMP to Fast Track Chairman Selection

04 May 2018 - 12:07PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Wealth-manager AMP Ltd. (AMP.AU) has

pledged to fast track the selection of a new chairman as it seeks

to recover from a scandal that has erupted over fees charged to

customers who didn't receive any service.

Catherine Brenner resigned from the board earlier this week,

accepting accountability in her role as chairman for governance

failings at the Australian firm. That came a little over a week

after Chief Executive Craig Meller agreed to bring forward his

retirement, stepping down with immediate effect.

The full board of AMP has elected to take a 25% cut in

directors' fees for the remainder of the year, and AMP said Friday

it accepted that further board renewal was necessary, including the

appointment of a new non-executive director.

The last round of public hearings in an ongoing judicial probe

of misconduct in Australia's financial industry focused on fees for

no service at AMP as a case study.

In a fresh submission to the royal-commission inquiry on Friday,

AMP said that the issues raised weren't new and had been disclosed

to the securities regulator in October 2017 and in evidence to the

commission in March. To date, it said 15,712 customers had been

refunded a total of 4.7 million Australian dollars (US$3.5

million), but conceded the process had been too slow.

AMP also said it had acknowledged communications with the

Australian Securities and Investments Commission by its advice

business had been misleading. It said that any misrepresentation,

even inadvertent, was unacceptable, but added the seven instances

of misrepresentations weren't "new news."

The company also said it strenuously denied allegations made by

counsel assisting the royal-commission probe that AMP had committed

a criminal offense. It said the issues raised in the case study

concerned matters almost entirely the subject of an ongoing ASIC

investigation that had begun in 2015.

The issues related to fees charged by AMP's advisers without

providing a service, as well as fees charges by licensees without

providing a service.

Worries over the royal-commission's study of the matter, and

what the probe will ultimately recommend to the government, have

hit AMP's shares hard. The stock slumped 19% in April, though had

started to recover the early part of this week.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

May 03, 2018 21:52 ET (01:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

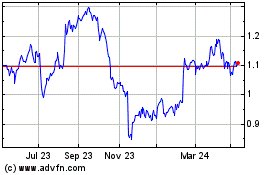

AMP (ASX:AMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

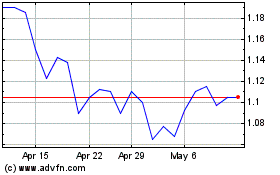

AMP (ASX:AMP)

Historical Stock Chart

From Mar 2024 to Mar 2025