UPDATE: Alinta Energy Receives Trade Bids

13 September 2010 - 6:30PM

Dow Jones News

Distressed power company Alinta Energy Group (AEJ.AU) said

Monday it has received a number of bids for its whole business and

individual assets.

The owner of 12 operational power stations said it expects to

talk with its lenders this week about the trade bids and other

options for reducing its debt. The company, which warned in June

its loan covenants may come under pressure, has also been

considering an equity raising.

"The bids remain confidential, and only capable of acceptance

subject to a number of terms and conditions including access to

black box due diligence information and consideration by lenders,"

Alinta said in a statement.

Alinta said on June 23 that it had received a number of

indicative takeover bids as it warned that its loan covenants could

come under pressure and it had asked its lenders to vary them.

Any buyer of Alinta would have to take on about A$3 billion in

debt, with the company currently trading at a market value of

around A$43 million after its securities were hammered in the wake

of the global financial crisis.

The former satellite fund of failed investment house Babcock

& Brown Ltd. said in April it had hired Lazard to examine ways

to reduce its heavy debt load, including potential asset sales and

capital management opportunities.

UBS AG is advising Alinta on the asset sales process.

-By Rebecca Thurlow, Dow Jones Newswires; 61-2-8272-4679;

rebecca.thurlow@dowjones.com

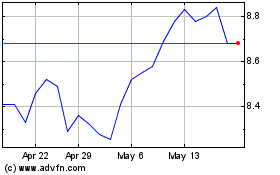

APA (ASX:APA)

Historical Stock Chart

From Jan 2025 to Feb 2025

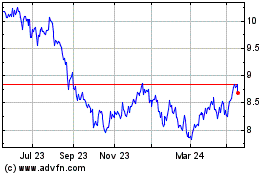

APA (ASX:APA)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about APA Group (Australian Stock Exchange): 0 recent articles

More APA Group News Articles