Australian Shares End Week Higher, Lifted by Resources Stocks

24 December 2015 - 3:13PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--A Christmas Eve rally has pushed

Australia's equities market to its highest close since the start of

the month, buoyed by resources stocks as oil and other commodities

recover some of this year's lost ground.

In a holiday-shortened trading day, the S&P/ASX 200 finished

65.8 points, or 1.3%, higher at 5207.6.

After seven straight gains, the index is at its highest level

since Dec. 3, having advanced 2% for the week. Still, it remains

down 3.8% in 2015.

The baskets of energy and materials stocks each rose by more

than 3%, while the heavily-weighed financials sector gained

1.2%.

"Sentiment toward the commodity sector was helped by a

surprisingly large drop in U.S. oil inventories last week as well

as recent signalling from Chinese authorities that more stimulus is

on the way," said Ric Spooner, chief market analyst at CMC Markets,

adding that the rally left some investors scrambling after finding

themselves on the wrong side of recent moves in commodity prices

and resources stocks.

Still, trading volumes have been thin all week in the run up to

the holidays, and were about 50% below the 30-day average on

Thursday, IG market analyst Angus Nicholson said.

Woodside Petroleum climbed 2.1%, Oil Search rose 3.8%, Santos

added 2.7% and Origin Energy gained 6.2%.

Among mining shares, BHP Billiton jumped 5.3%, Rio Tinto was

4.4% higher and Fortescue Metals Group rose 5%.

The four largest banks were each up more than 1%, led by a 1.6%

gain in Commonwealth Bank of Australia.

For the day, 1.1 billion shares valued at 2.14 billion

Australian dollars (US$1.55 billion) were traded, Commonwealth

Securities said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 23, 2015 22:58 ET (03:58 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

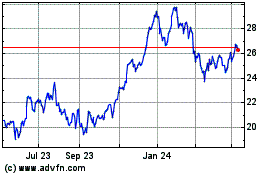

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024