Hexagon Energy Materials Limited (ASX:HXG)

(“

Hexagon” or the “

Company”) is

pleased to announce strong shareholder support for its updated

business strategy. Shareholders voted overwhelmingly to support the

change of the Company’s name to

Hexagon Energy Materials

Limited, reflecting Hexagon’s expanded strategy to include

downstream rare-earth processing; rare-earths also being a critical

component of the high-growth renewable-energy, energy-storage and

electric-vehicle sectors.

At the Company’s Annual General Meeting on November 22, 2019,

Chairman Charles Whitfield told shareholders, “We believe that the

RapidSX™ rare earth element (“REE”) separation

technology, developed by Innovation Metals Corp.

(“IMC”) that Hexagon has optioned has the

potential to transform the rare earths value chain as it

fundamentally changes the economics around new REE project

development. At the same time, Western businesses and governments

are becoming increasingly focused on security of supply and the

RapidSX process could unlock resources and supply chains to provide

a competitive alternative for industry.”

Hexagon’s Managing Director, Mike Rosenstreich

commented, “Picking up on Charles’ remarks at the AGM and

given the strong support for Hexagon’s expanded strategy and entry

into REE processing, we plan to start funding development of the

Commercial Demonstration Plant forthwith.”

“Initial work will comprise finalization of the capital budget

and schedule leading to commencement of front-end engineering and

design work so that ordering and construction can commence early in

Q1 of 2020. To earn our 49% interest in American Innovation

Metals Inc. (“AIM”), we need to fund the

US$2 million build-out of the Demonstration Plant and global patent

applications.

We are very excited by this opportunity and with shareholder

endorsement we want to get on with it. We look forward to working

with IMC’s principals to commercialize the RapidSX approach to meet

the wide interest that we are aware of from both existing REE

producers and advanced project sponsors.”

Background: Investment into American Innovation

Metals

More than 99% of votes cast at the recent Annual General Meeting

of Hexagon Shareholders were for a change in the nature and scale

of the Company’s activities through the acquisition of a 49%

interest in AIM, a special purpose vehicle to commercialize the

RapidSX processing technology, which separates the REEs contained

in chemical concentrates produced by mine-site operators, to

subsequently produce rare-earth oxides (“REOs”)

for use by various downstream manufacturers. The RapidSX technology

was developed by private Canadian company IMC, the 51% partner in

AIM.

For more information about Hexagon's REE business with IMC,

please refer to the Company's October 10, 2019 announcement

entitled, “Hexagon Enters Rare Earths Downstream Processing

Industry”.

AIM InvestmentHexagon has a binding Investment

Agreement to acquire 49% of the RapidSX technology for REE

separation through AIM. The key points are:

- Investment is US$6.0M, comprising:

-

- US$2.0M to build out a Commercial Demonstration Plant

(“CDP”) within 12 months; and

- US$4.0M in deferred payments, payable through Hexagon’s share

of future AIM cash flows.

- Hexagon will contribute commercial and marketing skills,

identify/secure feedstocks, generate RapidSX licencing

opportunities, and sales/offtakes for REOs produced.

The CDP is planned to be financially self-sustaining following

the initial investment for the build-out. Ultimate

commercialization could follow-on quickly centred on licensing

agreements with interested producers.

REE and Separation Technologies

REOs such as oxides of praseodymium, neodymium, terbium and

dysprosium are the precursors used in the production of REE

permanent magnets (“REPMs”). REPMs are critical

components for more efficient traction motors for electric

vehicles, and direct-drive wind turbine generators for renewable

power generation, as well as several key defense and high-tech

industrial technology applications.

Hexagon considers that REE separation for the production of REOs

is the key supply-chain constraint with approximately 85% of REOs

produced in China in an opaque and highly controlled market. The

dominant separation technology employed for REE separation is

solvent extraction (“SX”) which in its

conventional form, is highly capital intensive requiring a very

large plant footprint to accommodate up to 1,500 individual

mixer-settler units to achieve the desired separated REE

products.

RapidSX is a form of accelerated SX which IMC has developed and

operated successfully at pilot scale for various mixed REE chemical

concentrate types, with financial support from the United States

Department of Defense. The pilot program demonstrated significant

(approximately 70% to 90%) capital cost savings on the equivalent

conventional SX separation plant, as well as reduced operating

costs. Table 1 below highlights the advantages of RapidSX over

conventional SX — the only proven, commercial and established REE

separation technology. Table 1: Features of RapidSX

compared to conventional SX circuits

|

|

RapidSXTM |

Conventional Solvent Extraction |

Comment |

|

Performance & Efficiency |

|

|

Commercial Purity |

Yes |

Yes |

- Increased Separation Kinetics Faster metals separation

- Agnostic on feedstock type Robust process capable of taking

LREE-rich, HREE-rich and even blends of mixed REE feedstocks

|

|

REE Recovery Rates |

High |

High |

|

Processing Time |

Rapid |

Slow |

|

Time to Equilibrium |

Days |

Several Weeks |

|

CAPEX |

|

|

Equipment Cost |

Low |

High |

- Considerably reduced footprint

- Commercially Available All construction materials, equipment

and chemistry are readily available with no ‘black-box’

technology

|

|

Separation Staging |

90% Reduction |

Very High |

|

OPEX |

|

|

Metal Inventory/WIP |

Low |

High |

- Low Costs <US$2/kg for LREOs*<US$12/kg for HREOs*

- Significantly reduced separation times

* Estimated OPEX figures from IMC RapidSX pilot test program |

|

Organic Volumes |

Low |

High |

|

Labor |

Low |

High |

|

Power Consumption |

Low |

High |

| |

|

|

|

About Hexagon Energy Materials LimitedHexagon

Energy Materials Limited is listed on the Australian Securities

Exchange (“ASX”) under the ticker code “HXG”. The Company holds a

100% interest in the McIntosh Graphite Project in Western Australia

and an 80% interest in the Ceylon Graphite Project in Alabama, USA.

With a current focus on the downstream processing of graphite and

other energy materials, Hexagon has attained formidable technical

knowledge based on test work of its McIntosh project flake-graphite

material, which is applicable and highly valuable for a range of

specialty-material applications. The Company’s focus is on creating

sustained shareholder value by maximizing near-term growth

opportunities to commercialize that downstream business in the USA,

where it has forged strong technical, commercial and investor

relationships.

Learn more at www.hexagonresources.com

Forward-Looking StatementsThis news release

contains projections and statements that may constitute

"forward-looking statements" within the meaning of applicable

United States, Canadian and other laws. Forward-looking statements

in this release may include, among others, statements regarding the

future plans, costs, objectives, or performance of Hexagon Energy

Materials Limited or the assumptions underlying any of the

foregoing. In this news release, words such as "may", "could",

"would", "will", "likely", "believe", "expect", "anticipate",

"intend", "plan", “goal”, "estimate," and similar words, and the

negative forms thereof, are used to identify forward-looking

statements. Forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that are beyond the

control of Hexagon Energy Materials Limited, and which may cause

the actual results, level of activity, performance or achievements

of Hexagon Energy Materials Limited to be materially different from

those expressed or implied by such forward-looking statements. Such

risks and uncertainties could cause actual results, plans and

objectives of Hexagon Energy Materials Limited to differ materially

from those expressed in the forward-looking information. Hexagon

Energy Materials Limited can offer no assurance that its plans will

be completed. These and all subsequent written and oral

forward-looking information are based on estimates and opinions of

Hexagon Energy Materials Limited management on the dates they are

made and expressly qualified in their entirety by this notice.

Except as required by law, Hexagon Energy Materials Limited assumes

no obligation to update forward-looking information should

circumstances or the estimates or opinions of Hexagon Energy

Materials Limited management change.

North American Media and Investor Relations

Contact:

G&W Communications Inc. telephone: +1

416 915 3150email: hexagon@g-w.ca

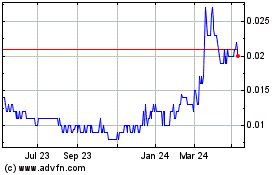

Hexagon Energy Materials (ASX:HXG)

Historical Stock Chart

From Dec 2024 to Jan 2025

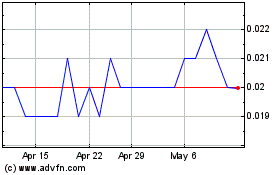

Hexagon Energy Materials (ASX:HXG)

Historical Stock Chart

From Jan 2024 to Jan 2025