MARKET MOVEMENTS:

-- Brent crude oil is up 0.2% at $74.28 a barrel.

-- European benchmark gas is up 1.8% at EUR33.83 a megawatt

hour.

-- Gold futures are 0.1% higher at $2,022.30 a troy ounce.

-- LME three-month copper futures are up 0.9 % at $8,317 a

metric ton.

-- Wheat futures are 1.2% higher at $6.43 a bushel.

TOP STORY:

The World's Biggest Gold Miner Bets Big on Copper

Newmont said it has agreed to acquire Australia's Newcrest

Mining for $17.5 billion, concluding weeks of talks over a

sweetened offer by the U.S. company that wants to complete the

largest-ever merger and acquisition deal in the gold-mining

industry.

Newmont's pursuit of Newcrest illustrates how gold producers are

seeking to make deals as the industry is struggling to make large

discoveries of the precious metal. It also extends a battle for

control among miners for commodities essential for making electric

vehicles and renewable-energy infrastructure, as Newcrest's gold

mines also produce significant amounts of copper.

The global mining sector is experiencing a wave of deal making

not seen for years, contrasting with a lull in overall global

M&A activity. While gold producers, including Newmont, had been

active seeking mines that could replace aging operations and lower

costs, the industry's hunger for deals has broadened out to

encompass many of the world's biggest mining companies, such as BHP

and Glencore.

OTHER STORIES:

$14 Billion Deal to Create Mega-Pipeline Company

Pipeline operator Oneok agreed Sunday to buy smaller rival

Magellan Midstream Partners for about $14 billion, a deal that

would form one of the biggest U.S. companies involved in

transporting and storing energy.

The deal's price tag, including $8.8 billion in equity and $5.1

billion in cash, amounted to a 22% premium over Magellan's common

units as of Friday. Oneok said it would assume Magellan's $5

billion in net debt. The deal was expected to close in the third

quarter, pending the approval of regulators and investors.

The proposed tie-up would be by far the biggest U.S. energy deal

announced so far this year. Some analysts have said the U.S.

oil-and-gas sector is ripe for major corporate transactions this

year, after energy prices surged last year and left companies with

a large windfall of cash. In Oneok's case, much of the cash portion

would be financed through a debt offering, it said.

--

RIP to the Lumber-Futures Contract That Jumped During

Covid-19

The lumber-futures contract that soared during the pandemic and

heralded the Covid-19 building boom, broken supply chains and

inflation will trade in its final session on Monday.

The longtime barometer of wood prices and building activity is

being retired and replaced with a new lumber-futures contract in an

effort by exchange operator CME Group to boost trading.

Lumber-futures trading dwindled as prices and volatility surged

and risk ballooned. By early last year they were so thinly traded

and prices so wild that on many days buying and selling was nearly

impossible. The price would race up or down at the open by the most

allowed by exchange rules and trading would be frozen for the

day.

--

Platinum Market to Move to Near Million-Ounce Deficit on Tight

Supply, Higher Demand

The platinum market is forecast to move to a nearly one million

ounce deficit in 2023, amid stronger demand from the investment

sector and constrained supply from South Africa.

The market is now expected to see a deficit of 983,000 ounces

this year, a shift of 1.8 million ounces from the 854,000 ounce

surplus seen in 2022, according to a new report from the World

Platinum Investment Council released on Monday.

Much of the move has come from demand strengthening for the

precious metal, WPIC said, with demand rising in the first quarter

of 2023 to 2 million ounces--up from 1.691 million ounces in the

fourth quarter of 2022--due to an upswing from the investment

sector as well as continued improved buying in the auto and

industrial sectors.

MARKET TALKS:

Grains Higher After Turkey Election Appears to Head to

Run-Off

0739 GMT - Grain markets are pushing higher after Turkey's main

candidates for president said they were both ready to accept a

run-off election later this month. Wheat futures in Chicago are up

1.1% to $6.42 a bushel while corn is up 0.4% to $5.89 a bushel. The

Black Sea Grain Initiative is due to expire Thursday and Turkey has

been one of the key brokers so far in ensuring food has passed out

of Ukraine. Negotiations around the corridor will be the main focus

this week in agricultural markets, according to Dave Whitcomb, head

of research at Peak Trading Research. "Wheat markets will follow

Grain Corridor headlines all week," he says in a note.

(yusuf.khan@wsj.com)

--

Oil Weakness Continues on Demand Worries

0735 GMT - Oil prices edge lower, adding to sharp losses this

month, as demand signals look weak while supplies have remained

strong. Brent crude oil declines 0.4% to $73.88 a barrel, while WTI

weakens 0.3% to $69.81 a barrel. Both have fallen over 8% so far

this month. "The sell-off in the market has been unrelenting over

recent weeks, with negative sentiment rising following concerns

over the macro environment and what it could eventually mean for

oil demand," ING says in a note. Oil supplies could also get a

boost in the coming days if a pipeline linking them to Turkey

restarts as suggested by Iraqi officials last week.

(william.horner@wsj.com)

--

Metals Are Mixed Ahead of Light Data Week

0722 GMT - Metal prices are mixed with concerns about the

macroeconomic outlook still weighing on investors, ahead of what is

a light data week for policy makers. Three-month copper is up 0.4%

to $8,276.50 a metric ton while aluminum is down 0.2% to $2,239.50

a ton. Gold meanwhile is up 0.1% to $2,021.70 a troy ounce. Last

week, copper fell more than 4%--the largest weekly fall since

February for the red metal. "China's uneven recovery has weighed on

sentiment in the base metals market," ANZ Research says in a note,

but adds that physical demand indicators are showing signs of

improvement. "Stockpiles held on exchange are down, while operating

rates of downstream processors in China have bounced sharply."

(yusuf.khan@wsj.com)

--

Chinese Lithium Producers' Outlook Likely Brightening

0525 GMT - Chinese lithium producers' earnings outlook is likely

brightening, as EV battery makers are likely to start restocking

their lithium supplies soon, Citi analysts say. Lithium sales and

prices have been under pressure in recent months as China's EV

sales slowed after the expiry of a government purchase subsidy

program. The EV industry is a major source of demand for lithium,

which is widely used in batteries. Citi notes that major battery

manufacturer CATL has recently noted sequential order improvement,

a sign that "an inflection point" may be emerging for EV battery

production rebound and the consequent lithium demand recovery, Citi

says. (yifan.wang@wsj.com)

Write to Yusuf Khan at yusuf.khan@wsj.com

(END) Dow Jones Newswires

May 15, 2023 05:43 ET (09:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

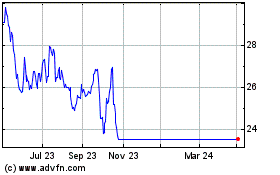

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Jan 2025 to Feb 2025

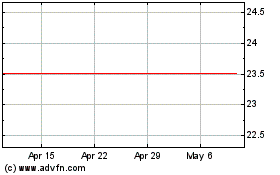

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Feb 2024 to Feb 2025