Treasury's Lew Tours Puerto Rico to Urge Congress to Act

10 May 2016 - 4:30AM

Dow Jones News

SAN JUAN, Puerto Rico—Treasury Secretary Jacob Lew on Monday

traveled to Puerto Rico for the second time this year to underscore

the administration's growing concern of a large debt default this

summer unless Congress intervenes.

Mr. Lew's agenda includes tours of a hospital, school and

business district on the island to highlight how the migration of

Puerto Ricans, who are U.S. citizens, to the mainland threatens to

extend an economic recession that has lasted for most of the last

decade.

Mr. Lew's primary audience is likely back in Washington, where

lawmakers are completing legislation this week pushed by House

Speaker Paul Ryan (R., Wis.) to allow Puerto Rico some authority to

restructure its nearly $70 billion in debt. The legislation would

also create a federal oversight board to ensure local compliance

with balanced budget standards.

"In the absence of a restructuring, what you will end up with is

a chaotic unwinding which does enormous harm to millions of

Americans," Mr. Lew said last week at a conference in Los

Angeles.

Puerto Rico faces a health-care crisis as reduced funding drives

doctors to the mainland. Migration of working families has also

accelerated in recent years, dropping the population of school-age

children. The population loss has created an even steeper uphill

climb for the island's business sector, which is facing higher

sales taxes to help close perennial budget deficits.

In Congress, the legislation has been the product of unusually

bipartisan negotiations between both parties and the Treasury

Department, but it faces deep concerns from some conservative

Republicans. Bondholders have objected loudly to legislation that

would force them to accept upfront losses on debts that the

island's government says it can't repay.

House Republicans last month scrapped a vote on the bill to make

modifications after some lawmakers raised concerns that the

legislation, which doesn't commit taxpayer funds, would be

construed as a bailout.

Those concerns have since subsided, but conservatives have

raised separate concerns that the legislation would be used to

elevate the standing of pensioners ahead of bondholders. Puerto

Rico not only faces a large debt load, but its pension system has

more than $40 billion in unfunded obligations and is likely to

exhaust its reserves later this decade.

Because Puerto Rico isn't a state, its municipalities and public

corporations can't file for bankruptcy protection, and because it

isn't a country, it can't seek assistance from the International

Monetary Fund. Gov. Alejandro Garcí a Padilla has warned of a

growing humanitarian crisis as the spread of the Zika virus tests

an already strained public-health infrastructure and pinches the

island's tourism sector.

Last week, Major League Baseball said it would move games

scheduled for later this month between the Pittsburgh Pirates and

Miami Marlins from San Juan to Miami after players on both clubs

raised concerns about traveling to Puerto Rico due to Zika. "It's

offensive. It's just ignorance," said Mr. Garcí a Padilla in an

interview last week.

He also said the territory won't make a roughly $800 million

payment on the island's general-obligation debt due July 1, which

could trigger a new round of lawsuits from and between creditors

who hold bonds with differing security pledges.

Treasury officials worry this will only forestall any chance of

attracting private investment and boosting job growth in Puerto

Rico. "The cost of delay is that you get to a point where there's

nothing to restructure," said Mr. Lew last week.

Puerto Rico has been mired in a recession for a decade and

borrowed heavily to balance budgets. Despite the shaky economy,

investors snapped up its debt for years thanks to generous tax

incentives. The borrowing spree plugged annual deficits but did

little to create economic opportunity on the island.

Write to Nick Timiraos at nick.timiraos@wsj.com

(END) Dow Jones Newswires

May 09, 2016 14:15 ET (18:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

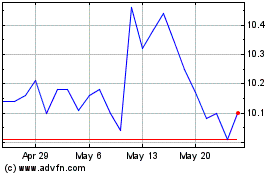

Pacific Current (ASX:PAC)

Historical Stock Chart

From Apr 2024 to May 2024

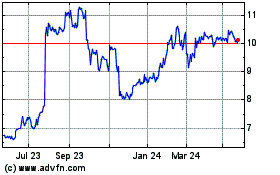

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2023 to May 2024