Santos Has Takeover Proposal for Oil Search Rejected

20 July 2021 - 10:28AM

Dow Jones News

By David Winning

SYDNEY--Santos Ltd. said it approached Oil Search Ltd. about a

possible merger last month, but its proposal to create an energy

company with a market value of 22 billion Australian dollars

(US$16.1 billion) was rejected.

Santos said it offered 0.589 of its own shares in exchange for

each Oil Search share on issue. A deal would have led to Santos

shareholders owning 63% of the combined company, with Oil Search

investors holding the remaining stock.

The proposal implied a value of A$4.25 for each Oil Search

share, Santos said, representing a 16% premium to the stock's

closing price on Monday.

"The potential merger of Santos and Oil Search is a logical

combination of two industry leaders to create an unrivalled

regional champion of size and scale," Santos said in a regulatory

filing.

Oil Search is Papua New Guinea's largest oil producer and owns a

minority stake in the Exxon Mobil Corp.-operated PNG LNG gas-export

project in the country, which also counts Santos as an investor.

Oil Search also owns undeveloped oil reserves in Alaska that it

hopes to develop if it can bring in another investor.

News of the merger proposal comes a day after Oil Search said

Managing Director Keiran Wulff had resigned for health reasons, and

named Chief Financial Officer Peter Fredricson as acting chief

executive with immediate effect.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

July 19, 2021 20:13 ET (00:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

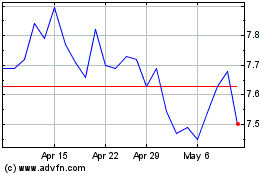

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

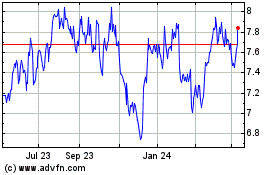

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Santos Limited (Australian Stock Exchange): 0 recent articles

More Santos Limited News Articles