INTERVIEW: New Hope Open To Takeover Offers At Right Price

20 September 2011 - 5:58PM

Dow Jones News

Australian coal miner New Hope Corp. Ltd. (NHC.AU) would be open

to takeover offers if suitors came up with worthwhile bids,

although only informal "tire kickers" have made approaches so far,

Managing Director Robert Neale said Tuesday.

New Hope will be the largest-listed Australian coal producer by

both output and market capitalization if Rio Tinto PLC (RIO) and

Mitsubishi Corp. (8058.TO) succeed in buying out minority

shareholders in Coal & Allied Industries Ltd. (CNA.AU), a deal

which values the target at 10.8 billion Australian dollars (US$11

billion).

The concurrent joint bid by Peabody Energy Corp. (BTU) and

ArcelorMittal (MT) for Macarthur Coal Ltd. (MCC.AU), valuing

Macarthur at A$4.83 billion, would leave just a handful of

pure-play coal miners left on the Australian market, even though

the country is the world's largest coal exporter by volume.

"There aren't too many green bottles left standing on the wall,"

Neale said in an interview with Dow Jones Newswires Tuesday.

"My business is to maximize the value of what we've got at any

one time, and our whole strategy has been if someone else is

prepared to offer more than the value that we can extract, we will

sell," he said.

The 59.7% shareholding owned by investment group Washington H.

Soul Pattinson & Co. (SOL.AU) could be viewed by potential

suitors as a block to any hostile takeover offer, or an opportunity

to secure majority control quickly. Notably, New Hope and Soul

Pattinson share the same chairman in Rob Millner.

"Rob (Millner) always says that at the right price everything's

for sale, and he's actually dead right," Neale said. "If we get a

good price then we've done the right thing by the

shareholders."

New Hope has a market capitalization of A$4.23 billion, although

its A$1.67 billion in cash and term deposits would significantly

lower the company's effective cost to a potential buyer.

The Brisbane-based company has a track record of trading assets

for the benefit of investors. In mid-2008, New Hope sold its Saraji

coking coal mine in Queensland state to the BMA joint venture of

BHP Billiton Ltd. (BHP) and Mitsubishi Corp. for US$2.4

billion.

In annual results Tuesday, the company said net profits more

than doubled to A$503.1 million in the year to July 31, largely

owing to A$369.8 million earned from selling its stakes in Arrow

Energy Ltd. and the Lenton coking coal project.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689; david.fickling@dowjones.com

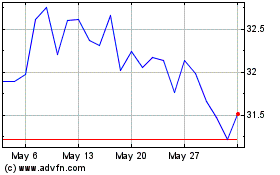

Washington H Soul Pattin... (ASX:SOL)

Historical Stock Chart

From Apr 2024 to May 2024

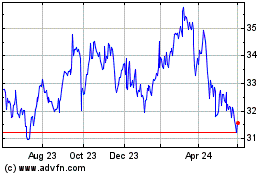

Washington H Soul Pattin... (ASX:SOL)

Historical Stock Chart

From May 2023 to May 2024