Michael Egorov’s $100 Million Position, A Risk To Curve Finance And DeFi?

02 August 2023 - 8:30AM

NEWSBTC

Following the recent exploit of Curve Finance pools, there have

been genuine concerns about the stability of the decentralized

exchange and the Decentralized Finance (DeFi) ecosystem. A new

report has emerged, raising questions about Curve founder Michael

Egorov’s $100 million loan positions. These positions have garnered

significant interest, as they are backed by about 47% of the entire

CRV circulating supply. With the price of CRV dwindling, these

debts appear to be at risk of liquidation, putting the Curve

protocol, CRV investors, and the overall DeFi space on edge.

Related Reading: Ethereum DeFi Coins Plunge As Curve Concerns

Threaten Major Market Crash A Breakdown Of Michael Egorov’s $100

Million Loan On Tuesday, August 1, crypto research firm Delphi

Digital released a series of tweets, detailing the loan positions

being held by Michael Egorov. According to the report, the Curve

Finance founder has around $100 million in loans across various

lending protocols backed by 427.5 million CRV tokens. Egorov has a

63.2 million USDT loan backed by 305 million CRV tokens on

Aave. Delphi Digital revealed that the position has a

liquidation threshold of 55% and is eligible for liquidation at

0.3767 CRV/USDT. For context, the CRV currently trades at

$0.608595, according to CoinGecko data. This means that a 38% price

decline will cause a liquidation of Egorov’s position on the Aave

protocol. Meanwhile, the Curve founder has 59 million CRV backing a

loan of 15.8 million FRAX on Frax Finance. Although this debt is

much lower than his Aave position, it poses a much more significant

risk to CRV due to Fraxlend’s Time-Weighted Variable Interest Rate.

Delphi Digital also noted that liquidation of the Frax loan

position can occur regardless of CRV’s price. According to the

research firm, the loan is currently at 100% utilization, which

allows the interest rate to double every 12 hours. While the

interest rate currently stands at 81.20%, Delphi Digital said that

it can potentially increase to the maximum of about 10,000% APY in

3.5 days. This high-interest rate could result in the eventual

liquidation of the debt. CRVUSDT trading at $0.598 | Source: daily

CRVUSDT chart from TradingView How Has The Curve Finance Founder

Responded? So far, Michael Egorov has tried to stabilize his

positions and the utilization rate twice, repaying a total of 4

million FRAX on July 31st. However, the utilization rate remained

at 100%, as users swiftly remove liquidity as soon as he makes the

payment. To address this, the Curve founder deployed a new Curve

pool on Tuesday, August 1. This pool consists of stablecoin crvUSD

and Fraxlend’s CRV/FRAX LP token, seeded with 100,000 CRV

rewards. This is to incentivize liquidity toward the lending

market, decrease the utilization rates, and ultimately reduce the

liquidation risks. According to Delphi Digital, this pool attracted

$2 million in liquidity and lowered the utilization rate to 89%

four hours after launch. Related Reading: Is It A Good Idea To Buy

Curve Now? Here’s What This Founder Thinks Featured image from

Binance Academy, chart from TradingView

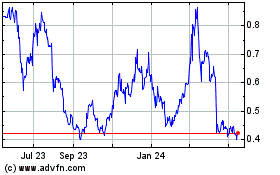

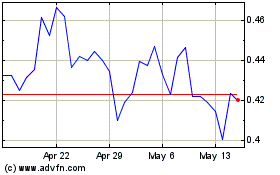

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024