By Bitget CEO Sandra Derivatives products have been playing a

significant role in the global finance market. As the concept of

decentralization experienced rapid development and gradually gained

wider recognition among users in recent years, decentralized

derivatives trading has naturally become one of the most promising

markets. So is it possible for decentralized derivatives exchanges

to disrupt their centralized counterparts in the short to medium

term? Here are some of my thoughts and I’d like to share them with

you. In the traditional financial sector, derivatives are

classified into the following categories by different product

forms: forwards, futures, options and swaps. Their underlying

assets can be stocks, interest rates, currencies and commodities.

The notional value of the overall derivatives market in 2020 is

roughly $840 trillion, compared to $56 trillion for the equity

market and $119 trillion for the bond market. And the size of the

derivatives market is four to five times larger than that of its

underlying assets. While in the crypto world, most of the

derivatives transactions happen in centralized exchanges in the

forms of quarterly futures, perpetual futures (also called

perpetual swaps) and options. According to Coingecko, Binance,

OKEx, Huobi, Bybit, FTX, Bitget and BitMEX are the world’s top7

derivatives exchanges. Take Binance as an example, its spot

trading volume in the last 24h reached $23 billion while the

derivatives trading volume hit $77.5, or 3.37 times the former.

Things are quite different in decentralized exchanges (DEX). With a

combined 24-hour trading volume of $1.25 billion for Uniswap V2 and

V3 and $96 million for the decentralized derivatives exchange

represented by Perpetual Protocol, futures trading volume accounts

for only one-fourteenth of spot trading. The world’s top7

derivatives exchanges. Source: Coingecko The volume of derivatives

trading vs. spot trading across different markets. Source:

Foresight Ventures Assuming that decentralized derivatives can also

reach four times the volume of spot trading as in centralized

exchanges, the room for growth is enormous. However, from what we

see now, the business development of decentralized derivatives

exchanges is far from satisfying. Trading data of

decentralized derivatives exchanges. Source: Dune Advantages and

Disadvantages of Decentralized Derivatives Exchanges In the

decentralized world, there are mainly two types of derivatives:

futures and options. Though index products, structured products and

insurances are also derivatives, they are not the focus for our

purpose here. Compared to centralized institutions in the crypto

space, decentralized derivatives exchanges have the following

advantages: Asset custody: The assets of decentralized derivatives

projects are hosted on the chain. It is transparent and traceable,

avoiding irregularities and default risks of centralized

institutions. Fairness: Set by smart contracts in advance, the

trading rules can not be tampered with in the back office,

providing greater fairness for both parties to the transaction.

Self-governance: In decentralized derivatives exchanges, things

like the fees to be charged, coins to be listed and development

plans can all be determined through community governance. People

involved in the decision-making process could enjoy the benefits of

project growth. However, there are also urgent problems to be

solved. Performance: Derivatives trading requires real-time

transactions, which are difficult to achieve through the current

on-chain solutions. Price discovery: Derivatives trading is

extremely price-sensitive. However, the mark prices and transaction

prices are dependent on the prediction of oracles. Risk control:

Liquidation is a major issue for both decentralized and centralized

exchanges. Decentralized platforms also need to address the

on-chain congestion caused by extreme price volatility to ensure

the liquidation process is reasonable and efficient, which is

essential for the continued existence of derivatives platforms.

Cost and liquidity: Margin trading with high leverages demands high

liquidity of underlying assets. The platform needs to avoid the

impact cost of transactions and establish a reasonable fee

schedule. Capital utilization: a core requirement for traders to

participate in derivatives trading is the ability to trade on

margin with additional leverage, but the overcollateralization

mechanism introduced by some synthetic asset projects once again

limits the efficient use of capital. Anonymity: On-chain data are

traceable, yet institutional investors want to keep their positions

and futures contract address anonymous. Different Types of

Decentralized Derivatives Exchanges In today’s market,

decentralized futures derivatives have the largest number of

project types and the most diverse solutions, mainly represented by

perpetual futures, which currently fall into three major genres:

AMM, order book and synthetic assets. AMM represented by Perpetual

Protocol The AMM (Automated Market Making) based exchanges are

mainly reinvented from the AMM model of Uniswap, such as vAMM and

sAMM. It allows traders to interact with the assets in a physical

or virtual asset pool to long or short. GMV Data of mainstream

decentralized derivatives platform. Source: Token terminal This

type is mainly represented by Perpetual Protocol. According to

Messari, Perpetual Protocol takes up 76% of the perpetual futures

market and its revenue size in July was the seventh-largest of all

Defi projects, behind Sushiswap. However, the trading volume and

revenue do not accurately reflect its true market share as it is

difficult to calculate how much is contributed by the wash trading

resulted from the trans-fee mining initiated in February this year.

Based on a virtual liquidity pool called vAMM. The Perpetual

Protocol uses the equation of X*Y=K to simulate pricing. Traders

can input USDC as collateral to the Vault. So external liquidity

providers are not required. It is also a way to mint synthetic

assets. With the only USDC in the pool, there is no actual exchange

between two actual currencies. The amount of funds flowing in and

out of the Vault, as well as the returns, are calculated using a

mathematical formula based on the price of the trading pair at the

time of their entry and exit. Let’s walk through an example trade

explained by the project white paper. X*Y=K,The price ratio of ETH

and USDC is Y/X=100 Assuming there are 10000 USDC in the Vault.

X=100,K=100*10000. Alice uses 100 USDC as the margin to open a 2x

leveraged long position on ETH; After that, the amount of USDC in

the vAMMs will become 10,200 (10,000+100*2), the amount of ETH/USDC

will become 98.04 (100*10,000/10,200), and the position Alices

opens is 1.96 ETH (100-98.04). Following Alice, Bob also uses 100

USDC to open a long position with 2x leverage. His position size

will be 1.89 ETH (98.03-96.15) using the same calculation. Note

that the price of ETH increases due to Alice’s opening, therefore

the average holding cost of Bob is higher than that of Alice. After

Bob gets his long position, the price of ETH further climbs. Alice

closes her position and realizes a profit of 7.84 USDC (10400 –

96.15*10,400/(96.15+1.96)- 200) Seeing Alice makes a profit, Bob

wants to close his position too, only to find out that he lost

-7.84 USDC (10192.15-98.11 * 10192.15 / (98.11+ 1.88)-200) after

closing his position. From the above example, we can see that one

trader’s gain equals another trader’s loss. All traders in the pool

are counterparties with their revenues calculated based on the

virtual AMM model. This model has the following features: AMM model

does not require the use of an external Oracle for price discovery.

Instead, the price will reach equilibrium through the balanced

activities of arbitrageurs between CEX and DEX. Though the approach

can avoid the risk of Oracles, there could be an extreme deviation

between asset prices in the exchange and outside market in the

absence of arbitrageurs, leading to the liquidation of margin

traders. In the Perpetual project, the K-value is a floating value

set by the team. If the K-value is too small, the depth of the pool

will be reduced. But if the value is too large, the price

fluctuation in the exchange will be too minor to match the outside

price. Therefore, the setting of the K value will significantly

impact the operation of the AMM model. In the AMM model, large

orders will incur greater impact costs to the pool, especially for

price-sensitive futures traders, whose revenue will be

significantly influenced by the size and sequence of the orders. To

address the above issues, Perpetual Protocol launched a V2 “Curie”.

The major improvements include: It built Uniswap V3 into the

original vAMM pool and created a liquidity pool in the form of

v-token (such as vETH/vUSDC). When traders deposit USDC to open a

position, the leverage liquidity provider will generate and input

the amount equivalent to that of the position. This is also a way

of minting synthetic assets. The only difference is that it uses a

liquidity pool consisted of actual tokens to replace the original

mathematic formulas. Introducing the role of makers to provide

liquidity management for Uni V3 can improve its liquidity to some

extent. But the liquidity of the pool depends on the funds and

market-making capacity of the makers. The Insurance Fund could be

used to cover abnormal settlements and serve as the counter-party

when there is an imbalance between long and short positions to

provide more liquidity to the pool. It seems that the AMM solution

used by Perpetual V1 can provide unlimited liquidity, but it will

suffer from inevitable impact cost when a larger amount of funds is

involved. The upgraded V2 model is also subject to the ability of

makers. Liquidity providers who employ the active market-making

strategy of Uni V3 may also bear the impermanent losses. Although

the AMM model has tackled the long tail problem of the derivatives

market, its impact cost is still high for large-scale and

price-sensitive traders. Order book model represented by dYdX The

locked amount and profit statistics of dYdX. Source: Token terminal

As one of the earliest trading platforms for decentralized

derivatives, dYdX launched its first BTC-USDC perpetual futures

last May. It went on to co-built a Layer 2 solution for cross

margin perpetuals on the StarkEX engine together with StarkWare

this April. Apart from supporting perpetuals, dYdX also offers

lending, spot trading and margin trading. Its futures trading

volume ranks second in the decentralized perpetuals market,

accounting for 12%. Adopting the order book model with Wintermute

as its leading maker to provide liquidity, dYdX combines off-chain

matching with on-chain settlements. Therefore, the transaction

model is basically the same as CEX, with the transaction price

determined by the market price, which is in turn set by the maker.

According to data released by Wintermute, 95% of the current

transactions on dYdX are quoted by makers, making them the core

strength for order-book-based platforms. This is the reason why

most critics criticize dYdX for being too centralized. The order

book model is very demanding on the performance of matching and

transactions. It basically operates like this: StarkEX will obtain

a sequence from dYdX, runs them internally, and ensures that

everything is checked out and meaningful. Then, it moves the

transaction to the Cairo program. The Cairo compiler will

compile the Cairo program, and then the prover will convert it into

a STARK proof. Then, the proof will be sent on this chain to

the verifier for verification. The proof is legal if it is accepted

by the verifier. So everyone can check the account balance of all

users on Layer 1 but the transaction data is not created on the

chain. In this way, it protects the privacy of the transaction

strategy and reduces transaction costs. At the same time, the gas

fee on Layer2 will be borne by the dYdX team. Users only need to

pay a transaction fee. As Layer2 and other scaling solutions

improve over time, the user experience of order-book transactions

will very much resemble that of a DEX. In addition, more advanced

orders have been launched by dYdX, including market orders, limit

orders, Take profit and Stop loss, Good-Till-Date, Fill Or Kill or

Post-Only, offering traders futures trading services that are

increasingly similar to those of centralized exchanges. For a

future exchange, there are different priorities at various stages.

For example, relying solely on makers is a necessary approach to

maintain liquidity in the early days. As professional investors

entering the market, the entire ecosystem will evolve and become

less centralized. Synthetic assets model represented by Synthetix

The locked amount and profit statistics of Synthetix. Source: Token

terminal As the earliest and largest synthetic assets platform, the

development of Synthetix is well known to most of the readers and

will not be elaborated here. On Synthetix, users stake SNX to

generate sUSD based on a collateralization ratio of 500%, and then

exchange the sUSD into any synthetic assets within the system

through transaction. They can go long on sToken, or go short on

iToken. The assets to be transacted are not limited to

cryptocurrencies, but include Forex, stock and commodities. In our

discussion, synthetic asset is listed as one of the transaction

models for decentralized derivatives because it is also a kind of

futures contract traded with collateral, or margin. The transaction

model of SNX is fairly new in that it introduces the concept of a

“dynamic debt pool”. The debt borne by the users and the system

will change in real-time. When a user stake SNX to mint sUSD, the

sUSD becomes the debt of the system. When the users convert the

sUSD into sToken, the debt of the system will evolve as the value

of the sToken changes. And such debt is shared proportionately by

all users who have staked SNX. Let’s look at an example: Suppose

there are only A and B in the system. They each minted 100 sUSD.

A’s debt B’s debt Total debt Mint 100 sUSD 100 sUSD 100 sUSD

200 sUSD A uses them to buy sBTC; B holds them 100 sUSD 100 sUSD

200 sUSD BTC price doubles(before debt distribution) 200 sUSD 100

sUSD 300 sUSD BTC price doubles(after debt distribution) 150 sUSD

150 sUSD 300 sUSD Eventually, their debts are both 150 sUSD, but

A’s asset value reached 200 sUSD while B’s asset remained 100 sUSD.

At this point, if A sells sBTC to get 200 sUSD, then he will only

need 150 sUSD to redeem SNX, while B will need to buy 50 sUSD

before redemption. From this point of view, Synthetix’s debt pool

model is actually a dynamic zero-sum game. The profit may come from

the rise in the price of one’s own assets, or the fall in the price

of other people’s assets; vice versa. Or we can say, stakers on

Synthetix are actually going long on “their own investment

capability/the investment capability of other participants” You may

also hold sUSD in the long term, but this will put you at the risk

of “I may lose money because other investors are too capable.” As

Taleb says, by staking SNX to generate sUSD, users have skin in the

game. The bold design of risk-sharing turn all users into real

“stakeholders”. Source: Mint Ventures

https://www.chainnews.com/articles/894865830615.htm This bold and

creative design of SNX is essentially similar to the zero-sum game

built in the AMM model. And for vAMM, its process of inputting

virtual assets as per the amount of open positions also resembles

the minting of synthetic assets. The difference is that Synthetix,

fed by an oracle machine, does not have to worry about price

slippage or the flow of assets. In this way, it provides the users

with truly unlimited liquidity. Current Problems for Decentralized

Derivatives Exchanges After illustrating on how decentralized

derivatives products operate, let’s get back to the problems listed

at the beginning of this article. Can they be solved by the above

projects? What’s the future of decentralized derivatives products?

Performance The performance issues are now being partly addressed,

with various decentralized derivatives platforms adopting different

scaling options: Perpetual Protocol uses the sidechain solution

xDai; dYdX adopts Layer2 solution based on ZK-rollup technology to

conduct off-chain matching and on-chain record-keeping; SNX

implements a Layer2 scaling solution “Optimisitc”. These scaling

solutions have addressed the demand for real-time transaction and

the front-run problem during transaction execution. Price Discovery

For the AMM model, prices are mainly defined by assets within the

pool and the equation of x*y=k. The execution price is independent

from an external oracle, but the funding fee uses Chainlink’s price

feed as the index price. The Perpetual V2 also will combine Uniswap

oracle after introducing the liquidity pool of Uni V3. The AMM

model is therefore less susceptible to oracle failures. On dYdX,

three different prices are used: index price, oracle price and

mid-market price. Among them, the index price is maintained by the

dYdX team. It is determined by referencing the prices of 6-7 spot

exchanges and is used to trigger conditional orders. The oracle

price is provided by Chainlink and MakerDao for the calculation of

margins and funding fees. The mid-market price is the price

generated by the order book, also used to calculate the funding

fees. The price discovery model of dYdX is similar to CEX where the

execution price is based on the order book while liquidation price

is determined by the oracle. On the whole, the price of dYdX is

mainly influenced by makers and arbitrageurs, but its liquidation

price may be affected by the risks of oracle malfunction. In

comparison, SNX uses Chainlink decentralized oracles to power all

price feed on its platform, including the transaction price, system

debt and liquidation price. Risk Control We can see that almost all

derivatives exchanges rely on oracle prices for liquidation, which

occurs when the position margin ratio falls to a certain level. In

such cases, the users will be compensated through the mechanism of

Insurance Fund. Given that most of the projects are dependent on

the quotes of Chainlink, the risk of oracle attack seems to be

unavoidable. Moreover, the on-chain liquidation congestion problem

caused by violent price swings remains unsolved, yet it may be

mitigated through scaling solutions in the future. Cost and

Liquidity The problem is twofold: small volume traders need to bear

higher gas fees, and large volume traders have to pay higher impact

costs caused by liquidity. While the former has been partly

resolved through Layer2 solutions, the latter is more complex. It

can be quite difficult to dodge in the AMM model; for platforms

based on order books, it may depend on the market-making capacity

and capital size of the makers; for synthetic assets, the impact

cost of a single trader may be smoothed out if the capital size of

the overall protocol is large enough. In addition, transaction fees

can be another concern for derivatives traders with a higher

turnover rate. From the current statistics, the transaction fees of

DEXes are much higher than those of CEXes. For example, Perpetual

Protocol charges 0.1% for each transaction, while dYdX collects a

maker fee of 0.05% and a taker fee of 0.2% for ordinary users,

compared to 0.02%-0.04% in centralized exchanges. Even though all

the above projects have launched the trans-fee mining feature to

compensate the transaction fees, the final transaction cost in

DEXes is still relatively high. Capital Utilization In terms of

capital utilization, the DEXes based on AMM and order books are not

very different from CEXes. The maintenance margin ratio is 6.25%

for Perpetual Protocol and 7.5% for dYdX. But derivatives exchanges

based on synthetic assets, such as SNX, require a 200%

overcollaterization to avoid liquidation. Though SNX can provide

unlimited liquidity, the overcollaterization mechanism puts

significant restrictions on capital utilization, which goes against

the intention of futures trading. Anonymity The current scaling

solutions of all exchanges are moving most of the transaction data

to off-chain. Take dYdX for example, it uses “zero-knowledge proof”

to protect the privacy of users. It can be expected that the

anonymity of futures will be guaranteed as privacy-focused layer2

solutions improve over time. Conclusion From the above comparison

between decentralized derivatives exchanges, we can see that the

order-book platforms represented by dYdX can better solve the major

pain points of currents derivatives products. Their transaction

models and functions are also more in line with the habits and

needs of derivatives traders. Critics may accuse dYdX of not being

decentralized enough, but actually, it is just a strategic choice

between survival and development at different stages. After all,

the primary goal of a decentralized project is to meet the basic

needs of users, while decentralization could be gradually achieved

by engaging more institutions and diversified participants to

enhance the ecosystem. Like fresh produce in e-commerce faced with

various limitations in products, technology, and channels,

derivatives also find it challenging to break barriers. It is

therefore not likely for decentralized derivatives exchanges to

shake up the dominant position of CEXes. However, with the

development of Layer2 and other scaling solutions, their problems

regarding performance, risk control, transaction cost and anonymity

will be partially solved. It is fair to say decentralized

derivatives exchanges will become the biggest beneficiary of Layer2

technology. From a long-term perspective, derivatives trading is

still one of the most promising segments with unlimited

possibilities.

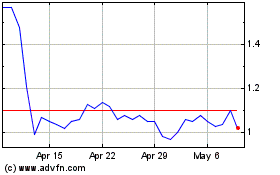

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024