By Alexa Liautaud and Sam Schechner

PARIS--A cascade of terrorist attacks in Europe is driving away

tourists at the height of the summer rush, casting a pall over

hotel chains, airline companies and luxury retailers that are

already grappling with Britain's vote to leave the European

Union.

Declines in airline and hotel bookings have spread into European

cities and countries that hadn't suffered recent attacks, analysts

and companies say. That raises the specter that the

violence--combined with a sluggish economy--could have a broader

economic impact, affecting companies like Air France-KLM,

AccorHotels SA and InterContinental Hotel Group PLC when they

report earnings in the next two weeks.

"Europe is not going to be doing them any favors," said C.

Patrick Scholes, a managing director at SunTrust Robinson Humphrey

Inc. "It's all about fear."

A confluence of negative factors is buffeting Europe's tourism

business. Travelers appear more cautious following a spate of

attacks-- most recently in Munich and in Nice, France. Economic

growth in many European countries is weak, straining some

consumers' pocketbooks. And the British pound is down 8.6% against

the euro since the Brexit vote--boosting costs for the bloc's

single largest source of international tourists after Germany.

"Europe has several, almost I guess, three strikes against it

looking forward," Scott Kirby, president of American Airlines Group

Inc., told analysts on Friday, adding that Europe was the only

region where he expects to see sequential declines in the third

quarter.

Those pressures have driven down stock prices of several

Europe-focused tourism firms that report earnings in the next week.

Shares in British travel agency Thomas Cook Group PLC, which

reports fiscal third-quarter results on Thursday, have plunged 52%

since the beginning of the year. Ryanair Holdings PLC, which

reports fiscal first-quarter results on Monday, is down 23%. Shares

in British Airways parent International Consolidated Airlines Group

SA, which reports first-half results on Friday, have fallen

34%.

Early data on hotel occupancy rates following the Bastille Day

attack in Nice, which killed 84 people, shows the impact stretched

well beyond the French Riviera. While occupancy at Paris hotels was

already depressed, and it fell precipitously in Nice, preliminary

data showed occupancy in London and Amsterdam dropped 2.7% and

8.3%, respectively, compared with a year earlier, by the Sunday

after the attack.

Airline bookings appear to have declined, too. German airline

Deutsche Lufthansa AG issued a profit warning on Wednesday, stating

revenue in the second half of the year would fall between 8% and 9%

because economic uncertainty and "repeated terrorist attacks in

Europe" had driven down bookings of long-haul flights to Europe. On

Thursday, EasyJet PLC said terrorism threats and the May crash of

an Egyptair jet were among factors that reduced demand for the

summer months.

"These events, which are tragic and very, very significant, each

take a small but noticeable bite out of demand," said David Katz, a

managing director at Telsey Advisory Group.

Luxury retail, which typically sees revenue from international

tourists visiting Paris, is hurting as well. Hermès International

SCA reported a sharp slowdown in first-half sales growth on

Thursday, citing terrorist attacks in Europe and currency

fluctuations as primary causes of the downturn.

"We do not see any improvement in tourist traffic in France,"

Chief Executive Axel Dumas said Thursday. "We will not see one

while we are in a state of emergency which prevents customers from

coming."

Luxury giant LVMH Moët Hennessy Louis Vuitton SE reports

first-half earnings on Tuesday. Kering SA reports on Thursday.

European travel businesses had already been girding for a

difficult tourist season. Despite the promise of the quadrennial

European soccer championships, Europe was the only region of the

world to receive fewer international bookings for the summer as of

May 31, with a decline of 2.1% from last summer, according to

ForwardKeys, a data provider that compiles flight-ticket

information.

While those figures showed the number of international bookings

for Spain and Ireland rising in the summer period, those increases

were more than offset by an 11% decline in bookings to France, 23%

decline to Belgium, and 31% decline to Turkey, ForwardKeys

said.

Other regions of the world are benefiting from the downturn in

Europe, which could soften the blow for some firms. The number of

international bookings for destinations this summer in the

Asia-Pacific region, which includes China and Australia, rose 7.8%

from a year earlier, according to ForwardKeys.

Charlie Bateson, product and commercial director of the U.K.

branch of luxury travel company Abercrombie & Kent, is also

seeing a "big increase" in travel to India, China, Japan and South

Africa. "I think we'll see, certainly from where we're sitting, an

increase in demand for the more unusual, the more experiential," he

said.

Write to Sam Schechner at sam.schechner@wsj.com

(END) Dow Jones Newswires

July 24, 2016 11:13 ET (15:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

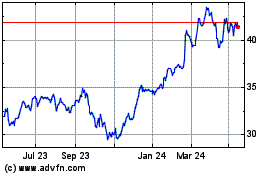

Accor (EU:AC)

Historical Stock Chart

From Nov 2024 to Dec 2024

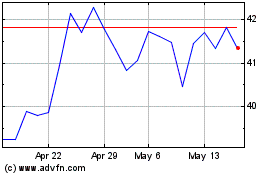

Accor (EU:AC)

Historical Stock Chart

From Dec 2023 to Dec 2024