Ecoslops : 2023 Turnover and significant events

06 February 2024 - 4:26AM

Ecoslops : 2023 Turnover and significant events

Paris, February 5th, 2024

- ONGOING DISPOSAL OF ECOSLOPS PROVENCE- REFOCUSING OF

THE BUSINESS ON ECOSLOPS PORTUGAL AND THE COMMERCIAL ROLLOUT OF

SCARABOX ®- RENEWAL OF THE "EFFICIENT SOLUTION" LABEL BY THE

SOLAR IMPULSE FOUNDATION

| Turnover in

M€ * |

2022 |

2023 |

Var M€ |

Var % |

| |

|

|

|

|

| Ecoslops Portugal |

14,4 |

10,3 |

-4,1 |

-28% |

| Industrial equipments -

Scarabox® |

0,3 |

|

-0,3 |

-100% |

| Total Turnover (at future

perimeter) |

14,7 |

10,3 |

-4,4 |

- 30% |

| |

|

|

|

|

| Turnover of discontinued

operations |

4,3 |

2,7 |

-1,6 |

-37% |

| (Ecoslops

Provence) |

|

|

|

|

| Total |

19,0 |

13,0 |

-6,0 |

- 32% |

| * : unaudited figures |

|

|

|

|

In the Group's future configuration,

following the disposal of Ecoslops Provence, turnover amounts to

€10.3 million, down 30% compared with 2022, on a like-for-like

basis.

Ongoing disposal of Ecoslops Provence

As previously announced, the two shareholders of

Ecoslops Provence (Ecoslops SA for 75% and TotalEnergies Raffinage

France for 25%), entered into a share transfer agreement in

December 2023. This contract provides for the purchase of Ecoslops

SA's shares and shareholder loan in Ecoslops Provence by

TotalEnergies for €8.0 million, payable in full at the closing of

the transaction, scheduled for the end of February 2024, after the

lifting of conditions precedent. To date, nothing has come to light

that would call this timetable into question.

Ecoslops Portugal

Ecoslops Portugal turnover fell by 28%, from

€14.4 million in 2022 to €10.3 million in 2023. Port Services sales

rose by 14% to €2.4 million, while Refined Products sales fell to

€7.9 million in 2023 from €12.3 million in 2022. This decline can

be broken down into: -20% of volume effect, -19% of price effect

(average Brent price having fallen from 94.3€/bbl in 2022 to

76.1€/bbl in 2023) and +3% of product mix effect. Over the period,

the unit produced 20,071 tonnes of refined products (in line with

the latest target communicated), compared with 24,509 tonnes in

2022, and sold 17,693 tonnes, compared with 22,165 tonnes the

previous year. In 2024, Ecoslops Portugal forecasts production of

24,500 tonnes, representing sales of around €13 million (including

port services) based on current prices (Brent at $80/bbl).

Scarabox®

The Scarabox business is the mainstay of the

Group's development. It responds to a recognized need to process

used oils in an environmentally-friendly way. The local production

of basic energy products through a circular process provides a

sustainable outlet for this harmful waste. For Ecoslops, this

activity as a supplier of turnkey technical solutions is a highly

complementary one to Ecoslops Portugal, as it requires little

capital and generates a good level of margin.

In 2024, Ecoslops will have the financial and

human resources needed to complete the work in Cameroon with

Valtech Energy, a full-scale demonstrator of the technology, and to

develop its pipeline of new business. In Ivory Coast, the aim is to

proceed with the sale of a Scarabox this year, following the

positive results of the local market study.

Cash position

At December 31, 2023, before closing of the

Ecoslops Provence disposal, the Group had cash and cash equivalents

of €3.2 million, of which €2.4 million was available (taking into

account a €0.8 million conditional advance on investment grants),

and net debt of €18.7 million (vs. €23.2 million at December 31,

2022).

Post closing of the Ecoslops Provence disposal,

the Group's net debt will be reduced to 10.7 M€.

Corporate Social Responsibility

As a player in the circular economy, Ecoslops

attaches major importance to environmental issues, in addition to

societal and governance issues. In this context, the Group

published its fourth sustainable development report on June 2,

2023.

The Group's commitment to continuous improvement

is illustrated by the further rise in its 2023 ESG rating, which

was derived from the Ethifinance ESG Campaign (formerly Gaïa

Research) for the year 2022. The company confirms its performance,

now ranked 24th/310 (vs. 39th/371 in the previous campaign) in the

general panel, 10th/416 in the panel of companies with turnover of

less than €150 million (vs. 14th/126 in the previous campaign) and

4th/272 in the industry panel (vs. 7th/76 for 2021).

In addition, the Solar Impulse Foundation's

"Efficient Solution" label, focused on promoting efficient,

cost-effective solutions to protect the environment, was

successfully renewed in January 2024.

Next appointment

Publication of 2023 annual results on April 11,

2024 after close of trading

A PROPOS D’ECOSLOPSEcoslops est cotée

sur Euronext Growth à Paris Code ISIN : FR0011490648 -

Mnémonique : ALESA / éligible PEA-PME. Contact Relations

investisseurs : info.esa@ecoslops.com - +33 (0)1 83 64 47

43

Ecoslops fait entrer le pétrole dans l’économie circulaire grâce

à une technologie innovante, permettant de produire du carburant et

du bitume léger à partir de résidus pétroliers. La solution

proposée par Ecoslops repose sur un procédé industriel unique de

micro-raffinage de ces résidus pour les transformer en produits

commerciaux de 2ème génération aux standards internationaux.

Ecoslops offre aux infrastructures portuaires, aux collecteurs de

résidus ainsi qu’aux armateurs une solution économique et plus

respectueuse de l’environnement. www.ecoslops.com

- PR02feb24_Ecoslops 2023 turnoverndd

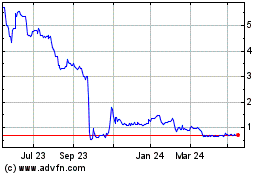

Ecoslops (EU:ALESA)

Historical Stock Chart

From Nov 2024 to Dec 2024

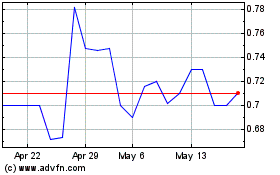

Ecoslops (EU:ALESA)

Historical Stock Chart

From Dec 2023 to Dec 2024