Antin to Acquire Wildstone, the Leading Outdoor Media Infrastructure Company in the UK

02 August 2022 - 4:25PM

Business Wire

Wildstone is poised to lead the digitisation

of outdoor media infrastructure, with over 3,000 billboards across

the UK, Ireland and the Netherlands

Regulatory News:

Antin Infrastructure Partners (Paris:ANTIN) announced today that

Antin Flagship Fund IV has agreed to acquire Wildstone, the leading

owner of independent outdoor media infrastructure in the UK, from

DigitalBridge Group. Wildstone marks Flagship Fund IV’s final

investment.

Founded in 2010 by CEO Damian Cox, Wildstone is one of the

fastest growing owners of outdoor media infrastructure and has a

portfolio of over 3,000 billboards across the UK and Europe,

including premium digital billboards located along major roads.

Wildstone has been at the forefront of the digital revolution in

the sector and has shifted the focus of the entire industry away

from paper to digital.

Wildstone’s business benefits from significant tailwinds as the

UK and European outdoor media market is at the early stages of

transformation and its growth is on a fast upward trajectory thanks

to the shift to digital. Wildstone’s premium assets are

increasingly in demand by leading global media companies seeking

high quality, flexible and long-term media distribution

infrastructure.

The Wildstone management team has a proven track record of

growing its portfolio by acquiring traditional paper panel assets

and upgrading them to next-generation screen technology backed by

long-term inflation-linked contracts. Antin looks forward to

partnering with Wildstone in this next chapter of its growth and

replicating the platform’s success in the UK across new European

markets.

Damian Cox, CEO and Founder of Wildstone, stated: “Europe

represents a huge untapped opportunity and expansion to these

territories is a natural extension of our business model which is

to acquire, upgrade and scale. The future of outdoor media

infrastructure is digital and we are, by far, the best positioned

to capture a substantial piece of the global market share. Antin

recognises the significant growth potential and together we are

well placed to accelerate expansion.”

Stéphane Ifker, Senior Partner at Antin, commented: “With the UK

market expected to achieve 70% digitisation within 10 years, we are

excited to support Wildstone in scaling up UK operations and

replicating its success across key European markets. Outdoor media

infrastructure is a trusted broadcast medium with a national reach,

which makes it essential for the advertising value chain and public

stakeholders.”

DC Advisory acted as financial adviser to Antin, Kirkland &

Ellis acted as legal adviser to Antin while Bain acted as a

commercial adviser, Alvarez & Marsal as a financial & tax

diligence adviser, and Mott MacDonald provided technical due

diligence. Greenhill is serving as financial adviser to Wildstone

on its sale by DigitalBridge, Linklaters is serving as legal

adviser to DigitalBridge, Lewis Silkin is serving as legal adviser

to Wildstone, and PwC is acting as financial & tax adviser to

Wildstone.

The transaction is expected to close in Q3 of 2022.

About Wildstone

Launched in 2010, Wildstone is the leading owner of independent

outdoor media infrastructure in the UK. Wildstone provides leading

global media companies with secure long-term access to high

quality, flexible media distribution infrastructure. For further

information about Wildstone, please visit: www.wildstone.co.uk

About Antin Infrastructure

Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €22 billion in assets under

management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, telecom, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore and Luxembourg,

Antin employs over 190 professionals dedicated to growing,

improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on Euronext Paris

(Ticker: ANTIN – ISIN: FR0014005AL0).

About DigitalBridge Group,

Inc.

DigitalBridge (NYSE: DBRG) is a leading global digital

infrastructure investment firm. With a heritage of over 25 years

investing in and operating businesses across the digital ecosystem

including cell towers, data centers, fiber, small cells, and edge

infrastructure, the DigitalBridge team manages a $47 billion

portfolio of digital infrastructure assets on behalf of its limited

partners and shareholders. Headquartered in Boca Raton,

DigitalBridge has key offices in New York, Los Angeles, London, and

Singapore.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220801005910/en/

Media Antin

Infrastructure Partners Nicolle Graugnard, Communication

Director Email: nicolle.graugnard@antin-ip.com

Ludmilla Binet, Head of Shareholder Relations Email:

ludmilla.binet@antin-ip.com

Brunswick Email: antinip@brunswickgroup.com Tristan

Roquet Montegon +33 (0) 6 37 00 52 57 Gabriel Jabès +33 (0) 6 40 87

08 14

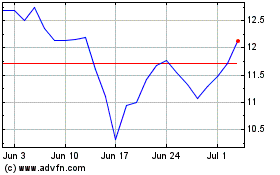

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

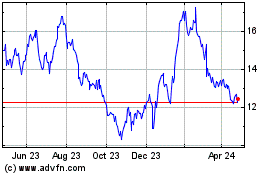

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024