Christian Dior: Excellent first half for Christian Dior

Excellent first half for Christian

Dior

Paris, July 25, 2023

The Christian Dior Group recorded revenue of

€42.2 billion in the first half of 2023, up 15%. Organic revenue

growth was 17% compared to the same period in 2022. All business

groups achieved double-digit organic revenue growth over the half

year, except for Wines & Spirits, which faced a particularly

high basis of comparison.

In the second quarter, organic revenue growth

was 17%, in line with trends seen in the first quarter.

Profit from recurring operations for the first

half of 2023 was up 13% at €11 571 million. Operating margin

reached 27.4% of revenue. Group share of net profit was up 31% at

€3 512 million.

Highlights of the first half of 2023

include:

- An excellent first half despite a disrupted environment,

- Significant revenue growth across all business groups except

Wines & Spirits, which faced a high basis of comparison,

- Strong growth in business in Europe and Asia;

- Solid performance by champagne thanks to its value-based

strategy, and a contraction in cognac compared to the first half of

2022 which benefited from the significant impact of inventory

rebuilding among distributors,

- Outstanding performance by the Fashion & Leather Goods

business group, in particular Louis Vuitton, Christian Dior

Couture, Celine, Loro Piana, Loewe and all the other brands which

gained market share worldwide,

- Rapid growth in perfume, makeup, and skincare,

- Impressive growth in high jewelry, and strong creative momentum

among all Watches and Jewelry Maisons, in particular Tiffany,

Bulgari, and TAG Heuer,

- Exceptional performance by Sephora, confirming its position as

world leader in beauty retail,

- Return to profit for DFS, which benefited from the recovery in

international travel.

- Operating free cash flow halved due to major investments in

exceptional real estate and in operational inventories, notably in

high jewelry.

Key figures

|

Euro millions |

First half 2022 |

First half 2023 |

% change |

|

Revenue |

36 729 |

42 240 |

+ 15 % |

|

Profit from recurring operations |

10 232 |

11 571 |

+ 13 % |

|

Group share of net profit |

2 678 |

3 512 |

+ 31 % |

|

Net financial debt |

10 885 |

12 301 |

+ 13 % |

|

Total equity |

50 324 |

57 005 |

+ 13 % |

Revenue by business group:

|

Euro millions |

First half2022 |

First half2023 |

% change Reported Organic* |

|

Wines & Spirits |

3 327 |

3 181 |

- 4 % |

- 3 % |

|

Fashion & Leather Goods |

18 136 |

21 162 |

+ 17 % |

+ 20 % |

|

Perfumes & Cosmetics |

3 618 |

4 028 |

+ 11 % |

+ 13 % |

|

Watches & Jewelry |

4 909 |

5 427 |

+ 11 % |

+ 13 % |

|

Selective Retailing |

6 630 |

8 355 |

+ 26 % |

+ 26 % |

|

Other activities and eliminations |

109 |

87 |

- |

- |

|

Total |

36 729 |

42 240 |

+ 15 % |

+ 17 % |

* With comparable structure and

constant exchange rates. The structural impact for the Group

compared to the first half of 2022 was zero and the currency effect

was -2%.

Profit from recurring operations

by business group:

|

Euro millions |

First half2022 |

First half 2023 |

% change |

|

Wines & Spirits |

1 154 |

1 046 |

- 9 % |

|

Fashion & Leather Goods |

7 509 |

8 562 |

+ 14 % |

|

Perfumes & Cosmetics |

388 |

446 |

+ 15 % |

|

Watches & Jewelry |

987 |

1 089 |

+ 10 % |

|

Selective Retailing |

367 |

734 |

+ 100 % |

|

Other activities and eliminations |

(173) |

(306) |

- |

|

Total |

10 232 |

11 571 |

+ 13 % |

Wines & Spirits: good half year for

the Champagne business; weak demand for Hennessy

The Wines & Spirits

business group recorded a slight revenue decline (3% organic) in

the first half of 2023, when compared to a particularly strong

first half of 2022. Profit from recurring operations was down 9%.

The Champagne business recorded an increase in revenue over the

half year, driven by its value-based strategy. Hennessy cognac was

impacted by the economic environment in the United States and by

the continued high stock level of its retailers. Among Provence

rosé wines, the Group acquired the prestigious, world leading

domain Minuty, and Château d'Esclans stepped up its international

expansion. The Joseph Phelps Vineyard, one of the most renowned

wine properties in Napa Valley, California, was included in the

first half accounts for the first time. Glenmorangie whisky and

Belvedere vodka continued to show strong momentum in

innovation.

Fashion & Leather Goods: remarkable

performances by Louis Vuitton, Christian Dior Couture, Celine, Loro

Piana, Loewe and Marc Jacobs

The Fashion & Leather Goods

business group recorded organic revenue growth of 20% in the first

half of 2023. Profit from recurring operations was up 14%. Louis

Vuitton had an excellent first half, still driven by its

exceptional creativity, the quality of its products and its strong

links with art and culture. Nicolas Ghesquière's talent for

creating a dialogue between fashion and architecture continued to

elevate the strong desirability of his Women's collections to the

highest level. A new chapter opened with the arrival of Pharrell

Williams as Men's Creative Director. Set on the stage of the

Pont-Neuf bridge in Paris, his first fashion show was met with huge

enthusiasm and more than 1.1 billion views on social media reaching

an all-time high. Christian Dior Couture continued to enjoy

remarkable growth in all its product categories. Whether in Mumbai,

Mexico City or Paris, each of the fashion shows inspired by Maria

Grazia Chiuri showcased the exceptional craftsmanship of the

Maison. The Lady Dior bag, an icon of the Maison Dior, was also

featured in the “Christian Dior, Designer of Dreams” Exhibition at

the Tokyo Museum of Contemporary Art. The exceptional Dior Homme

designs by Kim Jones and the unique high jewelry creations by

Victoire de Castellane elevated the superb craftsmanship of the

Maison to an unprecedented new contemporary level. The success of

Hedi Slimane's creations and fashion shows has continued to

increase the desirability of Celine. Driven by the bold creativity

of J.W. Anderson, Loewe continued to strengthen its distribution

network, most notably with the opening of Casa Dubaï. Fendi opened

new stores in Seoul and Tokyo. Loro Piana, Rimowa, Marc Jacobs and

Berluti enjoyed an excellent start to the year.

Perfumes & Cosmetics: strong

momentum in perfumes and makeup, supported by a highly selective

and high-quality distribution policy

The Perfumes & Cosmetics

business group recorded organic revenue growth of 13% in the first

half of 2023 thanks to strong momentum achieved through innovation,

combined with a highly selective distribution policy. Profit from

recurring operations was up 15%. Parfums Christian Dior enjoyed a

remarkable performance, strengthening its leadership in its

strategic markets. Sauvage confirmed its position as the world's

leading perfume, while the iconic women's fragrances J'adore and

Miss Dior saw continued success. Makeup also contributed to the

strong set of results from the Maison, particularly Dior Addict Lip

Maximizer and Forever Skin Correct foundation. Finally, skincare

had an excellent performance, particularly in the premium segment

in Asia with its iconic Prestige range. Guerlain continued to grow,

driven notably by the vitality of its Abeille Royale skincare and

its high-end perfumery collection l’Art et la Matière, enriched

with a new Jasmin Bonheur creation. Givenchy benefited from the

excellent reception of its new fragrance Gentleman Society. Benefit

successfully expanded its The Porefessional skincare range, while

Fenty Beauty's latest creation, Hella Thicc mascara, is already one

of the Maison’s bestsellers.

Watches & Jewelry: strong growth in

jewelry, sustained innovation in watchmaking

The Watches & Jewelry

business group achieved organic revenue growth of 13% in the first

half of 2023. Profit from recurring operations was up 10%. In

jewelry, Tiffany enjoyed excellent momentum with the exceptional

success of the reopening of the “Landmark” in New York; The

Landmark has once again become an emblematic venue for New York

life. The new Lock collection continued to be rolled out worldwide

and the first High Jewelry collection by Artistic Director Nathalie

Verdeille was unveiled. Bulgari, which experienced strong growth,

celebrated the 75th anniversary of its iconic Serpenti collection.

Its high jewelry, with notably the launch of the Mediterranea

collection, saw outstanding performance. Chaumet and Fred

experienced strong growth over the first half. TAG Heuer celebrated

60 years of its Carrera collection. The LVMH watchmaking Maisons

TAG Heuer, Hublot and Zenith unveiled many new products during LVMH

Watch Week and the Watches & Wonders trade show.

Selective Retailing: excellent

performance by Sephora; DFS growth supported by the recovery in

international travel

In Selective Retailing, organic

revenue growth was 26% in the first half of 2023. Profit from

recurring operations was up 100%. Sephora performed exceptionally

well and continued to gain market share thanks to its distinct and

innovative product and service offering. Momentum was particularly

strong in North America, Europe and the Middle East. Its

distribution network continued to expand, particularly in the

United Kingdom where its first store opening proved a huge success.

DFS benefited from the gradual recovery in international travel

and, in particular, from the return of tourists to the flagship

destinations of Hong Kong and Macau. In France, the strong

performance of La Samaritaine in Paris confirmed its appeal as a

destination, within the context of an increasing number of Asian

tourists. Le Bon Marché, which is growing strongly, continued to

develop innovative concepts and benefit from a loyal French

customer base as well as a return of international travelers.

Outlook 2023

In an uncertain geopolitical and economic

environment, the Christian Dior group will maintain a strategy

focused on continuously strengthening the desirability of its

brands, by relying on the exceptional quality of its products and

the excellence of their distribution.

Our strategy of focusing on the highest quality

across all of our activities, combined with the energy and

unparalleled creativity of our teams, will enable us to reinforce

the Group's global leadership position in luxury goods once again

in 2023.

An interim dividend of €5.50 will be paid on

Wednesday, December 6th, 2023.

This financial release is available on our

website www.dior-finance.com.

Limited review procedures have been carried out

and the related report will be issued following the board

meeting.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in Christian

Dior’s Annual Report which is available on the website

(www.dior-finance.com). These forward looking statements should not

be considered as a guarantee of future performance, the actual

results could differ materially from those expressed or implied by

them. The forward looking statements only reflect Christian Dior’s

views as of the date of this document, and Christian Dior does not

undertake to revise or update these forward looking statements. The

forward looking statements should be used with caution and

circumspection and in no event can Christian Dior and its

Management be held responsible for any investment or other decision

based upon such statements. The information in this document does

not constitute an offer to sell or an invitation to buy shares in

Christian Dior or an invitation or inducement to engage in any

other investment activities.”

ANNEX

The condensed consolidated financial statements

for the first half of 2023 are included in the PDF version of the

press release.

Christian Dior Group – Revenue by

business group and by quarter

Revenue first half 2023 (Euro

millions)

|

2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 694 |

10 728 |

2 115 |

2 589 |

3 961 |

(52) |

21 035 |

|

Second quarter |

1 486 |

10 434 |

1 913 |

2 839 |

4 394 |

140 |

21 206 |

|

First half |

3 181 |

21 162 |

4 028 |

5 427 |

8 355 |

87 |

42 240 |

Revenue first half 2023 (organic growth

compared to the first half of 2022)

|

2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

+ 3 % |

+ 18 % |

+ 10 % |

+ 11 % |

+ 28 % |

- |

+ 17 % |

|

Second quarter |

- 8 % |

+ 21 % |

+ 16 % |

+ 14 % |

+ 25 % |

- |

+ 17 % |

|

First half |

- 3 % |

+ 20 % |

+ 13 % |

+ 13 % |

+ 26 % |

- |

+ 17 % |

Revenue first half 2022 (Euro

millions)

|

2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 638 |

9 123 |

1 905 |

2 338 |

3 040 |

(41) |

18 003 |

|

Second quarter |

1 689 |

9 013 |

1 714 |

2 570 |

3 591 |

149 |

18 726 |

|

First half |

3 327 |

18 136 |

3 618 |

4 909 |

6 630 |

109 |

36 729 |

Alternative performance

indicators

For the purposes of its financial communication,

in addition to the accounting aggregates defined by IAS/IFRS,

Christian Dior uses alternative performance indicators established

in accordance with AMF position DOC-2015-12.

The table below lists these indicators and the

reference to their definition and their reconciliation with the

aggregates defined by IAS/IFRS standards, in the published

documents.

|

Indicators |

Reference to published documents |

|

Free operating cash flow |

AR (consolidated accounts, consolidated cash flow statement) |

|

Net Financial debt |

AR (notes 1.23 and 19 of the appendix to the consolidated

accounts) |

|

Gearing |

AR (part 2, Comments on the consolidated balance sheet) |

|

Organic Growth |

AR (part 1, Comments on the consolidated income statement) |

AR: 2022 Annual Report

This document is a free translation into English

of the original French financial release dated July 25th, 2023. It

is not a binding document. In the event of a conflict in

interpretation, reference should be made to the French version,

which is the authentic text.

- Christian Dior - Résultats S1 2023 VA

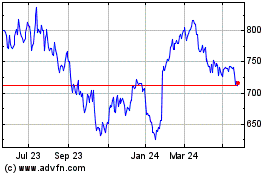

Christian Dior (EU:CDI)

Historical Stock Chart

From Jan 2025 to Feb 2025

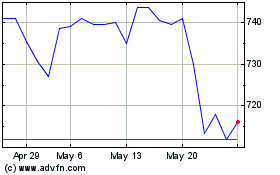

Christian Dior (EU:CDI)

Historical Stock Chart

From Feb 2024 to Feb 2025