Corbion: full year 2023 results

01 March 2024 - 5:00PM

Corbion: full year 2023 results

Corbion, the Amsterdam-listed sustainable ingredients company

that champions preservation through application of science, today

publishes its results for the year ending 31 December 2023.

Key highlights annual results 2023:

- Sales € 1,443.8 million; an organic increase of 1.2%

- Adjusted EBITDA € 191.8 million; an organic increase of

10.3%

- Operating profit € 117.2 million; an organic increase of

20.8%

- Organic growth core activities: Sales 3.0% & Adjusted

EBITDA 16.2%

- Q4 2023:

- Sales € 352.8 million and Adjusted EBITDA € 49.0 million

- Organic growth core activities: Sales -0.5% & Adjusted

EBITDA 29.3%

- Free Cash Flow full year € 18.6 million

- Covenant net debt/covenant EBITDA improved to 3.1x at

year-end

- Proposed regular cash dividend of € 0.61 per share, an increase

of 9% versus prior year reflecting the positive free cash flow

momentum

- World leading lactic acid plant in Thailand mechanical

completed in December 2023 according to schedule

- Divestment of Emulsifiers announced, completion anticipated in

Q2 2024

|

€ million |

YTD 2023 |

YTD 2022 |

Total growth |

Organic growth |

|

Sales |

1,443.8 |

1,457.9 |

-1.0% |

1.2% |

|

Adjusted EBITDA |

191.8 |

184.4 |

4.0% |

10.3% |

|

Adjusted EBITDA margin |

13.3% |

12.6% |

|

|

|

Operating profit |

117.2 |

110.8 |

5.8% |

20.8% |

|

|

|

|

|

|

|

Core activities |

|

|

|

|

|

Sales |

1,264.0 |

1,254.4 |

0.8% |

3.0% |

|

Adjusted EBITDA |

163.7 |

150.1 |

9.1% |

16.2% |

|

Adjusted EBITDA margin |

13.0% |

12.0% |

|

|

Commenting on today’s results, Olivier Rigaud, CEO, stated:

“I am pleased to report a 2023 full year outcome in line with

what we indicated earlier. We have reported organic sales growth

and double-digit organic growth in Adjusted EBITDA and Operating

Profit, whilst facing a challenging geopolitical and macro-economic

environment. We delivered a higher than anticipated positive free

cash flow for the year due to our focus on operational

efficiencies, optimizing working capital and capex discipline. As a

result, we propose to increase the regular cash dividend to our

shareholders with 9% to € 0.61 per share.

In Sustainable Food Solutions, sales growth was driven by

pricing. We observed strong growth in our product/market

adjacencies like dairy stabilizers, natural anti-oxidants and

natural mold inhibitors. In Q4, we saw a continuation of the upward

momentum in volume/mix growth reflecting the end of destocking.

In Lactic Acid & Specialties, we experienced lower lactic

acid supply to the TotalEnergies Corbion joint venture as well as

an ongoing market slowdown in semiconductors and agrochemicals.

Biomedical polymers continued its double digit growth

trajectory.

Algae Ingredients continued their growth momentum as a

sustainable alternative to fish oil in the aquaculture industry,

and concurrently we expanded our product portfolio and pipeline of

high-margin products for the petfood and human nutrition segments.

In 2023, the sales has grown over 50%, surpassing the € 100 million

landmark.

We achieved the mechanical completion of our world leading

lactic acid plant in December and are on track to commence the

start-up phase after commissioning is completed near the end of the

first quarter of 2024. In January 2024, we announced that we had

entered into a binding agreement for the divestment of the

Emulsifier business allowing Corbion to sharpen its focus on

fermentation based technologies”.

- 20240301 Press release 4Q23_FINAL

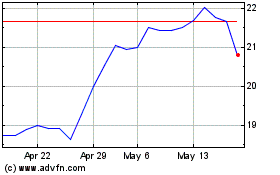

Corbion N.V (EU:CRBN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Corbion N.V (EU:CRBN)

Historical Stock Chart

From Jan 2024 to Jan 2025