Eurozone Inflation Expectations Remain Unchanged

26 July 2024 - 4:08PM

RTTF2

Eurozone consumers' inflation expectations remained stable in

July, the latest consumer expectations survey published by the

European Central Bank showed on Friday.

Inflation expectations for the coming year was steady at 2.8

percent after having fallen in May to their lowest level since

September 2021.

Inflation expectations for the next three years also remained

unchanged in July, at 2.3 percent.

However, economic expectations became more negative. The median

forecast for economic growth over the next 12 months dropped to

-0.9 percent from -0.8 percent in May.

Meanwhile, expectations for the unemployment rate over the

coming twelve months decreased to 10.6 percent from 10.7 percent in

May, the lowest level since the start of the series.

Further, consumers expect prices of their homes to increase over

the next twelve months in June. House prices were expected to rise

2.7 percent compared to 2.6 percent in May, while expectations for

mortgage interest rates edged down to 4.8 percent from 4.9

percent.

Earlier this month, the European Central Bank left its benchmark

interest rates unchanged ahead of a possible rate reduction in

September even as they worry about the sticky inflation.

In June, the ECB cut interest rates for the first time since

2019, citing an improvement in the inflation outlook.

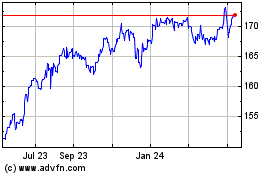

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

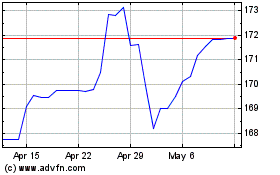

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024