Commodity Currencies Slide Amid Risk Aversion

05 March 2024 - 2:25PM

RTTF2

Commodity currencies such as Australia, the New Zealand and the

Canadian dollars weakened against their major currencies in the

Asian session on Tuesday, as Asian shares traded lower after China

set this year's GDP growth target at 5 percent and vowed to push

ahead with transforming the growth model in the face of a raft of

economic problems.

Earlier today, a private survey showed that China's services

activity grew at a slower pace in February.

Investors also awaited Federal Reserve Chair Jerome Powell's

congressional testimony and key jobs data for further clues on the

U.S. central bank's rate trajectory.

Crude oil prices ended lower on concerns about the outlook for

energy demand after OPEC extended its output cuts to the end of the

second quarter. West Texas Intermediate Crude oil futures for April

ended lower by $1.23 or 1.5 percent at 78.74 a barrel.

The European Central Bank announces its monetary policy decision

on Thursday, with investors waiting for cues on when it would start

easing interest rates from record highs.

In economic news, the services sector in Australia moved to

expansion in February, the latest survey from Judo Bank said on

Tuesday with a services PMI score of 53.1. That's up from 49.1 and

it moved above the boom-or-bust line of 50 that separates expansion

from contraction.

Meanwhile, Australia posted a seasonally adjusted current

account surplus of A$11.8 billion in the fourth quarter of 2023,

the Australian Bureau of Statistics said on Tuesday. That beat

forecasts for a surplus of A$4.8 billion following the upwardly

revised A$1.3 billion surplus in the previous three months.

The capital and financial account deficit was A$9.730 billion, a

turnaround of A$13.214 billion on the third quarter 2023 surplus.

The net international investment liability position was A$836.635

billion at 31 December 2023.

In the Asian trading today, the Australian dollar fell to a

3-1/2-month low of 1.6744 against the euro and nearly a 3-week low

of 0.6478 against the U.S. dollar, from yesterday's closing quotes

of 1.6665 and 0.6511, respectively. If the aussie extends its

downtrend, it is likely to find support around 1.69 against the

euro and 0.63 against the greenback.

Against the NZ dollar and the yen, the aussie slipped to 4-day

lows of 1.0665 and 97.47 from Monday's closing quotes of 1.0681 and

98.00, respectively. The aussie may test support near the 1.05

region.

The aussie slipped to a 6-day low of 0.8806 against the Canadian

dollar, from yesterday's closing value of 0.8835. On the downside,

0.87 is seen as the next support level for the aussie.

The NZ dollar fell to nearly a 3-week low of 0.6073 against the

U.S. dollar and nearly a 1-1/2 month low of 1.7862 against the

euro, from yesterday's closing quotes of 0.6091 and 1.7811,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.59 against the greenback and 1.80 against the

euro.

Against the yen, the kiwi dropped to a 4-day low of 91.38 from

Monday's closing value of 91.72. The kiwi may test support near the

90.00 region.

The Canadian dollar fell to nearly a 3-month low of 1.4751

against the euro and a 4-day low of 1.3599 against the U.S. dollar,

from yesterday's closing quotes of 1.4731 and 1.3571, respectively.

If the loonie extends its downtrend, it is likely to find support

around 1.48 against the euro and 1.37 against the greenback.

Against the yen, the loonie edged down to 110.64 from

yesterday's closing value of 110.86. The loonie is likely to find

support near the 108.00 region.

Looking ahead, PMI reports from various European economies and

U.K. for February and Eurozone PPI for January are due to be

released in the European session.

In the New York session, U.S. Redbook report, U.S. and Canada

PMI rports for February and U.S. factory orders for January are

slated for release.

At 12:00 pm ET, Federal Reserve Vice Chair for Supervision

Michael Barr will participate virtually in panel, "CRA

Modernization: A Conversation with Agency Leadership" before the

2024 National Interagency Community Reinvestment Conference in

Portland, Oregon, U.S.

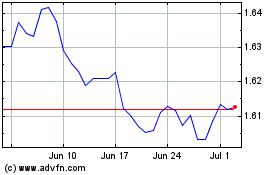

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024