Commodity Currencies Drop As Asian Stock Markets Traded Lower

08 October 2024 - 1:23PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Tuesday, as Asian shares traded lower dragged by

the tumbling Hong Kong market. Traders also reassessed their

expectations for the outlook on interest rates after upbeat U.S.

jobs data. Escalating tensions in the Middle East is also weighing

on market sentiment.

The Australian dollar fell after the remarks made by Zheng

Shanjie, the chairman of China National Development and Reform

Commission at the press conference. The investors were disappointed

over the lack of concrete information regarding the extent of

Beijing's newly announced stimulus program.

Traders also now cautiously await readings on U.S. consumer

price and producer price inflation later in the week for further

cues.

On the geopolitical front, Israeli defense forces intensified

air strikes targeting Gaza and the Lebanese capital of Beirut

simultaneously on the first anniversary of Hamas' cross-border

attack in Israel, which triggered the Middle East war.

The Reserve Bank of New Zealand (RBNZ) is due to announce its

monetary policy decision on Wednesday, where markets widely

anticipate it to cut interest rates by 50 basis points to 4.75

percent. In the Asian trading now, the Australian dollar fell to

more than a 2-week low of 1.6341 against the euro, a 6-day low of

99.09 against the yen and a 4-day low of 1.0988 against the NZ

dollar, from yesterday's closing quotes of 1.6239, 100.13 and

1.1030, respectively. If the aussie extends its downtrend, it is

likely to find support around 1.65 against the euro, 96.00 against

the yen and 1.08 against the kiwi.

Against the U.S. and the Canadian dollars, the aussie slipped to

more than 3-week lows of 0.6715 and 0.9155 from Monday's closing

quotes of 0.6757 and 0.9200, respectively. The aussie may test

support near 0.65 against the greenback and 0.90 against the

loonie.

The NZ dollar fell to nearly a 3-week low of 1.7967 against the

euro, from yesterday's closing value of 1.7914. The next possible

downside target is seen around the 1.81 region.

Against the U.S. dollar and the yen, the kiwi slid to nearly a

4-week low of 0.6108 and a 6-day low of 90.12 from Monday's closing

quotes of 0.6124 and 90.75, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.59 against the

greenback and 88.00 against the yen.

The Canadian dollar fell to 4-day lows of 108.21 against the yen

and 1.4966 against the euro, from yesterday's closing quotes of

108.80 and 1.4942, respectively. If the loonie extends its

downtrend, it is likely to find support around 104.00 against the

yen and 1.52 against the euro.

Against the U.S. dollar, the loonie edged down to 1.3635 from

Monday's closing value of 1.3616. On the downside, 1.37 is seen as

the next support level for the loonie.

Looking ahead, U.S. Sep NFIB business optimism index for

September and U.S. and Canada trade data for August, are slated for

release in the New York session.

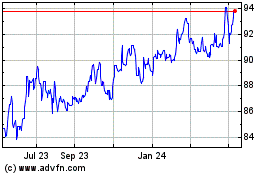

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Oct 2024 to Nov 2024

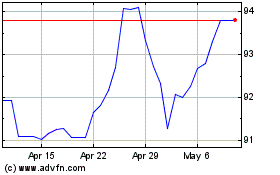

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Nov 2023 to Nov 2024