Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

06 September 2023 - 1:56AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant |

☒ |

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to § 240.14a-12 |

ACE GLOBAL BUSINESS ACQUISITION LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ACE GLOBAL BUSINESS ACQUISITION LIMITED

Rm. 806, 8/F, Tower 2, Lippo Centre,

No. 89 Queensway, Admiralty, Hong Kong

SUPPLEMENT TO PROXY STATEMENT

FOR THE SPECIAL MEETING OF

SHAREHOLDERS

To Be Held September 19, 2023

Explanatory Note

On August 29, 2023, Ace Global

Business Acquisition Limited (the “Company”) filed a definitive proxy statement (the “Proxy Statement”)

for a special meeting of shareholders of the Company (the “Special Meeting”) to be held at 10:00 a.m. local time on

September 19, 2023. This supplemental information to the Proxy Statement (this “Supplement”) supplements the Proxy

Statement as filed and should be read in conjunction with the Proxy Statement.

The purpose of this Supplement

is to correct a typographical error with respect to the anticipated redemption price per share of common stock applicable to the Company’s

shareholders at the meeting for the Company’s initial business combination or subsequent liquidation, should the Charter Amendment

Proposal and Trust Amendment Proposal be approved and the Company extend the Combination Period to April 8, 2024 (each as defined in the

Proxy Statement). The anticipated redemption price per share, assuming no redemptions, will be approximately $11.79.

THIS SUPPLEMENT SHOULD BE

READ IN CONJUNCTION WITH THE PROXY STATEMENT.

EXCEPT AS SPECIFICALLY SUPPLEMENTED

BY THE INFORMATION CONTAINED HEREIN, THIS SUPPLEMENT DOES NOT MODIFY ANY OTHER INFORMATION SET FORTH IN THE PROXY STATEMENT.

This Supplement supplements

and updates the disclosures in the Proxy Statement as follows:

| ● | On page two of the Proxy Statement, the paragraph that begins “As of August 28, 2023” is deleted

in its entirety and replaced with the following: |

As of August 28,

2023, there was approximately $26,714,047.01 in the Trust Account. If the Charter Amendment Proposal and Trust Amendment Proposal are

approved and the Company extends the Combination Period to April 8, 2024, the redemption price per share of common stock applicable to

all shareholders at the meeting for our initial business combination or the Company’s subsequent liquidation, assuming no redemptions

have occurred prior to the date thereof, will be approximately $11.79 per share.

| ● | On page three of the Proxy Statement, the paragraph that begins “Moreover, the process of government

review” is deleted in its entirety and replaced with the following: |

Moreover, the process

of government review, whether by the CFIUS or otherwise, could be lengthy and we have limited time to complete our initial business combination.

If we cannot complete our initial business combination within 36 months (assuming full extension of the time to complete a business combination)

from the closing of our initial public offering because the review process drags on beyond such timeframe or because our initial business

combination is ultimately prohibited by CFIUS or another U.S. government entity, we may be required to liquidate. If we liquidate, assuming

no redemptions have occurred prior to the date thereof, our public shareholders may only receive approximately $11.79 per share, and our

warrants will expire worthless. This will also cause you to lose the investment opportunity in a target company and the chance of realizing

future gains on your investment through any price appreciation in the combined company.

| ● | On page six of the Proxy Statement, the paragraph that begins “Pursuant to our currently existing

charter” is deleted in its entirety and replaced with the following: |

Pursuant to our

currently existing charter, any holders of our public shares may demand that such shares be redeemed for a pro rata share of the aggregate

amount on deposit in the trust account, less taxes payable, calculated as of two (2) business days prior to the Special Meeting. Regardless

whether you vote for or against the Charter Amendment and the Trust Amendment, if your request is properly made and the Charter Amendment

and Trust Amendment are approved, these shares will cease to be outstanding and will represent only the right to receive a pro rata share

of the aggregate amount on deposit in the trust account which holds the proceeds of our IPO (calculated as of two (2) business days prior

to the Special Meeting). For illustrative purposes only, based on funds in the trust account of approximately $26,714,047.01 on August

28, 2023 and assuming no redemptions have occurred prior to the date thereof, the estimated per share redemption price would have been

approximately $11.79.

Other than the changes described

in this Supplement, the terms in the Proxy Statement remain as described.

Important Information

There are no changes to the

proposals to be acted upon at the Special Meeting, which are described in the Proxy Statement or the proxy card you previously received.

Except as amended or supplemented by the information contained in this Supplement, all information set forth in the Proxy Statement continues

to apply and should be considered in voting your shares.

This Supplement and the Proxy

Statement are available on the SEC’s website at ww.sec.gov.

Whether or not you intend

to be present at the Special Meeting, we urge you to vote or submit your proxy promptly.

2

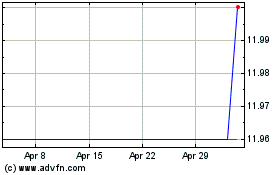

Ace Global Business Acqu... (NASDAQ:ACBAU)

Historical Stock Chart

From Apr 2024 to May 2024

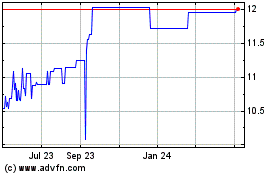

Ace Global Business Acqu... (NASDAQ:ACBAU)

Historical Stock Chart

From May 2023 to May 2024