false000071557900007155792024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

______________

Date of Report (Date of earliest event reported): January 23, 2024

ACNB Corporation

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Pennsylvania | | 1-35015 | | 23-2233457 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

16 Lincoln Square, Gettysburg, PA | | 17325 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| 717.334.3161 | |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title Of Each Class | Trading Symbol(s) | Name Of Each Exchange On Which Registered |

| Common Stock, $2.50 par value per share | ACNB | The NASDAQ Stock Market, LLC |

CURRENT REPORT ON FORM 8-K

ITEM 8.01 Other Events

As more fully described in the attached press release dated January 24, 2024, the Board of Directors of ACNB Corporation approved and declared the regular quarterly cash dividend for the first quarter of 2024 on January 23, 2024. The cash dividend of $0.30 per common share is payable on March 15, 2024, to shareholders of record as of March 1, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information furnished under this Item 8.01 of this Current Report on Form 8-K shall not be deemed to be filed for purposes of the Securities Exchange Act of 1934.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit Number Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | ACNB CORPORATION (Registrant) |

| | | |

| Dated: | January 24, 2024 | | /s/ Kevin J. Hayes |

| | | Kevin J. Hayes |

| | | Senior Vice President/ |

| | | General Counsel, Secretary & Chief Governance Officer |

PRESS RELEASE

FOR IMMEDIATE RELEASE

| | | | | | | | | | | | | | | | | |

| | | | Contact: | Kevin J. Hayes |

| | | | | SVP/General Counsel, |

| | | | | Secretary & Chief |

| | | | | Governance Officer |

| | | | | 717.339.5161 |

| | | | | khayes@acnb.com |

ACNB CORPORATION ANNOUNCES

FIRST QUARTER CASH DIVIDEND

GETTYSBURG, PA, January 24, 2024 --- ACNB Corporation (NASDAQ: ACNB), financial holding company for ACNB Bank and ACNB Insurance Services, Inc., announced today that the Board of Directors approved and declared a regular quarterly cash dividend of $0.30 per share of ACNB Corporation common stock payable on March 15, 2024, to shareholders of record as of March 1, 2024. This per share amount reflects a 7.1% increase over the same quarter of 2023 and will result in aggregate dividend payments of nearly $2.6 million to ACNB Corporation shareholders in the first quarter of 2024. Compared to a year ago, ACNB Corporation paid a $0.28 dividend per common share in the first quarter of 2023. This action marks the Corporation’s 165th consecutive quarterly cash dividend to shareholders since its formation in 1982.

ACNB Corporation, headquartered in Gettysburg, PA, is the independent $2.4 billion financial holding company for the wholly-owned subsidiaries of ACNB Bank, Gettysburg, PA, and ACNB Insurance Services, Inc., Westminster, MD. Originally founded in 1857, ACNB Bank serves its marketplace with banking and wealth management services, including trust and retail brokerage, via a network of 26 community banking offices and three loan offices located in the Pennsylvania counties of

ACNB Corporation

Press Release/2024 First Quarter Cash Dividend

January 24, 2024

Page 2 of 2

Adams, Cumberland, Franklin, Lancaster and York and the Maryland counties of Baltimore, Carroll and Frederick. ACNB Insurance Services, Inc. is a full-service insurance agency with licenses in 44 states. The agency offers a broad range of property, casualty, health, life and disability insurance serving personal and commercial clients through office locations in Westminster and Jarrettsville, MD, and Gettysburg, PA. For more information regarding ACNB Corporation and its subsidiaries, please visit investor.acnb.com.

# # #

FORWARD-LOOKING STATEMENTS - In addition to historical information, this press release may contain forward-looking statements. Examples of forward-looking statements include, but are not limited to, (a) projections or statements regarding future earnings, expenses, net interest income, other income, earnings or loss per share, asset mix and quality, growth prospects, capital structure, and other financial terms, (b) statements of plans and objectives of Management or the Board of Directors, and (c) statements of assumptions, such as economic conditions in the Corporation’s market areas. Such forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “intends”, “will”, “should”, “anticipates”, or the negative of any of the foregoing or other variations thereon or comparable terminology, or by discussion of strategy. Forward-looking statements are subject to certain risks and uncertainties such as national, regional and local economic conditions, competitive factors, and regulatory limitations. Actual results may differ materially from those projected in the forward-looking statements. Such risks, uncertainties, and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the following: short-term and long-term effects of inflation and rising costs on the Corporation, customers and economy; effects of governmental and fiscal policies, as well as legislative and regulatory changes; effects of new laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) and their application with which the Corporation and its subsidiaries must comply; impacts of the capital and liquidity requirements of the Basel III standards; effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Financial Accounting Standards Board and other accounting standard setters; ineffectiveness of the business strategy due to changes in current or future market conditions; future actions or inactions of the United States government, including the effects of short-term and long-term federal budget and tax negotiations and a failure to increase the government debt limit or a prolonged shutdown of the federal government; effects of economic conditions particularly with regard to the negative impact of any pandemic, epidemic or health-related crisis and the responses thereto on the operations of the Corporation and current customers, specifically the effect of the economy on loan customers’ ability to repay loans; effects of competition, and of changes in laws and regulations on competition, including industry consolidation and development of competing financial products and services; inflation, securities market and monetary fluctuations; risks of changes in interest rates on the level and composition of deposits, loan demand, and the values of loan collateral, securities, and interest rate protection agreements, as well as interest rate risks; difficulties in acquisitions and integrating and operating acquired business operations, including information technology difficulties; challenges in establishing and maintaining operations in new markets; effects of technology changes; effects of general economic conditions and more specifically in the Corporation’s market areas; failure of assumptions underlying the establishment of reserves for loan losses and estimations of values of collateral and various financial assets and liabilities; acts of war or terrorism or geopolitical instability; disruption of credit and equity markets; ability to manage current levels of impaired assets; loss of certain key officers; ability to maintain the value and image of the Corporation’s brand and protect the Corporation’s intellectual property rights; continued relationships with major customers; and, potential impacts to the Corporation from continually evolving cybersecurity and other technological risks and attacks, including additional costs, reputational damage, regulatory penalties, and financial losses. We caution readers not to place undue reliance on these forward-looking statements. They only reflect Management’s analysis as of this date. The Corporation does not revise or update these forward-looking statements to reflect events or changed circumstances. Please carefully review the risk factors described in other documents the Corporation files from time to time with the SEC, including the Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Please also carefully review any Current Reports on Form 8-K filed by the Corporation with the SEC.

ACNB #2024-2

January 24, 2024

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

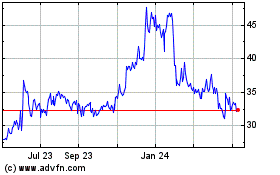

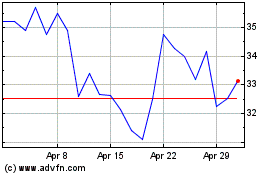

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Apr 2023 to Apr 2024