false000071557912/3100007155792024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

______________

Date of Report (Date of earliest event reported): February 20, 2024

ACNB Corporation

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Pennsylvania | | 1-35015 | | 23-2233457 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

16 Lincoln Square, Gettysburg, PA | | 17325 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| 717.334.3161 | |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title Of Each Class | Trading Symbol(s) | Name Of Each Exchange On Which Registered |

| Common Stock, $2.50 par value per share | ACNB | The NASDAQ Stock Market, LLC |

CURRENT REPORT ON FORM 8-K

ITEM 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On February 20, 2024, the Board of Directors of ACNB Corporation (the "Corporation") amended Article II, Section 203 of the Bylaws of the Corporation increasing the minimum number of shares that a director must own to qualify for and serve on the Board of Directors from five hundred (500) shares of common stock to one thousand five hundred (1,500) shares of common stock.

In addition, the Bylaws were amended to (1) replace all gender-specific pronouns with gender inclusive pronouns and (2) to replace all references to the title “chairman” with “chair”.

The foregoing description of the amendment to the Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Bylaws, which are attached hereto as Exhibit 3.2 and incorporated herein by reference.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit Number Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | ACNB CORPORATION (Registrant) |

| | | |

| Dated: | February 21, 2024 | | /s/ Kevin J. Hayes |

| | | Kevin J. Hayes |

| | | Senior Vice President/ |

| | | General Counsel, Secretary & Chief Governance Officer |

AMENDED AND RESTATED

BYLAWS

OF

ACNB CORPORATION

February 20, 2024

These Bylaws are supplemental to the Pennsylvania Business Corporation Law and other applicable provisions of law, as the same shall from time to time be in effect.

ARTICLE I

MEETINGS OF SHAREHOLDERS

Section 101. Place Of Meetings. All meetings of the shareholders shall be held at such place or places, within or without the Commonwealth of Pennsylvania, as shall be determined by the Board of Directors from time to time. The Board of Directors shall have the right to determine that a meeting of shareholders be held solely by means of the Internet or other electronic communications technology in the manner and to the extent provided by the Pennsylvania Business Corporation Law.

Section 102. Annual Meetings. The annual meeting of the shareholders for the election of Directors and the transaction of such other business as may properly come before the meeting shall be held at the Registered Corporate Office, or any convenient place duly authorized by the Board of Directors, at such time as the Board of Directors shall fix; but if no such election is held on that day, it may be held at any regular adjournment of the meeting or at a subsequent special meeting called in accordance with the provisions of the laws of the Commonwealth of Pennsylvania. Any business which is a proper subject for shareholder action may be transacted at the annual meeting, irrespective of whether the notice of said meeting contains any reference thereto, except as otherwise provided by applicable law.

Section 103. Special Meetings. Special meetings of the shareholders may be called at any time by the Board of Directors, or by the shareholders entitled to cast at least one-third (1/3) of the vote which all shareholders are entitled to cast at the particular meeting.

Section 104. Conduct of Shareholders’ Meetings. The President shall preside at all shareholders’ meetings. In the absence of the President, the Chair of the Board shall preside, or in his or her absence, any Officer designated by the Board of Directors. The Officer presiding over the shareholders’ meeting may establish such rules and regulations for the conduct of the meeting as he or she may deem to be reasonably necessary or desirable for the orderly and expeditious conduct of the meeting.

ARTICLE II

DIRECTORS AND BOARD MEETINGS

Section 201. Management by Board of Directors. The business and affairs of the Corporation shall be managed by its Board of Directors. The Board of Directors may exercise all such powers of the Corporation and do all such lawful acts and things as are not, by statute, regulation, the Articles of Incorporation or these Bylaws, directed or required to be exercised or done by the shareholders.

Section 202. Nominations of Directors. Nominations for election to the Board of Directors of the Corporation may be made by the Board of Directors or by any shareholder of any outstanding class of capital stock of the Corporation entitled to vote for the election of Directors. Any shareholder who intends to nominate or cause to have nominated any candidate for election to the Board of Directors, other than any candidate nominated by the Board of Directors of the Corporation, shall so notify the Secretary of the Corporation in writing not less than fourteen (14) days prior to the date of any meeting of the shareholders of the Corporation called for the election of Directors. In such notification, the class of Directors to which each proposed nominee is nominated must be specified, if more than one class of Directors is to be elected at any meeting of the shareholders called for the election of Directors.

In addition, such notification shall contain the following information to the extent known by the notifying shareholder: (a) the name and residence address of each proposed nominee; (b) the age of each proposed nominee; (c) the principal occupation of each proposed nominee; (d) the number of shares of stock of the Corporation beneficially owned by each proposed nominee; (e) the total number of shares of stock of the Corporation that to the knowledge of the notifying shareholder will be voted for each proposed nominee; (f) the name and residence address of the notifying shareholder; and, (g) the number of shares of stock of the Corporation beneficially owned by the notifying shareholder.

Any nomination for Director not made in accordance with this Section shall be disregarded by the chair of the meeting, and votes cast for each such nominee shall be disregarded by the judges of election. In the event that the same person is nominated by more than one (1) shareholder, if at least one (1) nomination for such person complies with this Section the nomination shall be honored and all votes cast for such nominee shall be counted.

Section 203. Directors Must Be Shareholders. Every Director must be a shareholder of the Corporation and, during the full term of his or her directorship, shall own a minimum of one thousand five hundred (1,500) shares of common stock of the Corporation. Any Director shall forthwith cease to be a Director when he or she no longer holds such shares, which fact shall be reported to the Board of Directors by the Secretary, whereupon the Board of Directors shall declare the seat of such Director vacated.

Section 204. The number of Directors that shall constitute the whole Board of Directors shall be not less than five (5) nor more than twenty-five (25). The Board of Directors shall be classified into three (3) classes (Class 1, Class 2 and Class 3), each class to be elected for a term of three (3) years. The terms of the respective classes shall expire in successive years as provided in Section 205 hereof. The Board of Directors shall have the sole discretion to increase the number of Directors that shall constitute the whole Board of Directors. Within the foregoing limits, the Board of Directors may from time to time fix the number of Directors and their respective classifications. Each class shall consist as nearly as possible of one-third (1/3) the number of the whole Board of Directors. Nothing herein should be construed to require exact equality in the number of Directors in each class.

Section 205. At each annual meeting of the shareholders, successors to the class of Directors whose term shall then expire shall be elected to hold office for a term of three (3) years, so that the term of office of one (1) class of Directors shall expire in each year.

Section 206. Vacancies. Vacancies in the Board of Directors, including vacancies resulting from an increase in the number of Directors, may be filled by the remaining members of the Board even though less than a quorum. Any Director appointed or elected to fill a vacancy in the Board of Directors shall become a member of the same class of Directors in which the vacancy existed; but if the vacancy is due to an increase in the number of Directors, a majority of the members of the Board of Directors shall designate such directorship as belonging to Class 1, Class 2 or Class 3 so as to maintain the three (3) classes of Directors as nearly equal in number as possible. Each Director so appointed or elected shall be a Director until the expiration of the term of office of the class of Directors to which he or she was appointed or elected, and until his or her successor has been elected and qualified by the shareholders or until his or her earlier death, resignation or removal.

Section 207. Resignations and Retirement Age.

(a) Resignations. Any Director may resign at any time. Such resignation shall be in writing, but the acceptance thereof shall not be necessary to make it effective.

(b) Retirement Age. Except as provided in this Section 207, no Director or nominee shall stand for election, be appointed, or be eligible to serve as a Director, if as of the date of election or appointment, he or she shall have attained the age of seventy-two (72) years old. Any Director who attains the age of seventy-two (72) years old during his or her term of office may continue to serve as a Director until the annual meeting at which the term of his or her class of Directors expires and their successors are duly elected.

Section 208. Compensation of Directors. No Director shall be entitled to any salary as such, but the Board of Directors may fix, from time to time, a reasonable annual fee for acting as a Director and a reasonable fee to be paid each Director for his or her services in attending meetings of the Board and meetings of Committees appointed by the Board. The Corporation may reimburse Directors for expenses related to their duties as a member of the Board.

Section 209. Regular Meetings. Regular meetings of the Board of Directors shall be held at the Registered Corporate Office, or any convenient place duly authorized by the Board of Directors, on the third Tuesday of every month at such hour of the day, or upon designation of such other day and hour of the day, as the Board of Directors shall select. When any regular meeting of the Board falls upon a holiday, the meeting shall be held on the next banking business day unless the Board shall designate some other day. The Board of Directors shall meet for reorganization at the first regular meeting following the annual meeting of shareholders at which the Directors are elected. Notice need not be given of regular meetings of the Board of Directors which are held at the time and place designated by the Board of Directors. If a regular meeting is not to be held at the time and place designated by the Board of Directors, notice of such meeting, which need not specify the business to be transacted thereat and which may be either verbal or in writing, shall be given by the Secretary to each member of the Board at least twenty-four (24) hours before the time of the meeting.

A majority of the members of the Board of Directors shall constitute a quorum for the transaction of business. If, at the time fixed for the meeting, including the meeting to organize the new Board following the annual meeting of shareholders, a quorum is not present, the Directors in attendance may adjourn the meeting from time to time until a quorum is obtained.

Except as otherwise provided herein, a majority of those Directors present and voting at any meeting of the Board of Directors shall decide each matter considered. A Director cannot vote by proxy, or otherwise act by proxy, at a meeting of the Board of Directors.

Section 210. Special Meetings. Special meetings of the Board of Directors may be called by the Chair of the Board, the President, or at the request of three (3) or more members of the Board of Directors. A special meeting of the Board of Directors shall be deemed to be any meeting other than the regular meeting of the Board of Directors. Notice of the time and place of every special meeting, which need not specify the business to be transacted thereat and which may be either verbal or in writing, shall be given by the Secretary to each member of the Board at least twenty-four (24) hours before the time of such meeting, excepting the reorganization meeting following the election of Directors.

Section 211. Chair of the Board. The Board of Directors shall elect a Chair of the Board at the first regular meeting of the Board following each annual meeting of shareholders at which Directors are elected. The Chair of the Board shall be a member of the Board of Directors; shall preside at the meetings of the Board; shall be an ex-officio member of all Committees of the Corporation; and, shall perform such other duties as may be prescribed by the Board of Directors.

Section 212. Vice Chairs of the Board. The Board of Directors may elect one (1) or more Vice Chairs of the Board as the Board of Directors may from time to time deem advisable. The Vice Chairs of the Board shall have such duties as are prescribed by the Board of Directors or the Chair of the Board.

Section 213. Reports and Records. The reports of Officers and Committees and the records of the proceedings of all Committees shall be filed with the Secretary of the Corporation and presented to the Board of Directors, if practicable, at its next regular meeting. The Board of Directors shall keep complete records of its proceedings in a minute book kept for that purpose. When a Director shall request it, the vote of each Director upon a particular question shall be recorded in the minutes.

Section 214. The Board of Directors may declare vacant the office of a Director who has been judicially declared of unsound mind or who has been convicted of an offense punishable by imprisonment for a term of more than one (1) year or for any other proper cause which these Bylaws may specify or if, within sixty (60) days or such other time as these Bylaws may specify after notice of his or her selection, he or she does not accept the office either in writing or by attending a meeting of the Board of Directors and fulfill such other requirements of qualification as these Bylaws may specify.

Section 215. Upon application of any shareholder or Director, the court may remove from office any Director in case of fraudulent or dishonest acts, or gross abuse of authority or discretion with reference to the Corporation, or for any other proper cause, and may bar from office any Director so removed for a period prescribed by the court. The Corporation shall be made a party to the action and, as a prerequisite to the maintenance of an action under this Section 215, a shareholder shall comply with Section 1782 of the Business Corporation Law of 1988, and any amendments or supplements thereto.

Section 216. An act of the Board of Directors done during the period when a Director has been suspended or removed for cause shall not be impugned or invalidated if the suspension or removal is thereafter rescinded by the shareholders or by the Board of Directors or by the final judgment of a court.

ARTICLE III

COMMITTEES

Section 301. Committees and the Organization and Proceedings of Committees. The Board of Directors may establish such Committee or Committees as the Board of Directors in its discretion deems best. Each Committee of the Board of Directors shall effect its own organization by the appointment of a Secretary and such other Officers, except the Chair and Vice Chair, as it may deem necessary. A record of the proceedings of all Committees shall be kept by the Secretary of such Committee and filed and presented as provided in Section 211 of these Bylaws.

ARTICLE IV

OFFICERS

Section 401. Officers. The Officers of the Corporation shall be a President, one (1) or more Vice Presidents, a Secretary, a Treasurer, and such other Officers and Assistant Officers as the Board of Directors may from time to time deem advisable. Except for the President, Secretary, and Treasurer, the Board may refrain from filling any of the said offices at any time and from time to time. The same individual may hold any two (2) or more offices, except both the offices of President and Treasurer. The following Officers shall be elected by the Board of Directors at the time, in the manner and for such terms as the Board of Directors from time to time shall determine: President, Executive Vice President, Senior Vice President, First Vice President, Secretary, and Treasurer. The President may, subject to change by the Board of Directors, appoint such Officers and Assistant Officers as he/she may deem advisable, provided such Officers or Assistant Officers have a title not higher than Vice President, who shall hold office for such periods as the President shall determine. Any Officer may be removed at any time, with or without cause, and regardless of the term for which such Officer was elected, but without prejudice to any contract right of such Officer. Each Officer shall hold his or her office for the current year for which he or she was elected or appointed by the Board, unless he or she shall resign, becomes disqualified, or be removed at the pleasure of the Board of Directors.

Section 402. President. The President shall have general supervision of all of the departments and business of the Corporation and shall prescribe the duties of the other Officers and

Employees and see to the proper performance thereof. The President shall be responsible for having all orders and resolutions of the Board of Directors carried into effect. The President shall execute on behalf of the Corporation and may affix or cause to be affixed a seal to all authorized documents and instruments requiring such execution, except to the extent that signing and execution thereof shall have been delegated to some other Officer or Agent of the Corporation by the Board of Directors or by the President. The President shall be a member of the Board of Directors. In the absence or disability of the Chair of the Board or his or her refusal to act, the President shall preside at meetings of the Board. In general, the President shall perform all the duties and exercise all the powers and authorities incident to such office or as prescribed by the Board of Directors. The President of the Corporation shall be the Chief Executive Officer of the Corporation and shall be an ex-officio member of all Committees of the Corporation.

Section 403. Vice Presidents. The Vice Presidents shall perform such duties, do such acts, and be subject to such supervision as may be prescribed by the Board of Directors or the President. In the event of the absence or disability of the President or his or her refusal to act, the Vice Presidents, in the order of their rank, and within the same rank in the order of their authority, shall perform the duties and have the powers and authorities of the President, except to the extent inconsistent with applicable law.

Section 404. Secretary. The Secretary shall act under the supervision of the President or such other Officer as the President may designate. Unless a designation to the contrary is made at a meeting, the Secretary shall attend all meetings of the Board of Directors and all meetings of the shareholders and record all of the proceedings of such meetings in a book to be kept for that purpose, and shall perform like duties for the standing Committees when required by these Bylaws or otherwise. The Secretary shall give, or cause to be given, notice of all meetings of the shareholders and of the Board of Directors. The Secretary shall keep a seal of the Corporation, and, when authorized by the Board of Directors or the President, cause it to be affixed to any documents and instruments requiring it. The Secretary shall perform such other duties as may he or she prescribed by the Board of Directors, the Chair of the Board, the President, or such other supervising Officer as the President may designate.

Section 405. Treasurer. The Treasurer shall act under the supervision of the President or such other Officer as the President may designate. The Treasurer shall have custody of the Corporation’s funds and such other duties as may be prescribed by the Board of Directors, the President, or such other supervising Officer as the President may designate.

Section 406. Assistant Officers. Unless otherwise provided by the Board of Directors, each Assistant Officer shall perform such duties as shall be prescribed by the Board of Directors, the President, or the Officer to whom he or she is an Assistant. In the event of the absence or disability of an Officer or his or her refusal to act, his or her Assistant Officers shall, in the order of their rank, and within the same rank in the order of their seniority, have the powers and authorities of such Officer.

Section 407. Compensation. Unless otherwise provided by the Board of Directors, the salaries and compensation of all Officers and Assistant Officers, except the President, shall be fixed by or in the manner designated by the President.

Section 408. General Powers. The Officers are authorized to do and perform such corporate acts as are necessary in the carrying on of the business of the Corporation, subject always to the direction of the Board of Directors.

ARTICLE V

AS OF

MAY 19, 1987

RESERVED FOR FUTURE USE

ARTICLE VI

SHARES OF CAPITAL STOCK

Section 601. Authority to Sign Share Certificates. Every share certificate of the Corporation shall be signed by the President and by the Secretary or one of the Assistant Secretaries. Certificates may be signed by a facsimile signature of the President and the Secretary or one of the Assistant Secretaries of the Corporation.

Section 602. Lost or Destroyed Certificates. Any person claiming a share certificate to be lost, destroyed or wrongfully taken shall receive a replacement certificate if such person shall have: (a) requested such replacement certificate before the Corporation has notice that the shares have been acquired by a bona fide purchaser; (b) provided the Corporation with an indemnity agreement satisfactory in form and substance to the Board of Directors, or the President or the Secretary; and (c) satisfied any other reasonable requirements (including providing an affidavit and a surety bond) fixed by the Board of Directors, or the President or the Secretary.

Section 603. Uncertificated Shares. Notwithstanding anything herein to the contrary, any or all classes and series of shares, or any part thereof, may be represented by uncertificated shares to the extent determined by the Board of Directors, except that shares represented by a certificate that is issued and outstanding shall continue to be represented thereby until the certificate is surrendered to the Corporation or its designee. Within a reasonable time after the issuance or transfer of uncertificated shares, the Corporation or its designee shall send to the registered owner thereof a written notice containing the information required to be set forth or stated on certificates. The rights and obligations of the holders of shares represented by certificates and the rights and obligations of the holders of uncertificated shares of the same class shall be identical. Notwithstanding anything herein to the contrary, the provisions of Section 601 shall not apply to uncertificated shares and, in lieu thereof, the Board of Directors shall adopt alternative procedures for the registration of transfers.

ARTICLE VII

GENERAL

Section 701. Fiscal Year. The fiscal year of the Corporation shall begin on the first (1st) day of January in each year and end on the thirty-first (31st) day of December in each year.

Section 702. Record Date. The Board of Directors may fix a time, not more than ninety (90) days prior to the date of any meeting of shareholders, or the date fixed for the payment of any dividend or distribution, or the date for the allotment of rights, or the date when any change or conversion or exchange of shares will be made or go into effect, as a record date for the determination of the shareholders entitled to notice of, or to vote at, any such meeting, or entitled to receive payment of any such dividend or distribution, or to receive any such allotment of rights, or to exercise the rights in respect to any such change, conversion, or exchange of shares.

Section 703. Emergency Bylaws. In the event of any emergency resulting from an attack on the United States, a nuclear disaster, or another catastrophe, and during the continuance of such emergency, the following Bylaw provisions shall be in effect, notwithstanding any other provisions of the Bylaws:

(a) A meeting of the Board of Directors or of any Committee thereof may be called by any Officer or Director upon one (1) hour’s notice to all persons entitled to notice whom, in the sole judgment of the notifier, it is feasible to notify;

(b) The Director or Directors in attendance at the meeting of the Board of Directors or of any Committee thereof shall constitute a quorum; and,

(c) These Bylaws may be amended or repealed, in whole or in part, by a majority vote of the Directors attending any meeting of the Board of Directors, provided such amendment or repeal shall only be effective for the duration of such emergency.

Section 704. Severability. If any provision of these Bylaws is illegal or unenforceable as such, such illegality or unenforceability shall not affect any other provision of these Bylaws and such other provisions shall continue in full force and effect.

ARTICLE VIII

AMENDMENT OR REPEAL

Section 801. Amendment or Repeal by the Board of Directors. These Bylaws may be amended or repealed, in whole or in part, by a majority vote of members of the Board of Directors at any regular or special meeting of the Board duly convened.

ARTICLE IX

INDEMNIFICATION OF OFFICERS AND EMPLOYEES

Section 901. The Corporation shall indemnify any Officer and/or employee, or any former Officer and/or employee, who was or is a party to, or is threatened to be made a party to, or who is called to be a witness in connection with, any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that such person is or was an Officer and/or employee of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in connection with such action, suit or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent, shall not of itself create a presumption that the person did not act in good faith and in a manner which he or she reasonably believed to be in, or not opposed to, the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was unlawful.

Section 902. The Corporation shall indemnify any Officer and/or employee, who was or is a party to, or is threatened to be made a party to, or who is called as a witness in connection with, any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against amounts paid in settlement and expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection with the defense or settlement of, or serving as a witness in, such action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Corporation and except that no indemnification shall be made in respect of any such claim, issue or matter as to which such person shall have been adjudged to be liable for misconduct in the performance of his or her duty to the Corporation.

Section 903. Except as may be otherwise ordered by a court, there shall be a presumption that any Officer and/or employee is entitled to indemnification as provided in Sections 901 and 902 of this Article unless either a majority of the Directors who are not involved in such proceedings (“disinterested directors”) or, if there are less than three (3) disinterested directors, then the holders of one-third (1/3) of the outstanding shares of the Corporation determine that the person is not entitled to such presumption by certifying such determination in writing to the Secretary of the Corporation. In such event the disinterested director(s) or, in the event of certification by shareholders, the Secretary of the Corporation shall request of independent counsel, who may be the outside general counsel of the Corporation, a written opinion as to whether or not the parties involved are entitled to indemnification under Sections 901 and 902 of this Article.

Section 904. Expenses incurred by an Officer and/or employee in defending a civil or criminal action, suit or proceeding may be paid by the Corporation in advance of the final disposition of such action, suit or proceeding as authorized in the manner provided under Section 903 of this Article upon receipt of an undertaking by or on behalf of the Officer and/or employee to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the Corporation.

Section 905. The indemnification provided by this Article shall not be deemed exclusive of any other rights to which a person seeking indemnification may be entitled under any agreement,

vote of shareholders or disinterested directors, or otherwise, both as to action in his or her official capacity while serving as an Officer and/or employee and as to action in another capacity while holding such office, and shall continue as to a person who has ceased to be an Officer and/or employee and shall inure to the benefit of the heirs, executors and administrators of such a person.

Section 906. The Corporation may create a fund of any nature, which may, but need not be, under the control of a trustee, or otherwise secure or insure in any manner its indemnification obligations arising under this Article.

Section 907. The Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was an Officer and/or employee of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as such, whether or not the Corporation would have the power to indemnify him or her against such liability under the provisions of this Article.

Section 908. Indemnification under this Article shall not be made in any case where the act or failure to act giving rise to the claim for indemnification is determined by a court to have constituted willful misconduct or recklessness.

ARTICLE X

INDEMNIFICATION OF DIRECTORS

Section 1001. A Director of this Corporation shall stand in a fiduciary relation to the Corporation and shall perform his or her duties as a Director, including his or her duties as a member of any Committee of the Board upon which he or she may serve, in good faith, in a manner he or she reasonably believes to be in the best interests of the Corporation, and with such care, including reasonable inquiry, skill and diligence, as a person of ordinary prudence would use under similar circumstances. In performing his or her duties, a Director shall be entitled to rely in good faith on information, opinions, reports or statements, including financial statements and other financial data, in each case prepared or presented by any of the following:

(a) One (1) or more Officers or employees of the Corporation whom the Director reasonably believes to be reliable and competent in the matters presented.

(b) Counsel, public accountants or other persons as to matters which the Director reasonably believes to be within the professional or expert competence of such person.

(c) A Committee of the Board upon which he or she does not serve, duly designated in accordance with law, as to matters within its designated authority, which Committee the Director reasonably believes to merit confidence.

A Director shall not be considered to be acting in good faith if he or she has knowledge concerning the matter in question that would cause his or her reliance to be unwarranted.

Section 1002. In discharging the duties of their respective positions, the Board of Directors, Committees of the Board, and individual Directors may, in considering the best interests of the Corporation, consider the effects of any action upon employees, upon suppliers and customers of the Corporation, and upon communities in which offices or other establishments of the Corporation are located, and all other pertinent factors. The consideration of those factors shall not constitute a violation of Section 1001 of this Article.

Section 1003. Absent a breach of fiduciary duty, lack of good faith, or self-dealing, actions taken as a Director or any failure to take any action shall be presumed to be in the best interests of the Corporation.

Section 1004. A Director of this Corporation shall not be personally liable for monetary damages as such for any action taken or for any failure to take any action, unless:

(a) the Director has breached or failed to perform the duties of his or her office under the provisions of Sections 1001 and 1002 of this Article, and

(b) the breach or failure to perform constitutes self-dealing, willful misconduct or recklessness.

Section 1005. The provisions of Section 1004 of this Article shall not apply to:

(a) the responsibility or liability of a Director pursuant to a criminal statute, or

(b) the liability of a Director for the payment of taxes pursuant to local, state or federal law.

Section 1006. The Corporation shall indemnify any Director, or any former Director, who was or is a party to, or is threatened to be made a party to, or who is called to be a witness in connection with, any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that such person is or was a Director of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in connection with such action, suit or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent, shall not of itself create a presumption that the person did not act in good faith and in a manner which he or she reasonably believed to be in, or not opposed to, the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was unlawful.

Section 1007. The Corporation shall indemnify any Director, who was or is a party to, or is threatened to be made a party to, or who is called as a witness in connection with, any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against amounts paid in settlement and expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection with the defense or settlement of, or serving as a witness in, such action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Corporation and except that no indemnification shall be made in respect of any such claim, issue or matter as to which such person shall have been adjudged to be liable for misconduct in the performance of his or her duty to the Corporation.

Section 1008. Except as may be otherwise ordered by a court, there shall be a presumption that any Director is entitled to indemnification as provided in Sections 1006 and 1007 of this Article unless either a majority of the Directors who are not involved in such proceedings (“disinterested directors”) or, if there are less than three (3) disinterested directors, then the holders of one-third (1/3) of the outstanding shares of the Corporation determine that the person is not entitled to such presumption by certifying such determination in writing to the Secretary of the Corporation. In

such event the disinterested director(s) or, in the event of certification by shareholders, the Secretary of the Corporation shall request of independent counsel, who may be the outside general counsel of the Corporation, a written opinion as to whether or not the parties involved are entitled to indemnification under Sections 1006 and 1007 of this Article.

Section 1009. Expenses incurred by a Director in defending a civil or criminal action, suit or proceeding may be paid by the Corporation in advance of the final disposition of such action, suit or proceeding as authorized in the manner provided under Section 1008 of this Article upon receipt of an undertaking by or on behalf of the Director to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the Corporation as authorized in this Article.

Section 1010. The indemnification provided by this Article shall not be deemed exclusive of any other rights to which a person seeking indemnification may be entitled under any agreement, vote of shareholders or disinterested directors, or otherwise, both as to action in his or her official capacity while serving as a Director and as to action in another capacity while holding such office, and shall continue as to a person who has ceased to be a Director and shall inure to the benefit of the heirs, executors and administrators of such a person.

Section 1011. The Corporation may create a fund of any nature, which may, but need not be, under the control of a trustee, or otherwise secure or insure in any manner its indemnification obligations arising under this Article.

Section 1012. The Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a Director, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as such, whether or not the Corporation would have the power to indemnify him or her against such liability under the provisions of this Article.

Section 1013. Indemnification under this Article shall not be made in any case where the act or failure to act giving rise to the claim for indemnification is determined by a court to have constituted willful misconduct or recklessness.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

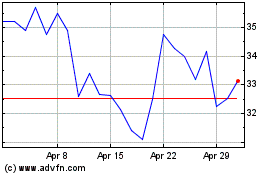

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Apr 2023 to Apr 2024