0001637873FALSE00016378732024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 8, 2024

Date of Report (date of earliest event reported)

___________________________________

ACV Auctions Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware | 001-40256 | 47-2415221 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

640 ELLICOTT STREET #321

Buffalo, NY 14203

(Address of principal executive offices and zip code)

(800) 553-4070

(Registrant's telephone number, including area code)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A common stock, par value $.001 per share | ACVA | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, ACV Auctions Inc. (the "Company") issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02, including Exhibit 99.1 hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits

(d): Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | ACV AUCTIONS INC. |

| | | | | |

| Date | May 8, 2024 | | By: | /s/ William Zerella |

| | | | William Zerella |

| | | | Chief Financial Officer |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

ACV Announces First Quarter 2024 Results

Delivered 22% Revenue Growth

Revenue and Adjusted EBITDA at the High-End of Guidance

•First quarter revenue of $146 million

•First quarter GAAP net income (loss) of ($20) million

•First quarter non-GAAP net income of $1 million

•First quarter Adjusted EBITDA of $4 million

•Expects 2024 revenue of $610 million to $625 million, growth of 27% to 30% YoY, net income (loss) of ($85) million to ($80) million and Adjusted EBITDA of $20 million to $25 million

BUFFALO, May 8, 2024 — ACV (Nasdaq: ACVA), a leading digital automotive marketplace and data services partner for dealers and commercial clients, today reported results for its first quarter ended March 31, 2024.

“We are very pleased with our strong first quarter results with revenue at the high-end of our guidance range, strong year-over-year margin expansion, and Adjusted EBITDA at the high-end of guidance range, resulting in our first profitable quarter as a public company, on a non-GAAP basis.” said George Chamoun, CEO of ACV.

“Our strong market position and competitive moat resulted in continued market share gains and accelerated revenue growth in the quarter. We experienced further adoption across our broad suite of dealer solutions and launched initiatives to support our long-term commercial wholesale strategy. And, we achieved this while continuing to increase margins,” continued Chamoun.

“Dealer wholesale volumes remain below historical levels due to lower-than-normal new and used vehicle inventory, which is causing dealers to keep more trades for retail. We expect market headwinds will ease resulting in modest growth in dealer wholesale volumes in the back-half of 2024. We believe ACV remains well positioned to deliver sustainable growth as end-markets further recover, and we execute on our emerging commercial wholesale strategy, while also continuing to scale our business model,” concluded Chamoun.

First Quarter 2024 Highlights

•Revenue of $146 million, an increase of 22% year over year

•Marketplace and Service Revenue of $130 million, an increase of 24% year over year

•Marketplace GMV of $2.3 billion, a decrease of 4% year over year

•Marketplace Units of 174,631, an increase of 15% year over year

•GAAP net income (loss) of ($20) million, compared to GAAP net income (loss) of ($18) million in the first quarter of 2023.

•Non-GAAP net income of $1 million, compared to non-GAAP net income (loss) of ($5) million in the first quarter of 2023.

•Adjusted EBITDA of $4 million, compared to Adjusted EBITDA of ($6) million in the first quarter of 2023

Second Quarter and Full-Year 2024 Guidance

Based on information as of today, ACV is providing the following guidance:

•Second Quarter of 2024:

oTotal revenue of $154 to $158 million, an increase of 24% to 27% year over year

oGAAP net income (loss) of ($19) to ($17) million

oNon-GAAP net income of $2 to $4 million

oAdjusted EBITDA of $6 to $8 million

•Full-Year 2024:

oTotal revenue of $610 to $625 million, an increase of 27% to 30% year over year

oGAAP net income (loss) of ($85) to ($80) million

oNon-GAAP net income of $3 to $8 million

oAdjusted EBITDA of $20 to $25 million

Our financial guidance includes the following assumptions:

•Dealer wholesale volumes are expected to improve modestly in the back-half of 2024, primarily due to increasing new vehicle supply and retail sales.

•Conversion rates and wholesale price depreciation expected to follow normal seasonal patterns.

•Revenue growth is expected to outpace Non-GAAP Operating Expense growth (excluding Cost of Revenue and Depreciation and Amortization) by approximately 10 percentage points.

•Second quarter non-GAAP net income guidance excludes approximately $18 million of stock-based compensation expense and approximately $3 million of intangible amortization.

•Full-year non-GAAP net income guidance excludes approximately $70 million of stock-based compensation expense and $10 million of intangible amortization.

ACV’s First Quarter Results Conference Call

ACV will host a conference call and live webcast today, May 8, 2024, at 5:00 p.m. ET to discuss the financial results. To access the live conference call participants are invited to dial 877-704-4453 (international callers please dial 1-201-389-0920) approximately 10 minutes prior to the start of the call. A live webcast and replay of the call will be available on the Company’s investor relations website at https://investors.acvauto.com/. Participants are encouraged to join the webcast unless asking a question.

About ACV Auctions

ACV is on a mission to transform the automotive industry by building the most trusted and efficient digital marketplace and data solutions for sourcing, selling and managing used vehicles with transparency and comprehensive insights that were once unimaginable. ACV offerings include ACV Auctions, ACV Transportation, ACV Capital, ACV MAX, True360, and ClearCar.

For more information about ACV, visit www.acvauto.com.

Information About Non-GAAP Financial Measures

ACV provides supplemental non-GAAP financial measures to its financial results. We use these non-GAAP financial measures, and we believe that they assist our investors to make period-to-period comparisons of our operating performance because they provide a view of our operating results without items that are not, in our view, indicative of our operating results. These non-GAAP financial measures should not be construed as an alternative to GAAP results as the items excluded from the non-GAAP financial measures often have a material impact on our operating results, certain of those items are recurring, and others often recur. Management uses, and investors should consider, our non-GAAP financial measures only in conjunction with our GAAP results.

Non-GAAP Financial Measures

Adjusted EBITDA is a financial measure that is not presented in accordance with GAAP. We believe that Adjusted EBITDA, when taken together with our financial results presented in accordance with GAAP, provides meaningful supplemental information regarding our operating performance and facilitates internal comparisons of our historical operating performance on a more consistent basis by excluding certain items that may not be indicative of our business, results of operations or outlook. In particular, we believe that the use of Adjusted EBITDA is helpful to our investors as it is a measure used by management in assessing the health of our business, determining incentive compensation and evaluating our operating performance, as well as for internal planning and forecasting purposes.

We define Adjusted EBITDA as net loss, adjusted to exclude: depreciation and amortization; stock-based compensation expense; interest (income) expense; provision for income taxes; and other one-time non-recurring items, when applicable, such as acquisition-related and restructuring expenses.

Adjusted EBITDA is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of these limitations include that (1) it does not properly reflect capital commitments to be paid in the future; (2) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures; (3) it does not consider the impact of stock-based compensation expense, (4) it does not reflect other non-operating income and expenses, including interest income and expense, (5) it does not consider the impact of any contingent consideration liability valuation adjustments, (6) it does not reflect tax payments that may represent a reduction in cash available to us, and (7) it does not reflect other one-time, non-recurring items, when applicable, such as acquisition-related and restructuring expenses. In addition, our use of Adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate Adjusted EBITDA in the same manner, limiting its usefulness as a comparative measure. Because of these limitations, when evaluating our performance, you should consider Adjusted EBITDA alongside other financial measures, including our net loss and other results stated in accordance with GAAP.

Non-GAAP net income (loss), a financial measure that is not presented in accordance with GAAP, provides investors with additional useful information to measure operating performance and current and future liquidity when taken together with our financial results presented in accordance with GAAP. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations.

We define non-GAAP net income (loss) as net income (loss), adjusted to exclude: stock-based compensation expense, amortization of acquired intangible assets, and other one-time, non-recurring items, when applicable, such as acquisition-related and restructuring expenses.

In the calculation of non-GAAP net income (loss), we exclude stock-based compensation expense because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact our non-cash expense. We believe that providing non-GAAP financial

measures that exclude stock-based compensation expense allows for more meaningful comparisons between our operating results from period to period.

We exclude amortization of acquired intangible assets from the calculation of non-GAAP net income (loss). We believe that excluding the impact of amortization of acquired intangible assets allows for more meaningful comparisons between operating results from period to period as the underlying intangible assets are valued at the time of acquisition and are amortized over several years after the acquisition.

We exclude contingent consideration liability valuation adjustments associated with the purchase consideration of transactions accounted for as business combinations. We also exclude certain other one-time, non-recurring items, when applicable, such as acquisition-related and restructuring expenses, because we do not consider such amounts to be part of our ongoing operations nor are they comparable to prior period nor predictive of future results.

Non-GAAP net income (loss) is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of these limitations include that: (1) it does not consider the impact of stock-based compensation expense; (2) although amortization is a non-cash charge, the underlying assets may need to be replaced and non-GAAP net income (loss) does not reflect these capital expenditures; (3) it does not consider the impact of any contingent consideration liability valuation adjustments; and (4) it does not consider the impact of other one-time charges, such as acquisition-related and restructuring expenses, which could be material to the results of our operations. In addition, our use of non-GAAP net income (loss) may not be comparable to similarly titled measures of other companies because they may not calculate non-GAAP net income (loss) in the same manner, limiting its usefulness as a comparative measure. Because of these limitations, when evaluating our performance, you should consider non-GAAP net income (loss) alongside other financial measures, including our net loss other results stated in accordance with GAAP.

Information About Operating and Financial Metrics

We regularly monitor the following operating and financial metrics in order to measure our current performance and estimate our future performance. Our key operating and financial metrics may be calculated in a manner different than similar business metrics used by other companies.

Operating and Financial Metrics

Marketplace GMV - Marketplace GMV is primarily driven by the volume and dollar value of Marketplace Units transacted on our marketplace platform. We believe that Marketplace GMV acts as an indicator of the success of our marketplace, signaling satisfaction of dealers and buyers on our marketplace, and the health, scale, and growth of our business. We define Marketplace GMV as the total dollar value of vehicles transacted through our marketplace platform within the applicable period, excluding any auction and ancillary fees.

Marketplace Units - Marketplace Units is a key indicator of our potential for growth in Marketplace GMV and revenue. It demonstrates the overall engagement of our customers on the ACV marketplace platform, the vibrancy of our marketplace platform and our market share of wholesale transactions in the United States. We define Marketplace Units as the number of vehicles transacted on our marketplace platform within the applicable period. Marketplace Units transacted includes any vehicle that successfully reaches sold status, even if the auction is subsequently unwound, meaning the buyer or seller does not complete the transaction. These instances have been immaterial to date. Marketplace Units excludes vehicles that were inspected by ACV, but not sold on our marketplace. Marketplace Units have generally increased over time as we have expanded our territory coverage, added new dealer partners and increased our share of wholesale transactions from existing customers.

Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements concerning our financial guidance for the second quarter of 2024 and the full year of 2024. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. You should not rely on forward-looking statements as predictions of future events.

The forward-looking statements contained in this presentation are based on ACV’s current assumptions, expectations and beliefs and are subject to substantial risks, uncertainties and changes in circumstances that may cause ACV’s actual results, performance or achievements to differ materially from those expressed or implied in any forward-looking statement. These risks and uncertainties include, but are not limited to: (1) our history of operating losses; (2) our limited operating history; (3) our ability to effectively manage our growth; (4) our ability to grow the number of participants on our marketplace platform; (5) general market, political, economic, and business conditions; (6) our ability to acquire new customers and successfully retain existing customers; (7) our ability to effectively develop and expand our sales and marketing capabilities; (8) breaches in our security measures, unauthorized access to our marketplace platform, our data, or our customers’ or other users’ personal data; (9) risk of interruptions or performance problems associated with our products and platform capabilities; (10) our ability to adapt and respond to rapidly changing technology or customer needs; (11) our ability to compete effectively with existing competitors and new market entrants; (12) our ability to comply or remain in compliance with laws and regulations that currently apply or become applicable to our business in the United States and other jurisdictions where we elect to do business; (13) the impact that economic conditions could have on our or our customers’ businesses, financial condition and results of operations; and (14) the impact of such economic conditions in the wholesale dealer market included in our guidance for the second quarter of 2024 and full year 2024, and the related impact on the performance of our marketplace and our operating expenses, stock-based compensation expense and intangible amortization. These and other risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission (“SEC”), including in the section entitled “Risk Factors” in our Form 10-K for the year ended December 31, 2023, filed with the SEC on February 21, 2024. Additional information will be made available in other filings and reports that we may file from time to time with the SEC. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. The forward-looking statements made in this presentation relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law.

Investor Contact:

Tim Fox

tfox@acvauctions.com

Media Contact:

Maura Duggan

mduggan@acvauctions.com

ACV AUCTIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue: | | | | | | | |

| Marketplace and service revenue | $ | 129,814 | | | $ | 104,863 | | | | | |

| Customer assurance revenue | 15,875 | | | 14,763 | | | | | |

| Total revenue | 145,689 | | | 119,626 | | | | | |

| Operating expenses: | | | | | | | |

| Marketplace and service cost of revenue (excluding depreciation & amortization) | 55,693 | | | 47,575 | | | | | |

| Customer assurance cost of revenue (excluding depreciation & amortization) | 12,814 | | | 12,143 | | | | | |

| Operations and technology | 38,069 | | | 35,660 | | | | | |

| Selling, general, and administrative | 53,853 | | | 41,797 | | | | | |

| Depreciation and amortization | 7,787 | | | 3,285 | | | | | |

| Total operating expenses | 168,216 | | | 140,460 | | | | | |

| Loss from operations | (22,527) | | | (20,834) | | | | | |

| Other income (expense): | | | | | | | |

| Interest income | 3,031 | | | 3,296 | | | | | |

| Interest expense | (535) | | | (315) | | | | | |

| Total other income (expense) | 2,496 | | | 2,981 | | | | | |

| Loss before income taxes | (20,031) | | | (17,853) | | | | | |

| Provision for income taxes | 440 | | | 347 | | | | | |

| Net loss | $ | (20,471) | | | $ | (18,200) | | | | | |

| Weighted-average shares - basic and diluted | 162,889,642 | | 158,694,919 | | | | |

| Net loss per share - basic and diluted | $ | (0.13) | | | $ | (0.11) | | | | | |

ACV AUCTIONS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share data)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Assets | | | |

| Current Assets : | | | |

| Cash and cash equivalents | $ | 209,845 | | | $ | 182,571 | |

| Marketable securities | 131,631 | | | 228,761 | |

| Trade receivables (net of allowance of $3,931 and $2,868) | 219,305 | | | 164,009 | |

| Finance receivables (net of allowance of $3,728 and $3,428) | 121,047 | | | 119,034 | |

| Other current assets | 14,398 | | | 12,524 | |

| Total current assets | 696,226 | | | 706,899 | |

| Property and equipment (net of accumulated depreciation of $4,289 and $4,462) | 7,903 | | | 4,918 | |

| Goodwill | 169,305 | | | 103,379 | |

| Acquired intangible assets (net of amortization of $19,676 and $17,534) | 78,585 | | | 34,192 | |

| Capitalized software (net of amortization of $21,836 and $17,059) | 59,662 | | | 55,771 | |

| Other assets | 32,971 | | | 17,765 | |

| Total assets | $ | 1,044,652 | | | $ | 922,924 | |

| Liabilities and Stockholders' Equity | | | |

| Current Liabilities : | | | |

| Accounts payable | $ | 393,144 | | | $ | 305,845 | |

| Accrued payroll | 14,126 | | | 12,245 | |

| Accrued other liabilities | 22,788 | | | 15,851 | |

| Total current liabilities | 430,058 | | | 333,941 | |

| Long-term debt | 125,000 | | | 115,000 | |

| Other long-term liabilities | 31,315 | | | 17,455 | |

| Total liabilities | 586,373 | | | 466,396 | |

| Commitments and Contingencies | | | |

| Stockholders' Equity : | | | |

| Preferred Stock | — | | | — | |

| Common Stock - Class A | 147 | | | 139 | |

| Common Stock - Class B | 17 | | | 23 | |

| Additional paid-in capital | 902,989 | | | 880,510 | |

| Accumulated deficit | (443,086) | | | (422,615) | |

| Accumulated other comprehensive loss | (1,788) | | | (1,529) | |

| Total stockholders' equity | 458,279 | | | 456,528 | |

| Total liabilities and stockholders' equity | $ | 1,044,652 | | | $ | 922,924 | |

ACV AUCTIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

| | | | | | | | | | | |

| Three months ended March 31, |

| 2024 | | 2023 |

| Cash Flows from Operating Activities | | | |

| Net income (loss) | $ | (20,471) | | | $ | (18,200) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 7,802 | | | 3,392 | |

| Stock-based compensation expense, net of amounts capitalized | 14,830 | | | 11,505 | |

| Provision for bad debt | 2,097 | | | 2,176 | |

| Other non-cash, net | 356 | | | (302) | |

| Changes in operating assets and liabilities, net of effects from purchases of businesses: | | | |

| Trade receivables | (33,676) | | | (21,487) | |

| Other operating assets | (289) | | | (841) | |

| Accounts payable | 68,217 | | | 62,761 | |

| Other operating liabilities | 4,109 | | | 3,976 | |

| Net cash provided by (used in) operating activities | 42,975 | | | 42,980 | |

| Cash Flows from Investing Activities | | | |

| Net increase in finance receivables | (1,047) | | | (27,407) | |

| Purchases of property and equipment | (1,075) | | | (266) | |

| Capitalization of software costs | (7,513) | | | (4,943) | |

| Purchases of marketable securities | (2,902) | | | (35,602) | |

| Maturities and redemptions of marketable securities | 30,030 | | | 41,950 | |

| Sales of marketable securities | 70,020 | | | 2,402 | |

| Acquisition of businesses (net of cash acquired) | (108,453) | | | — | |

| Net cash provided by (used in) investing activities | (20,940) | | | (23,866) | |

| Cash Flows from Financing Activities | | | |

| Proceeds from long term debt | 190,000 | | | 95,000 | |

| Payments towards long term debt | (180,000) | | | (75,000) | |

| Proceeds from exercise of stock options | 2,401 | | | 899 | |

| Payment of RSU tax withholdings in exchange for common shares surrendered by RSU holders | (7,090) | | | (3,619) | |

| | | |

| Other financing activities | (23) | | | — | |

| Net cash provided by (used in) financing activities | 5,288 | | | 17,280 | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (49) | | | 3 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 27,274 | | | 36,397 | |

| Cash, cash equivalents, and restricted cash, beginning of period | 182,571 | | | 280,752 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 209,845 | | | $ | 317,149 | |

The following table presents a reconciliation of non-GAAP net income (loss) to net income (loss), the most directly comparable financial measure stated in accordance with GAAP, for the periods presented:

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net income (loss) | $ | (20,471) | | | $ | (18,200) | | | | | |

| Stock-based compensation | 14,830 | | | 11,505 | | | | | |

| Amortization of acquired intangible assets | 2,213 | | | 1,173 | | | | | |

| Amortization of capitalized stock based compensation | 928 | | | 277 | | | | | |

| Acquisition-related costs | 2,120 | | | 206 | | | | | |

| | | | | | | |

Litigation-related costs (1) | 1,553 | | | — | | | | | |

| Other | 45 | | | — | | | | | |

| Non-GAAP Net income (loss) | $ | 1,218 | | | $ | (5,039) | | | | | |

| | | | | | | |

(1) Litigation-related costs are related to an anti-competition case which we do not consider to be representative of our underlying operating performance | | | | |

The following table presents a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable financial measure stated in accordance with GAAP, for the periods presented:

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Adjusted EBITDA Reconciliation | | | | | | | |

| Net income (loss) | $ | (20,471) | | | $ | (18,200) | | | | | |

| Depreciation and amortization | 7,802 | | | 3,392 | | | | | |

| Stock-based compensation | 14,830 | | | 11,505 | | | | | |

| Interest (income) expense | (2,496) | | | (2,981) | | | | | |

| Provision for income taxes | 440 | | | 347 | | | | | |

| Acquisition-related costs | 2,120 | | | 206 | | | | | |

Litigation-related costs (1) | 1,553 | | | — | | | | | |

| Other | 494 | | | 96 | | | | | |

| Adjusted EBITDA | $ | 4,272 | | | $ | (5,635) | | | | | |

| | | | | | | |

(1) Litigation-related costs are related to an anti-competition case which we do not consider to be representative of our underlying operating performance | | | | |

The following table presents a reconciliation of non-GAAP net income (loss) to GAAP net income (loss), the most directly comparable financial measure stated in accordance with GAAP, for the periods presented (in millions):

| | | | | | | | | | | | | | | | | |

| Q2'24 | | FY24 | | |

Non-GAAP net income (loss) to net income (loss) guidance Reconciliation | | | | | | | |

| Net income (loss) | ($19) - ($17) | | ($85) - ($80) | | | | |

Non-GAAP Adjustments: | | | | | | | |

| Stock-based compensation | $18 | | $70 | | | | |

Intangible amortization | $3 | | $10 | | | | |

Amortization of capitalized stock-based compensation | $1 | | $4 | | | | |

| Acquisition-related costs | — | | | $2 | | | | |

| Other | — | | | $2 | | | | |

Non-GAAP net income (loss) | $2 - $4 | | $3 - $8 | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

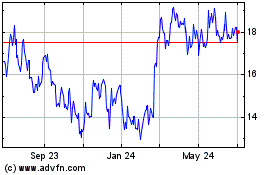

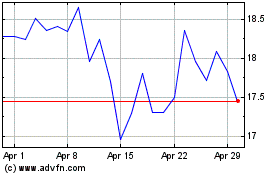

ACV Auctions (NASDAQ:ACVA)

Historical Stock Chart

From Nov 2024 to Dec 2024

ACV Auctions (NASDAQ:ACVA)

Historical Stock Chart

From Dec 2023 to Dec 2024