| PROSPECTUS |

|

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275375 |

Aditxt,

Inc.

Up to 264,516 shares of Common Stock

Pursuant to this prospectus, the

selling stockholders identified herein (the “Selling Stockholders”) are offering on a resale basis an aggregate of up to 264,516

shares of common stock of Aditxt, Inc. (the “Company,” “we,” “us” or our”), par value $0.001

per share (the “Common Stock”) consisting of (a) up to an aggregate of 79,268 shares of Common Stock that are issuable upon

exercise of warrants (the “Warrants”) purchased pursuant to securities purchase agreements by and between us and one of the

Selling Stockholders, dated, April 20, 2023 (the “April Purchase Agreement”), (b) up to an aggregate of 164,063 shares of

Common Stock that are issuable upon conversion of a secured promissory note (the “Note”) issued pursuant to a securities purchase

agreement by and between us and one of the Selling Stockholders, dated July 24, 2023 (the “July Purchase Agreement”), and

(c) 21,185 shares of common stock that were issued to certain of the Selling Stockholders as commitment shares, including 17,278 shares

that were issued pursuant to the July Purchase Agreement and 3,907 shares that were issued pursuant to a securities purchase agreement

dated July 3, 2023.

We

will not receive any of the proceeds from the sale by the Selling Stockholders of the Common Stock. Upon any exercise of the Warrants

by payment of cash, however, we will receive the exercise price of the Warrants, which, if exercised in cash with respect to the 79,268

shares of Common Stock offered hereby, would result in gross proceeds to us of approximately $2.7 million. However, we cannot predict

when and in what amounts or if the Warrants will be exercised by payments of cash and it is possible that the Warrants may expire and

never be exercised, in which case we would not receive any cash proceeds.

The

Selling Stockholders may sell or otherwise dispose of the Common Stock covered by this prospectus in a number of different ways and at

varying prices. We provide more information about how the Selling Stockholders may sell or otherwise dispose of the Common Stock covered

by this prospectus in the section entitled “Plan of Distribution” on page 47. Discounts, concessions, commissions and similar

selling expenses attributable to the sale of Common Stock covered by this prospectus will be borne by the Selling Stockholders. We will

pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the Common

Stock with the Securities and Exchange Commission (the “SEC”).

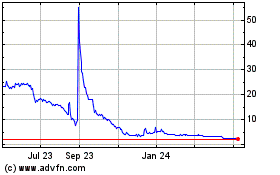

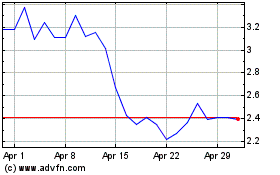

Our

common stock is listed on The Nasdaq Capital Market under the symbol “ADTX”. On November 6, 2023, the closing price as reported

on The Nasdaq Capital Market was $6.15 per share.

We

are an “emerging growth company” under the federal securities laws and, as such, are subject to reduced public company reporting

requirements.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 13, 2023

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

This prospectus relates to the

resale by the Selling Stockholders identified in this prospectus under the caption “Selling Stockholders,” from time to time,

of up to an aggregate of 264,516 shares of Common Stock. We are not selling any shares of Common Stock under this prospectus, and we will

not receive any proceeds from the sale of shares of Common Stock offered hereby by the Selling Stockholders, although we may receive cash

from the exercise of the Warrants.

You

should rely only on the information provided in this prospectus, including any information incorporated by reference. We have not authorized

anyone to provide you with any other information and we take no responsibility for, and can provide no assurances as to the reliability

of, any other information that others may give you. The information contained in this prospectus speaks only as of the date set forth

on the cover page and may not reflect subsequent changes in our business, financial condition, results of operations and prospects.

We

are not, and the Selling Stockholders are not, making offers to sell these securities in any jurisdiction in which an offer or solicitation

is not authorized or permitted or in which the person making such offer or solicitation is not qualified to do so or to any person to

whom it is unlawful to make such an offer or solicitation. You should read this prospectus, including any information incorporated by

reference, in its entirety before making an investment decision. You should also read and consider the information in the documents to

which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain

Information by Reference.”

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements, which reflect the views of our management with respect to future events and financial

performance. These forward-looking statements are subject to a number of uncertainties and other factors that could cause actual results

to differ materially from such statements. Forward-looking statements are identified by words such as “anticipates,” “believes,”

“estimates,” “expects,” “intends,” “plans,” “projects,” “targets,”

and similar expressions. Such forward-looking statements may be contained in the sections “Risk Factors,” and “Business,”

among other places in this prospectus. Readers are cautioned not to place undue reliance on these forward-looking statements, which are

based on the information available to management at this time and which speak only as of this date. We undertake no obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For a discussion of some

of the factors that may cause actual results to differ materially from those suggested by the forward-looking statements, please read

carefully the information under “Risk Factors.”

The

identification in this document of factors that may affect future performance and the accuracy of forward-looking statements is meant

to be illustrative and by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent

uncertainty. You may rely only on the information contained in this prospectus.

We

have not authorized anyone to provide information different from that contained in this prospectus. Neither the delivery of this prospectus

nor the sale of our common stock means that information contained in this prospectus is correct after the date of this prospectus. This

prospectus is not an offer to sell or solicitation of an offer to buy these securities in any circumstances under which the offer or

solicitation is unlawful.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus and in

the documents incorporated by reference. This summary is not complete and does not contain all the information that you should consider

before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage

you to read and consider carefully the more detailed information contained in or incorporated by reference in this prospectus, including

the information contained under the heading “Risk Factors” beginning on page 15 of this prospectus.

Overview

and Mission

We

believe the world needs—and deserves—a new approach to innovating that harnesses the power of large groups of stakeholders

who work together to ensure that the most promising innovations make it into the hands of people who need them most.

We

were incorporated in the State of Delaware on September 28, 2017, and our headquarters are in Richmond, Virginia. The company was founded

with a mission of bringing stakeholders together, to transform promising innovations into products and services that could address some

of the most challenging needs. The socialization of innovation through engaging stakeholders in every aspect of it, is key to transforming

more innovations, more rapidly, and more efficiently.

At

inception, the first innovation we took on was an immune modulation technology titled ADI/Adimune with a focus on prolonging life and

enhancing life quality of patients that have undergone organ transplants. Since then, we expanded our portfolio of innovations, and we

continue to evaluate a variety of promising health innovations.

Our

Model

Aditxt

is not about a single idea or a single molecule. It is about making sure the right innovation is made possible. Our business model has

three main components as follows:

| (1) | Securing

an Innovation: Our process begins with identifying and securing innovations through licensing or acquisition of an innovation asset.

Assets come from a variety of sources including research institutions, government agencies, and private organizations. |

| (2) | Growing

an Innovation: Once an innovation is secured, we surround it with activation resources that take a systemized approach to bringing that

idea to life. Our activation resources include innovation, operations, commercialization, finance, content and engagement, personnel,

and administration. |

| (3) | Monetizing

an Innovation: Our goal is for each innovation to become commercial-stage and financially and operationally self-sustainable, to create

shareholder value. |

We

engage various stakeholders for each of our programs on every level. This includes identifying researchers and research institution partners,

such as Stanford University; leading health institutions to get critical trials underway, such as Mayo Clinic; manufacturing partners

who enable us to take innovations from preclinical to clinical; municipalities and governments, such as the city of Richmond and the

state of Virginia and public health agencies who work with us to launch our program, Pearsanta’s laboratory; and thousands of shareholders

around the globe. We seek to enable promising innovation to become purposeful products that have the power to change lives.

Our

Value Proposition

We

believe that far too often, promising treatment or technology does not reach commercialization due to lack of expertise, key resources,

or efficiency. As a result, potentially life-changing and lifesaving treatments are not available to the individuals who so desperately

need them.

Aditxt

seeks to bring the holistic concept of an efficient, socialized ecosystem for advancing and accelerating innovations. Our process: We

seek to license or acquire promising innovations. We will then form and build out a subsidiary around each innovation and support the

subsidiaries through innovation, operation, commercialization, content and engagement, finance, personnel, and administration to thrive

and grow as a successful, monetizable business.

Since

our inception, we have built infrastructure consisting of innovation, operation, commercialization, content and engagement, finance,

personnel, and administration, to support the rapid transformation of untapped innovations. Each of the main components of our infrastructure

has established global access to partnerships with industry leaders, top-rated research and medical institutions, universities, manufacturing

and distribution companies, and critical infrastructure such as CLIA-certified state-of-the art labs and GMP manufacturing.

The

Shifting Landscape of Innovation

Innovation

in general, and health innovations specifically, require significant resources. The convergence of biotech, high-tech, and media offers

new possibilities of accelerating breakthrough innovations faster and more efficiently. This approach reflects our mission of “Making

Promising Innovations Possible, Together”.

People

deserve innovative solutions, which have never been more within reach. We believe the best idea, best product and the best solution will

come from creating an ecosystem where all stakeholders, such as vendors, customers, municipalities, and shareholders contribute. When

we disrupt the way we’re innovating, through our collaborative model, we believe we can move faster and more efficiently to activate

viable solutions that have the potential to make a measurable impact.

Our

Growth Strategy

We

believe that the era of precision and personalized medicine is here and that people around the globe would benefit from health diagnostics

and treatments that more accurately pinpoint the problems and more precisely treat the condition. In addition to our current programs,

Adimune and Pearsanta, we look to bring in future health innovations in the areas of software and AI, medical devices, therapeutics,

and other technologies that take a fundamentally different approach to health because they prioritize personalized precision medicine,

timely disease root cause analysis, and targeted treatments.

Year

over year, we plan to continue building our infrastructure and securing more personalized and precision health innovations that align

with our mission. These opportunities may come in different forms such as IP, an early-stage company, or a late-stage company. We will

continue to scale our systemized approach to the innovation process, making large-scale automation and enterprise systems available to

our portfolio companies at every stage of their growth. Specifically, certain subsidiaries will need to grow through further M&A

activities, operational infrastructure implementation, and development or acquisition of critical technologies.

Our

Team

Aditxt

is led by an entrepreneurial team with passion for transforming promising innovations into successful businesses. Our leadership come

from a variety of different industries, with collective expertise in founding startup innovation companies, developing and marketing

biopharmaceutical and diagnostic products, designing clinical trials, manufacturing, and management of private and public companies.

We have deep experience in identifying and accessing promising health innovations and developing them into products and services with

the ability to scale. We understand the capital markets, both public and private, as well as M&A and facilitating complex IPOs.

The

following are profiles of three subsidiaries we have formed, including the terms of the intellectual property licenses that have been

sublicensed from Aditxt to help build each of the businesses.

THE

ADITXT PROGRAMS

ADIMUNE,

INC.

Formed

in January 2023, Adimune™, Inc. (“Adimune”) is focused on leading our immune modulation therapeutic programs. Adimune’s

proprietary immune modulation product Apoptotic DNA Immunotherapy™, or ADI-100™, utilizes a novel approach that mimics the

way our bodies naturally induce tolerance to our own tissues. It includes two DNA molecules designed to deliver signals to induce tolerance.

ADI-100 has been successfully tested in several preclinical models (e.g., skin grafting, psoriasis, type 1 diabetes, multiple sclerosis).

In

May 2023, Adimune entered into a clinical trial agreement with Mayo Clinic to advance clinical studies targeting autoimmune diseases

of the central nervous system (“CNS”) with the initial focus on the rare, but debilitating, autoimmune disease Stiff Person

Syndrome (“SPS”). According to the National Organization of Rare Diseases, the exact incidence and prevalence of SPS is unknown;

however, one estimate places the incidence at approximately one in one million individuals in the general population.

Pending

approval by the International Review Board, a human trial for SPS is expected get underway in the second half of 2023 or the first half

of 2024 with enrollment of 10-15 patients, some of whom may also have type 1 diabetes. ADI-100 will initially be tested for safety and

efficacy. ADI-100 is designed to tolerize against an antigen known as glutamic acid decarboxylase (“GAD”), which is implicated

in type-1 diabetes, psoriasis, and in many autoimmune diseases of the CNS.

Background

The

discovery of immunosuppressive (anti-rejection and monoclonal) drugs over 40 years ago has made possible life-saving organ transplantation

procedures and blocking of unwanted immune responses in autoimmune diseases. However, immune suppression leads to significant undesirable

side effects, such as increased susceptibility to life-threatening infections and cancers, because it indiscriminately and broadly suppresses

immune function throughout the body. While the use of these drugs has been justifiable because they prevent or delay organ rejection,

their use for treatment of autoimmune diseases and allergies may not be acceptable because of the aforementioned side effects. Furthermore,

often transplanted organs ultimately fail despite the use of immune suppression, and about 40% of transplanted organs survive no more

than five years.

Through

Aditxt, Adimune has the right of use to the exclusive worldwide license for commercializing ADI nucleic acid-based technology (which

is currently at the pre-clinical stage) from Loma Linda University. ADI uses a novel approach that mimics the way the body naturally

induces tolerance to our own tissues (“therapeutically induced immune tolerance”). While immune suppression requires continuous

administration to prevent rejection of a transplanted organ, induction of tolerance has the potential to retrain the immune system to

accept the organ for longer periods of time. ADI may allow patients to live with transplanted organs with significantly reduced immune

suppression. ADI is a technology platform which we believe can be engineered to address a wide variety of indications.

Advantages

ADI™

is a nucleic acid-based technology (e.g., DNA-based), which we believe selectively suppresses only those immune cells involved

in attacking or rejecting self and transplanted tissues and organs. It does so by tapping into the body’s natural process of cell

turnover (i.e., apoptosis) to retrain the immune system to stop unwanted attacks on self or transplanted tissues. Apoptosis is a natural

process used by the body to clear dying cells and to allow recognition and tolerance to self-tissues. ADI triggers this process by enabling

the cells of the immune system to recognize the targeted tissues as “self.” Conceptually, it is designed to retrain the immune

system to accept the tissues, similar to how natural apoptosis reminds our immune system to be tolerant to our own “self”

tissues.

While

various groups have promoted tolerance through cell therapies and ex vivo manipulation of patient cells (i.e., takes

place outside the body), to our knowledge, we will be unique in our approach of using in-body induction of apoptosis to promote tolerance

to specific tissues. In addition, ADI treatment itself will not require additional hospitalization but only an injection of minute

amounts of the therapeutic drug into the skin.

Moreover,

preclinical studies have demonstrated that ADI treatment significantly and substantially prolongs graft survival, in addition to successfully

“reversing” other established immune-mediated inflammatory processes.

License

Agreement with Loma Linda University (“LLU”)

On

March 15, 2018, we entered into a License Agreement with LLU, which was subsequently amended on July 1, 2020. Pursuant to the LLU License

Agreement, we obtained the exclusive royalty-bearing worldwide license to all intellectual property, including patents, technical information,

trade secrets, proprietary rights, technology, know-how, data, formulas, drawings, and specifications, owned or controlled by LLU and/or

any of its affiliates (the “LLU Patent and Technology Rights”) and related to therapy for immune-mediated inflammatory diseases

(the Adi™ technology). In consideration for the LLU License Agreement, we issued 625 shares of common stock to LLU.

PEARSANTA,

INC.

Formed

in January 2023, our subsidiary Pearsanta™, Inc. (“Pearsanta”) seeks to take personalized medicine to a whole new level

by delivering “Health by the Numbers.” Since its founding, Pearsanta has been building the platform for enabling our vision

of lab quality testing, anytime, anywhere. Our plan for Pearsanta’s platform is for it to be the transactional backbone for sample

collection, sample processing (on- and off-site), and reporting. This will require the development and convergence of multiple components

developed by Pearsanta, or through transactions with third parties, including collection devices, “lab-on-a-chip” technologies,

Lab Developed Test (LDT) assays, a data-driven analysis engine, and telemedicine. According to a comprehensive research report by Market

Research Future, the clinical and consumer diagnostic market is estimated to hit $429.3 billion by 2030.

We

believe that timely and personalized testing enables far more informed treatment decisions. Pearsanta’s platform is being developed

as a seamless digital healthcare solution. This platform will integrate at-location sample collection, Point-of-Care (“POC”)

and LDT assays, and an analytical reporting engine, with telemedicine-enabled visits with licensed physicians to review test results

and, if necessary, order a prescription. Pearsanta’s goal of extending its platform to enable consumers to monitor their health

more proactively as the goal is to provide a more complete picture about someone’s dynamic health status, factoring in genetic

makeup and their response to medication. The POC component of Pearsanta would enable diagnostic testing at-home, at work, in pharmacies,

and more to generate results quickly so that an individual can access necessary treatment faster. With certain infections, prescribing

the most effective treatment according to one’s numbers can prevent hospital emergency room admissions and potentially life-threatening

consequences.

Examples

of indication-focused tests for the Test2Treat platform will include the evaluation for advanced urinary tract infections (“UTIs”),

COVID-19/flu/respiratory syncytial virus, sexually transmitted infections, gut health, pharmacogenomics (i.e., how your genes affect

the way your body responds to certain therapeutics), and sepsis. We believe that these offerings are novel and needed as the current

standard of care using broad spectrum antibiotic treatment can be ineffective and potentially life-threatening. For example, improperly

prescribed antibiotics may approach 50% of outpatient cases. Further, according to an article published in Physician’s Weekly,

only 1% of board-certified critical care medicine physicians are trained in infectious disease.

Licensed

Technologies – AditxtScoreTM

We

intend to sublicense to Pearsanta an exclusive worldwide sub-license for commercializing the AditxtScore™ technology which provides

a personalized comprehensive profile of the immune system. AditxtScore is intended to detect individual immune responses to viruses,

bacteria, peptides, drugs, supplements, bone marrow and solid organ transplants, and cancer. It has broad applicability to many other

agents of clinical interest impacting the immune system, including those not yet identified such as emerging infectious agents.

AditxtScore

is being designed to enable individuals and their healthcare providers to understand, manage and monitor their immune profiles and to

stay informed about attacks on or by their immune system. We believe AditxtScore can also assist the medical community and individuals

by being able to anticipate the immune system’s potential response to viruses, bacteria, allergens, and foreign tissues such as

transplanted organs. This technology may be able to serve as a warning signal, thereby allowing for more time to respond appropriately.

Its advantages include the ability to provide simple, rapid, accurate, high throughput assays that can be multiplexed to determine the

immune status with respect to several factors simultaneously, in approximately 3-16 hours. In addition, it can determine and differentiate

between distinct types of cellular and humoral immune responses (e.g., T and B cells and other cell types). It also provides for simultaneous

monitoring of cell activation and levels of cytokine release (i.e., cytokine storms).

We

are actively involved in the regulatory approval process for AditxtScore assays for clinical use and securing manufacturing, marketing,

and distribution partnerships for application in the various markets. To obtain regulatory approval to use AditxtScore as a clinical

assay, we have conducted validation studies to evaluate its performance in detection of antibodies and plan to continue conducting additional

validation studies for new applications in autoimmune diseases.

Advantages

The

sophistication of the AditxtScore technology includes the following:

| ● | greater

sensitivity/specificity. |

| ● | 20-fold

higher dynamic range, greatly reducing signal to noise compared to conventional assays. |

| ● | ability

to customize assays and multiplex a large number of analytes with speed and efficiency. |

| ● | ability

to test for cellular immune responses (i.e., T and B cells and cytokines). |

| ● | proprietary

reporting algorithm. |

License

Agreement with Leland Stanford Junior University (“Stanford”)

On

February 3, 2020, we entered into an exclusive license agreement (the “February 2020 License Agreement”) with Stanford with

regard to a patent concerning a method for detection and measurement of specific cellular responses. Pursuant to the February 2020 License

Agreement, we received an exclusive worldwide license to Stanford’s patent with regard to use, import, offer, and sale of Licensed

Products (as defined in the agreement). The license to the patented technology is exclusive, including the right to sublicense, beginning

on the effective date of the agreement, and ending when the patent expires. Under the exclusivity agreement, we acknowledged that Stanford

had already granted a non-exclusive license in the Nonexclusive Field of Use, under the Licensed Patents in the Licensed Field of Use

in the Licensed Territory (as those terms are defined in the “February 2020 License Agreement”). However, Stanford agreed

not to grant further licenses under the Licensed Patents in the Licensed Field of Use in the Licensed Territory. On December 29, 2021,

we entered into an amendment to the February 2020 License Agreement which extended our exclusive right to license the technology deployed

in AditxtScoreTM and securing worldwide exclusivity in all fields of use of the licensed technology.

ADIVIR,

INC.

Formed

in April of 2023, Adivir™, Inc., is Aditxt’s most recently formed wholly owned subsidiary, dedicated to the clinical and

commercial development efforts of innovative antiviral products, starting with Favipiravir-based monotreatment or combination therapies.

These products have the potential to address a wide range of infectious diseases, including those that currently lack viable treatment

options.

Background

On

April 18, 2023, we entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Cellvera Global Holdings

LLC (“Cellvera Global”), Cellvera Holdings Ltd. (“BVI Holdco”), Cellvera, Ltd. (“Cellvera Ltd.”),

Cellvera Development LLC (“Cellvera Development” and together with Cellvera Global, BVI Holdco, Cellvera Ltd. and Cellvera

Development (the “Sellers”), AiPharma Group Ltd. (“Seller Owner” and collectively with the Sellers, “Cellvera”),

and the legal representative of Cellvera, pursuant to which, the Company will purchase Cellvera’s 50% ownership interest in G Response

Aid FZE (“GRA”), certain other intellectual property and all goodwill related thereto (the “Acquired Assets”). Unless

expressly stated otherwise herein, capitalized terms used but not defined herein have the meanings ascribed to them in the Asset Purchase

Agreement. Pursuant to the Asset Purchase Agreement, the consideration for the Acquired Assets consists of (A) $24.5 million,

comprised of: (i) the forgiveness of the Company’s $14.5 million loan to Cellvera Global, and (ii) approximately $10 million in

cash, and (B) future revenue sharing payments for a term of seven years. GRA holds an exclusive, worldwide license for the antiviral

medication, Avigan® 200mg, excluding Japan, China and Russia. The other 50% interest in GRA is held by Agility, Inc. (“Agility”).

Additionally,

upon the closing, the Share Exchange Agreement previously entered into as of December 28, 2021, between Cellvera Global Holdings, LLC

f/k/a AiPharma Global Holdings, LLC (together with other affiliates and subsidiaries) and the Company, and all other related agreements

will be terminated.

The

obligations of the Company to consummate the Closing are subject to the satisfaction or waiver, at or prior to the Closing of certain

conditions, including but not limited to, the following:

| (i) | Satisfactory

completion of due diligence; |

| (ii) | Completion

by the Company of financing sufficient to consummate the transactions contemplated by the Asset Purchase Agreement; |

| (iii) | Receipt

by the Company of all required Consents from Governmental Bodies for the Acquisition, including but not limited to, any consents required

to complete the transfer and assignment of Cellvera’s membership interests in GRA; |

| |

(iv) |

Receipt

of executed payoff letters reflecting the amount required to be fully pay all of each of Seller’s and Seller Owner’s

Debt to be paid at Closing; |

| |

(v) |

Receipt

by the Company of a release from Agility; |

| |

(vi) |

Execution

of an agreement acceptable to the Company with respect to the acquisition by the Company of certain intellectual property presently

held by a third party; |

| |

(vii) |

Execution

of an amendment to an asset purchase agreement previously entered into by Cellvera with a third party that effectively grants the

Company the rights to acquire the intellectual property from the third party under such agreement; |

| |

(viii) |

Receipt

of a fairness opinion by the Company with respect to the transactions contemplated by the Asset Purchase Agreement; and |

| |

(ix) |

Receipt

by the Company from the Seller Owner of written consent, whether through its official liquidator or the Board of Directors of Seller

Owner, to the sale and purchase of the Acquired Assets and Assumed Liabilities pursuant to the Assert Purchase Agreement. |

There

can be no assurance that the conditions to closing will be satisfied or that the proposed acquisition will be completed as proposed or

at all.

Our

commitment to building our antiviral portfolio is strategic and timely. We believe that there has never has there been a more important

time to address the growing global need to uncover new treatments or commercialize existing ones that treat life-threatening global viral

infections.

Recent

Developments

Nasdaq

Hearing

As

previously disclosed on a Current Report on Form 8-K filed in May 26, 2023, on May 23, 2023, we received written notice (the “May

Notification Letter”) from Nasdaq that, based upon the stockholders equity reported by the Company in its Form 10-Q for the

period ended March 31, 2023, and as of March 31, 2023, the Company was no longer in compliance with Nasdaq Listing Rule 5550(b)(1), which

requires a company to maintain a minimum of $2,500,000 in stockholders’ equity, a market value of listed securities of at least

$35 million, or net income from continuing operations of $500,000 in the most recently completed fiscal year or in two of the three most

recently completed fiscal years (the “Equity Rule”). The May Notification Letter further provided that the Company had 45

calendar days, or until July 7, 2023, to submit a plan to regain compliance and if the plan is accepted by Nasdaq, an extension of up

to 180 calendar days, or until November 19, 2023 to evidence compliance. On

June 22, 2023, we received a letter from Nasdaq notifying the Company that it has failed to maintain compliance with the minimum bid

price rule in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Rule”) as the closing price of Company’s common

stock has remained below $1.00 for over 30 consecutive trading days. On June 29, 2023, we submitted an appeal to Nasdaq, which stayed

the delisting and suspension of our securities pending the decision of the Nasdaq Hearings Panel (the “Panel”) no later than

4:00 p.m. Eastern Time on June 29, 2023. The hearing was held on August 31, 2023, which represented the tenth trading day that the closing

price of our Common Stock was above $1.00 per share. At the hearing, we also presented our views and our plans to regain compliance with

the stockholders’ equity requirement to the Panel.

On

September 15, 2023, we received written notice from Nasdaq that we no longer met the minimum 500,000 publicly held shares requirement

for the Nasdaq Capital Market and we were no longer in compliance with Nasdaq Listing Rule 5550(a)(4) (the “Public Float Rule”).

The letter indicated that the Panel will consider this matter in their decision regarding our continued listing on the Nasdaq Capital

Market. On September 29, 2023, we received written notice from Nasdaq that the Panel had

granted the Company an exception through December 26, 2023, to allow the Company to complete its plan to demonstrate compliance with

the Equity Rule. The October Notification Letter also confirmed that the Company had demonstrated compliance with the Minimum Bid Price

Rule, and it granted the Company an exception through December 26, 2023, to allow the Company to demonstrate compliance with the Public

Float Rule.

Reverse

Stock Split

As

previously disclosed on a Current Report on Form 8-K filed on August 17, 2023, on August 17, 2023, we filed a Certificate of Amendment

to our Amended and Restated Certificate of Amendment with the Secretary of State of the State of Delaware to effect a 1-for-40 reverse

stock split of our shares of Common Stock.

August

2023 Private Placement

As

previously disclosed in a Current Report on Form 8-K filed on September 6, 2023, on August 31, 2023, we entered into a securities purchase

agreement (the “Purchase Agreement”) with an institutional investor for the issuance

and sale in a private placement (the “Private Placement”) of (i) pre-funded warrants (the “Pre-Funded Warrants”)

to purchase up to 1,000,000 shares of the Company’s common stock, par value $0.001 (the “Common Stock”), at an exercise

price of $0.001 per share, and (ii) warrants (the “Common Warrants”) to purchase up to 1,000,000 shares of the Company’s

Common Stock at an exercise price of $10.00 per share.

The

Common Warrants are exercisable immediately upon issuance and have a term of exercise equal to five and one-half years from the date

of issuance. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until the Pre-Funded Warrants are exercised

in full. A holder of Pre-Funded Warrants or Warrants (together with its affiliates) may not exercise any portion of a warrant to the

extent that the holder would own more than 4.99% (or, at the election of the holder 9.99%) of the Company’s outstanding common

stock immediately after exercise.

In

connection with the Private Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”),

dated as of August 31, 2023, with the investor, pursuant to which the Company agreed to prepare and file a registration statement with

the Securities and Exchange Commission (the “SEC”) registering the resale of the shares of Common Stock underlying the Pre-Funded

Warrants and the Common Warrants no later than 15 days after the date of the Registration Rights Agreement, and to use best efforts to

have the registration statement declared effective as promptly as practical thereafter, and in any event no later than 45 days following

the date of the Registration Rights Agreement (or 75 days following the date of the Registration Rights Agreement in the event of a “full

review” by the SEC).

The

Private Placement closed on September 6, 2023. We received net proceeds from the Private Placement of approximately $9 million, after

deducting placement agent fees and expenses and estimated offering expenses payable by us.

H.C.

Wainwright & Co., LLC (“Wainwright”) served as our exclusive placement agent in connection with the Private Placement,

pursuant to those certain engagement letters, dated as of March 27, 2023 and April 25, 2023, as amended, between the Company and Wainwright

(the “Engagement Letter”). Pursuant to the Engagement Letter, we paid Wainwright (i) a total cash fee equal to 7.75% of the

aggregate gross proceeds of the Private Placement, (ii) a management fee of 1.0% of the aggregate gross proceeds of the Private Placement,

(iii) a non-accountable expense allowance of $50,000, and (iv) $100,000 for legal fees and other out-of-pocket expenses. In addition,

we issued to Wainwright or its designees warrants (the “Placement Agent Warrants”) to purchase up to an aggregate of 60,000

shares of Common Stock at an exercise price equal to $12.50 per share. The Placement Agent Warrants are exercisable immediately upon

issuance and have a term of exercise equal to five and one-half years from the date of issuance.

July

Private Placement

On

July 3, 2023, we entered into a Securities Purchase Agreement (the “First Tranche Securities Purchase Agreement”) with an

accredited investor (the “First Tranche Investor”) pursuant to which we issued and sold a secured promissory note in the

principal amount of $375,000 (the “First Tranche Note”) resulting in gross proceeds of $250,000. In connection with the issuance

of the Note, we issued 3,907 shares of common stock (the “First Tranche Commitment Shares”) as a commitment fee to the investor.

Pursuant to the Securities Purchase Agreement, we are obligated to obtain approval of our shareholders (“Shareholder Approval”)

with respect to the issuance of any securities in connection with the Securities Purchase Agreement and the Note in excess of 19.99%

of our issued and outstanding shares on the closing date, which is equal to 33,791 shares of our common stock. Pursuant to the First

Tranche Securities Purchase Agreement, we also granted piggy-back registration rights to the investor with respect to First Tranche Commitment

Shares and any shares of our common stock issuable upon conversion of the First Tranche Note. In addition, we agreed that we would not

enter into any public or private offering of securities that has rights or benefits superior to the First Tranche Investor without providing

such rights and benefits to the First Tranche investor. Under the First Tranche Note, the First Tranche Investor has the right to require

us to immediately apply up to 25% of the cash proceeds from any source, to repay all or any portion of the outstanding balance of the

First Tranche Note. The First Tranche Note has a maturity date of December 31, 2023 and is convertible following Shareholder Approval

and the occurrence of an Event of Default (as defined in the Note) at a conversion price of $18.00 per share. As of the date of this

prospectus, the First Tranche Note has been fully repaid.

In

connection with the First Tranche Securities Purchase Agreement and the issuance of the First Tranche Note, we and certain of our subsidiaries

also entered into a Security Agreement with the investor (the “First Tranche Security Agreement”) pursuant to which we granted

the investor a security interest in certain Collateral (as defined in the First Tranche Security Agreement) to secure our obligations

under the First Tranche Note. In addition, we entered into a Registration Rights Agreement with the investor (the “First Tranche

Registration Rights Agreement”) pursuant to which we agreed to prepare and file with the U.S. Securities and Exchange Commission

a registration statement covering the resale of the First Tranche Commitment Shares and any shares of our common stock issuable upon

conversion of the First Tranche Note within 120 days of the closing date and to have such registration statement declared effective within

150 days of the closing date.

On

July 24, 2023, we entered into a Securities Purchase Agreement (the “Second Tranche Securities Purchase Agreement”) with

an accredited investor (the “Second Tranche Investor”) pursuant to which the Company issued and sold a secured promissory

note in the principal amount of $2,625,000 (the “Second Tranche Note”) resulting in gross proceeds to the Company of $1,750,000.

In connection with the issuance of the Note, we agreed to issue a total of 27,344 shares of common stock (the “Second Tranche Commitment

Shares”) as a commitment fee to the investor. At the request of the investor, we issued 17,277 Second Tranche Commitment Shares

and will issue the remaining 10,067 Second Tranche Commitment Shares within 120 days, subject to the investor’s discretion. Pursuant

to the Second Tranche Securities Purchase Agreement, we are obligated to obtain approval of our shareholders with respect to the issuance

of any securities in connection with the Second Tranche Securities Purchase Agreement and the Second Tranche Note in excess of 19.99%

of our issued and outstanding shares on the closing date, which is equal to 38,026 shares of the Company’s common stock. Pursuant

to the Second Tranche Securities Purchase Agreement, we also granted piggy-back registration rights to the investor with respect to Second

Tranche Commitment Shares and any shares of our common stock issuable upon conversion of the Second Tranche Note. In addition, we agreed

that we would not enter into any public or private offering of securities that has rights or benefits superior to the Second Tranche

Investor without providing such rights and benefits to the Second Tranche Investor. Under the Second Tranche Note, the Second Tranche

Investor has the right to require us to immediately apply up to 25% of the cash proceeds from any source, to repay all or any portion

of the outstanding balance of the Second Tranche Note. The Second Tranche Note has a maturity date of December 31, 2023 and is convertible

following shareholder approval and the occurrence of an Event of Default (as defined in the Note) at a conversion price of $15.60 per

share.

In

connection with the Second Tranche Securities Purchase Agreement and the issuance of the Second Tranche Note, we and certain of our subsidiaries

also entered into a Security Agreement with the investor (the “Second Tranche Security Agreement”) pursuant to which we granted

the investor a security interest in certain Collateral (as defined in the Second Tranche Security Agreement) to secure its obligations

under the Second Tranche Note. In addition, we entered into a Registration Rights Agreement with the investor (the “Second Tranche

Registration Rights Agreement”) pursuant to which we agreed to prepare and file with the U.S. Securities and Exchange Commission

a registration statement covering the resale of the Second Tranche Commitment Shares and any shares of our common stock issuable upon

conversion of the Second Tranche Note within 90 days of the closing date and to have such registration statement declared effective within

120 days of the closing date.

July

2023 Loan Transactions

On

July 3, 2023, we entered into a Business Loan and Security Agreement (the “July Loan Agreement”) with a commercial funding

source (the “July Lender”), pursuant to which we obtained a loan from the July Lender in the principal amount of $215,000,

which includes origination fees of $10,750 (the “July Loan”). Pursuant to the July Loan Agreement, we granted the Lender

a continuing secondary security interest in certain collateral (as defined in the July Loan Agreement). The total amount of interest

and fees payable by us to the July Lender under the July Loan will be $322,285, which will be repaid in 13 weekly installments of $24,500

with a final payment of $3,785 in the fourteenth week. As of August 18, 2023, the outstanding balance on the July Loan is $311,076. On

August 23, 2023, we entered into a new Business Loan and Security Agreement with the July Lender, pursuant to which we consolidated the

amounts outstanding under the April Loan and the July Loan and obtained a new loan in the principal amount of $1.4 million.

July

2023 Private Placement of Series C Preferred Stock

On

July 11, 2023, we entered into a Subscription and Investment Representation Agreement (the “Subscription Agreement”) with

Amro Albanna, our Chief Executive Officer, who is an accredited investor (the “Purchaser”), pursuant to which we agreed to

issue and sell one (1) share of the Company’s Series C Preferred Stock, par value $0.001 per share (the “Preferred Stock”),

to the Purchaser for $1,000.00 in cash. The sale closed on July 11, 2023.

On

July 11, 2023, we filed a certificate of designation (the “Certificate of Designation”) with the Secretary of State of Delaware,

effective as of the time of filing, designating the rights, preferences, privileges and restrictions of the share of Preferred Stock.

The Certificate of Designation provides that the share of Preferred Stock will have 250,000,000 votes and will vote together with the

outstanding shares of our common stock as a single class exclusively with respect to any proposal to amend the Company’s Amended

and Restated Certificate of Incorporation to effect a reverse stock split of our common stock. The Preferred Stock will be voted, without

action by the holder, on any such proposal in the same proportion as shares of common stock are voted. The Preferred Stock otherwise

has no voting rights except as otherwise required by the General Corporation Law of the State of Delaware.

The

Preferred Stock is not convertible into, or exchangeable for, shares of any other class or series of stock or other securities of the

Company. The Preferred Stock has no rights with respect to any distribution of assets of the Company, including upon a liquidation, bankruptcy,

reorganization, merger, acquisition, sale, dissolution or winding up of the Company, whether voluntarily or involuntarily. The holder

of the Preferred Stock will not be entitled to receive dividends of any kind.

The

outstanding share of Preferred Stock shall be redeemed in whole, but not in part, at any time (i) if such redemption is ordered by the

Board of Directors in its sole discretion or (ii) automatically upon the effectiveness of the amendment to the Certificate of Incorporation

implementing a reverse stock split. Upon such redemption, the holder of the Preferred Stock will receive consideration of $1,000.00 in

cash.

Resignation

of Executive Officer

On

July 21, 2023, Matthew Shatzkes tendered his resignation as Chief Legal Officer, General Counsel and Corporate Secretary of the Company.

In connection with his resignation, we entered into a Separation Agreement and General Release with Mr. Shatzkes (the “Separation

Agreement”). Pursuant to the Separation Agreement, Mr. Shatzkes employment with the Company terminated on August 4, 2023 (the “Termination

Date”). In addition, we agreed to pay Mr. Shatzkes within seven days after the Termination Date: (i) $122,292.32, representing

all accrued salary and wages (inclusive of Base Compensation and earned Subsequent Quarterly Bonus amounts, as those terms are defined

in Mr. Shatzkes employment agreement) (the “Accrued Salary and Wages”), and (ii) $32,575.84, representing Mr. Shatzkes accrued,

but unused paid time off (the “Accrued PTO”). On August 11, 2023, we paid Mr. Shatzkes $64,808. Pursuant to the Separation

Agreement, we also agreed to pay Mr. Shatzkes: (i) $385,000, representing 12 months of Mr. Shatzkes Base Compensation (as that term is

defined in Mr. Shatzkes employment agreement) (the “Severance Base Compensation”), and (ii) $290,000, representing Mr. Shatzkes

Subsequent Year Minimum Bonus (as such term is defined in Mr. Shatzkes employment agreement) (the “Severance Bonus”), on

the 60th day following the Termination Date. In addition, we are required to reimburse Mr. Shatzkes COBRA premium for a period of 12

months and shall cause any restricted stock units granted to Mr. Shatzkes to immediately vest as of the Termination Date.

On

August 15, 2023, we entered into an Amendment to Separation Agreement and General Release with Mr. Shatzkes (the “Separation Agreement

Amendment”). Pursuant to the Separation Agreement Amendment, we are required to pay Mr. Shatzkes, upon the earlier of (i) September

1, 2023 or (ii) two business days following the closing of a capital raise by the Company, an amount equal to $91,060.16, which amount

represents the balance of Mr. Shatzkes’ Accrued Salary and Wages and Accrued PTO plus an additional $1,000 to serve as consideration

for entering into the Separation Agreement Amendment. In addition, under the Separation Agreement Amendment, we are required to pay Mr.

Shatzkes the Severance Base Compensation and the Severance Bonus upon the earlier of (i) the 60th day following the Termination

Date or (ii) two business days following the closing of a capital raise by the Company. We expect to pay the amounts due to Mr. Shatzkes

from the proceeds of our recently completed Private Placement.

Termination

of Letter of Intent

On

August 1, 2023, the Company and Natural State Genomics and Natural State Laboratories mutually agreed to terminate the Amended and Restated

Non-Binding Letter of Intent dated June 12, 2023.

August

2023 Secured Loan Transaction

On

August 23, 2023, we entered into a Business Loan and Security Agreement (the “August Loan Agreement”) with a commercial funding

source (the “August Lender”) pursuant to which we obtained a loan from the August Lender in the principal amount of $1,400,000,

which will satisfy the outstanding balances on loans that we originally obtained From the August Lender in April 2023 and July 2023,

and includes origination fees of $70,000 (the “August Loan”). Pursuant to the August Loan Agreement, we granted the August

Lender a continuing secondary security interest in certain collateral (as defined in the August Loan Agreement). The total amount of

interest and fees payable by us to the August Lender under the August Loan will be $2,079,000, which will be repaid in 21 weekly installments

of $99,000.

April

2023 Registered Direct Offering and Concurrent Private Placement

On

April 20, 2023, we entered into a securities purchase agreement (the “April Purchase Agreement”) with an institutional investor,

pursuant to which the Company agreed to sell to such investor pre-funded warrants (the “Pre-Funded Warrants”) to purchase

up to 39,634 shares of common stock of the Company at a purchase price of $48.76 per Pre-Funded Warrant. The Pre-Funded Warrants (and

shares of common stock underlying the Pre-Funded Warrants) were offered by the Company pursuant to its shelf registration statement on

Form S-3 (File No. 333-257645), which was declared effective by the Securities and Exchange Commission on July 13, 2021.

Concurrently

with the sale of the Pre-Funded Warrants, pursuant to the Purchase Agreement in a concurrent private placement, for each Pre-Funded

Warrant purchased by the investor, such investor received from the Company an unregistered warrant (the “Warrant”) to purchase

two shares of Common Stock. The warrants have an exercise price of $34.40 per share, and are exercisable for a three year period. The

Warrant was issued were made pursuant to Section 4(a)(2) of the Securities Act.

Corporate

Information

We

were incorporated as a Delaware corporation on September 28, 2017. Our principal executive offices are located at 737 N. Fifth Street,

Suite 200 Richmond, VA 23219, and our telephone number is (650) 870-1200.

Our

common stock trades on The Nasdaq Capital Market under the symbol “ADTX.”

THE

OFFERING

Common

Stock to be

offered by the Selling

Stockholders |

|

Up to 264,516 shares of Common

Stock |

| |

|

|

Common

Stock

outstanding prior to this

offering |

|

441,851

shares of Common Stock |

| |

|

|

Common

Stock to be

outstanding after this

offering |

|

685,182 shares of Common Stock, assuming the exercise of

all of the Warrants and the issuance of all shares of Common Stock upon conversion of the Note. |

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of the shares of Common Stock by the Selling Stockholders, except for the Warrant exercise

price paid for the Common Stock offered hereby and issuable upon the exercise of the Warrants. See “Use of Proceeds”

on page 45 of this prospectus. |

| |

|

|

| Risk

factors |

|

See

“Risk Factors” beginning on page 15 of this prospectus, as well as other information included in this prospectus, for

a discussion of factors you should read and consider carefully before investing in our securities. |

| |

|

|

| Nasdaq

Capital Markets symbol |

|

Our

common stock is listed on The Nasdaq Capital Markets under the symbol “ADTX”. There is no established trading market

for the Warrants and we do not expect a trading market to develop. We do not intend to list the Warrants on any securities exchange

or other trading market. Without a trading market, the liquidity of the Warrants will be extremely limited. |

The number of shares of our common stock to be outstanding after this

offering as shown above is based on 441,851 shares outstanding as of November 6, 2023 and excludes as of that date:

| ● | 2,055,924

shares of our common stock issuable upon exercise of warrants, subject to vesting having a weighted average exercise price of $36.95

per share; and |

| ● | 1,127

shares of our common stock issuable upon exercise of outstanding options under our 2017 Equity Incentive Plan or the 2017 Plan, subject

to vesting. |

Except

as otherwise indicated herein, all information in this prospectus assumes no sale of pre-funded warrants, which, if sold, would reduce

the number of shares of common stock that we are offering on a one-for-one basis, no exercise of the warrants or placement agent warrants

issued in this offering, and no exercise of options issued under our Plan or of warrants described above, including the Placement Agent

Warrants.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. This prospectus contains a discussion of the risks applicable to an investment

in our securities. Prior to deciding about investing in our securities, you should carefully consider the specific factors discussed

within this prospectus. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or

unknown risks might cause you to lose all or part of your investment in the offered securities.

Risks

Related to Our Common Stock

We

received a written notice from Nasdaq that we have failed to comply with certain listing requirements of the Nasdaq Stock Market, which

could result in our Common Stock being delisted from the Nasdaq Stock Market.

On

May 23, 2023, we received written notice from Nasdaq that, based upon the stockholders equity reported by the Company in its Form

10-Q for the period ended March 31, 2023, and as of March 31, 2023, the Company was no longer in compliance with Nasdaq Listing Rule

5550(b)(1), which requires a company to maintain a minimum of $2,500,000 in stockholders’ equity, a market value of listed securities

of at least $35 million, or net income from continuing operations of $500,000 in the most recently completed fiscal year or in two of

the three most recently completed fiscal years (the “Continued Listing Requirements”). The May notification letter further

provided that the Company has 45 calendar days, or until July 7, 2023, to submit a plan to regain compliance and if the plan is accepted

by Nasdaq, an extension of up to 180 calendar days, or until November 19, 2023 to evidence compliance. On June 22, 2023, we received

a letter from Nasdaq notifying the Company that it has failed to maintain compliance with the minimum bid price rule in Nasdaq Listing

Rule 5550(a)(2) (the “Minimum Bid Price Rule”) as the closing price of Company’s common stock has remained below $1.00

for over 30 consecutive trading days. On June 29, 2023, we submitted an appeal to Nasdaq, which stays the delisting and suspension of

our securities pending the decision of the Nasdaq Hearings Panel (the “Panel”) no later than 4:00 p.m. Eastern Time on June

29, 2023.

On

August 17, 2023, we filed a Certificate of Amendment to our Certificate of Incorporation, as amended, to effect a reverse stock split

at a ratio of one-for-forty (1:40) in order to regain compliance with the Minimum Bid Price Rule. However, we can provide no assurance

that Nasdaq will accept our plan of compliance or grant us any additional time to demonstrate our ability to regain and sustain compliance

with the continued listing requirements over the long term. If we are delisted from Nasdaq, our common stock may be eligible for trading

on an over-the-counter market. If we are not able to obtain a listing on another stock exchange or quotation service for our common stock,

it may be extremely difficult or impossible for stockholders to sell their shares.

The

hearing was held on August 31, 2023, which represented the tenth trading day that the closing price of our Common Stock was above $1.00

per share. At the hearing, we also presented our views and our plans to regain compliance with the stockholders’ equity requirement

to the Panel.

On September 15,

2023, we received written notice from Nasdaq that we no longer met the minimum 500,000 publicly held shares requirement for the Nasdaq

Capital Market and we were no longer in compliance with Nasdaq Listing Rule 5550(a)(4) (the “Public Float Rule”). The letter

indicated that the Panel will consider this matter in their decision regarding our continued listing on the Nasdaq Capital Market. On

September 29, 2023, we received written notice from Nasdaq that the Panel had granted the

Company an exception through December 26, 2023, to allow the Company to complete its plan to demonstrate compliance with the Equity Rule.

The October Notification Letter also confirmed that the Company had demonstrated compliance with the Minimum Bid Price Rule, and it granted

the Company an exception through December 26, 2023, to allow the Company to demonstrate compliance with the Public Float Rule.

If

we are delisted from Nasdaq, but obtain a substitute listing for our common stock, it will likely be on a market with less liquidity,

and therefore experience potentially more price volatility than experienced on Nasdaq. Stockholders may not be able to sell their shares

of common stock on any such substitute market in the quantities, at the times, or at the prices that could potentially be available on

a more liquid trading market. As a result of these factors, if our common stock is delisted from Nasdaq, the value and liquidity of our

common stock, warrants and pre-funded warrants would likely be significantly adversely affected. A delisting of our common stock from

Nasdaq could also adversely affect our ability to obtain financing for our operations and/or result in a loss of confidence by investors,

employees and/or business partners.

We

do not expect to pay dividends in the foreseeable future.

We

do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any and all future earnings in

the development and growth of our business. Therefore, investors will not receive any funds unless they sell their securities, and holders

may be unable to sell their securities on favorable terms or at all. We cannot assure you of a positive return on your investment or

that you will not lose the entire amount of your investment.

Risks

Related to Our Financial Position and Need for Capital

Our

financial situation creates doubt whether we will continue as a going concern.

We

were incorporated in September 2017 and have a limited operating history and our business is subject to all the risks inherent in the

establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties,

complications and delays frequently encountered in connection with development and expansion of a new business enterprise. Since inception,

we have incurred losses and expect to continue to operate at a net loss for at least the next several years as we commence our research

and development efforts, conduct clinical trials, and develop manufacturing, sales, marketing, and distribution capabilities. Our net

loss for the years ended December 31, 2022 and 2021 was $27,649,876 and $46,371,364, respectively, and our accumulated deficit as of

December 31, 2022 was $95,040,362. Our net loss for the six months ended June 30, 2023 and 2022 was $11,666,724 and $11,909,147, respectively,

and our accumulated deficit as of June 30, 2023 was $106,707,086. There can be no assurance that the products under development by us

will be approved for sale in the U.S. or elsewhere. Furthermore, there can be no assurance that if such products are approved, they will

be successfully commercialized, and the extent of our future losses and the timing of our profitability are highly uncertain. If we are

unable to achieve profitability, we may be unable to continue our operations. There can be no assurances that we will be able to achieve

a level of revenues adequate to generate sufficient cash flow from operations or additional financing through private placements, public

offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from any private

placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can

be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial

doubt about our ability to continue as a going concern. If adequate working capital is not available, we may be forced to discontinue

operations, which would cause investors to lose their entire investment.

Our

cash and cash equivalents were approximately $500,000 as of November 6, 2023. We will not receive any of the proceeds from the sale by

the Selling Stockholders of the Common Stock. Upon any exercise of the Warrants by payment of cash, however, we will receive the exercise

price of the Warrants, which, if exercised in cash with respect to the 79,268 shares of Common Stock offered hereby, would result in

gross proceeds to us of approximately $2.7 million. However, we cannot predict when and in what amounts or if the Warrants will be exercised

by payments of cash and it is possible that the Warrants may expire and never be exercised, in which case we would not receive any cash

proceeds. There can be no assurance that the Warrants will be exercised for cash, and if they are

not, that it will not have a material adverse effect on our business.

If

we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development and

you will likely lose your entire investment.

We

will need to continue to seek capital from time to time to continue development of our lead drug candidate beyond our initial combined

Phase I/Iia clinical trial and to acquire and develop other product candidates. Once approved for commercialization, we cannot provide

any assurances that any revenues it may generate in the future will be sufficient to fund our ongoing operations.

Our

business or operations may change in a manner that would consume available funds more rapidly than anticipated and substantial additional

funding may be required to maintain operations, fund expansion, develop new or enhance products, acquire complementary products, business

or technologies, or otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment or a

change in preferred treatment modalities. In addition, we may need to accelerate the growth of our sales capabilities and distribution

beyond what is currently envisioned, and this would require additional capital. However, we may not be able to secure funding when we

need it or on favorable terms. We may not be able to raise sufficient funds to commercialize the product candidates we intend to develop.

If

we cannot raise adequate funds to satisfy our capital requirements, we will have to delay, scale back or eliminate our research and development

activities, clinical studies, or future operations. We may also be required to obtain funds through arrangements with collaborators,

which arrangements may require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing,

including rights to future product candidates or certain major geographic markets. This could result in sharing revenues which we might

otherwise retain for ourselves. Any of these actions may harm our business, financial condition, and results of operations.

The

amount of capital we may need depends on many factors, including the progress, timing and scope of our product development programs;

the progress, timing and scope of our preclinical studies and clinical trials; the time and cost necessary to obtain regulatory approvals;

the time and cost necessary to further develop manufacturing processes and arrange for contract manufacturing; our ability to enter into

and maintain collaborative, licensing and other commercial relationships; and our partners’ commitment of time and resources to

the development and commercialization of our products.

Our

obligations to certain of our creditors are secured by security interests in our assets, so if we default on those obligations, our creditors

could foreclose on some or all of our assets.

Our

obligations to certain of our creditors are secured by security interests in our assets. As of November 6, 2023, approximately $5.0 million

was owed to such secured creditors. Under such agreements, we are required to pay $248,000 on a weekly basis to such creditors. If we

default on our obligations under these agreements, our secured creditors could foreclose on its security interests and liquidate some

or all of these assets, which would harm our financial condition and results of operations and would require us to reduce or cease operations

and possibly seek Bankruptcy Protection.

In

the event we pursue Bankruptcy Protection, we will be subject to the risks and uncertainties associated with such proceedings.

In

the event we file for relief under the United States Bankruptcy Code, our operations, our ability to develop and execute our business

plan and our continuation as a going concern will be subject to the risks and uncertainties associated with bankruptcy proceedings, including,

among others: our ability to execute, confirm and consummate a plan of reorganization; the additional, significant costs of bankruptcy

proceedings and related fees; our ability to obtain sufficient financing to allow us to emerge from bankruptcy and execute our business

plan post-emergence, and our ability to comply with terms and conditions of that financing; our ability to continue our operations in

the ordinary course; our ability to maintain our relationships with our consumers, business partners, counterparties, employees and other

third parties; our ability to obtain, maintain or renew contracts that are critical to our operations on reasonably acceptable terms

and conditions; our ability to attract, motivate and retain key employees; the ability of third parties to use certain limited safe harbor

provisions of the United States Bankruptcy Code to terminate contracts without first seeking Bankruptcy Court approval; the ability of

third parties to force us to into Chapter 7 proceedings rather than Chapter 11 proceedings and the actions and decisions of our stakeholders

and other third parties who have interests in our bankruptcy proceedings that may be inconsistent with our operational and strategic

plans. Any delays in our bankruptcy proceedings would increase the risks of our being unable to reorganize our business and emerge from

bankruptcy proceedings and may increase our costs associated with the bankruptcy process or result in prolonged operational disruption

for us. Also, we would need the prior approval of the bankruptcy court for transactions outside the ordinary course of business during

the course of any bankruptcy proceedings, which may limit our ability to respond timely to certain events or take advantage of certain

opportunities. Because of the risks and uncertainties associated with any bankruptcy proceedings, we cannot accurately predict or quantify

the ultimate impact of events that could occur during any such proceedings. There can be no guarantees that if we seek Bankruptcy Protection

we will emerge from Bankruptcy Protection as a going concern or that holders of our common stock will receive any recovery from any bankruptcy

proceedings.

In

the event we are unable to pursue Bankruptcy Protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully

emerge from such proceedings, it may be necessary to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy Code

for all or a part of our businesses.

In

the event we are unable to pursue Bankruptcy Protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully

emerge from such proceedings, it may be necessary for us to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy

Code for all or a part of our businesses. In such event, a Chapter 7 trustee would be appointed or elected to liquidate our assets for

distribution in accordance with the priorities established by the United States Bankruptcy Code. We believe that liquidation under Chapter

7 would result in significantly smaller distributions being made to our stakeholders than those we might obtain under Chapter 11 primarily

because of the likelihood that the assets would have to be sold or otherwise disposed of in a distressed fashion over a short period

of time rather than in a controlled manner and as a going concern.

Upon

dissolution of our Company, you may not recoup all or any portion of your investment.

In

the event of a liquidation, dissolution or winding-up of our Company, whether voluntary or involuntary, our assets would be used to pay

all of our debts and liabilities, and only thereafter would any remaining assets be distributed to our stockholders, subject to rights

of the holders of the Preferred Stock, if any, on a pro rata basis. There can be no assurance that we will have assets

available from which to pay any amounts to our stockholders upon such a liquidation, dissolution or winding-up. In such an event, you

would lose all of your investment.

We

will need to raise substantial additional capital, which may not be available on acceptable terms, or at all. Failure to obtain this

necessary capital when needed may force us to delay, limit or terminate our product development efforts or cease operations.

We

do not expect that our current cash position will be sufficient to fund our current operations for the next 12 months. Our operating

plan may change because of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through

public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements and other

collaborations, strategic alliances and licensing arrangements or a combination of these approaches. In any event, we will require additional

capital to obtain regulatory approval for, and to commercialize, our product candidates. Raising funds in the current economic environment

may present additional challenges. Even if we believe we have sufficient funds for our current or future operating plans, we may seek

additional capital if market conditions are favorable or if we have specific strategic considerations.

Any

additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to

develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient

amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights

of our stockholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may

cause the market price of our shares to decline. The sale of additional equity or convertible securities may dilute our existing stockholders.

The incurrence of indebtedness would result in increased fixed payment obligations, and we may be required to agree to certain restrictive

covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual

property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required

to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable and

we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to

us, any of which may have a material adverse effect on our business, operating results and prospects.

If

we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay, or discontinue one or more of

our research or development programs or the commercialization of any product candidate or be unable to expand our operations or otherwise

capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of

operations.

Even

if we can raise additional funding, we may be required to do so on terms that are dilutive to you.

The

capital markets have been unpredictable in the past for unprofitable companies such as ours. In addition, it is generally difficult for

development stage companies to raise capital under current market conditions. The amount of capital that a company such as ours is able