false

0001726711

0001726711

2024-02-26

2024-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 26, 2024

Aditxt,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 737

N. Fifth Street, Suite 200 Richmond, VA |

|

23219 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (650) 870-1200

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value

$0.001 |

|

ADTX |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

As

previously reported in a Current Report on Form 8-K filed by Aditxt, Inc. (the “Company”), in connection with that

certain Agreement and Plan of Merger (the “Merger Agreement”) dated December 11, 2023 among the Company, Adicure,

Inc. and Evofem Biosciences, Inc. (“Evofem”), the Company, Evofem and the holders (the “Holders”) of certain

senior indebtedness of Evofem (the “Notes”) entered into an Assignment Agreement

dated December 11, 2023 (the “December Assignment Agreement”), pursuant to which the Holders assigned the Notes to

the Company in consideration for the issuance by the Company of (i) an aggregate principal amount of $5.0 million in secured notes of

the Company due on January 2, 2024 (the “January 2024 Secured Notes”), (ii) an aggregate principal amount of $8.0

million in secured notes of the Company due on September 30, 2024 (the “September 2024 Secured Notes”), (iii) an aggregate

principal amount of $5.0 million in ten-year unsecured notes (the “Unsecured Notes”), and (iv) payment of $154,480 in

respect of net sales of Phexxi in respect of the calendar quarter ended September 30, 2023.

As

previously reported in a Current Report on Form 8-K filed by the Company, on January 2, 2024, the Company and the Holders entered into

amendments to the January 2024 Secured Notes (“Amendment No. 1 to January 2024 Secured Notes”), pursuant to which

the maturity date of the January 2024 Notes was extended to January 5, 2024. On January 5, 2024, the Company and the Holders entered

into amendments to the January 2024 Secured Notes (“Amendment No. 2 to January 2024 Secured Notes”) and amendments

to the September 2024 Secured Notes (“Amendment No. 1 to September 2024 Secured Notes”), pursuant to which the Company

and the Holders agreed that in consideration of a principal payment in the aggregate amount of $1.0 million on the January 2024 Secured

Notes and in increase in the aggregate principal balance of $250,000 on the September 2024 Secured Notes, that the maturity date of the

January 2024 Secured Notes would be further extended to January 31, 2024.

As

previously reported in a Current Report on Form 8-K, on January 31, 2024, the Company and the Holders entered into amendments to the

January 2024 Secured Notes (“Amendment No. 3 to January 2024 Secured Notes”), pursuant to which the maturity date

of the January 2024 Notes was extended to February 29, 2024 in consideration of amendments to the September 2024 Secured Notes (“Amendment

No. 2 to September 2024 Secured Notes”), pursuant to which the Company and the Holders agreed that in consideration of a principal

payment in the aggregate amount of $1.25 million (the “Additional Consideration Payment”) no later than January 29,

2024 on the January 2024 Secured Notes, and in increase in the aggregate principal balance of $300,000 on the September 2024 Secured

Notes. As previously reported in a Current Report on Form 8-K, the Company failed to make the Additional Consideration Payment on February

9, 2024 and, as a result, was in default on the January 2024 Secured Notes and the September 2024 Secured Notes.

On

February 26, 2024, the Company and the Holders entered into an Assignment Agreement (the “February Assignment Agreement”),

pursuant to which the Company assigned all remaining amounts due under the January 2024 Secured Notes, the September 2024 Secured Notes

and the Unsecured Notes (collectively, the “Notes”) back to the Holders. In connection with the February Assignment

Agreement, the Company and the Holders entered into a payoff letter (the “Payoff Letter”) and amendments to the January

2024 Secured Notes (“Amendment No. 4 to January 2024 Secured Notes”), pursuant to which the maturity date of the January

2024 Secured Notes was extended to March 31, 2024 and the outstanding balance under the Notes, after giving effect to the transactions

contemplated by the February Assignment Agreement as applied pursuant to the Payoff Letter, was adjusted to $250,000.

The

foregoing descriptions of February Assignment Agreement, Amendment No. 4 to January 2024 Secured Notes and the Payoff Letter are not

complete and are qualified in their entirety by reference to the full text of the Form of February Assignment Agreement, Form of Amendment

No. 4 to January 2024 Secured Notes and the Form of Payoff Letter, copies of which are filed as Exhibits 10.1, 10.2 and 10.3, respectively,

to this Current Report on Form 8-K and are incorporated by reference herein.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement of a Registrant.

The

information contained in Item 1.01 of this Current Report on Form 8-K in relation to the February Assignment Agreement Amendment No.

4 to January 2024 Secured Notes and the Payoff Letter is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ADITXT, INC. |

| |

|

|

| Date: February 29, 2024 |

By: |

/s/ Amro Albanna |

| |

|

Amro Albanna |

| |

|

Chief Executive Officer |

Exhibit 10.1

ASSIGNMENT AGREEMENT

This Assignment Agreement

(the “Assignment Agreement”) is dated as of February 26, 2024 (the “Effective Date”) by and among

Aditxt, Inc. (“Aditxt”), Baker Brothers Life Sciences, L.P. (“BBLS”), 667, L.P. (“667”

and collectively with BBLS, “Baker”) and Baker Bros. Advisors LP as their designated agent (the “Designated

Agent”), and consented to by Evofem Biosciences, Inc., a Delaware corporation (“Borrower”).

WHEREAS, Baker entered into

that certain Securities Purchase and Security Agreement by and among Borrower, Baker and Designated Agent, dated as of April 23, 2020,

as amended on November 20, 2021, March 21, 2022, September 15, 2022 and September 8, 2023 (the “Agreement”);

WHEREAS, pursuant to the Agreement,

Baker loaned an original principal amount of twenty-five million dollars ($25,000,000) to Borrower (the “Original Loan Amount”);

WHEREAS, the Original Loan

Amount is evidenced by those certain convertible promissory notes (the “Notes”) that were issued by Borrower to Baker;

WHEREAS, Aditxt, Baker, Designated

Agent and Borrower entered into that certain Assignment Agreement, dated as of December 11, 2023 (the “Prior Assignment Agreement”).

All capitalized terms used but not otherwise defined in this Assignment Agreement shall have the meaning provided in the Agreement or

the Prior Assignment Agreement, as applicable;

WHEREAS, pursuant to the Prior Assignment Agreement,

Baker sold and assigned the Notes and all remaining amounts due under the Agreement and the Notes to Aditxt, for (i) an original aggregate

principal amount of Five Million Dollars ($5,000,000) secured notes due on December 31, 2023 (as amended, the “$5,000,000 Secured

Notes”), (ii) an original aggregate principal amount of Eight Million Dollars ($8,000,000) secured notes due on September 30,

2024 (as amended, the “$8,000,000 Secured Notes”) and (iii) an aggregate principal amount of Five Million ($5,000,0000)

ten-year unsecured coupon notes (the “$5,000,000 Unsecured Coupon Notes” and, together with the $5,000,000 Secured

Notes and the $8,000,000 Secured Notes, the “Aditxt Notes”), and Aditxt purchased and assumed the Notes and such remaining

amounts due under the Agreement and accepted the assignment;

WHEREAS, Aditxt desires to

sell and assign the Notes and all remaining amounts due under the Agreement and the Notes to Baker, for a purchase price of $17,300,000,

which amount shall be applied by Baker to the partial repayment of the Aditxt Notes, as more particularly described below, and Baker desires

to purchase and assume the Notes and such remaining amounts due under the Agreement and accept the assignment, all in accordance with

the terms of this Assignment Agreement;

WHEREAS, Borrower consents

to such purchase by and assignment to Baker; and

NOW, THEREFORE, based on the

mutual promises provided herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged,

Aditxt, Borrower and Baker agree as follows:

1.

Assignment.

a. Assignment.

For consideration of $17,300,000, which amount shall be applied by Baker to the payment in full of the $8,000,000 Secured Notes and the

$5,000,000 Unsecured Coupon Notes in accordance with the terms of the Payoff Letter of even date herewith, and the partial repayment of

the $5,000,000 Secured Notes in accordance with the terms of certain amendments to such notes delivered concurrently with the execution

of this Assignment Agreement (for the avoidance of doubt, Baker shall not make any cash payment), Aditxt hereby assigns to Baker, and

Baker hereby assumes, the Notes and all remaining amounts due under the Agreement and the Notes (the “Outstanding Loan Amount”;

the Outstanding Loan Amount and the Notes, collectively referred to herein as the “Assigned Loan”). Aditxt assigns,

transfers and conveys to Baker the Transaction Documents. The Assigned Loan shall be secured by the Collateral to the same extent that

the Collateral secures the Notes and the Outstanding Loan Amount. Baker acknowledges and agrees that after giving effect to the transactions

contemplated herein, the outstanding balance due under the Aditxt Notes shall be $250,000.

b. The

assignment of the Assigned Loan is without recourse to Aditxt.

2.

Representations and Warranties.

a. Baker.

Baker (i) represents and warrants that (A) it is legally authorized to enter into this Assignment Agreement; (B) it has obtained all consents

and approvals required to enter into this Assignment Agreement; (C) this Assignment Agreement is binding legal obligation of Baker, enforceable

against it in accordance with this Assignment Agreement’s terms, except as enforceability may be limited by applicable bankruptcy,

insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability;

(D) from and after the Effective Date, it shall be bound by the provisions of the Agreement as a Lender thereunder and, to the extent

of the Assigned Loan, shall have the obligations of a Lender thereunder; (E) it is sophisticated with respect to decisions to acquire

assets of the type represented by such Assigned Loan and either it, or the Person exercising discretion in making its decision to acquire

such Assigned Loan, is experienced in acquiring assets of such type; (F) it has, independently and without reliance upon Aditxt and based

on such documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into this Assignment

Agreement to purchase such Assigned Loan; and (G) it is not prohibited from being a Lender; (ii) will independently and without reliance

upon Aditxt and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions

in taking or not taking action permitted to be taken under the Transaction Documents; and (iii) agrees that it will perform in accordance

with their terms all the obligations which by the terms of the Transaction Documents (excluding the Warrants) are required to be performed

by it as a Lender.

b. Aditxt.

Aditxt represents and warrants that (i) it is legally authorized to enter into this Assignment Agreement, (ii) it has obtained all

consents and approvals required to enter into this Assignment Agreement, (iii) this Assignment Agreement is binding legal obligation of

Aditxt, enforceable against it in accordance with this Assignment Agreement’s terms, except as enforceability may be limited by

applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles

relating to enforceability, (iv) it is the legal and beneficial owner of the interest being assigned thereby free and clear of any adverse

claim, lien or encumbrance, (v) it is sophisticated with respect to decisions to acquire assets of the type represented by such Assigned

Loan and either it, or the Person exercising discretion in making its decision to sell such Assigned Loan, is experienced in disposing

of assets of such type; (vi) it has, independently and without reliance upon Baker and based on such documents and information as it have

deemed appropriate, made its own credit analysis and decision to enter into this Assignment Agreement to sell such Assigned Loan and (vii)

it will independently and without reliance upon Baker and based on such documents and information as it shall deem appropriate at the

time, continue to make its own credit decisions in taking or not taking action permitted to be taken under the Transaction Documents.

Except as set forth in this Section (b)(i)-(vii), Aditxt makes no representations or warranties and assumes no responsibility with respect

to any statements, warranties or representations made in or in connection with the Transaction Documents, or the execution, legality,

validity, enforceability, genuineness, sufficiency or value of the Transaction Documents or any other instrument or document furnished

pursuant to the Transaction Documents, or the financial condition of, Borrower or any of its Subsidiaries or the performance or observance

by Borrower or any such Subsidiary of any of its obligations under the Transaction Documents or any other instrument or document furnished

pursuant thereto. Except for the representations and warranties provided in this Section 2(b)(i)-(vi), the Assigned Loan is sold and assigned

“as is” and “where is” without representations or warranties of any kind, including without limitation, warranties

of merchantability or fitness of purpose.

c. Borrower.

Borrower represents and warrants that (i) it is legally authorized to enter into this Assignment Agreement, (ii) it has obtained

all consents and approvals required to enter into this Assignment Agreement, (iii) this Assignment Agreement is binding legal obligation

of Borrower, enforceable against it in accordance with this Assignment Agreement’s terms, except as enforceability may be limited

by applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles

relating to enforceability, and (iv) the Transaction Documents were duly authorized, executed, delivered and performed pursuant to all

requisite corporate action on behalf of Borrower and in accordance with all applicable law, including, without limitation, all federal

and state securities law.

3. Consent

and Approval. Borrower hereby approves the foregoing Assignment Agreement, the modifications to the Agreement made herein, and the

sale and assignment of the Assigned Loan to Baker.

4.

General Provisions.

a. Severability.

Whenever possible, each provision of this Assignment Agreement shall be interpreted in such manner as to be effective and valid under

applicable law, but if any provision of this Assignment Agreement shall be prohibited by or invalid under such law, such provision shall

be ineffective only to the extent and duration of such prohibition or invalidity, without invalidating the remainder of such provision

or the remaining provisions of this Assignment Agreement.

b. Notice.

Any notice or service of process or other communication shall be in writing, and shall be deemed to have been validly served, given, delivered,

and received upon the earlier of: (i) the day of transmission if sent by facsimile or email, (ii) the day of delivery if hand delivered

or delivered by an overnight express service or overnight mail delivery service, in each case addressed to the party to be notified as

follows:

Baker Brothers Life Sciences, L.P.

Attention: Scott Lessing, President

860 Washington St., 10th Floor

New York, NY 10014

Facsimile:

Telephone:

Email:

Aditxt, Inc.

Attn: Amro Albanna, CEO

737 Fifth Street, Suite 200

Richmond, VA 23219

E-mail:

Evofem Biosciences, Inc.

7770 Regents Road, Suite 113-618

San Diego, CA 92122

Attn: Sandra Pelletier, CEO

E-Mail:

or to such other

address as each party may designate for itself by like notice.

c. Entire

Agreement; Amendments. This Assignment Agreement and the agreements referenced herein, constitute the entire agreement and understanding

of the parties hereto in respect of the subject matter hereof and thereof, and supersede and replace in their entirety any prior proposals,

term sheets, letters, negotiations or other documents or agreements, whether written or oral, with respect to the subject matter hereof

or thereof. None of the terms of this Assignment Agreement may be amended except by an instrument executed by each of the parties hereto.

d. No

Strict Construction. The parties hereto have participated jointly in the negotiation and drafting of this Assignment Agreement. In

the event an ambiguity or question of intent or interpretation arises, this Assignment Agreement shall be construed as if drafted jointly

by the parties hereto and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship

of any provisions of this Assignment Agreement.

e. No

Waiver. No omission or delay by Baker or Aditxt at any time to enforce any right or remedy reserved to it, or to require performance

of any of the terms, covenants or provisions hereof by Aditxt at any time designated, shall be a waiver of any such right or remedy to

which such party is entitled, nor shall it in any way affect such party’s right to enforce such provisions thereafter.

f. Survival.

All agreements, representations and warranties contained in this Assignment Agreement or in any document delivered pursuant hereto or

thereto shall survive the execution and delivery of this Assignment Agreement.

g. Governing

Law. THIS ASSIGNMENT AGREEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND BE GOVERNED BY THE LAWS OF THE STATE OF NEW YORK, WITHOUT

REGARD TO ITS CONFLICT OF LAWS PRINCIPLES.

h. Consent

to Jurisdiction and Venue. All judicial proceedings arising in or under or related to this Assignment Agreement shall be brought in

any state or federal court located in the State of New York. Each of the parties hereto hereby irrevocably and unconditionally submits,

for itself and its property, to the nonexclusive jurisdiction of any New York State court or Federal court of the United States of America

sitting in New York City, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Assignment

Agreement, or for recognition or enforcement of any judgment, and each of the parties hereto hereby irrevocably and unconditionally agrees

that all claims in respect of any such action or proceeding may be heard and determined in any such New York State court or, to the fullest

extent permitted by law, in such Federal court. Each party hereto irrevocably waives all right to trial by jury in any action, proceeding

or counterclaim (whether based on contract, tort or otherwise) arising out of or relating to this Assignment Agreement.

i. Counterparts.

This Assignment Agreement and any amendments, waivers, consents or supplements hereto may be executed in any number of counterparts, and

by different parties hereto in separate counterparts, each of which when so delivered shall be deemed an original, but all of which counterparts

shall constitute but one and the same instrument.

j. No

Third Party Beneficiaries. No provisions of this Assignment Agreement are intended, nor will be interpreted, to provide or create

any third-party beneficiary rights or any other rights of any kind in any Person other than Baker, the Designated Agent, Aditxt and Borrower

unless specifically provided otherwise herein. For the avoidance of doubt, none of Baker, the Designated Agent, Aditxt or the Borrower

may assign this Assignment Agreement to any other person.

[Remainder of page intentionally left blank]

The

terms set forth in this Assignment Agreement are hereby agreed to as of the date first provided above.

ADITXT,

INC.

| Signature: |

/s/

Amro Albanna |

|

| Print Name: |

Amro Albanna |

|

| Title: |

Chief Executive

Officer |

|

[Assignment

Agreement]

BAKER

BROTHERS LIFE SCIENCES, L.P.

By:

BAKER BROS. ADVISORS LP, management company and investment adviser to Baker Brothers

Life Sciences, L.P., pursuant to authority granted to it by Baker Brothers Life Sciences Capital,

L.P., general partner to Baker Brothers Life Sciences, L.P., and not as the general partner.

| By: |

/s/

Scott Lessing |

|

| Print Name: |

Scott Lessing |

|

| Title: |

President |

|

667,

L.P.,

By:

Baker Bros. Advisors LP,

management company and investment adviser to 667,

L.P., pursuant to authority granted to it by Baker Biotech Capital, L.P., general partner to 667,

L.P., and not as the general partner.

| By: |

/s/

Scott Lessing |

|

| Print Name: |

Scott Lessing |

|

| Title: |

President |

|

Baker

Bros. Advisors LP

| Signature: |

/s/

Scott Lessing |

|

| Print Name: |

Scott Lessing |

|

| Title: |

President |

|

[Assignment

Agreement]

Consented

to by:

EVOFEM

BIOSCIENCES, INC.

| Signature: |

/s/

Saundra Pelletier |

|

| Print Name: |

Saundra Pelletier |

|

| Title: |

Chief Executive

Officer |

|

[Assignment

Agreement]

Exhibit 10.2

AMENDMENT NO. 4 TO SECURED PROMISSORY NOTE

This AMENDMENT NO. 4 TO SECURED

PROMISSORY NOTE dated as of February 26, 2024, is made with reference to the Secured Promissory Note (the “Note”) in the outstanding

amount of $______ dated December 11, 2023 made by ADITXT, INC. (“Borrower”) to ____ or its registered assigns (“Lender”).

Concurrently herewith, Borrower is delivering to

Lender a principal payment in the amount of $______, which amount will be netted against the purchase price paid by Lender to Borrower

under that certain Assignment Agreement dated as of the date hereof (the “Partial Repayment”).

FOR VALUE RECEIVED, the undersigned

agree that upon receipt of the Partial Repayment (a) the current “Maturity Date” of February 29, 2024 is amended to be March

31, 2024, and (b) the amount of the Note is $______.

| |

By: LENDER |

| |

|

|

| |

By: |

|

| |

Print Name: |

|

| |

Title: |

|

| |

|

|

| |

ADITXT, INC. |

| |

|

|

| |

Signature: |

|

| |

Print Name: |

Amro Albanna |

| |

Title: |

Chief Executive Officer |

Exhibit 10.3

PAYOFF LETTER

February 26, 2024

Aditxt, Inc.

Attn: Amro Albanna, CEO

737 Fifth Street, Suite 200

Richmond, VA 23219

E-mail:

| Re: | Termination and Cancellation of Aditxt Notes |

Ladies and Gentlemen:

Reference is made to (i) that

certain Secured Promissory Note due September 2024, dated as of December 11, 2023 (as amended, restated, amended and restated, supplemented,

or otherwise modified, the “BBLS Secured Note”), issued by Aditxt, Inc. (“Aditxt”) to Baker Brothers

Life Sciences, L.P. (“BBLS”), (ii) that certain Unsecured Promissory Note, dated as of December 11, 2023 (as amended,

restated, amended and restated, supplemented, or otherwise modified, the “BBLS Unsecured Note” and, together with the

BBLS Secured Note, the “BBLS Notes”), issued by Aditxt to BBLS, (iii) that certain Secured Promissory Note due September

2024, dated as of December 11, 2023 (as amended, restated, amended and restated, supplemented, or otherwise modified, the “667

Secured Note” and the 667 Secured Note, together with the BBLS Secured Note, the “Secured Notes”), issued

by Aditxt to 667, L.P. (“667” and, together with BBLS, “Baker”), (iv) that certain Unsecured Promissory

Note, dated as of December 11, 2023 (as amended, restated, amended and restated, supplemented, or otherwise modified, the “667

Unsecured Note” and, together with the BBLS Unsecured Note, the “Unsecured Notes” and the Unsecured Notes,

together with the Secured Notes, the “Aditxt Notes”), issued by Aditxt to 667, (v) the various instruments, documents

and other agreements executed in connection with the Aditxt Notes (including, but not limited to, that certain Security Agreement, dated

as of December 11, 2023 (the “Security Agreement”) by and among Aditxt and Baker Bros. Advisors LP (the “Designated

Agent”) as agent for Baker), together with the Adixt Notes, collectively, the “Existing Notes Documents”)

and (viii) that certain Assignment Agreement, dated as of the date hereof (the “Assignment Agreement”), by and among

Baker, Aditxt and the Designated Agent and consented to by Evofem Biosciences Inc.

Baker understands that, pursuant

to the Assignment Agreement, Aditxt intends (a) to pay in full all outstanding indebtedness and all other amounts owing under the Aditxt

Notes (such indebtedness and other amounts, the “Payoff Obligations”) and (b) to terminate the Existing Notes Documents

in exchange for the selling and assignment of the Notes (as defined in the Assignment Agreement).

1. The

aggregate amount of the Payoff Obligations under the Existing Note Documents (collectively, the “Payoff Amount”) is

set forth on Schedule A.

2. Upon

Baker’s receipt of (a) a fully executed copy of this letter, and (b) a fully executed copy of the Assignment Agreement and (c) receipt

of the Payoff Amount (which shall be netted against the purchase price under the Assignment Agreement), (i) each of the Existing Notes

Documents, including the Security Agreement, shall automatically terminate and be of no further force and effect (other than indemnification

obligations owing to Baker to the extent that pursuant to the express terms of such documents, such obligations survive the termination

thereof), (ii) all liens, encumbrances, pledges and security interests securing the obligations under the Existing Notes Documents shall

automatically terminate, (iii) Aditxt and Sheppard, Mullin, Richter & Hampton, as counsel to Aditxt, shall, at Aditxt’s expense,

be authorized to file the Uniform Commercial Code termination statements attached hereto as Schedule B and (iv) Baker shall, at Aditxt’s

expense, deliver such other release documents reasonably requested by Aditxt to evidence the termination and release of the liens and

security interests securing the Aditxt Notes under the Existing Notes Documents.

3. In

addition, Aditxt agrees that, upon the Payoff Effective Time, Aditxt releases the Designated Agent, Baker and their respective affiliates

and subsidiaries and their respective officers, directors, employees, shareholders, agents, attorneys and representatives as well as their

respective successors and assigns (the “Baker Released Parties”) from any and all claims, obligations, rights, causes

of action, and liabilities, of whatever kind or nature, whether known or unknown, whether foreseen or unforeseen, arising on or before

the date hereof, which Aditxt ever had, now have or hereafter can, shall or may have for, upon or by reason of any matter, cause or thing

whatsoever, which are based upon, arise under or are related to the Existing Notes Documents (other than (i) obligations of the Designated

Agent and Baker expressly set forth in this Agreement and (ii) any and all claims, causes of action, damages, liabilities or obligations

of every nature and description in any way or manner which relates, directly or indirectly, to or arises out of the any Baker Released

Party’s gross negligence or willful misconduct as determined by a court of competent jurisdiction pursuant to a final, non-appealable

order) (collectively, the “Baker Released Matters”). Without limiting the generality of the foregoing, Aditxt hereby

waives the provisions of any statute or doctrine to the effect that a general release does not extend to claims which a releasing party

does not know or suspect to exist in its favor at the time of executing the release, which if known by such releasing party would have

materially affected the releasing party’s settlement with the party being released. Aditxt acknowledges that the agreements in this

paragraph are intended to be in full satisfaction of all or any alleged injuries or damages arising in connection with the Baker Released

Matters. Aditxt acknowledges that the release contained herein constitutes a material inducement to the Designated Agent and Baker to

enter into this Agreement and that the Designated Agent and Baker would not have done so but for the Designated Agent’s and Baker’s

expectation that such release is valid and enforceable in all events.

4. In

addition, Baker agrees that, effective upon the occurrence of (i) the Payoff Effective Time and (ii) the receipt by Baker of the payment

in full of the remaining balance under the $5,000,000 Secured Notes (as defined in the Assignment Agreement), Baker releases Aditxt and

its affiliates and subsidiaries and their respective officers, directors, employees, shareholders, agents, attorneys and representatives

as well as their respective successors and assigns (the “Aditxt Released Parties”) from any and all claims, obligations,

rights, causes of action, and liabilities, of whatever kind or nature, whether known or unknown, whether foreseen or unforeseen, arising

on or before the date hereof, which Baker ever had, now have or hereafter can, shall or may have for, upon or by reason of any matter,

cause or thing whatsoever, which are based upon, arise under or are related to the Existing Notes Documents (other than (i) obligations

of Aditxt expressly set forth in this Agreement, (ii) any and all claims, causes of action, damages, liabilities or obligations of every

nature and description in any way or manner which relates, directly or indirectly, to or arises out of the any Aditxt Released Party’s

gross negligence or willful misconduct as determined by a court of competent jurisdiction pursuant to a final, non-appealable order and

(iii) any and all claims, causes of action, damages, liabilities or obligations of every nature and description in any way or manner which

relates, directly or indirectly, to Aditxt’s representations and warranties under Section 2(b)(iv) of the Assignment Agreement and

Aditxt’s obligations under Section 3(a) and 3(d) of the Prior Assignment Agreement (as defined in the Assignment Agreement)) (collectively,

the “Aditxt Released Matters”). Without limiting the generality of the foregoing, Baker hereby waives the provisions

of any statute or doctrine to the effect that a general release does not extend to claims which a releasing party does not know or suspect

to exist in its favor at the time of executing the release, which if known by such releasing party would have materially affected the

releasing party’s settlement with the party being released. Baker acknowledges that the agreements in this paragraph are intended

to be in full satisfaction of all or any alleged injuries or damages arising in connection with the Aditxt Released Matters. Baker acknowledges

that the release contained herein constitutes a material inducement to Aditxt to enter into this Agreement and that Aditxt would not have

done so but for Aditxt’s expectation that such release is valid and enforceable in all events.

5. This

letter agreement (a) shall be governed by the laws of the State of New York, (b) may be executed in one or more counterparts, and delivery

of such counterparts by facsimile or email transmission shall be effective as deliver of manually executed counterparts, (c) sets forth

the entire agreement among the parties relating to the subject matter pertaining hereto, and no term or provision hereof may be amended,

changed, waived, discharged or terminated orally or otherwise, except in writing signed by each such party and (d) shall be binding upon

and inure to the benefit of the parties hereto and their respective successors and assigns.

[Signature Page Follows]

BAKER BROTHERS LIFE SCIENCES, L.P.

By: BAKER BROS. ADVISORS LP, management

company and investment adviser to Baker Brothers Life Sciences, L.P., pursuant to authority granted to it by Baker Brothers Life

Sciences Capital, L.P., general partner to Baker Brothers Life Sciences, L.P., and not as the general partner.

| By: |

/s/ Scott Lessing |

|

| Print Name: |

Scott Lessing |

|

| Title: |

President |

|

667, L.P.,

By: Baker Bros. Advisors

LP, management company and investment adviser to 667, L.P., pursuant to authority granted to it by Baker Biotech Capital,

L.P., general partner to 667, L.P., and not as the general partner.

| By: |

/s/ Scott Lessing |

|

| Print Name: |

Scott Lessing |

|

| Title: |

President |

|

| Baker Bros. Advisors LP |

|

| |

|

| By: |

/s/ Scott Lessing |

|

| Print Name: |

Scott Lessing |

|

| Title: |

President |

|

[Payoff Letter – Aditxt]

| ADITXT, INC. |

|

| |

|

| Signature: |

/s/ Amro Albanna |

|

| Print Name: |

Amro Albanna |

|

| Title: |

Chief Executive Officer |

|

[Payoff Letter – Aditxt]

SCHEDULE A

TO

PAYOFF LETTER

Payoff Amount

as of Payoff Date and Time

Funds payable to BBLS:

| BBLS Secured Note: | |

| |

| Principal | |

$ | 7,831,372.50 | |

| | |

| | |

| Unsecured BBLS Note: | |

| | |

| Principal | |

$ | 4,579,750.00 | |

| | |

| | |

| Total BBLS Payoff Amount: | |

$ | 12,411,122.50 | |

Funds payable to 667:

| 667 Secured Note: | |

| |

| Principal | |

$ | 718,627.50 | |

| | |

| | |

| Unsecured 667 Note: | |

| | |

| Principal | |

$ | 420,250.00 | |

| | |

| | |

| Total 667 Payoff Amount: | |

$ | 1,138,877.50 | |

| | |

| | |

| Total Payoff Amount: | |

$ | 13,550,000.00 | |

The above amount shall

be paid in accordance with the wire transfer instructions separately provided by Baker to Aditxt (other than amounts that are net

funded as provided in this letter agreement):

SCHEDULE B

TO

PAYOFF LETTER

UCC-3s

v3.24.0.1

Cover

|

Feb. 26, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 26, 2024

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt,

Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

737

N. Fifth Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23219

|

| City Area Code |

650

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

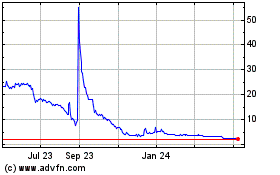

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

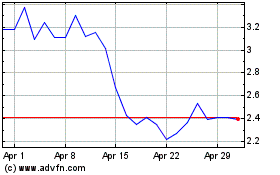

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Apr 2023 to Apr 2024