false

0001726711

0001726711

2024-03-06

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 6, 2024

Aditxt,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 737

N. Fifth Street, Suite 200 Richmond, VA |

|

23219 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (650) 870-1200

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value

$0.001 |

|

ADTX |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information relating to the Note (as defined below) included in Item 8.01 is incorporated by reference in this item to the extent required.

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

On

March 6, 2024, Aditxt, Inc. (the “Company”) received correspondence from 532 Realty Associates, LLC (the “Landlord”)

that the Company is in default under that certain Agreement of Lease dated November 3, 2021 by and between the Landlord and the Company

(the “Lease”) for failure to pay Basic Rent and Additional Rent (as each term is defined in the Lease) in the aggregate amount

of $40,707 (the “Past Due Rent”).

The

Company is working with the Landlord to come to an amicable resolution. However, no assurance can be given that the parties will reach

an amicable resolution on a timely basis, on favorable terms, or at all. In addition to the Past Due Rent, the Company remains obligated

for the full amount of Basic Rent and Additional Rent and other charges payable due during the remaining term of the Lease (less only

any net proceeds received by the Landlord if the premises is relet), which the Company estimates to be approximately $85,000. If the

Company is unable to resolve the alleged defaults under the Lease, it could have a material adverse effect on the Company’s liquidity,

financial condition and results of operations.

Item

8.01 Other Events

On

March 7, 2024, Sixth Borough Capital Fund, LP loaned $300,000 to Aditxt, Inc. The loans were evidenced by an unsecured promissory note

(the “Note”). Pursuant to the terms of the Note, it will accrue interest at the Prime rate of eight and one-half percent

(8.5%) per annum and is due on the earlier of March 31, 2024 or an event of default, as defined therein.

The

foregoing summary of the Note is qualified in its entirety by reference to the text of the Note, a copy of which is filed as an exhibit

hereto and incorporated by reference herein.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ADITXT, INC. |

| |

|

|

| Date: March 11, 2024 |

By: |

/s/ Amro Albanna |

| |

|

Amro Albanna |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

UNSECURED PROMISSORY NOTE

$300,000.00

March 7, 2024

FOR VALUE RECEIVED, the undersigned,

ADITXT, INC., a Delaware corporation (together with its successors and assigns, the “Borrower”), hereby promises to pay to the

order of Sixth Borough Capital Fund LP, a Delaware limited partnership (together with his successors and assigns, the “Lender”),

at the Lender’s offices at 737 N. Fifth Street, Suite 200, Richmond, Virginia (or such other place as the Lender may designate in writing

to the Borrower), the aggregate principal sum of Three Hundred Thousand Dollars ($300,000.00), with interest, upon the terms and subject

to the conditions of this unsecured promissory note (the “Note”) as set forth below. The Lender and Borrower collectively shall

be referred to as the “Parties.”

1. PAYMENT AND PREPAYMENT.

(a) REPAYMENT

OF PRINCIPAL. The Borrower shall repay the principal amount of this Note in one lump sum on the earlier of (i) March 31, 2024 (the “Maturity

Date”) or (ii) an Event of Default (as defined hereinafter).

(b) PAYMENT

OF INTEREST. The unpaid principal amount of this Note shall accrue interest (computed on the basis of a 365-day year) at the Prime rate,

as of the date of this agreement, of eight- and one-half percent (8.50%) per annum. Borrower shall repay the interest owed on the Maturity

Date.

(c) ADDITIONAL

INTEREST. If payment of any amount due under this Note shall be overdue, such overdue amount shall continue to bear interest from and

after the Maturity Date, to and including the date when paid in full.

(d) PREPAYMENT.

Any amounts due under this Note may be prepaid in full. If Borrower prepays the full principal amount owed, Borrower shall also pay interest

owed, calculated up to and including the date of prepayment.

(e) MANNER

OF PAYMENT AND PREPAYMENT. Payments and prepayments under this Note shall be applied first to interest accrued but unpaid and then to

principal. If the due date of any required payment under this Note is not a “business day” (for this purpose, any day other

than a Saturday, Sunday or legal holiday, such required payment shall be due and payable on the immediately succeeding business day.

2. EVENTS

OF DEFAULT. The occurrence and continuation of any one or more of the following events shall constitute an event of default under

this Note (“Event of Default”):

(a) PAYMENT

DEFAULT. The Borrower shall fail to make any required payment of principal of or interest on this Note.

(b)

BANKRUPTCY DEFAULT. The Borrower shall (i) commence any case, proceeding or other action relating to seeking to have an order for

relief entered with respect to it or its debts, or seeking reorganization, liquidation, dissolution, or other such relief with

respect to it or its debts, or seeking appointment of a receiver or other similar official (each of the foregoing, a

“Bankruptcy Action”); (ii) become the debtor named in any Bankruptcy Action which results in the entry of an order for

relief or any such adjudication or appointment described in the immediately preceding clause (i); or (iii) make a general assignment

for the benefit of its creditors.

In each and every Event of Default

under clause (a) or (b) of this Section 2, the Lender may, without limiting any other rights it may have at law or in equity, by written

notice to the Borrower, declare the unpaid principal of and interest on this Note due and payable, whereupon the same shall be immediately

due and payable, without presentment, demand, protest or other notice of any kind, all of which the Borrower hereby expressly waives,

and the Lender may proceed to enforce payment of such principal and interest or any part thereof in such manner as it may elect in its

discretion. In each and every Event of Default, the unpaid principal of and interest on this Note shall be immediately due and payable

without presentment, demand, protest or notice of any kind, all of which the Borrower hereby expressly waives, and the Lender may proceed

to enforce payment of such principal and interest or any part thereof in such manner as it may elect in its discretion.

3. NOTICES.

All notices, requests, demands or communications required or permitted under this Note shall be given in writing to the Parties at their

addresses as set forth at the beginning of this Note.

4. WAIVERS; RIGHTS AND REMEDIES.

(a) WAIVERS.

No delay on the part of the Lender in exercising any right, power or privilege under this Note shall operate as a waiver thereof, nor

shall any single or partial exercise of any right, power or privilege hereunder preclude the simultaneous or later exercise of any other

right, power or privilege hereunder. The Borrower hereby waives to the extent not prohibited by applicable law any requirement of diligence

or promptness on the part of the Lender to enforce its rights under this Note.

(b) RIGHTS

AND REMEDIES. The rights and remedies herein expressly provided are cumulative and not exclusive of any rights or remedies which the Lender

may otherwise have.

5. AMENDMENT.

No amendment or other modification of this Note may be made without the written consent of both Parties.

6. GOVERNING

LAW. This Note shall be governed by and construed in accordance with the laws of New York, and both Parties agree that any dispute

related to this Note shall be heard in the courts of New York, New York.

| BORROWER: |

| LENDER: |

| |

| |

| ADITXT, INC.

| | SIXTH BOROUGH CAPITAL FUND, LP |

| |

| |

| /s/ Amro Albanna |

| /s/ Robert D. Keyser, Jr. |

| By: |

Amro Albanna |

| By: |

Robert D. Keyser, Jr. |

| Title: |

Chief Executive Officer |

| Title: |

President |

-2-

v3.24.0.1

Cover

|

Mar. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt,

Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

737

N. Fifth Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23219

|

| City Area Code |

650

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

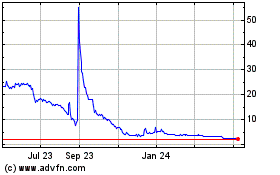

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

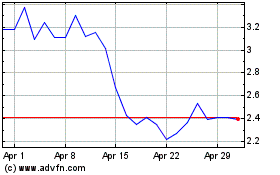

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Apr 2023 to Apr 2024