Form 8-K - Current report

16 February 2024 - 8:30AM

Edgar (US Regulatory)

false

0001726711

0001726711

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): February

9, 2024

Aditxt, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 737 N. Fifth Street, Suite 200 Richmond, VA |

|

23219 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (650) 870-1200

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

ADTX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement

As previously reported in a Current Report on Form

8-K filed by Aditxt, Inc. (the “Company”), in connection with that certain Agreement and Plan of Merger (the “Merger

Agreement”) dated December 11, 2023 among the Company, Adicure, Inc. and Evofem Biosciences, Inc. (“Evofem”), the Company,

Evofem and the holders (the “Holders”) of certain senior indebtedness of Evofem (the “Notes”) entered

into an Assignment Agreement dated December 11, 2023, pursuant to which the Holders assigned the Notes to the Company in consideration

for the issuance by the Company of (i) an aggregate principal amount of $5.0 million in secured notes of the Company due on January 2,

2024 (the “January 2024 Secured Notes”), (ii) an aggregate principal amount of $8.0 million in secured notes of the Company

due on September 30, 2024 (the “September 2024 Secured Notes”), (iii) an aggregate principal amount of $5.0 million in ten-year

unsecured notes, and (iv) payment of $154,480 in respect of net sales of Phexxi in respect of the calendar quarter ended September 30,

2023.

As previously reported in a Current Report on Form

8-K filed by the Company, on January 2, 2024, the Company and the Holders entered into amendments to the January 2024 Secured Notes (“Amendment

No. 1 to January 2024 Secured Notes”), pursuant to which the maturity date of the January 2024 Notes was extended to January 5,

2024. On January 5, 2024, the Company and the Holders entered into amendments to the January 2024 Secured Notes (“Amendment No.

2 to January 2024 Secured Notes”) and amendments to the September 2024 Secured Notes (“Amendment No. 1 to September 2024 Secured

Notes”), pursuant to which the Company and the Holders agreed that in consideration of a principal payment in the aggregate amount

of $1 million on the January 2024 Secured Notes and in increase in the aggregate principal balance of $250,000 on the September 2024 Secured

Notes, that the maturity date of the January 2024 Secured Notes would be further extended to January 31, 2024.

As previously reported in a Current Report on Form

8-K filed by the Company, on January 31, 2024, the Company and the Holders entered into amendments to the January 2024 Secured Notes (“Amendment

No. 3 to January 2024 Secured Notes”), pursuant to which the maturity date of the January 2024 Notes was extended to February 29,

2024. In addition, on January 31, 2024, the Company and the Holders entered into amendments to the September 2024 Secured Notes (“Amendment

No. 2 to September 2024 Secured Notes”), pursuant to which the Company and the Holders agreed that in consideration of a principal

payment in the aggregate amount of $1.25 million on the January 2024 Secured Notes (the “Additional Consideration”) and in

increase in the aggregate principal balance of $300,000 on the September 2024 Secured Notes.

Pursuant to Amendment No. 3 to the January 2024 Secured

Notes, the Company was required to make the Additional Consideration payment no later than February 9, 2024. As a result of the Company’s

failure to make the Additional Consideration payment by February 9, 2023, the January 2024 Secured Notes and the September 2024 Secured

Notes are in default and the entire principal balance of the January 2024 Secured Notes and the September 2024 Secured Notes, without

demand or notice, are now due and payable. Following and continuing during the defaults, the Holders may exercise any and all rights they

may have under their respective notes and related security agreements.

As a result of the defaults on the January 2024 Secured

Notes and the September 2024 Secured Notes, the Company is in default on the Business Loan and Security Agreement dated January 24, 2024

(the January Business Loan”), which has a current balance of approximately $5.2 million, and the Business Loan and Security Agreement

dated November 7, 2023 (the “November Business Loan”) which has a current balance of approximately $2.7 million. The lenders

under the January Business Loan and the November Business Loan may, without demand or notice, declare the full balances of their respective

loans due and payable, and may exercise any and all rights available to them under their respective loans.

The Company is working with its lenders to come to

an amicable resolution. However, no assurance can be given that the parties will reach an amicable resolution on a timely basis, on favorable

terms, or at all. If the Company is unable to resolve the alleged defaults under January 2024 Secured Notes, the September 2024 Secured

Notes, the January Business Loan and the November Business Loan, it could have a material adverse effect on the Company’s liquidity,

financial condition and results of operations.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ADITXT, INC. |

| |

|

|

| Date: February 15, 2024 |

By: |

/s/ Amro Albanna |

| |

|

Amro Albanna |

| |

|

Chief Executive Officer |

v3.24.0.1

Cover

|

Feb. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 09, 2024

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt, Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

737 N. Fifth Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23219

|

| City Area Code |

(650)

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

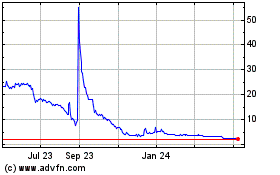

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

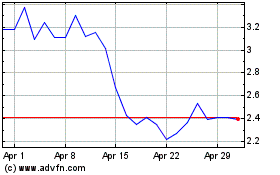

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Apr 2023 to Apr 2024