false

0001726711

0001726711

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 11, 2024

Aditxt, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 2569 Wyandotte Street, Suite 101, Mountain View, CA |

|

94043 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (650) 870-1200

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425 ) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.001 |

|

ADTX |

|

The

Nasdaq Stock

Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation

FD Disclosure

On December 12, 2024,

Aditxt, Inc. (the “Company”) issued a press release announcing that its subsidiary, Adimune, Inc. (“Adimune”)

has successfully completed preclinical efficacy and safety studies for its immune modulation therapeutic platform. A copy of the press

release is furnished to this Current Report on Form 8-K as Exhibit 99.1

The Company has prepared

presentation materials (the “Presentation”) regarding Adimune. The Presentation was posted to Adimune’s website

on December 11, 2024 and is furnished to this Current Report on Form 8-K as Exhibit 99.2

The information in this

Item 7.01 and Exhibit 99.1 and 99.2 of this Current Report on Form 8-K is furnished and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section. The information in this Item 7.01 and Exhibit 99.1 and 99.2 of this Current Report on Form

8-K shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether

made before or after the date of this Current Report, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 12, 2024

| |

Aditxt,

Inc. |

| |

|

|

| |

By: |

/s/

Amro Albanna |

| |

Name: |

Amro Albanna |

| |

Title: |

Chief

Executive Officer |

-2-

Exhibit 99.1

Aditxt’s Subsidiary Adimune Successfully

Completes Preclinical Efficacy and Safety Studies for

its Immune Modulation Therapeutic ADI Platform, Advancing Toward

First-in-Human Clinical Trials

Submission for Regulatory Approval to Initiate

Human Trials for Type 1 Diabetes, Psoriasis, and Stiff-Person Syndrome Targeted for H2 2025

MOUNTAIN VIEW, CA – (Dec. 12, 2024)

– Aditxt, Inc. (NASDAQ: ADTX) (“Aditxt” or the “Company”), a social innovation platform dedicated to

accelerating promising health innovations, today announced that its subsidiary, Adimune, Inc. (“Adimune”), has successfully

completed all preclinical efficacy and safety studies for its antigen-specific gene therapy, ADI-100. This achievement represents a major

milestone as Adimune prepares to submit a Clinical Trial Application (CTA)/Investigational New Drug (IND) application to initiate

first-in-human clinical trials for ADI-100 in the treatment of Type 1 Diabetes (T1D), Psoriasis, and in collaboration with Mayo Clinic,

Stiff-Person Syndrome (SPS).

Preclinical Data Highlight: Antigen specific

immune tolerization without impairment of the overall immune responsiveness: ADI-100 is an innovative immune modulation therapy designed

to restore immune tolerance in autoimmune diseases and induce tolerance for transplanted organs by leveraging the body’s natural

immune homeostasis mechanisms. Preclinical studies demonstrated the therapy’s potential to achieve antigen-specific tolerization

without impairing the immune system’s ability to fight infections or to suppress tumor growth.

In preclinical models, ADI-100 demonstrated efficacy

in reversing hyperglycemia in Type 1 Diabetes, restoring islet cell mass, and transferring protective immune modulation to animals that

were not treated with ADI-100. In separate preclinical experiments ADI-100 did not show any impairment of immune responses to infections

or tumor growth. In Non-Obese Diabetic (NOD) mice (prone to spontaneous type 1 diabetes) treated with anti-PD-1 checkpoint inhibitors,

which markedly hastened disease progression, ADI-100 prevented hyperglycemia in 70% of treated mice and provided durable protection lasting

over 300 days. In a study conducted using tumor bearing mice, ADI-100 did not impede the ability of the checkpoint inhibitor, anti-PD1,

to shrink the tumor.

Preclinical toxicology data confirmed the therapy’s

safety, with no detectable persistence of plasmids in tissues and organs, no formation of anti-plasmid antibodies, and no significant

adverse effects.

Advancing Toward IND Submission: Adimune

has successfully completed all preclinical efficacy and safety studies for ADI-100, with GMP drug substances manufactured and stability

studies underway. These steps position ADI-100 for first-in-human clinical trials, marking a significant milestone in transforming the

treatment landscape for autoimmune diseases.

Dr. Friedrich

Kapp, Co-CEO of Adimune commented, “The treatment of autoimmune diseases will see a fundamental change in the next few years,

a paradigm shift, which has been awaited since the processes were understood by which immune tolerance normally is being maintained. Restoring

immune tolerance will replace immunosuppressants in the treatment of autoimmune diseases, and insulin eventually will become a mere rescue

medication in type 1 diabetes. With the recent deal between Roche/Genentech and Cour on autoimmune treatments, the race is on and will

be won by the drug which best fulfils three main criteria: safety, effectiveness, and durability of response. Adimune’s ADI-100

is well positioned in this competitive endeavor. We are one of the front runners because we believe our drug candidate will meet all three

criteria in a perfect manner.”

The autoimmune disease market represents a significant

and growing unmet medical sector, with a total addressable market (TAM) of $84.12 billion. Autoimmune diseases affect approximately 8%

of the U.S. population, with prevalence increasing year over year. Recent industry developments underscore the demand for innovative therapies

in this space.

Adimune’s ADI-100 stands out in this competitive

landscape with its innovative mechanism of action, broad therapeutic potential, and very strong preclinical data.

Amro Albanna, Co-Founder, Chairman, and CEO of

Aditxt and Co-CEO of Adimune, added, “Adimune represents an opportunity for a fundamental shift in the way we treat autoimmunity

where reliance on immunosuppressants could be reduced or eliminated. With the successful completion of ADI-100’s preclinical efficacy

and safety study, Adimune is closer to bringing this therapy to human trials advancing its mission of addressing autoimmune diseases as

one of the most pressing health challenges we face.”

About ADI-100

ADI-100 is an innovative antigen-specific gene

therapy that consists of two DNA molecules designed to restore immune tolerance in autoimmune diseases or to induce tolerance to transplanted

organs. This approach should retrain the immune system to recognize antigens as “self” without relying on immunosuppression,

offering the possibility of significant safety and efficacy benefits.

The therapy consists of a pro-apoptotic DNA molecule

(BAX), which has been shown in preclinical models to induce localized apoptotic cell death combined with a methylated sGAD55 DNA molecule

that encodes a modified form of GAD to retrain the immune system to become tolerant to the antigen.

ADI-100 is designed to work through precision

immune reprogramming, downregulating pro-inflammatory cytokines while upregulating anti-inflammatory cytokines in an antigen-specific

manner. It tolerizes to GAD, which is a target of autoimmunity, directly or indirectly involved in Type 1 Diabetes, Psoriasis, and certain

CNS autoimmune disorders. In the mouse model for type 1 diabetes, ADI-100 demonstrated a reduction in the number of aggressive T cells

directed against insulin, which is another antigen in the pancreas that is a target of autoimmune attack. This bystander effect is an

important factor to counteract a phenomenon often observed where autoimmunity spreads to other regions of a protein or to other proteins

in a cell. Another potential benefit of downregulating anti-GAD antibodies by ADI-100 is restoration of GABA levels, further enhancing

the tolerization process.

To learn more and view the corporate presentation,

please visit adimune.com.

About Aditxt, Inc.

Aditxt, Inc.® is a social innovation platform

dedicated to accelerating promising health innovations. Aditxt’s ecosystem of research institutions, industry partners, and shareholders

collaboratively drives their mission to “Make Promising Innovations Possible Together.” The innovation platform is the cornerstone

of Aditxt’s strategy, where multiple disciplines drive disruptive growth and address significant societal challenges. Aditxt operates

a unique model that democratizes innovation, ensures every stakeholder’s voice is heard and valued, and empowers collective progress.

Aditxt currently operates two programs focused

on immune health and precision health. The Company plans to introduce two additional programs dedicated to public health and women’s

health. For these, Aditxt has entered into an Arrangement Agreement with Appili Therapeutics, Inc. (“Appili”) (TSX: APLI;

OTCPink: APLIF), which focuses on infectious diseases, and a Merger Agreement with Evofem Biosciences, Inc. (“Evofem”) (OTCQB:

EVFM). Each program will be designed to function autonomously while collectively advancing Aditxt’s mission of discovering, developing,

and deploying innovative health solutions to tackle some of the most urgent health challenges. The closing of each of the transactions

with Appili and Evofem is subject to several conditions, including but not limited to approval of the transactions by the respective target

shareholders and Aditxt raising sufficient capital to fund its obligations at closing. These obligations include cash payments of approximately

$17 million for Appili and $17 million for Evofem, which includes approximately $15.2 million required to satisfy Evofem’s senior

secured noteholder; should Aditxt fail to secure these funds, Evofem’s senior secured noteholder is expected to seek to prevent

the closing of the merger with Evofem. No assurance can be provided that all of the conditions to closing will be obtained or satisfied

or that either of the transactions will ultimately close.

For more information, www.aditxt.com.

Follow us on:

LinkedIn: https://www.linkedin.com/company/aditxt

Facebook: https://www.facebook.com/aditxtplatform/

Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of federal securities laws. Forward-looking statements include statements

regarding the Company’s intentions, beliefs, projections, outlook, analyses, or current expectations concerning, among other things,

the Company’s ongoing and planned product and business development; the Company’s ability to finance and execute its strategic

M&A initiatives; the Company’s ability to obtain the necessary funding and partner to commence clinical trials; the Company’s

intellectual property position; the Company’s ability to develop commercial functions; expectations regarding product launch and

revenue; the Company’s results of operations, cash needs, spending, financial condition, liquidity, prospects, growth, and strategies;

the Company’s ability to raise additional capital; expected usage of the Company’s ELOC and ATM facilities; the industry in

which the Company operates; and the trends that may affect the industry or the Company. Forward-looking statements are not guarantees

of future performance, and actual results may differ materially from those indicated by these forward-looking statements as a result of

various important factors, as well as market and other conditions and those risks more fully discussed in the section titled “Risk

Factors” in Aditxt’s most recent Annual Report on Form 10-K, as well as discussions of potential risks, uncertainties, and

other important factors in the Company’s other filings with the Securities and Exchange Commission. All such statements speak only

as of the date made, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as

a result of new information, future events or otherwise, except as required by law.

Aditxt, Inc.

Investors:

Jeff Ramson, PCG Advisory, Inc.

T: 646-863-6893

contactus@aditxt.com

Corporate Communications:

Mary O’Brien

Mobrien@aditxt.com

Exhibit 99.2

v3.24.3

Cover

|

Dec. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2024

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt, Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2569 Wyandotte Street

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

650

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

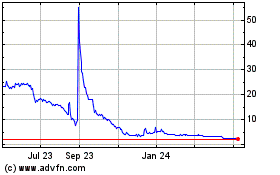

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Jan 2025 to Feb 2025

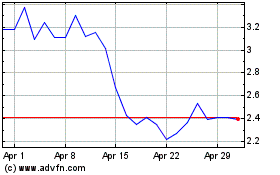

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Feb 2024 to Feb 2025