Current Report Filing (8-k)

31 December 2021 - 8:28AM

Edgar (US Regulatory)

0000874292false00008742922021-12-282021-12-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) December 28, 2021

ADDVANTAGE TECHNOLOGIES GROUP, INC.

(Exact name of Registrant as specified in its Charter)

Oklahoma

(State or other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

1-10799

|

73-1351610

|

|

(Commission file Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

1430 Bradley Lane, Suite 196, Carrollton, Texas

|

75007

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(918) 251-9121

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written Communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01

|

AEY

|

NASDAQ

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Loan Agreement with Vast Bank, N.A.

On December 28, 2021, the Company renewed its credit facility for its Nave and Triton subsidiaries with Vast Bank, N.A. ("Vast") by entering into a Business Loan Agreement and various ancillary debt and collateral agreements. The renewed Nave and Triton credit facility is for a maximum of $3,000,000 and is secured by the Company’s Nave and Triton Subsidiaries’ accounts receivable and inventory. As renewed, the Nave and Triton credit facility has been reduced by $1,000,000 and requires quarterly interest payments based on the Wall Street Journal Prime Rate floating rate plus 0.75%, and a fixed charge coverage ratio of 1.25x to be tested quarterly. The Company is required to pay a non-use fee equal to 25 basis points if the line of credit is not utilized. The Company may repay outstanding loans at any time without premium or penalty. The Nave and Triton credit facility matures on December 17, 2022.

On December 28, 2021, Vast also renewed a $4,500,000 accounts receivable purchase facility (“Existing Facility”), secured by the Company’s Fulton subsidiary’s accounts receivable excluding a major customer. This credit facility has been increased by $500,000 in connection with the renewal. In connection with the renewal, Vast originated a new accounts receivable purchase facility (“New Facility”) with a total capacity of $8,500,000 secured by receivables of a major customer that previously was collateralized under the Existing Facility. Under both facilities, Vast advances the Company 90% of sold receivables and establishes a reserve of 10% of the sold receivables until the Company collects the sold receivables. Under the Existing Facility, Vast charges a fee of 1.6% of sold receivables, and under the New Facility Vast charges a fee of 1.5% of sold receivables. Both facilities have a fixed charge coverage ratio of 1.25x to be tested quarterly. Both the Existing Facility and the New Facility mature on December 17, 2022.

As of September, 30, 2021, the Company was not in compliance with the fixed charge coverage ratio. On December 22, 2021, Vast granted a waiver of the covenant violation under the credit facility.

The proceeds of loans made under the Nave and Triton credit facility and the Fulton credit facilities will be used for working capital needs.

Item 2.03 Creation of a Direct Financial Obligation or An Obligation Under an Off-Balance Sheet Arrangement.

The information included or incorporated by reference in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this item 2.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished herewith:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

ADDvantage Technologies Group, Inc.

|

|

|

|

|

|

|

|

Date: December 30, 2021

|

|

|

|

|

|

|

|

/s/ Michael A. Rutledge

|

|

|

|

Michael A. Rutledge

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

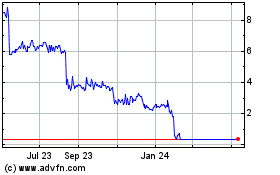

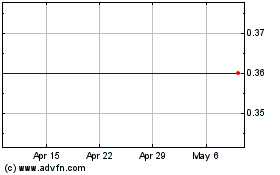

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Apr 2023 to Apr 2024