As filed with the Securities and Exchange Commission

on December 13, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ADAPTHEALTH CORP.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

82-3677704 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

220

West Germantown Pike, Suite 250

Plymouth Meeting, Pennsylvania |

19462 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

AdaptHealth LLC

Non-qualified Deferred Compensation Plan

(Full title of the plan)

Jonathan B. Bush

General Counsel

AdaptHealth Corp.

220 West Germantown Pike, Suite 250

Plymouth Meeting, Pennsylvania 19462

(Name and address of agent for service)

(610) 630-6357

(Telephone number, including area code, of agent

for service)

Copies to:

Michael Brandt

Danielle Scalzo

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019

(212) 728-8000

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

x |

Accelerated

filer |

¨ |

|

| |

Non-accelerated

filer |

¨ |

Smaller

reporting company |

¨ |

|

| |

|

|

Emerging

growth company |

¨ |

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. |

¨ |

EXPLANATORY NOTE

This Registration Statement on Form S-8 is

filed by AdaptHealth Corp. (the “Company” or “Registrant”) to register $100,000,000 of general unsecured

obligations of AdaptHealth LLC, a subsidiary of the Company (the “Sponsor”), to pay deferred compensation in the future

in accordance with the terms of the AdaptHealth LLC Non-qualified Deferred Compensation Plan, effective January 1, 2024 (the “Plan”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified

in Part I of this Registration Statement have been or will be sent or given to participating employees as specified by Rule 428(b)(1) of

the Securities Act of 1933, as amended (the “Securities Act”), in accordance with the rules and regulations of the

United States Securities and Exchange Commission (the “Commission”). Such documents are not being filed with the Commission

either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities

Act. These documents and the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II of

this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities

Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, previously filed with

the Commission by the Company, are incorporated by reference into this Registration Statement:

| (e) | the Company’s Current Reports on Form 8-K, filed on March 14, 2023, May 9, 2023, June 22, 2023, June 27, 2023, July 27, 2023, August 29, 2023, September 20, 2023, October 31, 2023 and November 22, 2023 (in each case,

other than any portions thereof which are “furnished” and not “filed” in accordance with the rules of the

Commission). |

In addition, all documents filed by the Company

with the Commission pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act, subsequent to the date of this Registration

Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all of the securities

offered hereby have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference

into this Registration Statement and to be a part hereof from the date of the filing of such documents with the Commission; provided,

however, that documents or portions thereof which are “furnished” and not “filed” in accordance with the rules of

the Commission shall not be deemed incorporated by reference into this Registration Statement unless the Registrant expressly provides

to the contrary that such document is incorporated by reference into this Registration Statement.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein (or in any other subsequently filed document which also is or is deemed to be incorporated

by reference herein) modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed to constitute

a part of this Registration Statement except as so modified or superseded.

Item 4. Description of Securities.

This Registration Statement registers deferred

compensation obligations of the Sponsor under the Plan. These securities represent contractual obligations to pay deferred compensation

in the future to participants in accordance with the terms of the Plan. The Plan constitutes an unfunded, non-qualified deferred compensation

plan that is intended to comply with Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”).

Participation in the Plan is limited to a select group of management and highly compensated employees of the Company and its subsidiaries

who satisfy certain eligibility requirements.

Deferral and distribution elections will be made

in accordance with the terms of the Plan and Section 409A. Participant contributions will be fully vested at all times. At its sole

discretion, the Sponsor may credit participant accounts with contributions from the Sponsor. The amount credited to each participant account

will be treated as if invested in the investment options made available under the Plan and be adjusted for hypothetical investment earnings,

expenses, gains or losses in an amount equal to the earnings, expenses, gains or losses attributable to such investment options.

Obligations of the Sponsor under the Plan represent

at all times an unfunded and unsecured promise to pay money in the future. Each participant in the Plan is an unsecured general creditor

of the Sponsor with respect to deferred compensation obligations. Any amounts set aside to defray the liabilities assumed by the Sponsor

will remain the general, unpledged unrestricted assets of the Sponsor. Neither a participant nor a participant's beneficiary will have

the right to alienate, anticipate, commute, pledge, encumber, or assign any of the payments which he or she may expect to receive, contingently

or otherwise, under the Plan, except the right to designate a beneficiary to receive death benefits provided thereunder.

The Sponsor reserves the right to amend the Plan

at any time, except that no amendment may deprive any current or former participant of all or any portion of their account which had accrued

and vested prior to the amendment. The Sponsor also retains the discretion to terminate the Plan in accordance with the terms of the Plan

and Section 409A.

The foregoing summary is qualified in its entirety

by reference to the Plan, which is filed as an exhibit to this Registration Statement, and the Plan is incorporated herein by reference

in its entirety in response to this Item 4.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

The following summary is qualified in its entirety

by reference to the complete Delaware General Corporation Law (“DGCL”), the Company’s Third Amended and Restated Certificate

of Incorporation, as amended (the “Charter”), and the Company’s Amended and Restated Bylaws, as amended (the “Bylaws”).

Section 145 of the DGCL provides that a Delaware

corporation may indemnify directors, officers, employees and agents against expenses (including attorneys’ fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred by such person in connection with any threatened, pending or completed

action, suit or proceeding in which such person is made a party by reason of such person being or having been a director, officer, employee

or agent to the corporation, provided that such person acted in good faith and in a manner he or she reasonably believed to be in or not

opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe

that his or her conduct was unlawful. The DGCL provides that Section 145 is not exclusive of other rights to which those seeking

indemnification may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise.

The Company’s Charter provides that its directors

and officers will be indemnified by the Company to the fullest extent authorized by the DGCL as it now exists or may in the future be

amended. In addition, the Charter provides that the Company’s directors will not be personally liable for monetary damages to the

Company for breaches of their fiduciary duty as directors, unless they violated their duty of loyalty to the Company or its stockholders,

acted in bad faith, knowingly or intentionally violated the law, authorized unlawful payments of dividends, unlawful stock purchases or

unlawful redemptions, or derived an improper personal benefit from their actions as directors.

The Company has entered into agreements with its

directors and officers to provide contractual indemnification in addition to the indemnification provided in the Charter. The Company

believes that these provisions and agreements are necessary to attract qualified directors and officers. The Company’s Bylaws also

permit the Company to secure insurance on behalf of any officer, director or employee for any liability arising out of his or her actions,

regardless of whether the DGCL would permit indemnification. The Company has purchased a policy of directors’ and officers’

liability insurance that insures the Company’s directors and officers against the cost of defense, settlement or payment of a judgment

in some circumstances and insures the Company against its obligations to indemnify the directors and officers.

These provisions may discourage stockholders from

bringing a lawsuit against the Company’s directors for breach of their fiduciary duty. These provisions also may have the effect

of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise

benefit the Company and its stockholders. Furthermore, a stockholder’s investment may be adversely affected to the extent the Company

pays the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions. The Company

believes that these provisions, the insurance and the indemnity agreements are necessary to attract and retain talented and experienced

directors and officers.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to the Company’s directors, officers and controlling persons pursuant to the foregoing

provisions, or otherwise, the Company has been informed that in the opinion of the Commission, such indemnification is against public

policy as expressed in the Securities Act and is, therefore, unenforceable.

Item 7. Exemption from Registration

Claimed.

Not applicable.

Item 8. Exhibits.

The following is

a list of all exhibits filed as part of this Registration Statement on Form S-8, including those incorporated herein by reference.

* Filed herewith.

Item 9. Undertakings.

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective Registration Statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement

or any material change to such information in the Registration Statement; |

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do

not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports

filed with or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Exchange Act that

are incorporated by reference in the Registration Statement.

| (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that

is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a

director, officer, or controlling person of the Registrant in the successful defense of any action, suit, or proceeding) is asserted by

such director, officer, or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Plymouth Meeting, State of Pennsylvania, on the 13th day of December 2023.

| |

AdaptHealth

Corp. |

| |

|

| |

By: |

/s/ Richard

Barasch |

| |

|

Richard

Barasch |

| |

|

Interim

Chief Executive Officer and Chairman of the Board |

SIGNATURES AND POWER OF ATTORNEY

We, the undersigned officers and directors of AdaptHealth

Corp., hereby severally constitute and appoint Richard Barasch, Jason Clemens and Jonathan B. Bush, or any of them individually, our true

and lawful attorneys-in-fact with full power of substitution, to sign for us and in our names in the capacities indicated below this Registration

Statement and any and all pre-effective and post-effective amendments to this Registration Statement and generally to do all such things

in our name and behalf in our capacities as officers and directors to enable this Registrant to comply with the provisions of the Securities

Act, and all requirements of the Commission, hereby ratifying and confirming our signatures as they may be signed by our said attorneys-in-fact

to said Registration Statement and any and all amendments thereto.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

|

| By: |

/s/ Richard

Barasch |

|

Interim

Chief Executive Officer and |

|

December

13, 2023 |

| |

Richard

Barasch |

|

Chairman

of the Board |

|

|

| |

|

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

|

| By: |

/s/ Jason

Clemens |

|

Chief

Financial Officer |

|

December

13, 2023 |

| |

Jason

Clemens |

|

(Principal

Financial Officer) |

|

|

| |

|

|

|

|

|

| By: |

/s/ Christine

Archbold |

|

Chief

Accounting Officer |

|

December

13, 2023 |

| |

Christine

Archbold |

|

(Principal

Accounting Officer) |

|

|

| |

|

|

|

|

|

| By: |

/s/ Joshua

Parnes |

|

President

and Director |

|

December

13, 2023 |

| |

Joshua

Parnes |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Greg

Belinfanti |

|

Director |

|

December

13, 2023 |

| |

Greg

Belinfanti |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Terence

Connors |

|

Director |

|

December

13, 2023 |

| |

Terence

Connors |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Bradley

Coppens |

|

Director |

|

December

13, 2023 |

| |

Bradley

Coppens |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Theodore

B. Lundberg |

|

Director |

|

December

13, 2023 |

| |

Theodore

B. Lundberg |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Dr. Susan

Weaver |

|

Director |

|

December

13, 2023 |

| |

Dr. Susan

Weaver |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ David

S. Williams III |

|

Director |

|

December

13, 2023 |

| |

David

S. Williams III |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Dale

Wolf |

|

Director |

|

December

13, 2023 |

| |

Dale

Wolf |

|

|

|

|

Exhibit 5.1

WILLKIE FARR & GALLAGHER LLP

787 Seventh Avenue

New York, NY 10019-6099

December 13, 2023

AdaptHealth Corp.

220 West Germantown Pike, Suite 250

Plymouth Meeting, Pennsylvania 19462

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to AdaptHealth Corp.,

a Delaware corporation (the “Company”), with respect to the Company’s Registration Statement on Form S-8 (the “Registration

Statement”) to be filed by the Company with the Securities and Exchange Commission on or about the date hereof. The Registration

Statement relates to the registration under the Securities Act of 1933, as amended (the “Act”), by the Company of general

unsecured obligations of AdaptHealth LLC, a subsidiary of the Company (the “Sponsor”), to pay up to $100,000,000 of deferred

compensation (the “Obligations”) from time to time in the future in accordance with the terms of the AdaptHealth LLC

Non-qualified Deferred Compensation Plan, effective as of January 1, 2024 (the “Plan”).

We have examined, among other things, originals

and/or copies (certified or otherwise identified to our satisfaction) of such documents, papers, statutes, and authorities as we have

deemed necessary to form a basis for the opinion hereinafter expressed. In our examination, we have assumed the genuineness of all signatures

and the conformity to original documents of all copies submitted to us. As to various questions of fact material to our opinion, we have

relied on statements and certificates of officers and representatives of the Company.

Based on the foregoing, we are of the opinion that,

when issued in accordance with the provisions of the Plan, the Obligations will be valid and binding obligations of the Sponsor, enforceable

against the Sponsor in accordance with the terms of the Plan, except as enforcement thereof may be limited by bankruptcy, insolvency or

other laws of general applicability relating to or affecting enforcement of creditors’ rights or by general equity principles.

This opinion is limited to the General Corporation

Law of the State of Delaware, and we express no opinion with respect to the laws of any other jurisdiction or any other laws of the State

of Delaware.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit

that we are in the category of persons whose consent is required under Section 7 of the Act.

| |

Very truly yours, |

| |

|

| |

/s/

Willkie Farr & Gallagher LLP |

| |

Willkie Farr & Gallagher LLP |

Exhibit 23.2

| |

KPMG

LLP

1601 Market Street

Philadelphia, PA 19103-2499 |

Consent of Independent Registered Public Accounting

Firm

We consent to the use of our reports dated February 28, 2023, with

respect to the consolidated financial statements of AdaptHealth Corp., and the effectiveness of internal control over financial reporting,

incorporated herein by reference.

Philadelphia, Pennsylvania

December 13, 2023

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

ADAPTHEALTH CORP.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities.

| Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount

Registered(1) | | |

Proposed Maximum Offering Price Per Unit(2) | | |

Maximum Aggregate Offering Price(2) | | |

Fee Rate | | |

Amount of Registration Fee | |

| Debt | |

Deferred Compensation Obligations | |

Other | |

$ | 100,000,000 | | |

| 100 | % | |

$ | 100,000,000 | | |

| 0.00014760 | | |

$ | 14,760 | |

| Total Offering Amounts | | |

| | | |

$ | 100,000,000 | | |

| | | |

$ | 14,760 | |

| Total Fee Offsets | |

| | | |

| | | |

| | | |

$ | 0.00 | |

| Net Fees Due | | |

| | | |

| | | |

| | | |

$ | 14,760 | |

| (1) | This Registration Statement registers general unsecured obligations

to pay up to $100,000,000 of deferred compensation from time to time in the future in accordance with the terms of the AdaptHealth LLC

Non-qualified Deferred Compensation Plan (the “Plan”). |

| (2) | Estimated solely for purposes of calculating the amount of the

registration fee pursuant to Rule 457(h) of the Securities Act of 1933, as amended. |

Table 2: Fee Offset Claims and Sources

Not applicable.

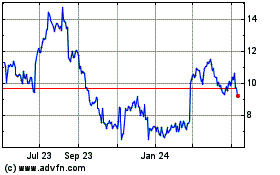

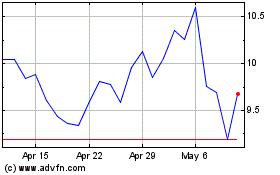

AdaptHealth (NASDAQ:AHCO)

Historical Stock Chart

From Apr 2024 to May 2024

AdaptHealth (NASDAQ:AHCO)

Historical Stock Chart

From May 2023 to May 2024