false000183246600018324662023-12-272023-12-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 27, 2023 |

Alignment Healthcare, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40295 |

46-5596242 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1100 W Town and Country Rd. |

|

Orange, California |

|

92868 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 844 310-2247 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

ALHC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 27, 2023, Alignment Healthcare USA, LLC ("AHCUSA"), an affiliate of Alignment Healthcare, Inc. (the "Company"), and Joseph Konowiecki, the Company's Chairman of the Board, entered into an amendment (the "Amendment") to that certain Employment Agreement between AHCUSA and Mr. Konowiecki dated October 31, 2022 (the "Employment Agreement"). Pursuant to the Amendment, Mr. Konowiecki will no longer serve in an executive role leading strategic network and business development (the "Executive Role"), effective as of December 31, 2023 (the “Effective Date”). Mr. Konowiecki will continue to serve as Chairman of the Board.

Pursuant to the Amendment, (i) no cash severance will be paid to Mr. Konowiecki; (ii) unvested equity awards granted to Mr. Konowiecki under the Employment Agreement will not be forfeited upon termination of the Executive Role and will continue to vest so long as he remains a service provider to the Company, including as Chairman of the Board; (iii) in consideration of the foregoing, Mr. Konowiecki will not receive the 2023 annual equity award received by other members of the Board of Directors; and (iv) notwithstanding the termination of the Executive Role, Mr. Konowiecki will receive the cash bonus payable under the Company's annual incentive program for fiscal year 2023, subject to the holdback and any positive or negative adjustments based on the Centers for Medicare & Medicaid Services Star ratings received by the Company's health plans for the 2025 rating year, as previously approved by the Board of Directors of the Company.

As of January 1, 2024, Mr. Konowiecki will be compensated for his service on the Board of Directors and as Chairman of the Board pursuant to the Company's then-current Non-Employee Director Compensation Policy.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is filed herewith as Exhibit 10.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

Alignment Healthcare, Inc. |

|

|

|

|

Date: |

December 29, 2023 |

By: |

/s/ Christopher Joyce |

|

|

|

Christopher Joyce

Chief Legal & Administrative Officer |

Exhibit 10.1

AMENDMENT TO EMPLOYMENT AGREEMENT

This AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”) is entered into by and between Alignment Healthcare USA, LLC (the “Employer”) and Joseph Konowiecki (the “Employee”) as of this 27th day of December 2023.

WHEREAS, Employer and Employee are parties to that certain Employment Agreement dated as of October 31, 2022 (the “Original Agreement”), pursuant to which Employee has served in an executive role leading strategic network and business development; and

WHEREAS, the parties desire terminate Employee’s employment status and in connection therewith to amend certain terms and conditions of the Original Agreement in accordance with the provisions set forth herein, effective as of December 31, 2023 (the “Effective Date”):

1.Termination of Employment Status. Employee’s employment as an executive officer of Employer is hereby terminated by mutual agreement under Section 5(c) of the Original Agreement, effective as of the Effective Date. As of the Effective Date, the Original Agreement is hereby terminated, except for any covenants or other obligations of Employer or Employee that survive by their terms (including, without limitation, the provisions set forth in Sections 2 and 3 of this Amendment). For the avoidance of doubt, nothing herein shall be construed to affect Employee’s status as Chairman of the Board or as a member of the Board of Directors (the “Board”) of Alignment Healthcare, Inc. (the “Parent”).

2.Equity Awards. Notwithstanding anything to the contrary set forth in the Original Agreement or in the applicable equity award agreements between Parent and Employee (“Award Agreements”), (a) vesting of the Equity Awards granted pursuant to the Original Agreement shall not terminate as of the Effective Date and such Equity Awards shall continue to vest on the original schedule set forth in the applicable Award Agreements so long as Employee remains a service provider to Employer, including, without limitation, as a member of the Board; and (b) Employee shall not be entitled to receive the equity award issued under Parent’s Non-Employee Director Compensation Policy (the “Policy”) to other directors for service during the 2023 calendar year. For the avoidance of doubt, this Section 2 shall have no effect on any equity grant issued prior to the date of the Original Agreement.

3.Cash Bonus. Notwithstanding the termination of employment set forth in Section 1 above, Employer shall pay Employee the amount of the cash bonus, if any, under its annual incentive program (“AIP”) which would have been payable to Employee for employment during calendar year 2023, determined after the end of calendar year 2023 and equal to the amount which would have been payable to Employee if Employee’s employment had not been terminated pursuant to this Amendment (the “2023 Bonus”). For the avoidance of doubt, Employee agrees and acknowledges that payment of the 2023 Bonus will be subject to the holdback and positive or negative adjustments based on the Centers for Medicare & Medicaid Services Star ratings received by Employer’s health plans for the 2025 rating year, as previously approved by the Board. Employee’s 2023 Bonus shall be paid to Employee at the same time at which other senior executives of the Employer receive their 2023 AIP bonuses, with the initial payout made in or about March 2024 and any earned portion of the held-back amount and any positive adjustment paid in or about October 2024.

4.Employee Acknowledgement; Director Compensation. Employee acknowledges and agrees that as of the Effective Date, except for the matters set forth in Sections 2 and 3 above, Employer will have paid Employee all wages earned, and no additional compensation or benefit is due to Employee as of the Effective Date with respect to Employee’s service as an executive officer of Employer or Parent or for his service during calendar year 2023 as a member of the Board. As of January 1, 2024, Employee shall be compensated for his service on the Board and as Chairman of the Board pursuant to the then-current Policy, in a manner consistent with prior periods.

5.Defined Terms. Terms used herein and not otherwise defined shall have the meanings set forth in the Original Agreement.

6.No Other Changes. Except as expressly provided herein, all other terms and conditions of the Original Agreement shall remain unchanged. Except as modified by this Amendment, the surviving provisions of the Original Agreement, including without limitation, Sections 13 (Arbitration), 23 (Choice of Law), 25 (Counterparts) and 26 (Notices), shall apply to this Amendment.

7.Entire Agreement. This Amendment, together with the Original Agreement, constitutes the entire agreement between the parties relating to the subject matter hereof and supersedes all prior discussions, negotiations, and agreements, whether oral or written.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first written above.

|

|

|

ALIGNMENT HEALTHCARE USA, LLC |

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Christopher J. Joyce |

Name: |

|

Christopher J. Joyce |

Title: |

|

Chief Legal & Administrative Officer |

|

|

|

|

|

|

|

|

|

/s/ Joseph Konowiecki |

Joseph Konowiecki, individually |

[Signature Page – Amendment to Employment Agreement]

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

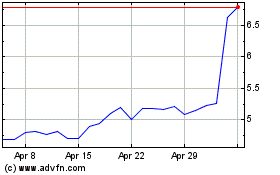

Alignment Healthcare (NASDAQ:ALHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alignment Healthcare (NASDAQ:ALHC)

Historical Stock Chart

From Apr 2023 to Apr 2024