UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

AMERISAFE, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

FROM OUR

Chairman of the Board |

|

|

|

|

April 29, 2022

Dear AMERISAFE Shareholder:

You are cordially invited to attend the annual meeting of shareholders of AMERISAFE, Inc. The meeting will be held on Friday, June 10, 2022, beginning at 9:00 a.m. CST at our corporate headquarters, which are located at 2301 Highway 190 West in DeRidder, Louisiana 70634.

Information about the meeting, including the nominees for election as directors and the other proposals to be considered is presented in the following notice of annual meeting and proxy statement. At the meeting, management will report on the Company’s operations during 2021 and comment on our outlook for the remainder of 2022. The report will be followed by a question and answer period.

We hope that you will attend the annual meeting. It is important that your shares be represented. Accordingly, please vote using the internet or telephone procedures described on the proxy card or sign, date and promptly mail the enclosed proxy card in the enclosed pre-addressed, postage-paid envelope.

We look forward to seeing you at the meeting on June 10th.

|

|

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

|

|

Jared A. Morris

Chairman |

|

|

|

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on June 10, 2022

The 2022 annual meeting of shareholders of AMERISAFE, Inc. (the “Company”) will be held on June 10, 2022, beginning at 9:00 a.m. CST at the Company’s corporate headquarters, which are located at 2301 Highway 190 West in DeRidder, Louisiana 70634. The meeting will be held for the following purposes:

|

|

1. |

to elect three directors to serve until the 2025 annual meeting of shareholders; |

|

|

2. |

to approve the Company’s 2022 Equity and Incentive Compensation Plan; |

|

|

3. |

to conduct an advisory vote on the Company’s executive compensation; |

|

|

4. |

to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2022; and |

|

|

5. |

to transact such other business as may properly come before the meeting. |

Information concerning the matters to be voted upon at the meeting is set forth in the accompanying proxy statement. Also enclosed is the Company’s annual report for the year ended December 31, 2021. Holders of record of the Company’s common stock as of the close of business on April 18, 2022 are entitled to notice of, and to vote at, the meeting.

If you plan to attend the meeting and will need special assistance or accommodation, please describe your needs on the enclosed proxy card.

|

|

By Order of the Board of Directors, |

|

|

|

|

|

Kathryn H. Shirley |

|

|

Executive Vice President,

Chief Administrative Officer

and Secretary |

|

IMPORTANT

Whether or not you plan to attend the meeting in person, please vote using the internet or telephone procedures described on the proxy card or by signing, dating, and promptly returning the enclosed proxy card in the pre-addressed, postage-paid envelope. |

DeRidder, Louisiana

April 29, 2022

TABLE OF CONTENTS

AMERISAFE, Inc.

2301 Highway 190 West

DeRidder, Louisiana 70634

PROXY STATEMENT

This proxy statement provides information in connection with the solicitation of proxies by the Board of Directors (the “Board”) of AMERISAFE, Inc. (the “Company”) for use at the Company’s 2022 annual meeting of shareholders or any postponement or adjournment thereof (the “Annual Meeting”). This proxy statement also provides information you will need in order to consider and act upon the matters specified in the accompanying notice of annual meeting. This proxy statement and the enclosed proxy card are being mailed to shareholders on or about May 3, 2022.

Record holders of the Company’s common stock as of the close of business on April 18, 2022 are entitled to vote at the Annual Meeting. Each record holder of common stock on that date is entitled to one vote at the Annual Meeting for each share of common stock held. As of April 18, 2022, there were 19,320,422 shares of common stock outstanding.

You cannot vote your shares unless you are present at the Annual Meeting or you have properly executed your proxy. You can vote by proxy in one of three convenient ways:

|

|

• |

by internet: visit the website shown on your proxy card and follow the instructions; |

|

|

• |

by telephone: dial the toll-free number shown on your proxy card and follow the instructions; or |

|

|

• |

in writing: sign, date, and return the enclosed proxy card in the enclosed pre-addressed, postage paid envelope. |

You may revoke your proxy at any time prior to the vote at the Annual Meeting by:

|

|

• |

delivering a written notice revoking your proxy to the Company’s Secretary at the address above; |

|

|

• |

delivering a new proxy bearing a date after the date of the proxy being revoked; or |

|

|

• |

voting in person at the Annual Meeting. |

Unless revoked as described above, all properly executed proxies will be voted at the Annual Meeting in accordance with your directions on the proxy. If a properly executed proxy gives no specific instructions, the shares of common stock represented by your proxy will be voted:

|

|

• |

FOR the election of three directors to serve until the 2025 annual meeting of shareholders; |

|

|

• |

FOR the approval of the 2022 Equity and Incentive Compensation Plan; |

|

|

• |

FOR the approval of the compensation of our executive officers, as disclosed in this proxy statement; |

|

|

• |

FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2022; and |

|

|

• |

at the discretion of the proxy holders with regard to any other matter that is properly presented at the Annual Meeting. |

If you own shares of common stock held in “street name” and you do not instruct your broker how to vote your shares using the instructions your broker provides you, your shares will be voted in the ratification of the appointment of Ernst & Young as the Company’s independent registered public accounting firm for 2022, but not for any other proposal. To be sure your shares are voted in the manner you desire, you should instruct your broker how to vote your shares.

Holders of a majority of the outstanding shares of the Company’s common stock must be present, either in person or by proxy, to constitute a quorum necessary to conduct the Annual Meeting.

- 1 -

Abstentions and broker non-votes are counted for purposes of determining a quorum and are considered present and entitled to vote.

The following table sets forth the voting requirements, whether broker discretionary voting is allowed and the treatment of abstentions and broker non-votes for each of the matters to be voted on at the Annual Meeting.

|

Proposal

|

|

Vote Necessary to

Approve Proposal

|

|

Broker Discretionary

Voting Allowed?

|

|

Treatment of Abstentions

and Broker Non-Votes

|

|

No. 1 – |

Election of directors |

|

Plurality (that is, the largest number) of the votes cast; provided that any director that does not receive a majority of the votes cast is required to submit his or her resignation |

|

No |

|

Abstentions and broker non-votes are not considered votes cast and will have no effect |

|

|

|

|

|

|

|

|

|

|

No. 2 |

Approval of 2022 Equity and Incentive Compensation

Plan |

|

Affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the matter |

|

No |

|

Abstentions will have the effect of a vote cast against the matter and broker non-votes are not considered votes cast and will have no effect |

|

|

|

|

|

|

|

|

|

|

No. 3 – |

Advisory vote on executive compensation |

|

Affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the matter |

|

No |

|

Abstentions will have the effect of a vote cast against the matter and broker non-votes are not considered votes cast and will have no effect |

|

|

|

|

|

|

|

|

|

|

No. 4 – |

Ratification of the appointment of Ernst &Young |

|

Affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the matter |

|

Yes |

|

Abstentions will have the effect of a vote cast against the matter |

The Company pays the costs of soliciting proxies. We have engaged Georgeson, Inc. to serve as our proxy solicitor for the Annual Meeting at a base fee of $10,000 plus reimbursement of reasonable expenses. Georgeson will conduct our broker search, solicit banks, brokers, institutional investors and hedge funds to determine voting instructions, monitor voting and deliver executed proxies to our voting tabulator. Our employees also may solicit proxies by telephone or in person. However, they will not receive additional compensation for soliciting proxies. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of these proxy materials to the beneficial holders and to request instructions for the execution of proxies. The Company may reimburse these persons for their related expenses. Proxies are solicited to provide all record holders of the Company’s common stock an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting in person.

- 2 -

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, three directors will be elected to serve three-year terms expiring at our annual shareholder meeting in 2025. This section of the proxy statement contains information relating to the director nominees and the directors whose terms of office continue after the Annual Meeting. The director nominees were selected by the Nominating and Corporate Governance Committee and approved by the Board for submission to the shareholders. The nominees for election are Teri G. Fontenot, Billy B. Greer, and Jared A. Morris, each of whom currently serve as directors.

The Board recommends a vote “FOR” the election of each of the nominees.

Nominees to be elected for terms expiring at the Annual Meeting in 2025

|

TERI G. FONTENOT |

|

|

|

Age 68, has served as a director of the Company since January 2016 |

|

|

|

|

|

|

|

Ms. Fontenot served as President and Chief Executive Officer of Woman’s Hospital from 1996 until her retirement in March 2019. Upon her retirement, Ms. Fontenot was named Chief Executive Officer Emeritus. From 2011 to 2013, Ms. Fontenot served on the American Hospital Association Board and was the chair in 2012. Ms. Fontenot has served as a director for LHC Group, Inc., a national provider of in-home health care services, since March 2019 and AMN Healthcare, a healthcare staffing provider, since September 2019. |

|

|

|

|

|

|

|

|

Ms. Fontenot brings to the Board substantial experience as a former chief executive officer and chief financial officer of healthcare institutions and as chair of an insurance provider for over ten years. Her experience in the healthcare and insurance industries provide her with valuable insight into the issues affecting the Company and our policyholders. She is also an inactive certified public accountant. This experience enables her to serve on the Audit Committee as an “audit committee financial expert.” |

|

BILLY B. GREER |

|

|

|

Age 57, has served as a director of the Company since March 2022 |

|

|

|

|

|

|

|

Mr. Greer is Managing Director for PGIM Private Capital, a division of Prudential Financial, a position he has held since 2012. From 2004 until 2011 Mr. Greer served as Senior Vice President of PGIM and Vice President from 1999 until 2004. He is also an inactive certified public accountant.

Mr. Greer possesses deep expertise in the areas of investment management, business development and asset administration. In particular, this experience will enhance the Board’s capabilities with respect to oversight of our investment portfolio. |

|

|

|

3 |

|

JARED A. MORRIS |

|

|

|

Age 47, has served as a director of the Company since 2005 |

|

|

|

|

|

|

|

Mr. Morris has served as our lead director from November 2012 until he was appointed Chairman of the Board in April 2016. Since 2002, he has been an officer and a principal owner of Marine One Acceptance Corporation and Dumont Land, LLC, both of which are specialty finance companies. Since 2002, he has also served as an officer of Dumont Management Group, LLC, a privately held company that provides management services to various affiliated finance and investment companies. His experience enables him to serve on the Audit Committee as an “audit committee financial expert.” He serves on the board of directors of First National Bank of DeRidder and the Audit Committee of Beauregard Health System. Jared A. Morris is the son of Millard E. Morris. |

|

|

|

|

|

|

|

|

Jared A. Morris is currently our Chairman of the Board and the former chair of the Nominating and Corporate Governance Committee. In these capacities, he has taken a lead role in developing and maintaining the Company’s corporate governance policies and practices. His experience and training in financial and credit management, as well as business investment, enhances the Board’s business sophistication. |

|

|

4 |

Current directors whose terms expire at the Annual Meeting in 2023

|

MICHAEL J. BROWN |

|

|

|

Age 58, has served as a director of the Company since November 2014 |

|

|

|

|

|

|

|

Mr. Brown serves as Chair of the Compensation Committee. Mr. Brown Mr. Brown was President of Regional Banking for First Horizon from July 2020, when First Horizon completed its merger with IberiaBank Corp., until his retirement on December 31, 2021. From September 2009 until July 2020, Mr. Brown was the Vice Chairman and Chief Operating Officer of IberiaBank Corp., managing IberiaBank’s retail and commercial banking operations. From 2001 to 2009, Mr. Brown served as Senior Executive Vice President of IberiaBank Corp. Prior to joining IberiaBank in 1999, Mr. Brown was a managing director with Bank One Capital Markets. |

|

|

|

|

|

|

|

|

Mr. Brown’s experience in the financial services industry in a number of the Company’s key markets makes him well qualified to serve as a director of the Company and enables him to serve on the Audit Committee as an “audit committee financial expert.” |

|

G. JANELLE FROST |

|

|

|

Age 51, has served as a Director since April 2016 |

|

|

|

|

|

|

|

Ms. Frost has served as the Company’s Chief Executive Officer since April 2015 and President since September 2013. Prior to becoming Chief Executive Officer, Ms. Frost served as Chief Operating Officer from May 2013 to April 2015. She served as Executive Vice President and Chief Financial Officer from November 2008 to April 2013 and Controller from May 2004 to November 2008. She has been employed with the Company since 1992. Ms. Frost currently serves as chair of the board of directors of the New Orleans Branch of the Federal Reserve Bank of Atlanta. |

|

|

|

|

|

|

|

|

Ms. Frost’s over 25 years of experience with the Company and her performance in numerous roles with the Company gives her in-depth knowledge of the Company’s business and insurance industry. Her tenure with the Company provides valuable insight about operational and strategic matters impacting the Company. |

|

SEAN M. TRAYNOR |

|

|

|

Age 53, has served as a director of the Company since March 2020 |

|

|

|

|

|

|

|

Mr. Traynor previously served as a director for the Company from 2001 until 2013. He is currently a general partner of Welsh, Carson, Anderson & Stowe, a private equity investment firm that he joined in March 1999. Mr. Traynor has served as a director for Innovage Holding Corp., a healthcare company, since 2015 and Managed Markets Insights and Technology since 2018. Mr. Traynor has also served as a director for Universal American Financial Corporation, a health insurer, and K2M, Inc., a provider of medical products. |

|

|

|

|

|

|

|

|

Mr. Traynor has strong expertise in the insurance and healthcare industries through his role and as at Welsh, Carson, Anderson & Stowe, which invests in companies in both industries. Mr. Traynor’s experience with companies in these industries provides valuable insight to the Board regarding industry trends that affect the Company.

|

|

|

5 |

Current directors whose terms expire at the Annual Meeting in 2024

|

PHILIP A. GARCIA |

|

|

|

Age 65, has served as a director of the Company since 2010 |

|

|

|

|

|

|

|

Mr. Garcia serves as Chair of the Audit Committee. He retired from the Erie Insurance Group in April 2009, where he served as executive vice president and chief financial officer for the final 12 years of his 28-year career with that company. Mr. Garcia was a director of Donegal Group Inc. from December 2009 to May 2011.

Mr. Garcia possesses a strong background in financial, accounting and investment management with a publicly traded property and casualty insurance company, as evidenced by his prior service as chief financial |

|

|

|

officer of Erie Insurance Group. He brings substantial experience in the insurance industry to the Board, including a strategic understanding of the operations of a property and casualty insurance company, as well as an understanding of the current economic and other challenges facing our industry. He is also an inactive certified public accountant. His experience enables him to serve on the Audit Committee as an “audit committee financial expert.” |

|

MILLARD E. MORRIS |

|

|

|

Age 77, founded the Company in 1985 |

|

|

|

|

|

|

|

Mr. Morris was our Chairman, Chief Executive Officer and principal shareholder until the Company was sold to a private investment group in 1997. He served on the Company’s Board from 1985 until 2005, when he voluntarily retired from our Board prior to the Company’s initial public offering. Mr. Morris was re-elected to the Board in June 2007. Mr. Morris serves as Chair of the Risk Committee. From 1996 until 2015, he served as the managing member of Dumont Management Group, LLC, a privately held company that provides management services to various affiliated finance and investment companies. Millard E. Morris is the father of Jared A. Morris. |

|

|

|

|

|

|

|

|

Millard E. Morris’s experience as founder of the Company and his long-term service as a director give him unique knowledge of the opportunities and challenges associated with the Company’s business. His familiarity with the Company and the insurance industry make him uniquely qualified to serve as a director of the Company. |

|

|

6 |

|

RANDALL E. ROACH |

|

|

|

Age 71, has served as a director of the Company since March 2007 |

|

|

|

|

|

|

|

Mr. Roach serves as Chair of the Nominating and Corporate Governance Committee. Mr. Roach is an attorney and served as the Mayor of Lake Charles, Louisiana from 2000 until 2017. In 2016 he was also appointed to serve on the legislative task force on Structural Changes in Budget and Tax Policy. Prior to assuming his duties as Mayor, Mr. Roach served as a member of the Louisiana House of Representatives from 1988 thru 1995. He also served as Chairman of the House National Resources Committee in 1994. |

|

|

|

|

|

|

|

|

As a practicing attorney, Mr. Roach was engaged in the practice of law focusing on real estate, trusts and estate and business law. He is a director of The First National Bank of Louisiana and Financial Corporation of Louisiana. Mr. Roach has also served as an adjunct instructor in the field of Business Law at McNeese State University.

Mr. Roach’s experience as an attorney and as an elected government official brings valuable insight to the Board given that the Company operates in a highly regulated industry. Mr. Roach’s background as an attorney, legislator and government official is particularly helpful in his role as a member of the Nominating and Corporate Governance Committee. |

|

|

7 |

PROPOSAL 2

Approval of the AMERISAFE, Inc. 2022 Equity and Incentive Compensation Plan

Overview

We are asking shareholders to approve the AMERISAFE, Inc. 2022 Equity and Incentive Compensation Plan (the “2022 Plan”). Our Board of Directors is recommending that the Company’s shareholders vote in favor of the 2022 Plan, which will succeed the AMERISAFE, Inc. 2012 Equity and Incentive Compensation Plan (the “2012 Plan”). The 2012 Plan has shares remaining available for new awards as of the date of this proxy statement, but if the 2022 Plan is approved by our shareholders, no further grants will be made under the 2012 Plan. However, outstanding awards under the 2012 Plan will generally continue in effect in accordance with their terms.

The 2022 Plan will continue to afford the Compensation Committee the ability to design compensatory awards that are responsive to the Company’s needs and includes authorization for a variety of awards designed to advance the interests and long-term success of the Company by encouraging stock ownership among 2022 Plan participants.

Shareholder approval of the 2022 Plan would constitute approval of 500,000 common shares, $0.01 par value per share, of the Company (“Common Shares”) to be available for awards under the 2022 Plan, as described below and in the 2022 Plan, with such amount subject to adjustment, including under the 2022 Plan’s share counting rules. If the 2022 Plan is approved by our shareholders, it will be effective as of the day of the Annual Meeting. If the 2022 Plan is not approved by our shareholders, no awards will be made under the 2022 Plan, and the 2012 Plan will remain in effect until June 15, 2022.

The actual text of the 2022 Plan is attached to this Proxy Statement as Appendix A. The following description of the 2022 Plan is only a summary of its principal terms and provisions and is qualified by reference to the actual text as set forth in Appendix A.

Why We Believe You Should Vote for this Proposal

The 2022 Plan authorizes the Compensation Committee to provide cash awards and equity-based compensation in the forms described below for the purpose of providing 2022 Plan participants incentives and rewards for performance and/or service. Some of the key features of the 2022 Plan that reflect our commitment to effective management of equity and incentive compensation are set forth below in this subsection.

We believe our future success depends in part on our ability to attract, motivate, and retain high quality employees and directors and that the ability to provide equity-based and incentive-based awards under the 2022 Plan is critical to achieving this success. We would be at a significant competitive disadvantage if we could not use share-based awards to recruit and compensate our employees and directors. The use of Common Shares as part of our compensation program is also important because equity-based awards are an essential component of our compensation for key employees, as they help link compensation with long-term shareholder value creation and reward participants based on service and/or performance.

As of April 18, 2022, 269,839 Common Shares remained available for issuance under the 2012 Plan, disregarding shares potentially issuable for outstanding performance-based awards, as described below. However, as noted above, the 2012 plan will expire by it terms on June 15, 2022. Therefore, if the 2022 Plan is not approved, it may be necessary to increase significantly the cash component of our employee and director compensation, which approach may not necessarily align employee and director compensation interests with the investment interests of our shareholders. Replacing equity awards with cash also would increase cash compensation expense and use cash that could be better utilized.

- 8 -

The following includes aggregated information regarding our view of the overhang and dilution associated with the 2012 Plan, and the potential dilution associated with the 2022 Plan. This information is as of April 18, 2022. As of that date, there were approximately 19,320,422 Common Shares outstanding. As of that date, approximately 160,093 shares (approximately 0.8% of our outstanding Common Shares) were subject to outstanding awards under the 2012 Plan (consisting of 12,821 time-based restricted shares and the estimated number of shares to be issued to satisfy performance-based awards 147,272). For purposes of outstanding performance-based awards (which are denominated in cash until share settlement), we have calculated an estimated number of shares to be issued under such awards by dividing the estimated dollar value of such awards as of September 30, 2021 by the closing price of a Common Share on April 18, 2022. Although the 2012 Plan does not count shares as used until they are issued or delivered pursuant to an award, for purposes of this proposal we view the outstanding awards described above as reducing the available shares under the 2012 Plan. On that basis, 122,567 shares (approximately 0.6% of our outstanding Common Shares) were available for future awards under the 2012 Plan as of April 18¸2022. As a result, we view the 2012 Plan as representing an overhang percentage (in other words, potential dilution of the holders of Common Shares) of approximately 1.5% as of April 18, 2022 (based on the 282,660 total shares subject to outstanding awards and available for future awards as of such date).

The proposed additional 500,000 Common Shares available for awards under the 2022 Plan represent approximately 2.6% of our outstanding Common Shares as of April 18, 2022, a percentage that reflects the simple dilution of the holders of Common Shares that could occur if the 2022 Plan is approved. Factoring in both those additional shares and the 282,660 Common Shares subject to outstanding awards or available for future awards under the 2012 Plan, the approximate total overhang under the 2012 Plan and the 2022 Plan is 782,660 Common Shares (or approximately 4.1% of the Common Shares outstanding as of April 18, 2022). However, as noted above, no further grants will be made under the 2012 Plan upon the effective date of the 2022 Plan.

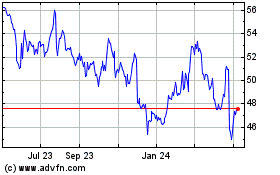

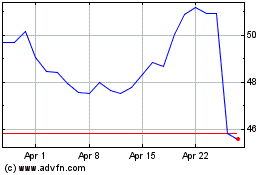

Based on the closing price on Nasdaq Global Select Market for our Common Shares on April 18, 2022 of $46.61 per share, the aggregate market value as of April 18, 2022 of the new 500,000 Common Shares requested under the 2022 Plan was $23,305,000.

In 2019, 2020 and 2021, awards under the 2012 Plan covered 22,713 shares, 23,207 shares, and 27,388 shares, respectively. Because the number of shares to be issued to satisfy our performance-based awards (which are cash-denominated) is not determinable as of the dates of grant, these numbers reflect, for each year, the number of shares subject to time-based awards granted during such year, plus the number of shares actually earned under performance-based awards during such year. As a result, based on our basic weighted average Common Shares outstanding for those fiscal years of 19,248,657, 19,288,966, and 19,322,391, respectively, for the three-fiscal-year period 2019-2021, our average burn rate, not taking into account forfeitures, was approximately 0.13% (our individual years’ burn rates were 0.12% for fiscal 2019, 0.12% for fiscal 2020 and 0.14% for fiscal 2021).

In determining the number of shares to request for approval under the 2022 Plan, our management worked with the Compensation Committee to evaluate a number of factors, including our recent share usage and criteria expected to be utilized by institutional proxy advisory firms in evaluating our proposal for the 2022 Plan.

If the 2022 Plan is approved, we intend to utilize the shares authorized under the 2022 Plan to continue our practice of incentivizing key individuals through equity grants. We currently anticipate that the shares requested in connection with the approval of the 2022 Plan will last for the entire ten-year life of the 2022 Plan, based on our recent grant rates and the approximate current share price, but could last for a shorter period of time if actual practice does not match recent rates or our share price changes materially. As noted below, our Compensation Committee retains full discretion under the 2022 Plan to determine the number and amount of awards to be granted under the 2022 Plan, subject to the terms of the 2022 Plan, and future benefits that may be received by participants under the 2022 Plan are not determinable at this time.

- 9 -

We believe that we have demonstrated a commitment to sound equity compensation practices in recent years. We recognize that equity compensation awards dilute shareholders’ equity, so we have carefully managed our equity incentive compensation. Our equity compensation practices are intended to be competitive and consistent with market practices, and we believe our historical share usage has been responsible and mindful of shareholder interests, as described above.

In evaluating this proposal, shareholders should consider all of the information in this proposal.

2022 Plan Highlights

Below are certain highlights of the 2022 Plan. These features of the 2022 Plan are designed to reinforce alignment between equity compensation arrangements awarded pursuant to the 2022 Plan and shareholders’ interests, consistent with sound corporate governance practices.

Reasonable 2022 Plan Limits. Generally, up to 500,000 Common Shares, plus the number of Common Shares that are added (or added back, as applicable) to the aggregate number of shares available under the 2022 Plan pursuant to the share counting rules of the 2022 Plan (as described below), may be issued or transferred pursuant to 2022 Plan awards. These shares may be shares of original issuance or treasury shares, or a combination of the two. Generally, the aggregate number of Common Shares available for issuance or transfer under the 2022 Plan will be reduced by one Common Share for every one Common Share issued or transferred in connection with an award granted under the 2022 Plan. Common Shares covered by an award granted under the 2022 Plan will not be counted as used unless and until they are actually issued or transferred to a participant.

Minimum Vesting Requirement. The 2022 Plan provides for certain minimum vesting periods for awards granted to participants other than non-employee directors that consist of restricted shares, restricted share units (“RSUs”), performance shares, performance units, cash incentive awards and certain other awards. Specifically, if such an award vests based only on the passage of time rather than the achievement of management objectives, the period of time will be no shorter than three years, except that vesting may occur ratably during the three-year period, on at least an annual basis, as determined by the Committee. If an award vests upon the achievement of management objectives, then such award may not vest sooner than one year from the date of grant (or, in the case of performance shares, performance units and cash incentive awards, after a one-year performance period). Notwithstanding anything in the 2022 Plan to the contrary, up to 10% of the maximum number of Common Shares that may be issued or transferred under the 2022 Plan, as may be adjusted under the terms of the 2022 Plan, may be used for (1) awards of restricted shares, RSUs, performance shares, performance units, cash incentive awards and other awards granted to participants other than non-employee directors that do not comply with the applicable three-year or one-year vesting requirements set forth in the 2022 Plan plus (2) awards granted to non-employee directors.

Incentive Stock Option Limit. The 2022 Plan also provides that, subject as applicable to adjustment as described in the 2022 Plan, the aggregate number of Common Shares actually issued or transferred upon the exercise of Incentive Stock Options (as defined below) will not exceed 500,000 Common Shares.

Limited Share Recycling Provisions. Subject to certain exceptions described in the 2022 Plan, if any Common Shares issued or transferred pursuant to an award granted under the 2022 Plan are forfeited, or an award granted under the 2022 Plan (in whole or in part) is canceled or forfeited, expires, is settled for cash, or is unearned, the Common Shares issued or transferred pursuant to, or subject to, such award (as applicable) will, to the extent of such cancellation, forfeiture, expiration, cash settlement, or unearned amount, again be available (or continue to be available) for issuance or transfer under the 2022 Plan. Additionally, if after the effective date of the 2022 Plan, any Common Shares issued or transferred pursuant to an award granted under the 2012 Plan are forfeited, the Common Shares subject to such award will, to the extent of such forfeiture, be available for awards under the 2022 Plan. Further, the following will reduce the aggregate number of Common Shares available under the 2022 Plan:

- 10 -

|

|

• |

If Common Shares are withheld by us, tendered or otherwise used in payment of the exercise price of a stock option granted under the 2022 Plan, the total number of Common Shares covered by the stock option being exercised; |

|

|

• |

Common Shares withheld by us, tendered or otherwise used to satisfy tax withholding with respect to awards granted under the 2022 Plan; and |

|

|

• |

Common Shares subject to a stock appreciation right, to the extent it is exercised and settled in Common Shares, and whether or not all Common Shares covered by the stock appreciation right are actually issued to the participant on exercise. |

Common Shares reacquired by the Company on the open market or otherwise using cash proceeds from the exercise of stock options will not be added to the aggregate number of Common Shares available for issuance or transfer under the 2022 Plan.

Further, if a participant elects to give up the right to receive compensation in exchange for Common Shares based on fair market value, such Common Shares will not count against the aggregate number of shares available for issuance or transfer under the 2022 Plan.

No Repricing Without Shareholder Approval. Outside of certain corporate transactions or adjustment events described in the 2022 Plan or in connection with a “change in control,” the exercise or base price of stock options and stock appreciation rights (“SARs”) cannot be reduced, nor can “underwater” stock options or SARs be cancelled in exchange for cash or replaced with other awards with a lower exercise or base price, without shareholder approval under the 2022 Plan.

Change in Control Definition. The 2022 Plan includes a non-liberal definition of “change in control,” which is described below.

Exercise or Base Price Limitation. Except with respect to certain converted, assumed or substituted awards as described in the 2022 Plan, no stock options or SARs will be granted with an exercise or base price less than the fair market value of a Common Share on the date of grant.

Clawback Provisions. The 2022 Plan includes clawback provisions, as described below.

Summary of Other Material Terms of the 2022 Plan

Administration. The 2022 Plan will generally be administered by the Compensation Committee (or its successor), or any other committee of the Board of Directors designated by the Board of Directors to administer the 2022 Plan. However, at the discretion of the Board of Directors, the 2022 Plan may be administered by the Board of Directors, including with respect to the administration of any responsibilities and duties held by the Compensation Committee under the 2022 Plan. References to the “Committee” in this proposal refer to the Compensation Committee, such other committee designated by the Board of Directors, or the Board of Directors, as applicable. Subject to applicable law, the Committee may delegate certain administrative duties to officers, agents or advisors. In addition, the Committee may by resolution, subject to certain restrictions set forth in the 2022 Plan, authorize one or more officers of the Company to (1) designate employees to be recipients of awards under the 2022 Plan, and (2) determine the size of such awards. However, the Committee may not delegate such responsibilities to officers for awards granted to non-employee directors or certain employees who are subject to the reporting requirements of Section 16 of the Exchange Act of 1934.

Eligibility. Any person who is selected by the Committee to receive benefits under the 2022 Plan and who is at that time an officer or other employee of the Company or any of its subsidiaries (including a person who has agreed to commence serving in such capacity within 90 days of the date of grant) is eligible to participate in the 2022 Plan. In addition, persons (including consultants) who provide services to the Company or any of its subsidiaries that are equivalent to those typically provided by an employee (provided that such persons satisfy the Form S-8 definition of “employee”), and non-employee

- 11 -

directors of the Company, may also be selected by the Committee to participate in the 2022 Plan. As of April 18, 2022, the Company and its subsidiaries had approximately 377 employees, and the Company had 8 non-employee directors. Although consultants of the Company and its subsidiaries are eligible to participate in the 2022 Plan, we have not granted equity awards to consultants in recent years and, due to the temporary status of such service providers, do not have a current estimate of how many such consultants may be eligible in the future to participate in the 2022 Plan. We do not currently expect to make material grants of awards under the 2022 Plan to consultants. The basis for participation in the 2022 Plan by eligible persons is the selection of such persons by the Committee (or its authorized delegate) in its discretion.

Evidence of Awards. Generally, each grant of an award under the 2022 Plan will be evidenced by an award agreement, certificate, resolution or other type or form of writing or other evidence approved by the Committee (an “Evidence of Award”), which will contain such terms and provisions as the Committee may determine, consistent with the 2022 Plan.

Treatment of Awards on Termination or Change in Control. Awards under the 2022 Plan may be subject to service-based vesting requirements, and the Committee may specify management objectives regarding the vesting of such awards. However, such awards may provide for continued vesting or earlier vesting (1) in the event of the retirement, death or disability of a participant or (2) in the event of a change in control where either (A) within a specified period the participant is involuntarily terminated for reasons other than for “cause” or terminates his or her employment for “good reason” (as such terms may be defined in the Evidence of Award or otherwise) or (B) the award is not assumed or converted into replacement awards in a manner described in the Evidence of Award.

Types of Awards Under the 2022 Plan. Pursuant to the 2022 Plan, the Company may grant cash awards and restricted shares, RSUs, stock options (including stock options intended to be “incentive stock options” as defined in Section 422 of the Code (“Incentive Stock Options”)), SARs, performance shares, performance units, cash incentive awards, and certain other awards based on or related to our Common Shares. A brief description of the types of awards which may be granted under the 2022 Plan is set forth below.

Restricted Shares. Restricted shares constitute an immediate transfer of the ownership of Common Shares to the participant in consideration of the performance of services, entitling such participant to dividend, voting and other ownership rights, subject to the substantial risk of forfeiture and restrictions on transfer determined by the Committee. Each such grant or sale of restricted shares may be made without additional consideration or in consideration of a payment by the participant that is less than the fair market value per Common Share on the date of grant. Any grant of restricted shares may require that any and all dividends or distributions paid on restricted shares that remain subject to a substantial risk of forfeiture be automatically deferred and/or reinvested in additional restricted shares, which will be subject to the same restrictions as the underlying restricted shares. Any such dividends or other distributions on restricted shares will be deferred until, and paid contingent upon, the vesting of such restricted shares.

RSUs. RSUs awarded under the 2022 Plan constitute an agreement by the Company to deliver Common Shares, cash, or a combination of the two, to the participant in the future in consideration of the performance of services, but subject to the fulfillment of such conditions during the restriction period as the Committee may specify. Each grant or sale of RSUs may be made without additional consideration or in consideration of a payment by the participant that is less than the fair market value of our Common Shares on the date of grant. During the restriction period applicable to RSUs, the participant will have no right to transfer any rights under the award and will have no rights of ownership in the Common Shares deliverable upon payment of the RSUs and no right to vote them. The Committee may, at or after the date of grant, authorize the payment of dividend equivalents on such RSUs on a deferred and contingent basis, either in cash or in additional Common Shares. However, dividend equivalents or other distributions on Common Shares underlying RSUs will be deferred until, and paid contingent upon, the vesting of such RSUs. Each grant or sale of RSUs will specify the time and manner of payment of the

- 12 -

RSUs that have been earned. An RSU may be paid in cash, Common Shares or any combination of the two.

Stock Options. A stock option is a right to purchase Common Shares upon exercise of the stock option. Stock options granted to an employee under the 2022 Plan may consist of either an Incentive Stock Option, a non-qualified stock option that is not intended to be an “incentive stock option” under Section 422 of the Code, or a combination of both. Each grant will specify whether the consideration to be paid in satisfaction of the exercise price will be payable: (1) in cash, by check acceptable to the Company, or by wire transfer of immediately available funds; (2) by the actual or constructive transfer to the Company of Common Shares owned by the participant with a value at the time of exercise that is equal to the total exercise price; (3) subject to any conditions or limitations established by the Committee, by a net exercise arrangement pursuant to which the Company will withhold Common Shares otherwise issuable upon exercise of a stock option; (4) by a combination of the foregoing methods; or (5) by such other methods as may be approved by the Committee. To the extent permitted by law, any grant may provide for deferred payment of the exercise price from the proceeds of a sale through a bank or broker of some or all of the shares to which the exercise relates. Stock options granted under the 2022 Plan may not provide for dividends or dividend equivalents.

SARs. A SAR is a right to receive from us an amount equal to 100%, or such lesser percentage as the Committee may determine, of the spread between the base price of the SAR and the value of our Common Shares on the date of exercise. A SAR may be paid in cash, Common Shares or any combination of the two. SARs granted under the 2022 Plan may not provide for dividends or dividend equivalents.

Stock Option and SAR Expiration. The term of a stock option or SAR may not extend more than 10 years from the date of grant, and the Committee may provide in an Evidence of Award for the automatic exercise of a stock option or SAR.

Performance Shares, Performance Units and Cash Incentive Awards. A performance share is a bookkeeping entry that records the equivalent of one Common Share, and a performance unit is a bookkeeping entry that records a unit equivalent to $1.00 or such other value as determined by the Committee. Each grant of a cash incentive award, performance shares or performance units will specify the number or amount of performance shares or performance units, or the amount payable with respect to a cash incentive award being awarded, which number or amount may be subject to adjustment to reflect changes in compensation or other factors. Each grant will specify management objectives regarding the earning of the award. Each grant will specify the time and manner of payment of performance shares, performance units or a cash incentive award that has been earned.

Any grant of performance shares or performance units may provide for the payment of dividend equivalents in cash or in additional Common Shares, subject to deferral and payment on a contingent basis based on the participant’s earning and vesting of the performance shares or performance units, as applicable, with respect to which such dividend equivalents are paid.

Awards to Non-Employee Directors. Subject to the applicable limits set forth in the 2022 Plan, the Committee may, from time to time and upon such terms and conditions as it may determine, authorize the granting to non-employee directors of stock options, SARs or Other Awards (as defined below) and may also authorize the grant or sale of Common Shares, restricted shares or RSUs to non-employee directors. Each grant of an award to a non-employee director will be upon such terms and conditions as approved by the Committee, will not be subject to any minimum vesting period, and will be evidenced by an Evidence of Award in such form as will be approved by the Committee. Each stock option and SAR granted under the 2022 Plan to a non-employee director will expire not more than 10 years from the date of grant. If a non-employee director subsequently becomes an employee of the Company or a subsidiary of the Company while remaining a member of the Board, any award held under the 2022 Plan by such individual at the time of such commencement of employment will not be affected thereby. Non-employee directors may be awarded, or may be permitted to elect to receive, pursuant to procedures established by

- 13 -

the Board, all or any portion of their annual retainer, meeting fees or other fees in Common Shares, Restricted shares, RSUs or other awards under the 2022 Plan in lieu of cash.

Other Awards. Subject to applicable law and applicable share limits under the 2022 Plan, the Committee may grant to any participant Common Shares or such other awards (“Other Awards”) that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, or related to, Common Shares or factors that may influence the value of such Common Shares, as further described in the 2022 Plan. The terms and conditions of any such awards will be determined by the Committee. In addition, the Committee may grant cash awards, as an element of or supplement to any other awards granted under the 2022 Plan. The Committee may also authorize the grant of Common Shares as a bonus, or may authorize the grant of Other Awards in lieu of obligations of the Company or a subsidiary to pay cash or deliver other property under the 2022 Plan or under other plans or compensatory arrangements, subject to terms determined by the Committee in a manner that complies with Section 409A of the Code.

The Committee may provide for the payment of dividends or dividend equivalents on Other Awards on a deferred and contingent basis, either in cash or in additional Common Shares. However, dividend equivalents or other distributions on Common Shares underlying Other Awards will be deterred until, and paid contingent upon, the earning and vesting of such awards.

Change in Control. The 2022 Plan includes a definition of “change in control.” In general, except as may be otherwise prescribed by the Committee in an Evidence of Award, a change in control will be deemed to have occurred upon the occurrence (after the effective date of the 2022 Plan) of any of the following events (subject to certain exceptions and limitations and as further described in the 2022 Plan): (1) the acquisition by any person or entity of beneficial ownership of 35% or more of the then outstanding securities of the Company entitled to vote generally in the election of directors; (2) a majority of the Board ceases to be comprised of incumbent directors (as defined in the 2022 Plan); (3) the consummation of a reorganization, merger or consolidation, a sale or other disposition of all or substantially all of the assets of the Company or other transaction that results in a substantial change in the ownership or leadership of the Company (as further described in the 2022 Plan); or (4) approval by our shareholders of a complete liquidation or dissolution of the Company, except as otherwise provided in the 2022 Plan.

Management Objectives. The 2022 Plan generally provides that any of the awards set forth above may be granted subject to the achievement of specified management objectives. Management objectives are defined as the performance objective(s) established pursuant to the 2022 Plan for applicable awards. The management objectives applicable to an award under the 2022 Plan (if any) will be determined by the Committee, and may be based on one or more, or a combination, of metrics under the following categories or such other metrics as may be determined by the Committee (including relative or growth achievement regarding such metrics): (1) cash flow/net assets ratio; (2) return on assets, capital or investment; (3) return on equity; (4) earnings per share growth; (5) revenue growth; (6) total shareholder return; (7) loss ratio; (8) expense ratio; (9) combined ratio; (10) direct premiums written or premium volume; (11) net income (before or after taxes); (12) earnings before all or any interest, taxes, depreciation and/or amortization (“EBIT”, “EBITA” or “EBITDA”); (13) market share; (14) cost reduction goals; (15) earnings from continuing operations; (16) levels of expense, costs or liabilities; (17) operating profit; (18) sales or revenues; (19) stock price appreciation; or (20) implementation or completion of critical projects or processes.

If the Committee determines that a change in the business, operations, corporate structure or capital structure of the Company, or the manner in which it conducts its business, or other events or circumstances render the management objectives unsuitable, the Committee may in its discretion modify such management objectives or the goals or actual levels of achievement, in whole or in part, as the Committee deems appropriate and equitable.

Transferability of Awards. Except as otherwise provided by the Committee, and subject to the terms of the 2022 Plan with respect to Section 409A of the Code, no awards under the 2022 Plan will be

- 14 -

transferrable by a participant except by will or the laws of descent and distribution. In no event will any such award granted under the 2022 Plan be transferred for value.

Adjustments; Corporate Transactions. The Committee will make or provide for such adjustments in: (1) if applicable, the number of and kind of Common Shares covered by awards under the 2022 Plan; (2) the exercise price or base price provided in outstanding stock options and SARs, respectively; (3) cash incentive awards; and (4) other award terms, as the Committee in its sole discretion, determines in good faith is equitably required in order to prevent dilution or enlargement of the rights of participants that otherwise would result from (a) any extraordinary cash dividend, stock dividend, stock split, combination of shares, recapitalization or other change in the capital structure of the Company; (b) any merger, consolidation, spin-off, spin-out, split-off, split-up, reorganization, partial or complete liquidation or other distribution of assets, issuance of rights or warrants to purchase securities; or (c) any other corporate transaction or event having an effect similar to any of the foregoing.

In the event of any such transaction or event, or in the event of a change in control of the Company, the Committee may provide in substitution for any or all outstanding awards under the 2022 Plan such alternative consideration (including cash), if any, as it may in good faith determine to be equitable under the circumstances and will require the surrender of all awards so replaced in a manner that complies with Section 409A of the Code. In addition, for each stock option or SAR with an exercise price or base price, respectively, greater than the consideration offered in connection with any such transaction or event or change in control of the Company, the Committee may cancel such stock option or SAR without any payment to the person holding such stock option or SAR. The Committee will make or provide for such adjustments to the number of Common Shares available under the 2022 Plan and the share limits of the 2022 Plan as the Committee, in its sole discretion, determines in good faith is appropriate to reflect such transaction or event, subject to certain tax-based limitations.

Detrimental Activity and Recapture. Any Evidence of Award may reference a clawback policy of the Company or provide for the cancellation or forfeiture of an award or forfeiture and repayment to us of any gain related to an award, or other provisions intended to have a similar effect, upon such terms and conditions as may be determined by the Committee from time to time, if any participant, either during employment or other service with us or a subsidiary or within a specified period after such employment or service, engages in any detrimental activity as described in the 2022 Plan, in the applicable Evidence of Award or in such clawback policy. In addition, any Evidence of Award or such clawback policy may provide for cancellation or forfeiture of an award or the forfeiture and repayment of any Common Shares issued under and/or any other benefit related to an award, or other provisions intended to have a similar effect, including upon such terms and conditions as may be required by the Committee or under Section 10D of the Exchange Act and any applicable rules and regulations promulgated by the Securities and Exchange Commission or any national securities exchange or national securities association on which the Common Shares may be traded.

Withholding. To the extent the Company is required to withhold federal, state, local or foreign taxes or other amounts in connection with any payment made or benefit realized by a participant or other person under the 2022 Plan, and the amounts available to us for such withholding are insufficient, it will be a condition to the receipt of such payment or the realization of such benefit that the participant or such other person make arrangements satisfactory to the Company for payment of the balance of such taxes or other amounts required to be withheld, which arrangements, in the discretion of the Committee, may include relinquishment of a portion of such benefit. If a participant’s benefit is to be received in the form of Common Shares, and such participant fails to make arrangements for the payment of taxes or other amounts, then, unless otherwise determined by the Committee, we will withhold Common Shares having a value equal to the amount required to be withheld. When a participant is required to pay the Company an amount required to be withheld under applicable income, employment, tax or other laws, the Committee may require the participant to satisfy the obligation, in whole or in part, by having withheld, from the shares delivered or required to be delivered to the participant, Common Shares having a value equal to the amount required to be withheld or by delivering to us other Common Shares held by such participant. The Common Shares used for tax or other withholding will be valued at an amount equal to the fair market value of such Common Shares on the date the benefit is to be included in the participant’s

- 15 -

income. In no event will the fair market value of the Common Shares to be withheld and delivered pursuant to the 2022 Plan exceed the minimum amount required to be withheld, unless (1) an additional amount can be withheld and not result in adverse accounting consequences, and (2) such additional withholding amount is authorized by the Committee.

Amendment and Termination of the 2022 Plan. The Board of Directors generally may amend the 2022 Plan from time to time in whole or in part, subject to shareholder approval in certain circumstances as required under the 2022 Plan, applicable law, or stock exchange rules.

Further, subject to the 2022 Plan’s prohibition on repricing, the Committee generally may amend the terms of any award prospectively or retroactively, subject in certain circumstances to participant consent. If permitted by Section 409A of the Code and subject to certain other limitations set forth in the 2022 Plan, and including in the case of termination of employment or service, or in the case of unforeseeable emergency or other circumstances or in the event of a change in control, the Committee may provide for continued vesting or accelerate the vesting of certain awards granted under the 2022 Plan or waive any other limitation or requirement under any such award.

The Board of Directors may, in its discretion, terminate the 2022 Plan at any time. Termination of the 2022 Plan will not affect the rights of participants or their successors under any awards outstanding and not exercised in full on the date of termination. No grant will be made under the 2022 Plan on or after the tenth anniversary of the effective date of the 2022 Plan, but all grants made prior to such date will continue in effect thereafter subject to their terms and the terms of the 2022 Plan.

Allowances for Conversion Awards and Assumed Plans. Common Shares issued or transferred under awards granted under the 2022 Plan in substitution for or conversion of, or in connection with an assumption of, restricted shares, RSUs, stock options, SARs or other share or share-based awards held by awardees of an entity engaging in a corporate acquisition or merger transaction with us or any of our subsidiaries will not count against (or be added to) the aggregate share limit or other 2022 Plan limits described above. Additionally, shares available under certain plans that we or our subsidiaries may assume in connection with corporate transactions from another entity may be available for certain awards under the 2022 Plan, under circumstances further described in the 2022 Plan, but will not count against the aggregate share limit or other 2022 Plan limits described above.

New Plan Benefits

It is not possible to determine the specific amounts and types of awards that may be awarded in the future under the 2022 Plan because the grant and actual settlement of awards under the 2022 Plan are subject to the discretion of the plan administrator.

U.S. Federal Income Tax Consequences

The following is a brief summary of certain of the Federal income tax consequences of certain transactions under the 2022 Plan based on Federal income tax laws in effect. This summary, which is presented for the information of shareholders considering how to vote on this proposal and not for 2022 Plan participants, is not intended to be complete and does not describe Federal taxes other than income taxes (such as Medicare and Social Security taxes), or state, local or foreign tax consequences.

Tax Consequences to Participants

Restricted Shares. The recipient of restricted shares generally will be subject to tax at ordinary income rates on the fair market value of the restricted shares (reduced by any amount paid by the recipient) at such time as the restricted shares are no longer subject to forfeiture or restrictions on transfer for purposes of Section 83 of the Code. However, a recipient who so elects under Section 83(b) of the Code within 30 days of the date of transfer of the shares will generally have taxable ordinary income on the date of transfer of the shares equal to the excess of the fair market value of such shares over any purchase price.

- 16 -

RSUs, Performance Shares, Performance Units, and Cash Incentive Awards. No income generally will be recognized upon the grant of RSUs, performance shares, performance units or cash incentive awards. Upon payment in respect of such awards, the recipient generally will be required to include as taxable ordinary income in the year of receipt an amount equal to the amount of cash received and the fair market value of any unrestricted Common Shares received (reduced by any amount paid by the recipient).

Nonqualified Stock Options and SARs. In general:

|

|

• |

no income will be recognized by a grantee at the time a non-qualified stock option or SAR is granted; and |

|

|

• |

at the time of exercise of a non-qualified stock option or SAR, ordinary income will be recognized by the grantee in an amount equal to, in the case of a non-qualified stock option, the difference between the option price paid for the shares and the fair market value of the unrestricted shares on the date of exercise and, in the case of a SAR, the amount of cash received and the fair market value of any unrestricted shares received. |

Incentive Stock Options. No income generally will be recognized by an optionee upon the grant or exercise of an “incentive stock option” as defined in Section 422 of the Code. If Common Shares are issued to the optionee pursuant to the exercise of an incentive stock option, and if no disqualifying disposition of such shares is made by such optionee within two years after the date of grant or within one year after the transfer of such shares to the optionee, then upon sale of such shares, any amount realized in excess of the option price will be taxed to the optionee as a long-term capital gain and any loss sustained will be a long-term capital loss.

If Common Shares acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of either holding period described above, the optionee generally will recognize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such shares at the time of exercise (or, if less, the amount realized on the disposition of such shares if a sale or exchange) over the exercise price paid for such shares. Any further gain (or loss) realized by the participant generally will be taxed as short-term or long-term capital gain (or loss) depending on the holding period.

Tax Consequences to the Company and its Subsidiaries

To the extent that a participant recognizes ordinary income in the circumstances described above, the Company or the subsidiary for which the participant performs services will be entitled to a corresponding deduction provided that, among other things, it is not disallowed by the $1 million limitation on certain executive compensation under Section 162(m) of the Code.

Registration with the SEC

We intend to file a Registration Statement on Form S-8 relating to the issuance of Common Shares under the 2022 Plan with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, as soon as practicable after approval of the 2022 Plan by our shareholders.

Vote Required

The affirmative vote of a majority of the holders of our common shares entitled to vote and present at the Annual Meeting is required to approve the 2022 Plan. Accordingly, abstentions will have the effect of a vote against this proposal. Broker non-votes will not have any effect on the adoption of this proposal.

The Board recommends a vote “FOR” the approval of the 2022 Plan.

- 17 -

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant to Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are submitting the compensation of our executive officers as disclosed in this proxy statement to our shareholders for an advisory vote. Our Board has adopted a policy to hold annual advisory votes on executive compensation. Our next advisory vote on the frequency of shareholder votes on executive compensation will take place at our annual meeting of shareholders in 2023.

We encourage shareholders to review the information regarding our compensation practices and decisions as described below under the heading “Compensation Discussion and Analysis.” We seek to offer our employees, including our named executive officers, a competitive pay package that rewards individual contributions, performance and experience with our Company, while aligning the interests of our executive officers and other key employees with those of the Company’s shareholders. The Compensation Committee sets compensation in this manner to ensure that our compensation practices do not put the Company at a disadvantage in attracting and retaining executives and other employees, while also ensuring a competitive cost structure for our Company.

The vote on this proposal is not intended to address any specific element of compensation. Rather, the vote relates to the compensation of our executive officers, as described under the headings “Compensation Discussion and Analysis” and “Executive Compensation” in this proxy statement. The vote is advisory, which means that the vote is not binding on the Company, our Board of Directors or the Compensation Committee. However, the Compensation Committee expects to consider the outcome of this advisory vote in evaluating whether any actions are appropriate with respect to our compensation programs for our executive officers.

The Board recommends a vote “FOR” the approval of the compensation of our named executive officers.

- 18 -

PROPOSAL 4

RATIFICATION OF APPOINTMENT OF

ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR 2022

The Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for 2022. The Board is asking shareholders to ratify this appointment. SEC regulations and the Nasdaq listing requirements require the Company’s independent registered public accounting firm to be engaged, retained and supervised by the Audit Committee. However, the Board considers the selection of an independent registered public accounting firm to be an important matter to shareholders. Accordingly, the Board considers a proposal for shareholders to ratify this appointment to be an opportunity for shareholders to provide input to the Audit Committee and the Board on a key corporate governance issue.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and will be offered the opportunity to make a statement if they so desire. They will also be available to respond to appropriate questions. For additional information regarding our independent registered public accounting firm, see “Independent Public Accountants.”

The Board recommends a vote “FOR” the ratification of Ernst & Young LLP

as the Company’s independent registered public accounting firm.

- 19 -

Corporate governance and board information

Board of Directors

The Board presently consists of eight non-employee directors and one employee director. The Board is divided into three classes, with each class serving three-year terms. The term of one class expires at each annual meeting of shareholders.

Director Compensation

The elements of compensation payable to our non-employee directors in 2021 are briefly described below.

|

Board Service: |

|

|

|

|

|

Annual cash retainer |

|

$ |

50,000 |

|

|

Annual restricted stock award |

|

|

50,000 |

|

|

Board Committee Service: |

|

|

|

|

|

Chairman annual retainer |

|

$ |

45,000 |

|

|

Audit Committee Chair annual cash retainer |

|

|

20,000 |

|

|

Compensation Committee Chair annual cash retainer |

|

|

17,500 |

|

|

Nominating and Corporate Governance Committee Chair annual cash retainer |

|

|

12,500 |

|

|

Risk Committee Chair annual cash retainer |

|

|

12,500 |

|

|

Committee member annual cash retainer |

|

|

5,000 |

|

Committee Chairs do not receive annual cash retainers for being members of the committees they chair. Directors do not receive additional compensation for serving on our Risk Committee. The Company reimburses directors for reasonable out-of-pocket expenses incurred in connection with their service as directors. Any director who is an employee of the Company does not receive additional compensation for serving as a director.

The amount of restricted stock granted to each non-employee director is equal to $50,000 divided by the closing price of our common stock on the date of the annual meeting of shareholders at which the non-employee director is elected or continues to be a member of the Board. The shares of restricted stock granted to non-employee directors vest at the next annual meeting of shareholders. If a non-employee director is first elected or appointed to the Board at a time other than at an annual meeting of shareholders, the non-employee director is awarded a prorated initial restricted stock grant at that time. Awards to non-employee directors are made under the Director Plan.

On June 11, 2021, each non-employee director was granted 801 shares of restricted stock.

The following table provides information regarding the compensation of our non-employee directors for the year ended December 31, 2021.

|

Name |

|

Fees Earned or

Paid in Cash |

|

|

Stock

Awards (1) |

|

|

Total |

|

|

Michael J. Brown |

|

$ |

72,500 |

|

|

$ |

49,982 |

|

|

$ |

122,482 |

|

|

Teri G. Fontenot |

|

|

60,000 |

|

|

|

49,982 |

|

|

|

109,982 |

|

|

Philip A. Garcia |

|

|

75,000 |

|

|

|

49,982 |

|

|

|

124,982 |

|

|

Billy B. Greer (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Jared A. Morris |

|

|

110,000 |

|

|

|

49,982 |

|

|

|

159,982 |

|

|

Millard E. Morris |

|

|

62,500 |

|

|

|

49,982 |

|

|

|

112,482 |

|

|

Randall E. Roach |

|

|

67,500 |

|

|

|

49,982 |

|

|

|

117,482 |

|

|

Sean M. Traynor |

|

|

60,000 |

|

|

|

49,982 |

|

|

|

109,982 |

|

__________

|

1. |

The grant date fair value of each award, calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 (“Topic 718”), was $49,982. Pursuant to SEC rules, the amounts shown in this column exclude the impact of estimated forfeitures related to service-based vesting conditions. See Note 12 to our consolidated |

- 20 -

|

financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021 for information regarding the assumptions made in determining these values. As of December 31, 2021, each non-employee director held 801 shares of restricted stock. |

|

2. |

Mr. Greer became a director on March 15, 2022. He received a prorated award of 261 shares of restricted stock, when he joined the Board on March 15, 2022. |

Non-Employee Director Stock Ownership and Retention Guidelines

Our Board recognizes that ownership of common stock is an effective means to align the interests of our directors with those of our shareholders. The following is a summary of our stock ownership and retention guidelines for our non-employee directors.

Non-Employee Director Stock Ownership Guidelines. Non-employee directors are expected to acquire and hold during their Board service shares of our common stock equal in value to at least three times the annual cash retainer paid to our directors, or $150,000. Non-employee directors have five years from their initial election to the Board to meet these ownership guidelines.

Non-Employee Director Retention Guidelines. Directors are expected to continuously own sufficient shares to meet the guidelines once attained. Until a director meets the ownership guidelines, the director will be required to hold 75% of the shares of common stock received from any equity award, net of any shares used to pay the tax withholding. If a director attains compliance with the stock ownership guideline and subsequently falls below the guideline because of a decrease in the price of our common stock, the director will be deemed in compliance provided that the director retains the shares then held.

The following table provides the equity ownership of each of our non-employee directors as of December 31, 2021, measured in dollars. Ownership was calculated based on a price of $53.83 per share, the closing price of the Company’s common stock on December 31, 2021, the last trading day of the year.

|

Non-Employee Director |

|

Total Ownership |

|

|

Michael J. Brown |

|

$ |

331,647 |

|

|

Teri G. Fontenot |

|

$ |

291,113 |

|

|

Billy B. Greer (1) |

|

$ |

— |

|

|

Philip A. Garcia |

|

$ |

1,003,553 |

|

|

Jared A. Morris |

|

$ |

4,133,714 |

|

|

Millard E. Morris |

|

$ |

5,955,805 |

|

|

Randall E. Roach |

|

$ |

552,403 |

|

|

Sean M. Traynor |

|

$ |

523,551 |

|

__________

|

1. |

Mr. Greer became a director on March 15, 2022. Under the guidelines, Mr. Greer has until March 15, 2027 to meet the ownership guidelines. |

Corporate Governance

The Board and senior management of the Company believe that one of their primary responsibilities is to promote a corporate culture of accountability, responsibility and ethical conduct throughout the Company. Consistent with these principles, the Company has, among other things, adopted:

|

|

• |

corporate governance guidelines that describe the principles under which the Board operates; |

|

|

• |

a code of business conduct and ethics applicable to all employees; |

|

|

• |

written charters for each of its standing committees; |

|

|

• |

a majority voting and director resignation policy that requires any director nominee who receives a greater number of votes “withheld” or “against” his or her election than votes “for” his or her election to tender his or her resignation as a director; |

- 21 -

|

|

• |