false

0000738214

0000738214

2023-11-21

2023-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2023

Aemetis, Inc.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

001-36475

|

|

26-1407544

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification

No.)

|

20400 Stevens Creek Blvd., Suite 700

Cupertino, CA 95014

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(408) 213-0940

(Former name or former address, if changed since last report.)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001

|

AMTX

|

NASDAQ Stock Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

☐

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

|

| |

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 8.01 Other Events

On November 20, 2023, the Aemetis, Inc. (the “Company”) filed Supplement No. 1 to Prospectus Supplement (the “Supplement”) to supplement its prospectus supplement dated August 18, 2021 (as amended by Amendment No. 1, dated November 30, 2021, the “Prospectus Supplement”) with certain financial and operational updates of the Company set forth below.

Financial Updates for Third Quarter 2023

On November 9, 2023, Aemetis, Inc. (the “Company”) announced its financial results for the three and nine months ended September 30, 2023. Revenues of $68.7 million for the third quarter of 2023 reflect the Company’s India Biodiesel segment fulfilling $20.1 million of supply contracts from the three Indian government-owned Oil Marketing Companies combined with the Company’s California Ethanol segment generating $47.4 million of revenue from the restart of the Keyes ethanol plant. Investments in capital projects of $18.6 million were made during the first nine months of 2023, further indicating progress on the Company’s carbon intensity reduction projects.

Net income was $30.7 million for the third quarter of 2023 and basic earnings per share was $0.79 for the third quarter of 2023, which includes the sale of $63 million of Inflation Reduction Act (“IRA”) investment tax credits related to the Aemetis Biogas assets for cash proceeds of $55.2 million. The Company repaid $50.2 million to its senior lender as payments against existing high-interest rate debt obligations in October.

Operational Updates for Third Quarter 2023

The Company has achieved several milestones that it believes will help enable the transition to positive cash flows from its operating businesses in California and in India.

India – The Company expanded the production capacity of biodiesel at its India plant to 60 million gallons per year, which allows the Company to meet rapidly expanding demand for biodiesel by the three India government-owned Oil Marketing Companies.

California Renewable Natural Gas – The Company closed the second $25 million USDA guaranteed loan that provides funds to build biogas digesters for an additional eight dairies, bringing its total to $50 million of committed USDA REAP based project financing to build fifteen fully funded dairy digesters that, in combination with one other constructed digester and another under construction, are designed to produce a combined 400,000 MMBtu of renewable natural gas (“RNG”) each year. The Company’s RNG business currently includes seven operating dairy digesters, a biogas collection pipeline that leads to a centralized upgrading hub, and an interconnect to PG&E’s natural gas pipeline. The Company is actively expanding the number of digesters and dairies, with seven digesters serving ten dairies under construction and more in various stages of development as part of its plan to increase production to 1.6 million MMBtu per year of RNG at its upgrading hub.

California Ethanol – The Company completed an extended maintenance and upgrade cycle for its Keyes ethanol plant that included the installation of key components of its energy efficiency upgrades intended to significantly reduce the use of fossil-based natural gas at the plant. The plant’s new solar microgrid with battery back-up is expected to begin supplying electricity to the plant within the next few months. The Company has made progress on the engineering and procurement of a new mechanical vapor recompression system that is expected to be installed by the end of 2024.

The Company has also completed key milestones for two of its development projects.

Riverbank SAF/RD – In September 2023, the Company received approval of the Use Permit and CEQA for the development of its sustainable aviation fuel and renewable diesel (“SAF/RD”) plant in Riverbank, California. The plant is currently designed to produce 90 million gallons per year of SAF/RD from renewable oil and fats obtained from the Company’s other biofuels plants and other sources. The plant will use low-carbon hydroelectric electricity and renewable hydrogen that is generated within the plant’s own processes using byproducts of the SAF/RD production. The Company is continuing with the engineering and other required development activities for the plant.

Carbon Capture and Underground Sequestration – In May 2023, the Company received a permit from the State of California to build a geologic characterization well that will provide information for the permitting and design of its Carbon Capture and Underground Sequestration (“CCUS”) well in Riverbank, California. The Company plans to construct that well in the first half of 2024 and is at the same time continuing with the engineering, permitting and other development activities for the sequestration well.

The Company’s current and planned businesses produce renewable fuels and reduce carbon emissions, while generating valuable federal tax credits, Renewable Fuel Standard credits, and California Low Carbon Fuel Standard credits. These carbon credits are needed by the energy industry, corporations and companies seeking to decarbonize their operations or to offset their carbon emissions.

Risks Related to Our Overall Business

In addition, the Supplement supplemented the risk factors incorporated into the Prospectus Supplement with the following risk factors:

We are in the process of developing SAF/RD, CCUS, dairy digester, and other projects, and the success of such projects depends on many factors; as such, cash flows and revenue projections may not be achieved.

We are actively developing projects designed to reduce emissions of greenhouse gases. These include (i) a biofuels production plant in Riverbank, California designed to produce SAF/RD using renewable fats and oils obtained from existing Aemetis biofuels plants and other sources, (ii) Carbon Capture and Underground Sequestration (“CCUS”) projects designed to compress and inject CO₂ into deep wells for long-term sequestration of carbon underground, (iii) additional dairy digesters at new locations, along with associated infrastructure for transporting and producing biogas and Renewable Natural Gas. We also plan to develop additional projects beyond those listed here.

Each of these development projects depends on completing all necessary development activities, including, but not limited to, obtaining necessary regulatory approvals and permits, acquisition of property rights, contracting, engineering and cost estimating, determination of feasibility, funding of project development costs, construction financing, construction, and startup. There is no certainty that we will successfully complete all the necessary development activities for any particular project, that a project will ultimately be built, that a project will be built or operational according to our planned schedule, or that a project will ultimately generate revenue or contribute to our cash flows, any of which could have a material adverse effect on our business, financial condition, results of operations and cash flow.

We rely on the availability of tax credits, carbon credits, grants, and other regulatory and financial incentives. The expiration, elimination, modification, or reduction of these regulations, credits, and incentives could adversely impact our business.

U.S. and India federal, state, and local governments provide regulations and incentives for operations and projects that are designed to promote renewable fuels and reduce carbon emissions. Each of our currently operating businesses and development projects are expected to generate revenue, cash, and credits from these government programs. In particular, we have used and plan to continue to use the provisions of the Internal Revenue Code (“IRC”) and the Inflation Reduction Act (“IRA”) amendments to the IRC in 2022 that provide Investment Tax Credits, Production Tax Credits, and other credits, and that allow us to either use the credits or to monetize the credits by selling them to third parties. These include certain transferrable IRA tax credits generated from our qualified biogas facilities. We also currently generate and plan to continue to generate credits under the federal Renewable Fuel Standard (“RFS”) and the California Low Carbon Fuel Standard (“LCFS”). Our India plant produces biofuel to help India meet the goals of its National Policy on Biofuels. The IRA, RFS, LCFS and other regulations, as well as our ability to qualify for and monetize the tax credits, carbon credits, grants and other financial incentives available thereunder, are subject to modifications, additional regulatory requirements or limits, varying interpretations, reduction, expiration, and other changes. These can occur with or without advance notice, may affect our past business activities or future plans, and may occur for a variety of reasons resulting from legislation, new or changing regulations, regulatory interpretation, court cases, and other sources. These regulatory programs, credits, and incentives have been and will continue to be material to our business and to our projects under development. Changes to regulations and reductions in or expirations of governmental credits and incentives could adversely impact our revenue, increase cost of materials, and reduce the size of our addressable market, any of which could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Forward-Looking Statements

This Current Report on Form 8-K contains a number of forward-looking statements, including statements regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events or other statements that are not historical facts. Forward-looking statements in this Current Report on Form 8-K include, without limitation, statements regarding management’s plans; our ability to leverage our location and infrastructure; our ability to transition to positive cash flows from our operating businesses in California and in India; our ability to expand into alternative markets for biodiesel and its by-products; our ability to access governmental carbon reduction incentives; our ability to construct and fund diary digesters; our ability to adopt, develop and commercialize new technologies; our ability to continue to fund operations and our future sources of liquidity and capital resources; our ability to receive permits and authority to construct; and our ability to raise additional capital. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions are intended to identify forward looking statements. These forward-looking statements are based on current assumptions and predictions and are subject to numerous risks and uncertainties. Actual results or events could differ materially from those set forth or implied by such forward-looking statements and related assumptions due to certain factors, including, without limitation, the risks set forth in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the factors set forth under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement in this Current Report on Form 8-K, except as required by applicable law or regulation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AEMETIS, INC.

| November 21, 2023 |

By: |

/s/ Eric A. McAfee

|

|

Name:

|

Eric A. McAfee

|

|

Title:

|

Chief Executive Officer

|

| |

(Principal Executive Officer)

|

v3.23.3

Document And Entity Information

|

Nov. 21, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Aemetis, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 21, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36475

|

| Entity, Tax Identification Number |

26-1407544

|

| Entity, Address, Address Line One |

20400 Stevens Creek Blvd., Suite 700

|

| Entity, Address, City or Town |

Cupertino

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

95014

|

| City Area Code |

408

|

| Local Phone Number |

213-0940

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AMTX

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000738214

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

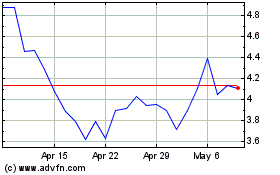

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Apr 2024 to May 2024

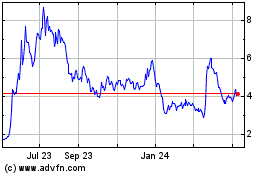

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From May 2023 to May 2024