0000794619false00007946192023-09-052023-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2023

| | | | | | | | | | | | | | |

| American Woodmark Corporation |

| (Exact name of registrant as specified in its charter) |

|

| Virginia | | 000-14798 | | 54-1138147 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | | | | |

| 561 Shady Elm Road, | Winchester, | Virginia | | 22602 |

| (Address of principal executive offices | | (Zip Code) |

Registrant’s telephone number, including area code: (540) 665-9100

| | |

| Not applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock (no par value) | | AMWD | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

American Woodmark Corporation

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

(e) Effective September 5, 2023, the Compensation and Social Principles Committee (the “Committee”) of the Board of Directors of American Woodmark Corporation (the “Company”) awarded supplemental long term incentive awards under the American Woodmark Corporation 2023 Stock Incentive Plan. The awards consisted of a combination of (i) performance-based stock options (“Performance-Based Options”), and (ii) performance-based restricted stock units (“RSUs”). Both the Performance-Based Options and the RSUs are subject to (x) performance conditions related to a three-year cumulative Adjusted EBITDA target through April 30, 2026 (the “Target”) determined by the Committee, and (y) such executive’s continued employment through September 5, 2026. Assuming continued employment, the Performance-Based Options and RSUs both vest completely if the Target is achieved, but both will be completely forfeited if the Target is not achieved. If the Target is achieved, the Performance-Based Options will expire ten years from the grant date. The Performance-Based Options have an exercise price equal to the closing stock price on the date of grant.

The awards made to the Company’s named executive officers are as follows:

| | | | | | | | | | | |

| Name | Title | Number of

Performance-Based Options | Number of RSUs |

| M. Scott Culbreth | President and CEO | 20,520 | 6,840 |

| Paul Joachimczyk | SVP and CFO | 10,260 | 3,420 |

| Robert J. Adams, Jr. | SVP, Manufacturing and Technical Operations | 10,260 | 3,420 |

The form of grant letter used in connection with the grant of the Performance-Based Options and RSUs contains other important terms and conditions of these awards and is filed herewith as Exhibit 10.1. The terms set forth therein are hereby incorporated by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit 10.1 Form of Grant Letter used in connection with the grant of a supplemental long-term incentive award effective September 5, 2023 under the American Woodmark Corporation 2023 Stock Incentive Plan (filed herewith).

Exhibit 104 Cover Page Interactive Data File (embedded within Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

AMERICAN WOODMARK CORPORATION

(Registrant)

| | | | | | | | |

| | |

| /s/ PAUL JOACHIMCZYK | | /s/ M. SCOTT CULBRETH |

| | |

| Paul Joachimczyk | | M. Scott Culbreth |

| Senior Vice President and Chief Financial Officer | | President & Chief Executive Officer |

| | |

Date: September 6, 2023 | | Date: September 6, 2023 |

| Signing on behalf of the registrant and as principal financial officer | | Signing on behalf of the registrant and as principal executive officer |

| | |

Exhibit 10.1

September 5, 2023

RSU - Performance-Based and Nonqualified Stock Option Award

%Name%

561 Shady Elm

Winchester, VA 22601

Dear %Name%:

On September 5, 2023 (the “Award Date”), American Woodmark Corporation (the “Company”) granted to you a one-time award of performance based restricted stock units and performance based nonqualified stock options (the “Award”). Your Award is subject to the terms set forth in this letter and in the American Woodmark Corporation 2023 Stock Incentive Plan (the “Plan”). A copy of the Plan will be furnished to you upon your request. Capitalized terms that are not defined in this letter shall have the meaning assigned to them under the Plan.

The terms of your Award are as follows:

I. In consideration of your agreements contained in this letter, the Company hereby grants you restricted stock units (RSUs) and Nonqualified Options as detailed below. Each Performance-Based RSU represents the right to receive one (1) share of the voting common stock of the Company. Each Performance-Based Nonqualified Option represents the right to purchase one (1) share of the voting common stock of the Company at the exercise price listed below. Your Award is subject to vesting based on your continued employment through September 5, 2026 and the achievement of certain annual performance goals for the Company for the cumulative three (3) year period ending April 30, 2026 (the “Performance Period”).

1.The number of Performance-Based RSUs granted pursuant to this agreement are [insert number].

2.The number of shares of common stock covered by the Nonqualified Options are [insert number].

3.The exercise price per share of each option is [insert number].

4.The expiration date of the options are 10 years from date of grant, unless the options are terminated sooner as described below in Section II.C.

II. Your performance-based RSU and nonqualified options are subject to the following vesting terms and conditions:

1.You are eligible to earn Performance-Based RSUs and Performance-Based Nonqualified Options based on the Company’s performance with respect to one annual operating measurement during the three-year fiscal period ending April 30, 2026: Adjusted cumulative earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”).

2.The entirety of the award will be earned based upon the Company attaining cumulative Adjusted EBITDA of [xxx] which is 95% of the [xxx] (“Adjusted EBITDA Target”) for the three-year period ending April 30, 2026, but will vest on September 5, 2026. If the Company’s cumulative Adjusted EBITDA Target is not met, the Award shall be forfeited.

3.The Company’s performance with respect to the Adjusted EBITDA Target for the Performance Period will be assessed by the Committee following the end of the Performance Period. The Committee will determine whether the award has been earned based on the Company’s performance for the Performance Period. If the Committee determines that the Adjusted EBITDA Target is not met for the Performance Period, the Award will be forfeited as of the date of the Committee’s determination. The Award, if any, will be subject to additional service-based vesting based on your continued employment through September 5, 2026. In the event your employment terminates at any time for any reason other than as provided in Section II.D below between the Award Date and the Vesting Date, all of your Performance-Based RSUs and nonqualified options (whether earned or unearned) will be forfeited.

4.You will vest in 100% of the earned amount of any Performance-Based RSUs and nonqualified options if, at any time before the Vesting Date, a Change of Control occurs and on or after the date of the Change of Control, either:

(a)Your employment with the Company or any successor of the Company or parent or other affiliate thereof is involuntarily terminated by the Company (or any such successor or parent or affiliate) without Cause; or

(b)You voluntarily terminate your employment with the Company (or any such successor or parent or affiliate) for Good Reason.

If such a termination occurs before the date on which the Committee has completed its evaluation with respect to a given fiscal year pursuant to Section II.C above, then all of the unearned Performance-Based RSUs and Nonqualified Options shall be deemed to have been earned for purposes hereof.

5.Certain Definitions. For purposes of applying this Section II, the following terms shall have the following meanings:

(a)Cause: The occurrence of any of the following conditions:

1.The neglect of your duty of which is not corrected after 90 days’ written notice thereof;

2.Your misconduct, malfeasance, fraud or dishonesty that materially and adversely affects the Company or its reputation in the industry; or

3.Your conviction of, or plea of nolo contendere to, a felony or a crime involving moral turpitude.

(b)Good Reason: The occurrence of any of the following conditions without your written consent:

1.A reduction in your base salary;

2.You are not in good faith considered for an annual cash bonus;

3.You are not in good faith considered for other benefits that are afforded generally by the Company from time to time to its senior personnel;

4.The relocation of your place of your employment to a location further than 50 miles from your current place of employment; or

5.A substantial diminution in your working conditions or management responsibilities, other than on account of Disability.

6.Adjustments. The Committee may, in its sole discretion, make adjustments to the measurements and Adjusted EBITDA Target, or may reduce or increase the number of Performance-Based RSUs and/or Nonqualified Options deemed earned, to reflect any unusual or infrequent event, such as a major merger, acquisition or disposition involving the Company, which substantially impacts the level of difficulty of achieving the stated goals at the time the Award was granted.

III. Payment of any vested portion of your Performance-Based RSU Award will be made in shares of the Company’s common stock. The timing of such payment will be as follows:

1.Payment will occur on or as soon as administratively practicable (within 60 days) after the Vesting Date.

2.For an employee whose employment terminates due involuntary termination without Cause or Good Reason termination on or following the date of a Change of Control, timing of the payment will depend upon whether or not the employee is deemed to be a “specified employee” of the Company as defined by Section 409A(a)(2)(B)(i) of the Internal Revenue Code. If an employee is not a specified employee, then payment will occur as soon as administratively practicable (within 60 days) after the employee’s termination date. If an employee qualifies as a specified employee, then payment will occur as soon as administratively practicable (within 60 days) after the date that is six months after the employee’s termination date.

IV. Term and Exercise of the Nonqualified Option.

1.To the extent Nonqualified Options become vested and exercisable pursuant to the terms set forth in this Agreement and have not been previously exercised, subject to termination or acceleration as provided in this Agreement and the requirements set forth in this Agreement or the Plan, you may exercise the option to purchase up to the number of shares of the Common Stock set forth above. Notwithstanding anything to the contrary, no part of the Nonqualified Option may be exercised after ten (10) years from the date of grant.

2.The process for exercising the Nonqualified Option (or any part thereof) is governed by this Agreement, the Plan and your agreements with the Company’s stock plan administrator. Exercises of the Nonqualified Option will be processed as soon as practicable.

3.The exercise price per Option shares may be paid (a) in cash, (b) by arrangement with the Company’s stock plan administrator which is acceptable to the Company where payment of the option price is made pursuant to an irrevocable direction to the broker to deliver all or part of the proceeds from the sale of the shares of the Common Stock issuable under the option to the Company, (c) by delivery of any other lawful consideration approved in advance by the Committee or its delegate, or (d) in any combination of the foregoing. Fractional shares may not be exercised. Shares of the Common Stock will be issued as soon as practicable.

4.You will have the rights of a stockholder only after the shares of the Common Stock have been issued.

5.For administrative or other reasons, the Company may from time to time suspend the ability of employees to exercise options for limited periods of time.

6.Notwithstanding the foregoing, the Company shall not be obligated to deliver any shares of the Common Stock during any period when the Company determines that the exercisability of the Option or the delivery of shares hereunder would violate any federal, state or other applicable laws.

7.Except as expressly provided otherwise in this Agreement, if your employment with the Company terminates for any reason, whether voluntarily or involuntarily, other than death, Disablement (as defined below), or discharge for misconduct, you may exercise any portion of the Option that had vested on or prior to the date of termination at any time prior to ninety (90) days after the date of such termination, but in no event later than the expiration date. The Option shall terminate on the 90th day to the extent that it is unexercised.

8.Your employment with any subsidiary, partnership, joint venture shall be considered employment with the Company for purposes of this Agreement.

9.Except as expressly provided otherwise in this Agreement, if you die while employed by the Company, the executor of your will, administrator of your estate or any successor trustee of a grantor trust may exercise the Option, to the extent not previously exercised, at any time prior to 365 days measured from the date of death or until the expiration date of the Option, if earlier.

10.The Option shall terminate on the applicable expiration date described above, to the extent that it is unexercised.

V. You agree, as a condition of receiving the Award to pay to the Company or make arrangements satisfactory to the Company regarding the payment of all Applicable Withholding Taxes with respect to the Award. Unless otherwise agreed, the Company will withhold from the Award an amount of shares sufficient to cover the minimum statutory amount of all Applicable Withholding Taxes.

VI. Unless otherwise indicated above, this Award is not transferable by you except by will or by the laws of descent and distribution.

VII. In the event of changes in the capital structure of the Company, appropriate adjustments will be made according to the Plan.

VIII. In consideration of the grant of this Award, you agree that you will comply with such lawful conditions as the Board of Directors or the Compensation Committee may impose on the Award, and will perform such duties as may be assigned from time to time by the Board of Directors or by the executive officers of the Company operating under the authority of the Board; provided, however, that the provisions of this sentence shall not be interpreted as affecting the right of the Company to terminate your employment at any time.

IX. Until the Performance-Based RSUs are converted into actual shares of the Company’s stock or the Nonqualified Options are exercised and the Common shares are delivered, your Award will not convey actual rights normally accruing to shareholders, including but not limited to the right to participate in shareholder votes or the right to receive dividends.

X. The Award is intended to comply with all applicable requirements of Section 409A of the Internal Revenue Code and the terms hereof shall be interpreted consistent with such intent. The award pursuant to this letter shall not be effective until the effectiveness of a Registration Statement under the Securities Act of 1933, as amended, for the shares for such grant shall have occurred.

XI. If the Company’s financial statements are required to be restated at any time prior to the Vesting Date or within a two (2) year period following the Vesting Date as a result of material noncompliance of the Company with federal securities laws, the Committee may, in its discretion, based on the facts and circumstances surrounding the restatement, direct the Company to cancel without payment all or a portion of the RSUs and options granted to you under this agreement, or if shares with respect to such RSUs or Nonqualified Options have already been issued, to recover all or a portion of the shares from you (or, if you have already sold or disposed of the shares, the value thereof), if the Committee determines that either (i) the RSUs or Nonqualified Options would not have been earned or vested based on the restated financials or (ii) your misconduct contributed to the need for the restatement. Recovery of shares may be pursued in any manner the Committee deems appropriate, including (without limitation) reducing compensation otherwise payable to you or reducing or withholding future incentive awards or salary increases. The Company’s right to cancel RSUs or options or recover issued shares or the value thereof shall be in addition to, and not in lieu of, any other rights or remedies the Company may have. In addition, this Award and any shares of Company common stock issued pursuant hereto shall be subject to any other compensation recoupment or clawback policy that is adopted by, or applicable to, the Company, pursuant to any requirement of law or any exchange listing requirement related to clawback or other recovery of compensation.

XII. This Award is not valid unless electronically accepted.

Your electronic acceptance shall be deemed as your understanding and acceptance to the terms and conditions of this Award.

American Woodmark Corporation

Scott Culbreth

President & Chief Executive Officer

Agreed to

By: %Name%

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

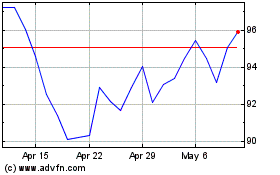

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Apr 2024 to May 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From May 2023 to May 2024