ASLAN Pharmaceuticals Reports First Quarter 2021 Financial Results and Provides Corporate Update

11 May 2021 - 9:30PM

ASLAN Pharmaceuticals (Nasdaq:ASLN), a clinical-stage immunology

focused biopharmaceutical company developing innovative treatments

to transform the lives of patients, today announced financial

results for the first quarter ended March 31, 2021 and provided an

update on its clinical development activities.

Dr Carl Firth, Chief Executive Officer, ASLAN

Pharmaceuticals, said: “We have continued to make solid

progress in 2021 and we are on track to complete the expansion

cohort in our multiple ascending dose trial for ASLAN004 with an

additional 27 patients expected to be enrolled by mid-2021 followed

by the announcement of topline data expected in the third quarter

of 2021. We are excited to expand our senior management team with

two highly experienced executives, Dr Karen Veverka, who will be

leading our clinical development program, and Joseph Suttner to

lead clinical operations. In addition, we are preparing for our

Phase 2b trial for ASLAN004, which we expect to initiate in the

second half of 2021. Our robust financial position provides the

resources to fund development activities and achieve additional

value creating milestones for shareholders.”

First quarter 2021 and recent business

highlights

Clinical development

ASLAN004

- Positive interim data from the three dose cohorts of the

ongoing Phase 1 randomised, double-blind placebo controlled

multiple ascending dose (MAD) study of ASLAN004 for the treatment

of moderate to severe atopic dermatitis (AD) were announced in

March. ASLAN004, a novel, first-in-class antibody, was well

tolerated across all doses and showed improvements compared to

placebo in all efficacy endpoints, supporting its potential as a

differentiated treatment for AD. Additional data from the expansion

cohort is planned for the third quarter of 2021.

- New data from the Single Ascending Dose study that demonstrate

ASLAN004’s favourable tolerability profile as an IL-13Rα1 inhibitor

and as a differentiated treatment method for atopic dermatitis

patients were accepted for poster presentation at the 2021 Society

for Investigative Dermatology virtual meeting on 6 May. The data

will also be published in the fall edition of the Journal of

Investigative Dermatology.

Corporate updates

- Appointed Dr Karen Veverka as Vice President, Medical to lead

ASLAN’s clinical medical development program for new products,

including Phase 2 and 3 trials. Dr Veverka brings more than 20

years of experience in the pharmaceutical industry, as well as

significant preclinical and clinical research and development

(R&D) experience in immunology and dermatology. Prior to

joining ASLAN, Dr Veverka was Senior Medical Director and Medical

Head for the Innovative Portfolio at LEO Pharma, a leader in global

dermatology. At LEO she led the development of brand medical

strategy and execution of medical affairs activities for products

in the AD and psoriasis therapeutic areas, including tralokinumab.

Dr Veverka has also held leadership roles at Novartis and GTx. Dr

Veverka earned her PhD in Pharmacology at The Mayo Clinic Graduate

School of Biomedical Sciences and completed a postdoctoral research

fellowship at St Jude Children’s Research Hospital.

- Appointed Joseph Suttner as Vice President, Clinical

Operations. Mr Suttner brings more than 20 years in clinical

operations and R&D, including more than 8 years in dermatology.

Mr Suttner has successfully led clinical operations teams at

Dermira, PellePharm and several other biotechnology companies

through Phase 2b trials in AD, Gorlin syndrome, and actinic

keratosis, among other conditions.

Anticipated upcoming milestones

- Completion of MAD clinical study of ASLAN004 in

moderate-to-severe AD patients with clinical results expected in

third quarter of 2021.

- Initiation of Phase 2b study of ASLAN004 for AD expected in the

second half of 2021.

First quarter 2021 financial highlights

- Cash used in operations for the first quarter of 2021 was

US$7.6 million compared to US$5.2 million in the same period in

2020.

- Research and development expenses were US$3.8 million in the

first quarter of 2021 compared to US$2.4 million in the first

quarter of 2020. The increase was driven by manufacturing expenses

incurred in preparation for the Phase 2b trial of ASLAN004.

- General and administrative expenses were US$3.1 million in the

first quarter of 2021 compared to US$1.0 million in the first

quarter of 2020. The increase was due to the increase in headcount

and staffing costs in preparation for the Phase 2b trial of

ASLAN004 and additional corporate costs incurred to support the

fundraising activities that were concluded in the first quarter of

2021.

- Net loss for the first quarter of 2021 was US$6.7 million

compared to a net loss of US$3.0 million for the first quarter of

2020.

- Cash, cash equivalents and short-term investments totalled

US$100.8 million as of 31 March 2021 compared to US$14.3 million as

of 31 December 2020. Following the financing activities in the

first quarter of 2021, which raised combined gross proceeds of

approximately US$101 million, management believes that its cash and

cash equivalents will be sufficient to fund operations into

2023.

- The weighted-average number of American Depository Shares

(ADSs) outstanding in the computation of basic loss per share for

the first quarter of 2021 was 51.4 million (representing 257.2

million ordinary shares) compared to 38.0 million (representing

190.0 million ordinary shares) for the first quarter of 2020.

Following the financing activities in the first quarter of 2021,

the number of ADSs outstanding on 31 March 2021 was 69.5 million

(representing 347.6 million ordinary shares). One ADS is the

equivalent of five ordinary shares.

|

|

|

ASLAN Pharmaceuticals LimitedCONSOLIDATED

BALANCE SHEETS(In U.S. Dollars) |

| |

| |

|

December 31, 2020(audited) |

|

March 31, 2021(unaudited) |

| ASSETS |

|

|

|

|

| |

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,324,371 |

|

|

$ |

100,818,328 |

|

|

Other receivables |

|

|

528,841 |

|

|

|

528,841 |

|

|

Prepayments |

|

|

511,208 |

|

|

|

397,135 |

|

|

Financial assets at fair value through profit or loss |

|

|

137,926 |

|

|

|

- |

|

|

Total current assets |

|

|

15,502,346 |

|

|

|

101,744,304 |

|

|

|

|

|

|

|

| NON-CURRENT ASSETS |

|

|

|

|

|

Property, plant and equipment |

|

|

13,387 |

|

|

|

8,153 |

|

|

Right-of-use assets |

|

|

462,550 |

|

|

|

396,349 |

|

|

Intangible assets |

|

|

160 |

|

|

|

- |

|

|

Refundable deposits |

|

|

103,307 |

|

|

|

70,050 |

|

|

Total non-current assets |

|

|

579,404 |

|

|

|

474,552 |

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

16,081,750 |

|

|

$ |

102,218,856 |

|

| |

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

| |

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

Trade payables |

|

$ |

2,319,558 |

|

|

$ |

1,943,657 |

|

|

Other payables |

|

|

4,280,409 |

|

|

|

3,450,273 |

|

|

Current portion of long-term borrowing |

|

|

2,900,971 |

|

|

|

- |

|

|

Current portion of long-term borrowing from related parties |

|

|

617,912 |

|

|

|

- |

|

|

Lease liabilities - current |

|

|

271,624 |

|

|

|

161,602 |

|

|

Financial liabilities at fair value through profit or loss |

|

|

267,000 |

|

|

|

- |

|

|

Total current liabilities |

|

|

10,657,474 |

|

|

|

5,555,532 |

|

|

|

|

|

|

|

| NON-CURRENT LIABILITIES |

|

|

|

|

|

Financial liabilities at fair value through profit or loss |

|

|

- |

|

|

|

- |

|

|

Long-term borrowings |

|

|

15,183,421 |

|

|

|

15,098,337 |

|

|

Lease liabilities - non-current |

|

|

281,149 |

|

|

|

281,149 |

|

|

Other non-current liabilities |

|

|

111,990 |

|

|

|

111,990 |

|

|

Total non-current liabilities |

|

|

15,576,560 |

|

|

|

15,491,476 |

|

|

|

|

|

|

|

| Total liabilities |

|

|

26,234,034 |

|

|

|

21,047,008 |

|

| |

|

|

|

|

| EQUITY ATTRIBUTABLE TO

STOCKHOLDERS OF THE COMPANY |

|

|

|

|

|

Ordinary shares |

|

|

61,826,237 |

|

|

|

63,008,864 |

|

|

Capital surplus |

|

|

123,582,460 |

|

|

|

220,694,153 |

|

|

Accumulated deficits |

|

|

(195,682,714 |

) |

|

|

(202,403,231 |

) |

|

Other reserves |

|

|

(178,948 |

) |

|

|

(178,948 |

) |

|

|

|

|

|

|

| Total equity attributable to

stockholders of the Company |

|

|

(10,452,965 |

) |

|

|

81,120,838 |

|

| |

|

|

|

|

| NON-CONTROLLING INTERESTS |

|

|

300,681 |

|

|

|

51,010 |

|

| |

|

|

|

|

| Total equity |

|

|

(10,152,284 |

) |

|

|

81,171,848 |

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

EQUITY |

|

$ |

16,081,750 |

|

|

$ |

102,218,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASLAN Pharmaceuticals LimitedCONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS(In U.S. Dollars,

other than shares or share data) |

| |

| |

|

For the Three Months Ended March

31 |

|

|

|

|

|

2020 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

| NET REVENUE |

|

$ |

- |

|

|

$ |

- |

|

|

| |

|

|

|

|

|

| COST OF REVENUE |

|

|

- |

|

|

|

- |

|

|

| |

|

|

|

|

|

| GROSS PROFIT |

|

|

- |

|

|

|

- |

|

|

| |

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

General and administrative expenses |

|

|

(997,543 |

) |

|

|

(3,105,064 |

) |

|

|

Research and development expenses |

|

|

(2,354,616 |

) |

|

|

(3,750,972 |

) |

|

|

Total operating expenses |

|

|

(3,352,159 |

) |

|

|

(6,856,036 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

|

(3,352,159 |

) |

|

|

(6,856,036 |

) |

|

| |

|

|

|

|

|

| NON-OPERATING INCOME AND

EXPENSES |

|

|

|

|

|

|

Interest income |

|

|

102 |

|

|

|

137 |

|

|

|

Other gains and losses |

|

|

457,251 |

|

|

|

297,185 |

|

|

|

Finance costs |

|

|

(339,025 |

) |

|

|

(411,474 |

) |

|

|

Total non-operating income and expenses |

|

|

118,328 |

|

|

|

(114,152 |

) |

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAX |

|

|

(3,233,831 |

) |

|

|

(6,970,188 |

) |

|

| |

|

|

|

|

|

| INCOME TAX EXPENSE |

|

|

- |

|

|

|

- |

|

|

| |

|

|

|

|

|

| NET LOSS FOR THE PERIOD |

|

|

(3,233,831 |

) |

|

|

(6,970,188 |

) |

|

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

| Items that will not be

reclassified subsequently to profit or loss: |

|

|

|

|

|

| Unrealized loss on investments

in equity instruments at fair value through OCI |

|

|

(35,007 |

) |

|

|

- |

|

|

| TOTAL COMPREHENSIVE LOSS FOR

THE PERIOD |

|

$ |

(3,268,838 |

) |

|

$ |

(6,970,188 |

) |

|

|

|

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO: |

|

|

|

|

|

| Stockholders of the

Company |

|

$ |

(3,046,705 |

) |

|

$ |

(6,720,517 |

) |

|

| Non-controlling interests |

|

|

(187,126 |

) |

|

|

(249,671 |

) |

|

| |

|

$ |

(3,233,831 |

) |

|

$ |

(6,970,188 |

) |

|

|

|

|

|

|

|

|

| TOTAL COMPREHENSIVE LOSS

ATTRIBUTABLE TO: |

|

|

|

|

|

|

Stockholders of the Company |

|

$ |

(3,081,712 |

) |

|

$ |

(6,720,517 |

) |

|

| Non-controlling interests |

|

|

(187,126 |

) |

|

|

(249,671 |

) |

|

|

|

|

$ |

(3,268,838 |

) |

|

$ |

(6,970,188 |

) |

|

| LOSS PER ORDINARY SHARE |

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

| LOSS PER EQUIVALENT ADS |

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.13 |

) |

|

| Weighted-average number of

ordinary shares in the computation of basic loss per ordinary

share |

|

|

189,954,970 |

|

|

|

257,163,743 |

|

|

| Weighted-average number of ADS

in the computation of basic loss per ADS |

|

|

37,990,994 |

|

|

|

51,432,749 |

|

|

|

|

|

|

|

|

|

Each ADS represents five ordinary shares.

Media and IR contacts

|

Emma ThompsonSpurwing CommunicationsTel: +65 6751

2021Email: ASLAN@spurwingcomms.com |

Robert UhlWestwicke PartnersTel: +1 858 356 5932

Email: robert.uhl@westwicke.com |

About ASLAN

PharmaceuticalsASLAN Pharmaceuticals (Nasdaq:ASLN) is a

clinical-stage immunology focused biopharmaceutical company

developing innovative treatments to transform the lives of

patients. Led by a senior management team with extensive experience

in global development and commercialisation, ASLAN has a clinical

portfolio comprised of a first-in-class monoclonal therapy,

ASLAN004, that is being developed in atopic dermatitis and other

immunology indications, and ASLAN003, which it plans to develop for

autoimmune disease. For additional information please visit

www.aslanpharma.com.

Forward looking statements

This release and the accompanying financial information, if any,

contains forward-looking statements. These statements are based on

the current beliefs and expectations of the management of ASLAN

Pharmaceuticals Limited and/or its affiliates (the "Company").

These forward-looking statements may include, but are not limited

to, statements regarding the Company’s business strategy and

clinical development plans; the Company’s plans to develop and

commercialise ASLAN004; the safety and efficacy of ASLAN004; the

Company’s plans and expected timing with respect to clinical trials

and clinical trial results for ASLAN004; the potential for ASLAN004

as a differentiated treatment for atopic dermatitis; and the

Company’s belief that its cash and cash equivalents will be

sufficient to fund operations into 2023. The Company’s estimates,

projections and other forward-looking statements are based on

management's current assumptions and expectations of future events

and trends, which affect or may affect the Company’s business,

strategy, operations or financial performance, and inherently

involve significant known and unknown risks and uncertainties.

Actual results and the timing of events could differ materially

from those anticipated in such forward-looking statements as a

result of many risks and uncertainties, which include, unexpected

safety or efficacy data observed during preclinical or clinical

studies; clinical site activation rates or clinical trial enrolment

rates that are lower than expected; the impact of the COVID-19

pandemic on the Company’s business and the global economy; general

market conditions; changes in the competitive landscape; and the

Company’s ability to obtain sufficient financing to fund its

strategic and clinical development plans. Other factors that may

cause actual results to differ from those expressed or implied in

such forward-looking statements are described in the Company’s US

Securities and Exchange Commission filings and reports (Commission

File No. 001-38475), including the Company’s Annual Report on Form

20-F filed with the US Securities and Exchange Commission on April

23, 2021

All statements other than statements of historical fact are

forward-looking statements. The words “believe,” “may,” “might,”

“could,” “will,” “aim,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “plan,” or the negative of those terms, and

similar expressions that convey uncertainty of future events or

outcomes are intended to identify estimates, projections, and other

forward-looking statements. Estimates, projections, and other

forward-looking statements speak only as of the date they were

made, and, except to the extent required by law, the Company

undertakes no obligation to update or review any estimate,

projection, or forward-looking statement.

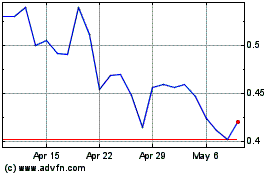

ASLAN Pharmaceuticals (NASDAQ:ASLN)

Historical Stock Chart

From Apr 2024 to May 2024

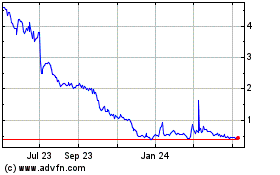

ASLAN Pharmaceuticals (NASDAQ:ASLN)

Historical Stock Chart

From May 2023 to May 2024