0001745999false00017459992024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

BEAM THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-39208 |

|

81-5238376 |

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

|

|

238 Main Street |

|

|

|

|

Cambridge, MA |

|

|

|

02142 |

(Address of principal executive offices) |

|

|

|

(Zip Code) |

(Registrant’s telephone number, including area code): (857) 327-8775

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

BEAM |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Beam Therapeutics Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended June 30, 2024. A copy of this press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 as well as in the accompanying Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing by the Company, under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

BEAM THERAPEUTICS INC. |

|

|

|

|

Date: August 6, 2024 |

|

By: |

/s/ John Evans |

|

|

Name: |

John Evans |

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

Beam Therapeutics Reports Pipeline Updates and Second Quarter 2024 Financial Results

U.S. Food and Drug Administration Cleared Investigational New Drug (IND) Application for BEAM-301 in Glycogen Storage Disease Type Ia (GSDIa)

More than 20 Patients Enrolled and Six Patients Dosed in BEACON Phase 1/2 Trial of BEAM-101 in Severe Sickle Cell Disease

Initial Clinical Data for BEAM-101 and Preclinical Non-human Primate Data for ESCAPE Submitted for Presentation at the American Society of Hematology (ASH) Annual Meeting

First Patient Dosed in the Phase 1/2 Trial of BEAM-302 in Alpha-1 Antitrypsin Deficiency (AATD); Initial Clinical Data Expected in 2025

Ended Second Quarter 2024 with $1.0 Billion in Cash, Cash Equivalents and Marketable Securities; Expected Operating Runway into 2027

CAMBRIDGE, Mass., August 6, 2024 – Beam Therapeutics Inc. (Nasdaq: BEAM), a biotechnology company developing precision genetic medicines through base editing, today reported second quarter 2024 financial results and provided updates across the company’s hematology and genetic disease franchises.

“This quarter we’ve made significant progress across our rapidly expanding clinical portfolio, where each program utilizes the power and precision of base editing technology to provide potential best-in-class genetic medicines for patients,” said John Evans, chief executive officer of Beam. “In our genetic disease franchise, we’re pleased to announce the clearance of our U.S. investigational new drug (IND) application for BEAM-301, our first U.S. in vivoregulatory filing. We’re focused on initiating site activation activities for BEAM-301 as well as continuing to enroll our BEAM-302 Phase 1/2 clinical trial in alpha-1 antitrypsin deficiency (AATD) following study initiation in June. We look forward to reporting the first data from the BEAM-302 trial next year. In addition, enrollment in the BEACON trial of BEAM-101 in sickle cell disease (SCD) has exceeded expectations, with more than 20 patients enrolled and six dosed, plus additional patients consented and in the screening process. Initial BEAM-101 clinical data have been submitted for presentation at the American Society of Hematology (ASH) Annual Meeting taking place in December, along with abstracts for the first clinical data for BEAM-201 as well as our first ESCAPE preclinical data in non-human primates.”

Second Quarter 2024 and Recent Progress

•To date, more than 20 patients have cleared screening and enrolled in the BEACON Phase 1/2 clinical trial of BEAM-101, an investigational genetically modified cell therapy for the treatment of SCD. Of these patients, six have been dosed with BEAM-101, with the other enrolled patients going through pre-transplant stages including mobilization and manufacturing.

•In June, Beam reported data at the European Hematology Association (EHA) Hybrid Congress highlighting its optimized, closed and automated manufacturing process for its base-edited CD34+ hematopoietic stem and progenitor cell genetic medicines, which is currently being deployed for the manufacturing of BEAM-101 in the BEACON Phase 1/2 clinical trial. The data, which include both preclinical and GMP clinical manufacturing experience to date, demonstrate that the use of base editing technology plus the advanced CD34+ manufacturing process employed by Beam are achieving reproducible and robust product yields and viability that meet high-quality standards.

•In June, Beam announced that the first patient was treated with BEAM-302, an investigational in vivo base editing medicine designed to precisely correct the underlying cause of severe AATD that is currently being evaluated in a Phase 1/2 clinical trial.

•The U.S. Food and Drug Administration has cleared the IND application for BEAM-301, an investigational in vivo base editing medicine designed to directly correct the R83C mutation, one of the primary disease-causing mutations of glycogen storage disease type Ia (GSDIa).

Key Anticipated Milestones

Hematology Franchise

•Initial data from the BEACON Phase 1/2 clinical trial have been submitted for presentation at the ASH Annual Meeting, taking place December 7-10, 2024. Pending acceptance, Beam anticipates presenting data on all patients from the sentinel cohort as well as multiple patients from the expansion cohort.

•Beam continues to advance and invest in its Engineered Stem Cell Antibody Paired Evasion (ESCAPE) conditioning platform and anticipates initiating Phase 1-enabling preclinical studies for the program in 2024. Preclinical data for ESCAPE in non-human primates have been submitted for presentation at ASH.

Genetic Disease Franchise

•Beam continues to enroll the Phase 1/2 clinical trial of BEAM-302 in patients with AATD and expects to report initial clinical data in 2025.

•The company is now initiating site activation activities for the Phase 1/2 clinical trial for BEAM-301 in GSDIa with patient dosing expected to commence in early 2025.

Oncology

•Initial data from the Phase 1/2 clinical trial of BEAM-201, a multiplex-edited allogeneic CAR-T product candidate for the treatment of relapsed/refractory T-cell acute lymphoblastic leukemia (T-ALL)/T-cell lymphoblastic lymphoma (T-LL), have been submitted for presentation at the ASH Annual Meeting.

Second Quarter 2024 Financial Results

•Cash Position: Cash, cash equivalents and marketable securities, were $1.0 billion as of June 30, 2024, compared to $1.2 billion as of December 31, 2023.

•Research & Development (R&D) Expenses: R&D expenses were $87.0 million for the second quarter of 2024, compared to $97.6 million for the second quarter of 2023.

•General & Administrative (G&A) Expenses: G&A expenses were $29.6 million for the first quarter of 2024, compared to $24.7 million for the second quarter of 2023.

•Net Loss: Net loss was $91.1 million for the second quarter of 2024, or $1.11 per share, compared to $82.8 million for the second quarter of 2023, or $1.08 per share.

Cash Runway

Beam expects that its cash, cash equivalents and marketable securities as of June 30, 2024, will enable the company to fund its anticipated operating expenses and capital expenditure requirements into 2027. This expectation includes funding directed toward reaching each of the key anticipated milestones for BEAM-101, ESCAPE, BEAM-301 and BEAM-302 described above, as well as continued investments in platform advancements and manufacturing capabilities, and excludes commercial spend related to the potential launch of BEAM-101.

About Beam Therapeutics

Beam Therapeutics (Nasdaq: BEAM) is a biotechnology company committed to establishing the leading, fully integrated platform for precision genetic medicines. To achieve this vision, Beam has assembled a platform that includes a suite of gene editing and delivery technologies and is in the process of building internal manufacturing capabilities. Beam’s suite of gene editing technologies is anchored by base editing, a proprietary technology that is designed to enable precise, predictable and efficient single base changes, at targeted genomic sequences, without making double-stranded breaks in the DNA. This has the potential to enable a wide range of potential therapeutic editing strategies that Beam is using to advance a diversified portfolio of base editing programs. Beam is a values-driven organization committed to its people, cutting-edge science, and a vision of providing life-long cures to patients suffering from serious diseases.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned not to place undue reliance on these forward-looking statements, including, but not limited to, statements related to: the therapeutic applications and potential of our technology, including with respect to SCD, T-ALL/T-LL, AATD, GSDIa, and ESCAPE; our plans, and anticipated timing, to advance our programs; the clinical trial designs and expectations for BEAM-101, BEAM-301, BEAM-302 and ESCAPE; our potential presentations at the ASH annual meeting; our estimated cash, cash equivalents and marketable securities as of June 30, 2024 and our expectations related thereto; the sufficiency of our capital

resources to fund operating expenses and capital expenditure requirements and the period in which such resources are expected to be available; and our ability to develop life-long, curative, precision genetic medicines for patients through base editing. Each forward-looking statement is subject to important risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statement, including, without limitation, risks and uncertainties related to: our ability to successfully achieve the benefits of our portfolio prioritization and strategic restructuring; our ability to develop, obtain regulatory approval for, and commercialize our product candidates, which may take longer or cost more than planned; our ability to raise additional funding, which may not be available; our ability to obtain, maintain and enforce patent and other intellectual property protection for our product candidates; the uncertainty that our product candidates will receive regulatory approval necessary to initiate human clinical trials; that preclinical testing of our product candidates and preliminary or interim data from preclinical studies and clinical trials may not be predictive of the results or success of ongoing or later clinical trials; that initiation and enrollment of, and anticipated timing to advance, our clinical trials may take longer than expected; that our product candidates or the delivery modalities we rely on to administer them may cause serious adverse events; that our product candidates may experience manufacturing or supply interruptions or failures; risks related to competitive products; and the other risks and uncertainties identified under the headings “Risk Factors Summary” and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and in any subsequent filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this press release. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by applicable law.

Contacts:

Investors:

Holly Manning

Beam Therapeutics

hmanning@beamtx.com

Media:

Dan Budwick

1AB

dan@1abmedia.com

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheet Data (unaudited) |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

Cash, cash equivalents, and marketable securities |

|

$ |

1,008,165 |

|

|

$ |

1,189,876 |

|

Total assets |

|

|

1,261,266 |

|

|

|

1,459,714 |

|

Total liabilities |

|

|

407,172 |

|

|

|

478,385 |

|

Total stockholders’ equity |

|

|

854,094 |

|

|

|

981,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statement of Operations (unaudited) |

|

(in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

License and collaboration revenue |

|

$ |

11,772 |

|

|

$ |

20,116 |

|

|

$ |

19,182 |

|

|

$ |

44,324 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

87,041 |

|

|

|

97,608 |

|

|

|

171,859 |

|

|

|

197,254 |

|

General and administrative |

|

|

29,626 |

|

|

|

24,656 |

|

|

|

56,350 |

|

|

|

48,146 |

|

Total operating expenses |

|

|

116,667 |

|

|

|

122,264 |

|

|

|

228,209 |

|

|

|

245,400 |

|

Loss from operations |

|

|

(104,895 |

) |

|

|

(102,148 |

) |

|

|

(209,027 |

) |

|

|

(201,076 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of derivative liabilities |

|

|

5,500 |

|

|

|

(900 |

) |

|

|

2,600 |

|

|

|

4,700 |

|

Change in fair value of non-controlling equity investments |

|

|

(7,586 |

) |

|

|

6,148 |

|

|

|

(10,939 |

) |

|

|

(6,649 |

) |

Change in fair value of contingent consideration liabilities |

|

|

1,779 |

|

|

|

2,171 |

|

|

|

1,646 |

|

|

|

1,875 |

|

Interest and other income (expense), net |

|

|

14,190 |

|

|

|

11,953 |

|

|

|

26,039 |

|

|

|

21,914 |

|

Total other income (expense) |

|

|

13,883 |

|

|

|

19,372 |

|

|

|

19,346 |

|

|

|

21,840 |

|

Net loss before income taxes |

|

$ |

(91,012 |

) |

|

$ |

(82,776 |

) |

|

$ |

(189,681 |

) |

|

$ |

(179,236 |

) |

Provision for income taxes |

|

|

(39 |

) |

|

|

— |

|

|

|

(39 |

) |

|

|

— |

|

Net loss |

|

$ |

(91,051 |

) |

|

$ |

(82,776 |

) |

|

$ |

(189,720 |

) |

|

$ |

(179,236 |

) |

Unrealized gain (loss) on marketable securities |

|

|

(189 |

) |

|

|

(1,250 |

) |

|

|

(1,714 |

) |

|

|

415 |

|

Comprehensive loss |

|

$ |

(91,240 |

) |

|

$ |

(84,026 |

) |

|

$ |

(191,434 |

) |

|

$ |

(178,821 |

) |

Net loss per common share, basic and diluted |

|

$ |

(1.11 |

) |

|

$ |

(1.08 |

) |

|

$ |

(2.31 |

) |

|

$ |

(2.41 |

) |

Weighted-average common shares outstanding, basic and diluted |

|

|

82,312,467 |

|

|

|

76,335,175 |

|

|

|

82,005,550 |

|

|

|

74,315,721 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

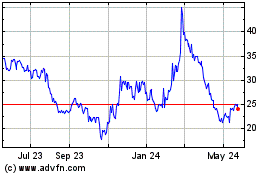

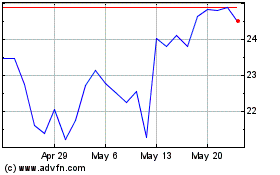

Beam Therapeutics (NASDAQ:BEAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Beam Therapeutics (NASDAQ:BEAM)

Historical Stock Chart

From Nov 2023 to Nov 2024