false

0001303942

0001303942

2024-01-31

2024-01-31

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 31, 2024

BANKFINANCIAL CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

0-51331

|

75-3199276

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

60 North Frontage Road, Burr Ridge, Illinois

(Address of Principal Executive Offices)

|

60527

(Zip Code)

|

| |

|

Registrant’s telephone number, including area code: (800) 894-6900

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

BFIN

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 31, 2024, BankFinancial Corporation (Nasdaq – BFIN) issued a press release announcing the results for the fourth quarter and year ended December 31, 2023 and issued the Quarterly Financial and Statistical Supplement for the latest five quarters. The press release and Quarterly Financial and Statistical Supplement are included as Exhibits 99.1 and 99.2 to this report.

BankFinancial Corporation will review results for the fourth quarter and year ended December 31, 2023 in a conference call and webcast for stockholders and analysts on Friday, February 2, 2024 at 9:30 a.m. Chicago, Illinois Time. All participants will need to register for the conference call using the conferencing link below. We will also publish the conferencing link on our website. Participant registration URL: https://register.vevent.com/register/BI0b6c092b40134a41a155b5c2d186393a

This link will take participants to the online registration form. On the day of the call participants will have their choice of options: dial-in to the call with the number and unique passcode provided OR select the dial-out “Call Me” option to connect their phone instantly. Participants can join via desktop, tablet or phone.

Item 9.01 Financial Statements and Exhibits.

| |

Exhibit No.

|

Description

|

| |

|

Press Release dated January 31, 2024

|

| |

|

Quarterly Financial and Statistical Supplement

|

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

BANKFINANCIAL CORPORATION

|

|

|

|

|

|

|

|

|

|

Dated:

|

January 31, 2024 |

|

By:

|

/s/ F. Morgan Gasior

|

|

|

|

|

|

|

F. Morgan Gasior

|

|

|

|

|

|

|

Chairman of the Board, Chief Executive Officer and President

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

BankFinancial Corporation Reports Financial Results for 2023 and

Will Host Conference Call and Webcast on Friday, February 2, 2024

Burr Ridge, Illinois - (January 31, 2024) BankFinancial Corporation (Nasdaq – BFIN) (the “Company”) announced today that the Company recorded net income of $9.4 million and basic and diluted earnings per common share of $0.74 for the year ended December 31, 2023. The Company recorded net income of $2.1 million and basic and diluted earnings per common share of $0.17 for the fourth quarter of 2023.

Total assets at December 31, 2023 were $1.487 billion, a decline of $88.1 million (5.6%) compared to December 31, 2022. Cash and interest-bearing deposits were $178.5 million, an increase of $111.7 million (167.3%) compared to 2022. Total net loans decreased by $176.0 million (14.3%) to $1.051 billion for the year ended 2023 due to business plan changes we implemented in 2023 focused on increasing liquidity, maintaining asset-liability flexibility and loan pricing discipline, and reducing credit risk to certain asset classes. Total commercial loans and leases decreased by $159.7 million (28.9%) resulting from a $153.1 million (33.6%) decline in equipment finance portfolio balances and a $6.6 million (6.8%) decline in commercial finance loan balances. Total multi-family residential and nonresidential real estate loans decreased by $11.6 million (1.8%). Our loan to deposit ratio was 83.3% as of December 31, 2023, compared to 89.2% as of December 31, 2022.

Total deposits decreased by $113.3 million (8.2%) in 2023 primarily due to a general decline in balances related to retail and commercial depositors’ use of funds and to a lesser extent, national and local competition for interest-bearing retail deposits by banks and credit unions. Core deposits represented 82.4% of total deposits, with noninterest-bearing demand deposits representing 20.7% of total deposits. Commercial deposits were 21.2% of total deposits at December 31, 2023, consistent with 2022.

The Company’s capital position remained strong, with a Tier 1 leverage ratio of 10.54% as of December 31, 2023. Throughout 2023, the Company maintained its quarterly dividend rate at $0.10 per common share. The Company repurchased 266,716 common shares during 2023, which represented 2.1% of the common shares that were outstanding on December 31, 2022. The book value of the Company’s common shares increased from $11.90 per share at December 31, 2022 to $12.45 per share at December 31, 2023.

For the year ended December 31, 2023, interest income increased by $10.9 million (19.6%) due to our investment of scheduled loan and lease portfolio repayments into short-term liquidity investments and higher yields earned within the commercial loan portfolio. Interest expense increased by $9.8 million (219.7%) due to higher rates paid on deposit accounts, as certain depositors managed their funds in a way that benefited from increases in short-term market interest rates. Accordingly, the Company's net interest income before the provision for credit losses increased by $1.0 million (2.0%) in 2023.

Noninterest income decreased by $1.6 million primarily due to a $753,000 reduction in Bank-Owned Life Insurance revenues and death benefits and a $602,000 asset valuation reduction related to the closure of two branch office facilities. Trust Department income increased by $77,000 due to growth in assets under management during 2023. Noninterest expense increased by $2.1 million primarily due to increases in compensation expenses, FDIC insurance expense related to higher uniform premium rates assessed on all insured depository institutions, and other expenses.

The ratio of nonperforming loans to total loans was 2.11% and the ratio of nonperforming assets to total assets was 1.69% at December 31, 2023 primarily due to two U.S. Government equipment finance transactions totaling 1.78% of total loans and 1.27% of total assets for which the government did not remit required payments and are now subject to a federal claims process. The provision for credit losses - loans decreased by $1.4 million in 2023 primarily due to the decrease in loan portfolio balances during 2023 and the impact of the Current Expected Credit Loss accounting standard implemented in 2023. Our allowance for credit losses increased to 0.79% of total loans at December 31, 2023, compared to 0.66% at December 31, 2022.

F. Morgan Gasior, the Chairman and CEO of the Company, said: “The Company ended 2023 in good financial and operational condition. Our asset-liability management strategies enabled us to strengthen liquidity and improve interest income in a highly uncertain environment. In turn, the improvement in interest income enabled us to improve net interest income despite a significant increase in deposit interest expense due to sharply rising market interest rates. To ensure appropriate liquidity, reduce risk exposures and maintain asset-liability flexibility in a rising rate environment, we reduced commercial credit originations in our equipment finance and commercial real estate portfolios, which provided liquidity to fund the reduction in total deposits and increases in short-term investments. These actions resulted in strong liquidity and capital ratios as of December 31, 2023. The reduction in loan balances and the unexpected developments in our government equipment finance portfolio reduced the earnings benefits from our asset-liability management actions. We expect our Commercial Finance, Commercial Equipment Finance and Treasury Services originations capabilities will contribute to earnings improvements and to loan portfolio diversity in 2024. We remain committed to delivering strong financial results and contributions to our shareholders and communities.”

The Company's Quarterly Financial and Statistical Supplement will be available today on BankFinancial's website, www.bankfinancial.com on the “Investor Relations” page, and through the EDGAR database on the SEC's website, www.sec.gov. The Quarterly Financial and Statistical Supplement includes comparative GAAP and non-GAAP performance data and financial measures for the most recent five quarters.

BankFinancial's management will review fourth quarter 2023 results in a conference call and webcast for stockholders and analysts on Friday, February 2, 2024 at 9:30 a.m. Chicago, Illinois Time. All participants will need to register for the conference call using the conferencing link below. We will also publish the conferencing link on our website. Participant registration URL: https://register.vevent.com/register/BI0b6c092b40134a41a155b5c2d186393a

This link will take participants to the online registration form. On the day of the call participants will have their choice of options: dial-in to the call with the number and unique passcode provided OR select the dial-out “Call Me” option to connect their phone instantly. Participants can join via desktop, tablet or phone.

For those unable to participate in the conference call, the webcast will be archived through Friday, February 23, 2024 on our website.

BankFinancial Corporation is the holding company for BankFinancial, NA, a national bank providing banking, wealth management and fiduciary services to individuals, families and businesses in the Chicago metropolitan area and on a regional or national basis for commercial finance, equipment finance, commercial real estate finance and treasury management business customers. BankFinancial Corporation's common stock trades on the Nasdaq Global Select Market under the symbol “BFIN.” Additional information may be found at the company's website, www.bankfinancial.com.

This release includes “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. A variety of factors could cause BankFinancial’s actual results to differ from those expected at the time of this release. For a discussion of some of the factors that may cause actual results to differ from expectations, please refer to BankFinancial’s most recent Annual Report on Form 10-K as filed with the SEC, as supplemented by subsequent filings with the SEC. Investors are urged to review all information contained in these reports, including the risk factors discussed therein. Copies of these filings are available at no cost on the SEC's web site at www.sec.gov or on BankFinancial’s web site at www.bankfinancial.com. Forward looking statements speak only as of the date they are made, and we do not undertake to update them to reflect changes.

|

For Further Information Contact:

|

|

|

|

Shareholder, Analyst and Investor Inquiries:

|

|

Media Inquiries:

|

|

Elizabeth A. Doolan

Senior Vice President – Finance

BankFinancial Corporation

Telephone: 630-425-5568

|

|

Gregg T. Adams

President – Marketing & Sales

BankFinancial, NA

Telephone: 630-425-5877

|

Exhibit 99.2

BANKFINANCIAL CORPORATION

FOURTH QUARTER 2023

QUARTERLY FINANCIAL AND STATISTICAL SUPPLEMENT

FOR THE LATEST FIVE QUARTERS

Note: Certain reclassifications have been made in the prior period’s financial statements and reflected in the Selected Quarterly Financial and Statistical Data tables to conform to the current period’s presentation.

The information and statistical data contained herein have been prepared by BankFinancial Corporation and have been derived or calculated from selected quarterly and period–end historical financial statements prepared in accordance with accounting principles generally accepted in the United States. BankFinancial Corporation is under no obligation to update, keep current, or continue to provide the information contained herein. This information is provided solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or establish any business relationships with BankFinancial Corporation or its subsidiary.

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023 |

|

|

2022 |

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

PERFORMANCE MEASUREMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on assets (ratio of net income to average total assets) (1)

|

|

|

0.56 |

% |

|

|

0.63 |

% |

|

|

0.61 |

% |

|

|

0.68 |

% |

|

|

0.86 |

% |

|

Return on equity (ratio of net income to average equity) (1)

|

|

|

5.37 |

|

|

|

6.16 |

|

|

|

6.02 |

|

|

|

6.96 |

|

|

|

9.01 |

|

|

Net interest rate spread (1)

|

|

|

3.01 |

|

|

|

3.16 |

|

|

|

3.23 |

|

|

|

3.41 |

|

|

|

3.39 |

|

|

Net interest margin (1)

|

|

|

3.46 |

|

|

|

3.56 |

|

|

|

3.56 |

|

|

|

3.66 |

|

|

|

3.59 |

|

|

Efficiency ratio (2)

|

|

|

77.39 |

|

|

|

76.02 |

|

|

|

79.11 |

|

|

|

74.51 |

|

|

|

65.12 |

|

|

Noninterest expense to average total assets (1)

|

|

|

2.92 |

|

|

|

2.86 |

|

|

|

2.94 |

|

|

|

2.65 |

|

|

|

2.50 |

|

|

Average interest–earning assets to average interest–bearing liabilities

|

|

|

136.25 |

|

|

|

136.78 |

|

|

|

136.86 |

|

|

|

135.85 |

|

|

|

137.62 |

|

|

Number of full service offices

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

20 |

|

|

Employees (full time equivalents)

|

|

|

205 |

|

|

|

200 |

|

|

|

198 |

|

|

|

202 |

|

|

|

203 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY STATEMENT OF FINANCIAL CONDITION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from other financial institutions

|

|

$ |

19,781 |

|

|

$ |

19,691 |

|

|

$ |

20,401 |

|

|

$ |

19,963 |

|

|

$ |

12,046 |

|

|

Interest-bearing deposits in other financial institutions

|

|

|

158,703 |

|

|

|

151,870 |

|

|

|

94,930 |

|

|

|

57,042 |

|

|

|

54,725 |

|

|

Securities, at fair value

|

|

|

182,716 |

|

|

|

158,425 |

|

|

|

169,647 |

|

|

|

170,239 |

|

|

|

210,338 |

|

|

Loans receivable, net

|

|

|

1,050,761 |

|

|

|

1,105,604 |

|

|

|

1,170,767 |

|

|

|

1,225,288 |

|

|

|

1,226,743 |

|

|

Foreclosed assets, net

|

|

|

2,777 |

|

|

|

902 |

|

|

|

950 |

|

|

|

1,393 |

|

|

|

476 |

|

|

Stock in Federal Home Loan Bank and Federal Reserve Bank, at cost

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

Premises held-for-sale

|

|

|

523 |

|

|

|

540 |

|

|

|

540 |

|

|

|

1,246 |

|

|

|

— |

|

|

Premises and equipment, net

|

|

|

22,950 |

|

|

|

22,914 |

|

|

|

22,957 |

|

|

|

22,955 |

|

|

|

24,956 |

|

|

Bank-owned life insurance

|

|

|

18,469 |

|

|

|

18,556 |

|

|

|

18,644 |

|

|

|

18,731 |

|

|

|

18,815 |

|

|

Deferred taxes

|

|

|

4,512 |

|

|

|

4,979 |

|

|

|

5,476 |

|

|

|

5,395 |

|

|

|

5,480 |

|

|

Other assets

|

|

|

18,702 |

|

|

|

14,483 |

|

|

|

14,894 |

|

|

|

14,368 |

|

|

|

14,373 |

|

|

Total assets

|

|

$ |

1,487,384 |

|

|

$ |

1,505,454 |

|

|

$ |

1,526,696 |

|

|

$ |

1,544,110 |

|

|

$ |

1,575,442 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

$ |

1,261,623 |

|

|

$ |

1,275,828 |

|

|

$ |

1,303,720 |

|

|

$ |

1,315,214 |

|

|

$ |

1,374,934 |

|

|

Borrowings

|

|

|

25,000 |

|

|

|

25,000 |

|

|

|

25,000 |

|

|

|

35,000 |

|

|

|

— |

|

|

Subordinated Notes, net of unamortized issuance costs

|

|

|

19,678 |

|

|

|

19,667 |

|

|

|

19,656 |

|

|

|

19,645 |

|

|

|

19,634 |

|

|

Other liabilities

|

|

|

25,700 |

|

|

|

31,204 |

|

|

|

26,017 |

|

|

|

21,892 |

|

|

|

29,203 |

|

|

Total liabilities

|

|

|

1,332,001 |

|

|

|

1,351,699 |

|

|

|

1,374,393 |

|

|

|

1,391,751 |

|

|

|

1,423,771 |

|

|

Stockholders’ equity

|

|

|

155,383 |

|

|

|

153,755 |

|

|

|

152,303 |

|

|

|

152,359 |

|

|

|

151,671 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

1,487,384 |

|

|

$ |

1,505,454 |

|

|

$ |

1,526,696 |

|

|

$ |

1,544,110 |

|

|

$ |

1,575,442 |

|

|

(2)

|

The efficiency ratio represents noninterest expense, divided by the sum of net interest income and noninterest income. |

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023

|

|

|

2022

|

|

|

For the years ended December 31,

|

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

2023

|

|

|

2022

|

|

|

SUMMARY STATEMENT OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest income

|

|

$ |

16,923 |

|

|

$ |

16,894 |

|

|

$ |

16,178 |

|

|

$ |

16,160 |

|

|

$ |

16,064 |

|

|

$ |

66,155 |

|

|

$ |

55,296 |

|

|

Total interest expense

|

|

|

4,491 |

|

|

|

3,940 |

|

|

|

3,235 |

|

|

|

2,660 |

|

|

|

2,076 |

|

|

|

14,326 |

|

|

|

4,481 |

|

|

Net interest income

|

|

|

12,432 |

|

|

|

12,954 |

|

|

|

12,943 |

|

|

|

13,500 |

|

|

|

13,988 |

|

|

|

51,829 |

|

|

|

50,815 |

|

|

Provision for (recovery of) credit losses

|

|

|

317 |

|

|

|

136 |

|

|

|

(188 |

) |

|

|

48 |

|

|

|

743 |

|

|

|

313 |

|

|

|

1,828 |

|

|

Net interest income after provision for (recovery of) credit losses

|

|

|

12,115 |

|

|

|

12,818 |

|

|

|

13,131 |

|

|

|

13,452 |

|

|

|

13,245 |

|

|

|

51,516 |

|

|

|

48,987 |

|

|

Noninterest income

|

|

|

1,625 |

|

|

|

1,240 |

|

|

|

1,239 |

|

|

|

313 |

|

|

|

1,406 |

|

|

|

4,417 |

|

|

|

5,976 |

|

|

Noninterest expense

|

|

|

10,879 |

|

|

|

10,790 |

|

|

|

11,220 |

|

|

|

10,292 |

|

|

|

10,039 |

|

|

|

43,181 |

|

|

|

41,128 |

|

|

Income before income tax

|

|

|

2,861 |

|

|

|

3,268 |

|

|

|

3,150 |

|

|

|

3,473 |

|

|

|

4,612 |

|

|

|

12,752 |

|

|

|

13,835 |

|

|

Income tax expense

|

|

|

782 |

|

|

|

899 |

|

|

|

838 |

|

|

|

840 |

|

|

|

1,174 |

|

|

|

3,359 |

|

|

|

3,341 |

|

|

Net income

|

|

$ |

2,079 |

|

|

$ |

2,369 |

|

|

$ |

2,312 |

|

|

$ |

2,633 |

|

|

$ |

3,438 |

|

|

$ |

9,393 |

|

|

$ |

10,494 |

|

|

Basic and diluted earnings per common share

|

|

$ |

0.17 |

|

|

$ |

0.19 |

|

|

$ |

0.18 |

|

|

$ |

0.21 |

|

|

$ |

0.27 |

|

|

$ |

0.74 |

|

|

$ |

0.80 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST INCOME AND EXPENSE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit service charges and fees

|

|

$ |

836 |

|

|

$ |

836 |

|

|

$ |

830 |

|

|

$ |

816 |

|

|

$ |

835 |

|

|

$ |

3,318 |

|

|

$ |

3,271 |

|

|

Loan servicing fees

|

|

|

164 |

|

|

|

98 |

|

|

|

141 |

|

|

|

129 |

|

|

|

240 |

|

|

|

532 |

|

|

|

590 |

|

|

Trust insurance commissions and annuities income

|

|

|

347 |

|

|

|

290 |

|

|

|

276 |

|

|

|

367 |

|

|

|

266 |

|

|

|

1,280 |

|

|

|

1,153 |

|

|

Losses on sales of securities

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(454 |

) |

|

|

— |

|

|

|

(454 |

) |

|

|

— |

|

|

Gain (loss) on sale of premises and equipment

|

|

|

— |

|

|

|

— |

|

|

|

13 |

|

|

|

(4 |

) |

|

|

— |

|

|

|

9 |

|

|

|

— |

|

|

Valuation adjustment on bank premises held-for-sale

|

|

|

(17 |

) |

|

|

— |

|

|

|

(32 |

) |

|

|

(553 |

) |

|

|

— |

|

|

|

(602 |

) |

|

|

— |

|

|

Loss on bank-owned life insurance

|

|

|

(87 |

) |

|

|

(88 |

) |

|

|

(87 |

) |

|

|

(84 |

) |

|

|

(64 |

) |

|

|

(346 |

) |

|

|

(39 |

) |

|

Bank-owned life insurance death benefit

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

446 |

|

|

Other

|

|

|

382 |

|

|

|

104 |

|

|

|

98 |

|

|

|

96 |

|

|

|

129 |

|

|

|

680 |

|

|

|

555 |

|

|

Total noninterest income

|

|

$ |

1,625 |

|

|

$ |

1,240 |

|

|

$ |

1,239 |

|

|

$ |

313 |

|

|

$ |

1,406 |

|

|

$ |

4,417 |

|

|

$ |

5,976 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits

|

|

$ |

5,679 |

|

|

$ |

5,369 |

|

|

$ |

5,629 |

|

|

$ |

5,555 |

|

|

$ |

5,366 |

|

|

$ |

22,232 |

|

|

$ |

21,576 |

|

|

Office occupancy and equipment

|

|

|

1,937 |

|

|

|

2,046 |

|

|

|

2,031 |

|

|

|

2,038 |

|

|

|

1,944 |

|

|

|

8,052 |

|

|

|

7,981 |

|

|

Advertising and public relations

|

|

|

139 |

|

|

|

171 |

|

|

|

262 |

|

|

|

190 |

|

|

|

202 |

|

|

|

762 |

|

|

|

690 |

|

|

Information technology

|

|

|

974 |

|

|

|

944 |

|

|

|

965 |

|

|

|

849 |

|

|

|

926 |

|

|

|

3,732 |

|

|

|

3,566 |

|

|

Professional fees

|

|

|

292 |

|

|

|

366 |

|

|

|

355 |

|

|

|

317 |

|

|

|

262 |

|

|

|

1,330 |

|

|

|

1,292 |

|

|

Supplies, telephone, and postage

|

|

|

289 |

|

|

|

311 |

|

|

|

295 |

|

|

|

359 |

|

|

|

342 |

|

|

|

1,254 |

|

|

|

1,393 |

|

|

FDIC insurance premiums

|

|

|

207 |

|

|

|

222 |

|

|

|

282 |

|

|

|

154 |

|

|

|

111 |

|

|

|

865 |

|

|

|

467 |

|

|

Other

|

|

|

1,362 |

|

|

|

1,361 |

|

|

|

1,401 |

|

|

|

830 |

|

|

|

886 |

|

|

|

4,954 |

|

|

|

4,163 |

|

|

Total noninterest expense

|

|

$ |

10,879 |

|

|

$ |

10,790 |

|

|

$ |

11,220 |

|

|

$ |

10,292 |

|

|

$ |

10,039 |

|

|

$ |

43,181 |

|

|

$ |

41,128 |

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023

|

|

|

2022

|

|

|

For the years ended December 31,

|

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

2023

|

|

|

2022

|

|

|

LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

18,945 |

|

|

$ |

19,233 |

|

|

$ |

20,448 |

|

|

$ |

21,475 |

|

|

$ |

23,133 |

|

|

|

|

|

|

|

|

|

|

Multi–family residential real estate

|

|

|

527,460 |

|

|

|

528,251 |

|

|

|

542,165 |

|

|

|

544,673 |

|

|

|

537,394 |

|

|

|

|

|

|

|

|

|

|

Nonresidential real estate

|

|

|

118,016 |

|

|

|

117,641 |

|

|

|

120,505 |

|

|

|

123,360 |

|

|

|

119,705 |

|

|

|

|

|

|

|

|

|

|

Commercial loans and leases

|

|

|

393,321 |

|

|

|

447,687 |

|

|

|

495,520 |

|

|

|

544,216 |

|

|

|

553,056 |

|

|

|

|

|

|

|

|

|

|

Consumer

|

|

|

1,364 |

|

|

|

1,351 |

|

|

|

1,355 |

|

|

|

1,596 |

|

|

|

1,584 |

|

|

|

|

|

|

|

|

|

| |

|

|

1,059,106 |

|

|

|

1,114,163 |

|

|

|

1,179,993 |

|

|

|

1,235,320 |

|

|

|

1,234,872 |

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses

|

|

|

(8,345 |

) |

|

|

(8,559 |

) |

|

|

(9,226 |

) |

|

|

(10,032 |

) |

|

|

(8,129 |

) |

|

|

|

|

|

|

|

|

|

Loans, net

|

|

$ |

1,050,761 |

|

|

$ |

1,105,604 |

|

|

$ |

1,170,767 |

|

|

$ |

1,225,288 |

|

|

$ |

1,226,743 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN ORIGINATIONS (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

758 |

|

|

$ |

137 |

|

|

$ |

128 |

|

|

$ |

173 |

|

|

$ |

215 |

|

|

$ |

1,196 |

|

|

$ |

1,423 |

|

|

Multi–family residential real estate

|

|

|

6,226 |

|

|

|

5,902 |

|

|

|

6,686 |

|

|

|

17,097 |

|

|

|

67,888 |

|

|

|

35,911 |

|

|

|

223,918 |

|

|

Nonresidential real estate

|

|

|

3,183 |

|

|

|

834 |

|

|

|

200 |

|

|

|

5,436 |

|

|

|

7,694 |

|

|

|

9,653 |

|

|

|

43,732 |

|

|

Commercial loans

|

|

|

145,930 |

|

|

|

172,081 |

|

|

|

157,704 |

|

|

|

181,227 |

|

|

|

179,421 |

|

|

|

656,942 |

|

|

|

715,613 |

|

|

Equipment finance

|

|

|

8,141 |

|

|

|

14,442 |

|

|

|

7,290 |

|

|

|

24,623 |

|

|

|

90,157 |

|

|

|

54,496 |

|

|

|

265,227 |

|

|

Consumer

|

|

|

617 |

|

|

|

514 |

|

|

|

539 |

|

|

|

565 |

|

|

|

544 |

|

|

|

2,235 |

|

|

|

2,147 |

|

| |

|

$ |

164,855 |

|

|

$ |

193,910 |

|

|

$ |

172,547 |

|

|

$ |

229,121 |

|

|

$ |

345,919 |

|

|

$ |

760,433 |

|

|

$ |

1,252,060 |

|

|

Weighted average interest rate

|

|

|

9.09 |

% |

|

|

9.11 |

% |

|

|

9.24 |

% |

|

|

8.67 |

% |

|

|

6.88 |

% |

|

|

9.00 |

% |

|

|

5.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN PAYMENTS and PAYOFFS (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

1,049 |

|

|

$ |

1,409 |

|

|

$ |

1,139 |

|

|

$ |

1,826 |

|

|

$ |

1,525 |

|

|

$ |

5,423 |

|

|

$ |

8,378 |

|

|

Multi–family residential real estate

|

|

|

7,336 |

|

|

|

19,784 |

|

|

|

9,095 |

|

|

|

10,151 |

|

|

|

13,465 |

|

|

|

46,366 |

|

|

|

113,377 |

|

|

Nonresidential real estate

|

|

|

3,278 |

|

|

|

3,253 |

|

|

|

2,934 |

|

|

|

1,967 |

|

|

|

3,708 |

|

|

|

11,432 |

|

|

|

27,009 |

|

|

Commercial loans

|

|

|

148,964 |

|

|

|

176,493 |

|

|

|

169,402 |

|

|

|

168,461 |

|

|

|

177,205 |

|

|

|

663,320 |

|

|

|

706,162 |

|

|

Equipment finance

|

|

|

55,433 |

|

|

|

56,844 |

|

|

|

43,567 |

|

|

|

45,250 |

|

|

|

64,144 |

|

|

|

201,094 |

|

|

|

211,295 |

|

|

Consumer

|

|

|

565 |

|

|

|

529 |

|

|

|

675 |

|

|

|

615 |

|

|

|

541 |

|

|

|

2,384 |

|

|

|

2,210 |

|

| |

|

$ |

216,625 |

|

|

$ |

258,312 |

|

|

$ |

226,812 |

|

|

$ |

228,270 |

|

|

$ |

260,588 |

|

|

$ |

930,019 |

|

|

$ |

1,068,431 |

|

|

Weighted average interest rate

|

|

|

7.85 |

% |

|

|

7.86 |

% |

|

|

8.35 |

% |

|

|

8.20 |

% |

|

|

6.97 |

% |

|

|

8.06 |

% |

|

|

5.56 |

% |

| (1) |

Loan originations include purchased loans, draws on revolving lines of credit and exclude loan renewals. |

| (2) |

Loan payments and payoffs exclude loan renewals. |

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023

|

|

|

2022

|

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

CREDIT QUALITY:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

37 |

|

|

$ |

40 |

|

|

$ |

45 |

|

|

$ |

55 |

|

|

$ |

92 |

|

|

Multi–family residential real estate

|

|

|

— |

|

|

|

— |

|

|

|

148 |

|

|

|

— |

|

|

|

— |

|

|

Equipment finance

|

|

|

21,294 |

|

|

|

23,468 |

|

|

|

23,965 |

|

|

|

8,807 |

|

|

|

1,310 |

|

|

Consumer

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

| |

|

|

21,331 |

|

|

|

23,508 |

|

|

|

24,158 |

|

|

|

8,862 |

|

|

|

1,407 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans past due over 90 days, still accruing

|

|

|

1,007 |

|

|

|

6,245 |

|

|

|

— |

|

|

|

— |

|

|

|

238 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreclosed assets, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other real estate owned

|

|

|

405 |

|

|

|

468 |

|

|

|

472 |

|

|

|

472 |

|

|

|

472 |

|

|

Other foreclosed assets

|

|

|

2,372 |

|

|

|

434 |

|

|

|

478 |

|

|

|

921 |

|

|

|

4 |

|

| |

|

|

2,777 |

|

|

|

902 |

|

|

|

950 |

|

|

|

1,393 |

|

|

|

476 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets

|

|

$ |

25,115 |

|

|

$ |

30,655 |

|

|

$ |

25,108 |

|

|

$ |

10,255 |

|

|

$ |

2,121 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets to total assets

|

|

|

1.69 |

% |

|

|

2.04 |

% |

|

|

1.64 |

% |

|

|

0.66 |

% |

|

|

0.13 |

% |

|

Nonperforming loans to total loans (1)

|

|

|

2.11 |

|

|

|

2.67 |

|

|

|

2.05 |

|

|

|

0.72 |

|

|

|

0.13 |

|

|

Nonperforming commercial-related loans to total commercial-related loans (2)

|

|

|

2.15 |

|

|

|

2.72 |

|

|

|

2.08 |

|

|

|

0.73 |

|

|

|

0.13 |

|

|

Nonperforming residential and consumer loans to total residential and consumer loans

|

|

|

0.18 |

|

|

|

0.19 |

|

|

|

0.21 |

|

|

|

0.24 |

|

|

|

0.39 |

|

|

Allowance for credit losses to nonperforming loans

|

|

|

37.36 |

|

|

|

28.77 |

|

|

|

38.19 |

|

|

|

113.20 |

|

|

|

494.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concentrations of Credit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate for FFIEC concentration limits

|

|

$ |

624,575 |

|

|

$ |

624,469 |

|

|

$ |

641,022 |

|

|

$ |

645,768 |

|

|

$ |

634,482 |

|

|

% FFIEC total capital

|

|

|

370.83 |

% |

|

|

363.55 |

% |

|

|

372.44 |

% |

|

|

374.63 |

% |

|

|

365.95 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multi–family residential real estate loans - 50% risk based capital qualified (included above)

|

|

$ |

315,179 |

|

|

$ |

248,128 |

|

|

$ |

175,902 |

|

|

$ |

122,213 |

|

|

$ |

101,052 |

|

|

% FFIEC total capital

|

|

|

187.13 |

% |

|

|

144.45 |

% |

|

|

102.20 |

% |

|

|

70.90 |

% |

|

|

58.28 |

% |

|

(1)

|

Nonperforming loans include nonaccrual loans and loans past due 90 days and still accruing.

|

|

(2)

|

Commercial-related loans include multi-family residential real estate, nonresidential real estate, and commercial loans and leases.

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023 |

|

|

2022 |

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

SUBSTANDARD PERFORMING LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

272 |

|

|

$ |

282 |

|

|

$ |

272 |

|

|

$ |

280 |

|

|

$ |

327 |

|

|

Multi–family residential real estate

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

148 |

|

|

|

— |

|

|

Commercial loans and leases

|

|

|

4,056 |

|

|

|

5,685 |

|

|

|

3,759 |

|

|

|

3,846 |

|

|

|

4,041 |

|

|

Consumer

|

|

|

3 |

|

|

|

3 |

|

|

|

5 |

|

|

|

5 |

|

|

|

4 |

|

| |

|

$ |

4,331 |

|

|

$ |

5,970 |

|

|

$ |

4,036 |

|

|

$ |

4,279 |

|

|

$ |

4,372 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWANCE FOR CREDIT LOSSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning balance

|

|

$ |

8,559 |

|

|

$ |

9,226 |

|

|

$ |

10,032 |

|

|

$ |

8,129 |

|

|

$ |

7,386 |

|

|

Impact of adopting ASC 326

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,907 |

|

|

|

— |

|

|

Charge–offs:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One-to-four family residential real estate

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Commercial loans and leases

|

|

|

(570 |

) |

|

|

(889 |

) |

|

|

(638 |

) |

|

|

(79 |

) |

|

|

(1 |

) |

|

Consumer

|

|

|

(9 |

) |

|

|

(14 |

) |

|

|

(7 |

) |

|

|

(22 |

) |

|

|

(12 |

) |

| |

|

|

(580 |

) |

|

|

(903 |

) |

|

|

(645 |

) |

|

|

(101 |

) |

|

|

(13 |

) |

|

Recoveries:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

|

1 |

|

|

|

32 |

|

|

|

7 |

|

|

|

5 |

|

|

|

4 |

|

|

Multi–family residential real estate

|

|

|

5 |

|

|

|

4 |

|

|

|

6 |

|

|

|

5 |

|

|

|

5 |

|

|

Commercial loans and leases

|

|

|

50 |

|

|

|

20 |

|

|

|

6 |

|

|

|

1 |

|

|

|

4 |

|

|

Consumer

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| |

|

|

56 |

|

|

|

56 |

|

|

|

19 |

|

|

|

12 |

|

|

|

13 |

|

|

Net charge–offs

|

|

|

(524 |

) |

|

|

(847 |

) |

|

|

(626 |

) |

|

|

(89 |

) |

|

|

— |

|

|

Provision for (recovery of) credit losses

|

|

|

310 |

|

|

|

180 |

|

|

|

(180 |

) |

|

|

85 |

|

|

|

743 |

|

|

Ending balance

|

|

$ |

8,345 |

|

|

$ |

8,559 |

|

|

$ |

9,226 |

|

|

$ |

10,032 |

|

|

$ |

8,129 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses to total loans

|

|

|

0.79 |

% |

|

|

0.77 |

% |

|

|

0.78 |

% |

|

|

0.81 |

% |

|

|

0.66 |

% |

|

Net charge–offs ratio (1)

|

|

|

(0.19 |

) |

|

|

(0.30 |

) |

|

|

(0.21 |

) |

|

|

(0.03 |

) |

|

|

— |

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023 |

|

|

2022 |

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

DEPOSITS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest–bearing demand

|

|

$ |

260,851 |

|

|

$ |

258,318 |

|

|

$ |

278,170 |

|

|

$ |

287,493 |

|

|

$ |

280,625 |

|

|

Interest–bearing NOW accounts

|

|

|

306,548 |

|

|

|

326,874 |

|

|

|

349,374 |

|

|

|

360,441 |

|

|

|

400,416 |

|

|

Money market accounts

|

|

|

297,074 |

|

|

|

291,154 |

|

|

|

271,194 |

|

|

|

273,256 |

|

|

|

302,863 |

|

|

Savings deposits

|

|

|

174,759 |

|

|

|

178,318 |

|

|

|

190,277 |

|

|

|

200,659 |

|

|

|

204,506 |

|

|

Certificates of deposit - retail

|

|

|

222,391 |

|

|

|

220,915 |

|

|

|

214,456 |

|

|

|

193,116 |

|

|

|

186,524 |

|

|

Certificates of deposit - wholesale

|

|

|

— |

|

|

|

249 |

|

|

|

249 |

|

|

|

249 |

|

|

|

— |

|

| |

|

$ |

1,261,623 |

|

|

$ |

1,275,828 |

|

|

$ |

1,303,720 |

|

|

$ |

1,315,214 |

|

|

$ |

1,374,934 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED AVERAGE BALANCES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average assets

|

|

$ |

1,492,759 |

|

|

$ |

1,511,422 |

|

|

$ |

1,526,246 |

|

|

$ |

1,553,445 |

|

|

$ |

1,605,375 |

|

|

Total average interest–earning assets

|

|

|

1,425,504 |

|

|

|

1,444,259 |

|

|

|

1,459,369 |

|

|

|

1,494,248 |

|

|

|

1,546,499 |

|

|

Average loans

|

|

|

1,088,172 |

|

|

|

1,141,788 |

|

|

|

1,206,175 |

|

|

|

1,225,636 |

|

|

|

1,158,474 |

|

|

Average securities

|

|

|

171,903 |

|

|

|

170,806 |

|

|

|

176,052 |

|

|

|

212,344 |

|

|

|

215,359 |

|

|

Average stock in FHLB & FRB

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

Average other interest–earning assets

|

|

|

157,939 |

|

|

|

124,175 |

|

|

|

69,652 |

|

|

|

48,778 |

|

|

|

165,176 |

|

|

Total average interest–bearing liabilities

|

|

|

1,046,249 |

|

|

|

1,055,874 |

|

|

|

1,066,332 |

|

|

|

1,099,950 |

|

|

|

1,123,780 |

|

|

Average interest–bearing deposits

|

|

|

1,001,576 |

|

|

|

1,011,212 |

|

|

|

1,021,023 |

|

|

|

1,066,321 |

|

|

|

1,104,152 |

|

|

Average borrowings and Subordinated Notes

|

|

|

44,673 |

|

|

|

44,662 |

|

|

|

45,309 |

|

|

|

33,629 |

|

|

|

19,628 |

|

|

Average stockholders’ equity

|

|

|

154,927 |

|

|

|

153,796 |

|

|

|

153,703 |

|

|

|

151,417 |

|

|

|

152,672 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED YIELDS AND COST OF FUNDS (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average interest–earning assets

|

|

|

4.71 |

% |

|

|

4.64 |

% |

|

|

4.45 |

% |

|

|

4.39 |

% |

|

|

4.12 |

% |

|

Average loans

|

|

|

4.99 |

|

|

|

4.96 |

|

|

|

4.77 |

|

|

|

4.76 |

|

|

|

4.57 |

|

|

Average securities

|

|

|

2.18 |

|

|

|

1.88 |

|

|

|

1.92 |

|

|

|

2.13 |

|

|

|

2.04 |

|

|

Average other interest–earning assets

|

|

|

5.47 |

|

|

|

5.42 |

|

|

|

5.14 |

|

|

|

4.66 |

|

|

|

3.69 |

|

|

Total average interest–bearing liabilities

|

|

|

1.70 |

|

|

|

1.48 |

|

|

|

1.22 |

|

|

|

0.98 |

|

|

|

0.73 |

|

|

Average interest–bearing deposits

|

|

|

1.59 |

|

|

|

1.36 |

|

|

|

1.08 |

|

|

|

0.87 |

|

|

|

0.67 |

|

|

Average cost of total deposits

|

|

|

1.26 |

|

|

|

1.07 |

|

|

|

0.85 |

|

|

|

0.70 |

|

|

|

0.53 |

|

|

Average cost of retail and commercial deposits

|

|

|

1.59 |

|

|

|

1.36 |

|

|

|

1.08 |

|

|

|

0.87 |

|

|

|

0.67 |

|

|

Average cost of wholesale deposits, borrowings and Subordinated Notes

|

|

|

4.18 |

|

|

|

4.18 |

|

|

|

4.21 |

|

|

|

4.34 |

|

|

|

4.01 |

|

|

Average cost of funds

|

|

|

1.36 |

|

|

|

1.18 |

|

|

|

0.96 |

|

|

|

0.79 |

|

|

|

0.58 |

|

|

Net interest rate spread

|

|

|

3.01 |

|

|

|

3.16 |

|

|

|

3.23 |

|

|

|

3.41 |

|

|

|

3.39 |

|

|

Net interest margin

|

|

|

3.46 |

|

|

|

3.56 |

|

|

|

3.56 |

|

|

|

3.66 |

|

|

|

3.59 |

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2023 |

|

|

2022 |

|

| |

|

IVQ

|

|

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

CAPITAL RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BankFinancial Corporation (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity to total assets (end of period)

|

|

|

10.45 |

% |

|

|

10.21 |

% |

|

|

9.98 |

% |

|

|

9.87 |

% |

|

|

9.63 |

% |

|

Tangible equity to tangible total assets (end of period)

|

|

|

10.45 |

|

|

|

10.21 |

|

|

|

9.98 |

|

|

|

9.87 |

|

|

|

9.63 |

|

|

Risk–based total capital ratio

|

|

|

20.70 |

|

|

|

19.13 |

|

|

|

17.75 |

|

|

|

16.98 |

|

|

|

17.00 |

|

|

Common Tier 1 (CET1)

|

|

|

17.66 |

|

|

|

16.30 |

|

|

|

15.05 |

|

|

|

14.34 |

|

|

|

14.43 |

|

|

Risk–based tier 1 capital ratio

|

|

|

17.66 |

|

|

|

16.30 |

|

|

|

15.05 |

|

|

|

14.34 |

|

|

|

14.43 |

|

|

Tier 1 leverage ratio

|

|

|

10.54 |

|

|

|

10.38 |

|

|

|

10.23 |

|

|

|

10.03 |

|

|

|

9.73 |

|

|

Tier 1 capital

|

|

$ |

157,246 |

|

|

$ |

156,780 |

|

|

$ |

156,050 |

|

|

$ |

155,789 |

|

|

$ |

156,086 |

|

|

BankFinancial, NA (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk–based total capital ratio

|

|

|

18.96 |

% |

|

|

17.90 |

% |

|

|

16.64 |

% |

|

|

15.88 |

% |

|

|

16.04 |

% |

|

Common Tier 1 (CET1)

|

|

|

18.13 |

|

|

|

17.10 |

|

|

|

15.83 |

|

|

|

15.04 |

|

|

|

15.28 |

|

|

Risk–based tier 1 capital ratio

|

|

|

18.13 |

|

|

|

17.10 |

|

|

|

15.83 |

|

|

|

15.04 |

|

|

|

15.28 |

|

|

Tier 1 leverage ratio

|

|

|

10.85 |

|

|

|

10.93 |

|

|

|

10.80 |

|

|

|

10.52 |

|

|

|

10.31 |

|

|

Tier 1 capital

|

|

$ |

161,037 |

|

|

$ |

164,172 |

|

|

$ |

163,806 |

|

|

$ |

163,249 |

|

|

$ |

165,252 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCK AND DIVIDENDS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Prices:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

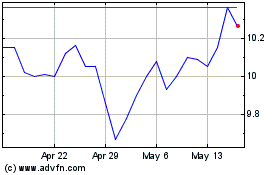

Close

|

|

$ |

10.26 |

|

|

$ |

8.62 |

|

|

$ |

8.18 |

|

|

$ |

8.75 |

|

|

$ |

10.53 |

|

|

High

|

|

|

10.76 |

|

|

|

9.11 |

|

|

|

8.94 |

|

|

|

10.59 |

|

|

|

10.60 |

|

|

Low

|

|

|

8.31 |

|

|

|

7.98 |

|

|

|

7.17 |

|

|

|

8.55 |

|

|

|

9.06 |

|

|

Common shares outstanding

|

|

|

12,475,881 |

|

|

|

12,547,390 |

|

|

|

12,600,478 |

|

|

|

12,693,993 |

|

|

|

12,742,597 |

|

|

Book value per share

|

|

$ |

12.45 |

|

|

$ |

12.25 |

|

|

$ |

12.09 |

|

|

$ |

12.00 |

|

|

$ |

11.90 |

|

|

Tangible book value per share

|

|

$ |

12.45 |

|

|

$ |

12.25 |

|

|

$ |

12.09 |

|

|

$ |

12.00 |

|

|

$ |

11.90 |

|

|

Cash dividends declared on common stock

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

Dividend payout ratio

|

|

|

60.33 |

% |

|

|

53.16 |

% |

|

|

54.88 |

% |

|

|

48.36 |

% |

|

|

37.45 |

% |

|

Stock repurchases

|

|

$ |

676 |

|

|

$ |

471 |

|

|

$ |

744 |

|

|

$ |

502 |

|

|

$ |

1,760 |

|

|

Stock repurchases – shares

|

|

|

71,509 |

|

|

|

53,088 |

|

|

|

93,515 |

|

|

|

48,604 |

|

|

|

179,577 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE COMPUTATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

2,079 |

|

|

$ |

2,369 |

|

|

$ |

2,312 |

|

|

$ |

2,633 |

|

|

$ |