Form 8-K - Current report

20 December 2023 - 8:15AM

Edgar (US Regulatory)

false

0001787518

00-0000000

0001787518

2023-12-13

2023-12-13

0001787518

BRLI:UnitsEachConsistingOfOneOrdinaryShareOneRightAndOneRedeemableWarrantMember

2023-12-13

2023-12-13

0001787518

BRLI:OrdinarySharesNoParValuePerShareMember

2023-12-13

2023-12-13

0001787518

BRLI:RightsEachRightEntitlingHolderTo110OfOneOrdinaryShareMember

2023-12-13

2023-12-13

0001787518

BRLI:WarrantsEachWarrantExercisableForOneOrdinaryShareFor11.50PerShareMember

2023-12-13

2023-12-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 13, 2023

BRILLIANT ACQUISITION CORPORATION

(Exact name of registrant as specified in its charter)

| British Virgin Islands |

|

001-39341 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

99

Dan Ba Road, C-9,Putuo District,

Shanghai,

Peoples Republic of China

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (86) 021-80125497

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Units, each consisting of one Ordinary Share, one Right and one Redeemable Warrant |

|

BRLIU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Ordinary Shares, no par value per share |

|

BRLI |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Rights, each right entitling the holder to 1/10 of one Ordinary Share |

|

BRLIR |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each warrant exercisable for one Ordinary Share for $11.50 per share |

|

BRLIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.07. Submissions of Matters to a Vote

of Security Holders.

As previously reported, on February 22, 2022,

Brilliant Acquisition Corporation, a British Virgin Islands company (“Brilliant” or the “Company”),

entered into an Agreement and Plan of Merger, and on June 23, 2023, entered into an Amended and Restated Agreement and Plan of Merger

(as amended and restated and as it may be further amended, supplemented or otherwise modified from time to time, the “Merger

Agreement”), by and among Brilliant, Nukkleus Inc., a Delaware corporation (“Nukkleus”) and BRIL Merger Sub,

Inc., a Delaware corporation (“Merger Sub”). Pursuant to the terms of the Merger Agreement, Brilliant will continue

out of the British Virgin Islands and into the State of Delaware so as to re-domicile as and become a Delaware corporation, following

which, Merger Sub will merge with and into Nukkleus, with Nukkleus surviving the merger as a wholly-owned subsidiary of Brilliant, such

transactions being referred to herein as the “Business Combination.”

Brilliant initiated its special meeting of

shareholders (the “Initial Special Meeting”) on December 1, 2023 at

10:00 a.m. Eastern Time, at which time the chairman adjourned the special meeting to December 13, 2023 at 10:00 a.m. ET. On December

13, 2023 at 10:00 a.m. Eastern Time, Brilliant held its adjourned special meeting of shareholders (the “Adjourned

Special Meeting”). On the record date, there were 1,814,696 ordinary shares of Brilliant entitled to vote at the

Adjourned Special Meeting. At the Adjourned Special Meeting, there were 1,362,515 ordinary shares voted by proxy or in person, which

is 75.08% of the total outstanding shares.

Summarized below are the results of the matters

submitted to a vote at the Adjourned Special Meeting.

| Matter |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 1 – The Brilliant Business Combination Proposal - A proposal to approve the Agreement and Plan of Merger, dated as of February 22, 2022 (as amended and restated on June 23, 2023, as amended by the First Amendment to the Amended and Restated Agreement and Plan of Merger on November 1, 2023, and as it may be further amended from time to time, the “Merger Agreement”), by and between Nukkleus Inc, a Delaware Corporation (“Nukkleus”), BRIL Merger Sub, Inc. (“Merger Sub”) and the Company, and the transactions contemplated thereby (the “Business Combination”). |

|

|

1,359,686 |

|

|

|

2,829 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Proposal 2 – The Brilliant Domestication Proposal - A proposal to (a) re-domicile the Company out of the British Virgin Islands and continue as a company incorporated in the State of Delaware, prior to the Closing (the “Domestication”); (b) in connection therewith to adopt upon the Domestication taking effect the certificate of incorporation, a copy of which was attached to the Definitive Proxy Statement of Brilliant as Annex F (the “Interim Charter”) in place of the Company’s memorandum and articles of association (the “Current Charter”), which will remove or amend those provisions of the Company’s Current Charter that terminate or otherwise cease to be applicable as a result of the Domestication; and (c) to file a notice of continuation out of the British Virgin Islands with the British Virgin Islands Registrar of Corporate Affairs under Section 184 of the Companies Act of 2004 and in connection therewith to file the Interim Charter with the Secretary of State of the State of Delaware, under which the Company will be domesticated and continue as a Delaware corporation. |

|

|

1,359,686 |

|

|

|

2,829 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Proposal 3 – The Brilliant Charter Amendment Proposal - A proposal to approve the Amended and Restated Certificate of Incorporation of the Company, a copy of which was attached to the Definitive Proxy Statement of Brilliant as Annex C (the “Amended Charter”). |

|

|

1,359,686 |

|

|

|

2,829 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Proposals 4A – 4D – The Brilliant Advisory Proposals – Proposals to approve, on a non-binding advisory basis, upon four governance proposals relating to material differences between the Current Charter and the Amended Charter to be in effect upon the completion of the Business Combination , as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Brilliant Proposal 4A – to change the name of the Corporation from “Brilliant Acquisition Corporation” to “Nukkleus, Inc.” |

|

|

1,359,681 |

|

|

|

2,829 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Brilliant Proposal 4B – to change the total number of authorized shares of capital stock to (i) 40,000,000 shares of Common Stock having a par value of $0.0001 per share and 15,000,000 shares of preferred stock having a par value of $0.0001 per share. |

|

|

1,359,681 |

|

|

|

2,829 |

|

|

|

5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Brilliant Proposal 4C – to eliminate various provisions applicable only to blank check companies, including business combination requirements. |

|

|

1,359,686 |

|

|

|

2,829 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Brilliant Proposal 4D – to approve all other changes necessary or desirable in connection with the approval of the Amended Charter as part of the Business Combination. |

|

|

1,359,686 |

|

|

|

2,829 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Proposal 5 – The Brilliant Incentive Plan Proposal - A proposal to approve the Nukkleus, Inc. 2023 Equity Incentive Plan, a copy of which was attached to the Definitive Proxy Statement of Brilliant as Annex D, to be effective after consummation of the Business Combination. |

|

|

1,356,234 |

|

|

|

6,281 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Proposal 6 – The Brilliant Nasdaq Proposal - A proposal to approve: (i) for purposes of complying with Nasdaq Listing Rules 5635 (a) and (b), the issuance of more than 20% of the issued and outstanding shares of common stock and the resulting change in control in connection with the Business Combination. |

|

|

1,359,685 |

|

|

|

2,830 |

|

|

|

0 |

|

All of the proposals were approved by the Company’s

shareholders.

Item 7.01 Regulation FD Disclosure.

Brilliant currently expects to close the Business

Combination with Nukkleus in the coming days.

Cautionary Note Regarding

Forward-Looking Statements

Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking

statements in this document, including but not limited to: (i) the risk that the proposed business combination may not be completed in

a timely manner or at all, which may adversely affect the price of Nukkleus and/or Brilliant securities; (ii) the risk that the proposed

business combination may not be completed by Brilliant’s business combination deadline and the potential failure to obtain an extension

of the business combination deadline if sought by Brilliant; (iii) the failure to satisfy the conditions to the consummation of the proposed

business combination, including the approval of the proposed business combination by the stockholders of Nukkleus and/or Brilliant, the

satisfaction of the minimum trust account amount following redemptions by Brilliant’s public shareholders and the receipt of certain

governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on Nukkleus’s

business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of

Nukkleus and potential difficulties in Nukkleus employee retention as a result of the proposed business combination; (vi) the outcome

of any legal proceedings that may be instituted against Nukkleus or Brilliant related to the agreement and plan of merger or the proposed

business combination; (vii) the ability to maintain the listing of Brilliant’s securities on the Nasdaq Stock Market; (viii) the

price of Nukkleus’s and/or Brilliant’s securities, including volatility resulting from changes in the competitive and highly

regulated industries in which Nukkleus and Brilliant plan to operate, variations in performance across competitors, changes in laws and

regulations affecting Nukkleus’s business and changes in the combined capital structure; and (ix) the ability to implement business

plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional

opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks

and uncertainties described in the proxy statement/prospectus contained in Brilliant’s Form S-4 registration statement described

above, when available, including those under “Risk Factors” therein, the Annual Report on Form 10-K for Nukkleus and Brilliant,

Quarterly Reports on Form 10-Q for Nukkleus and Brilliant and other documents filed by Nukkleus and/or Brilliant from time to time with

the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties

that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and

Nukkleus and Brilliant assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise. Neither Nukkleus nor Brilliant gives any assurance that either Nukkleus

or Brilliant will achieve its expectations.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BRILLIANT ACQUISITION CORPORATION |

| |

|

|

| |

By: |

/s/ Dr. Peng Jiang |

| |

|

Name: |

Dr. Peng Jiang |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

| Dated: December 19, 2023 |

|

|

3

v3.23.4

Cover

|

Dec. 13, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 13, 2023

|

| Entity File Number |

001-39341

|

| Entity Registrant Name |

BRILLIANT ACQUISITION CORPORATION

|

| Entity Central Index Key |

0001787518

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

D8

|

| Entity Address, Address Line One |

99

Dan Ba Road

|

| Entity Address, Address Line Two |

C-9,Putuo District

|

| Entity Address, City or Town |

Shanghai

|

| Entity Address, Country |

CN

|

| City Area Code |

86

|

| Local Phone Number |

021-80125497

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Ordinary Share, one Right and one Redeemable Warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Ordinary Share, one Right and one Redeemable Warrant

|

| Trading Symbol |

BRLIU

|

| Security Exchange Name |

NASDAQ

|

| Ordinary Shares, no par value per share |

|

| Title of 12(b) Security |

Ordinary Shares, no par value per share

|

| Trading Symbol |

BRLI

|

| Security Exchange Name |

NASDAQ

|

| Rights, each right entitling the holder to 1/10 of one Ordinary Share |

|

| Title of 12(b) Security |

Rights, each right entitling the holder to 1/10 of one Ordinary Share

|

| Trading Symbol |

BRLIR

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one Ordinary Share for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one Ordinary Share for $11.50 per share

|

| Trading Symbol |

BRLIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BRLI_UnitsEachConsistingOfOneOrdinaryShareOneRightAndOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BRLI_OrdinarySharesNoParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BRLI_RightsEachRightEntitlingHolderTo110OfOneOrdinaryShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BRLI_WarrantsEachWarrantExercisableForOneOrdinaryShareFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

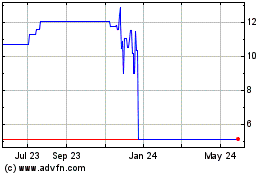

Brilliant Axquisition (NASDAQ:BRLIU)

Historical Stock Chart

From Apr 2024 to May 2024

Brilliant Axquisition (NASDAQ:BRLIU)

Historical Stock Chart

From May 2023 to May 2024