LOS ANGELES, Oct. 19 /PRNewswire-FirstCall/ -- Cathay General

Bancorp (the "Company") (NASDAQ:CATY), the holding company for

Cathay Bank (the "Bank"), today announced results for the third

quarter of 2006. STRONG FINANCIAL PERFORMANCE Third Quarter 2006

Third Quarter 2005 Net income $30.7 million $26.7 million Basic

earnings per share $0.60 $0.53 Diluted earnings per share $0.59

$0.53 Return on average assets 1.60% 1.74% Return on average

stockholders' equity 13.76% 14.22% Efficiency ratio 38.62% 37.91%

HIGHLIGHTS * Third quarter earnings increased $4.0 million, or

14.9%, compared to the same quarter a year ago. * Third quarter

diluted earnings per share reached $0.59, increasing 11.3%,

compared to the same quarter a year ago. * Return on average assets

was 1.60% for the quarter ended September 30, 2006, compared to

1.59% for the quarter ended June 30, 2006, and compared to 1.74%

for the same quarter a year ago. * Return on average stockholders'

equity was 13.76% for the quarter ended September 30, 2006,

compared to 13.70% for the quarter ended June 30, 2006, and

compared to 14.22% for the same quarter a year ago. * Gross loans

increased by $118.1 million, or 2.2%, from $5.4 billion at June 30,

2006 to $5.5 billion at September 30, 2006. * The Company completed

the acquisition of New Asia Bancorp on October 18, 2006. "We are

pleased to report another record quarter of earnings and the

completion of the acquisition of New Asia Bancorp on October 18,

2006. Steady loan growth and low credit losses were the main

factors that contributed to the record third quarter results,

despite the twenty-one basis points drop in our net interest margin

for the third quarter compared to the second quarter," commented

Dunson Cheng, Chairman of the Board, Chief Executive Officer, and

President of the Company. "We expect to open a new branch in

Dallas, Texas during the first quarter of 2007 and have also filed

an application to convert our Hong Kong representative office into

a full branch. We are pleased to welcome the customers and key

officers of New Asia Bank into the Cathay family," said Peter Wu,

Executive Vice Chairman and Chief Operating Officer. "While the

margin compression and the slowdown in loan demand continue to

present challenges, we are still optimistic that 2006 should be

another record year for Cathay General Bancorp," concluded Dunson

Cheng. INCOME STATEMENT REVIEW The comparability of financial

information is affected by our acquisitions. Operating results

included the operations of acquired entities from the date of

acquisition. Net interest income before provision for loan losses

Net interest income before provision for loan losses increased

$10.6 million, or 17.7%, to $70.7 million during the third quarter

of 2006 from $60.1 million during the same quarter a year ago. The

increase was due primarily to the strong growth in loans as well as

the acquisition of Great Eastern Bank ("GEB") on April 7, 2006. The

net interest margin, on a fully taxable-equivalent basis, was 4.06%

for the third quarter of 2006. The net interest margin decreased

twenty-one basis points from 4.27% for the second quarter of 2006

and decreased twenty- two basis points from 4.28% in the third

quarter of 2005. The decrease in the net interest margin was

primarily due to the decline in core deposits, which exclude jumbo

time certificate deposits and brokered deposits, and increased

reliance on more expensive wholesale borrowings. For the third

quarter of 2006, the yield on average interest-earning assets was

7.42% on a fully taxable-equivalent basis, and the cost of funds on

average interest-bearing liabilities equaled 4.01%. In comparison,

for the third quarter of 2005, the yield on average

interest-earning assets was 6.33% and cost of funds on average

interest-bearing liabilities equaled 2.54%. The interest spread

decreased primarily for the reasons discussed above. Provision for

loan losses The provision for loan losses was a negative $1.0

million for the third quarter of 2006 compared to a negative $1.0

million provision for loan losses for the third quarter of 2005 and

a $1.5 million provision for loan losses for the second quarter of

2006. The provision for loan losses was based on the review of the

adequacy of the allowance for loan losses at September 30, 2006.

The provision for loan losses represents the charge or credit

against current earnings that is determined by management, through

a credit review process, as the amount needed to establish an

allowance that management believes to be sufficient to absorb loan

losses inherent in the Company's loan portfolio. The following

table summarizes the charge-offs and recoveries for the quarters

shown: For the three months ended, September June 30, September

(Dollars in thousands) 30, 2006 2006 30, 2005 Charge-offs $36 $544

$-- Recoveries 310 422 881 Net Charge-offs (Recoveries) $(274) $122

$(881) Non-interest income Non-interest income, which includes

revenues from depository service fees, letters of credit

commissions, securities gains (losses), gains (losses) on loan

sales, wire transfer fees, and other sources of fee income, was

$5.4 million for the third quarter of 2006, a decrease of $449,000,

or 7.7%, compared to the non-interest income of $5.9 million for

the third quarter of 2005. Depository service fees decreased

$312,000, or 21.5%, from $1.4 million in the third quarter of 2005

to $1.1 million in the third quarter of 2006 due primarily to the

reclassification of certain wire transfer fees from depository

service fees to other operating income in 2006. Other operating

income decreased $558,000, or 17.6%, from $3.2 million in the third

quarter of 2005 to $2.6 million in the third quarter of 2006

primarily due to the decrease in warrant mark-to-market income of

$485,000, the decrease in wealth management commissions of

$292,000, and venture capital investment write-downs of $257,000.

Offsetting the decreases were a $204,000 increase in wire transfer

fees due to the acquisition of GEB, a $105,000 increase in safe

deposit box commission and a $130,000 increase in other loan fees.

The above decreases were partially offset by the increase in

letters of credit commissions. Letters of credit commissions

increased $384,000, or 36.3%, to $1.4 million in the third quarter

of 2006 from $1.1 million in the third quarter of 2005 primarily

due to a $136,000 increase in standby letter of credit commissions

and a $104,000 increase in export letter of credit commissions.

Non-interest expense Non-interest expense increased $4.4 million,

or 17.6%, to $29.4 million for the third quarter of 2006 compared

to the same quarter a year ago. The efficiency ratio was 38.62% for

the third quarter of 2006 compared to 37.91% in the year ago

quarter and 37.85% for the second quarter of 2006. The increase of

non-interest expense from the third quarter a year ago to the third

quarter of 2006 was primarily due to the following: * Salaries and

employee benefits increased $2.5 million, or 19.1%, from $13.4

million in the third quarter of 2005 to $15.9 million in the third

quarter of 2006 due primarily to the merger with GEB and a $497,000

decrease in the amount of loan origination related salaries expense

capitalized during the current quarter. * Occupancy expenses

increased $204,000, or 8.4%, primarily due to the increases in

depreciation expenses and utility expenses. * Computer and

equipment expenses increased $204,000, or 12.2%, primarily due to a

$111,000 increase in depreciation expenses. * Marketing expenses

increased $240,000, or 49.7%, in the third quarter of 2006 compared

to the same quarter a year ago mainly due to increased media and

promotion expenses. * Expenses from operation of affordable housing

investments increased $404,000, or 39.4%, to $1.4 million compared

to $1.0 million in the same quarter a year ago as a result of

additional investments in affordable housing in 2004 and 2005. *

Amortization of core deposit premium increased $397,000, or 28.3%,

due to the merger with GEB. * Other operating expenses increased

$479,000, or 23.5%, due to increases in contract termination

charges of $102,000, higher travel expenses related to GEB, and

settlement of litigation. Income taxes The effective tax rate was

35.7% for the third quarter of 2006, compared to 36.3% for the same

quarter a year ago and 37.5% for the full year 2005. The decrease

in the effective tax rate was primarily due to the resolution of

certain tax issues and a lower projected income for the full year.

As previously disclosed, on December 31, 2003, the California

Franchise Tax Board (FTB) announced its intent to list certain

transactions that in its view constitute potentially abusive tax

shelters. Included in the transactions subject to this listing were

transactions utilizing regulated investment companies (RICs) and

real estate investment trusts (REITs). As part of the notification

indicating the listed transactions, the FTB also indicated its

position that it intends to disallow tax benefits associated with

these transactions. While the Company continues to believe that the

tax benefits recorded in three prior years with respect to its RIC

were appropriate and fully defensible under California law, the

Company has deemed it prudent to participate in Voluntary

Compliance Initiative -- Option 2, requiring payment of all

California taxes and interest on these disputed 2000 through 2002

tax benefits, and permitting the Company to claim a refund for

these years while avoiding certain potential penalties. The Company

retains potential exposure for assertion of an accuracy-related

penalty should the FTB prevail in its position in addition to the

risk of not being successful in its refund claims. As of September

30, 2006, the Company reflected a $12.1 million net state tax

receivable for the years 2000, 2001, and 2002 after giving effect

to reserves for loss contingencies on the refund claims, or an

equivalent of $7.9 million after giving effect to Federal tax

benefits. The FTB is currently in the process of reviewing and

assessing our refund claims for taxes and interest for tax years

2000 through 2002. Although the Company believes its tax deductions

related to the regulated investment company were appropriate and

fully defensible, there can be no assurance of the outcome of its

refund claims, and an adverse outcome on the refund claims could

result in a loss of all or a portion of the $7.9 million net state

tax receivable after giving effect to Federal tax benefits. BALANCE

SHEET REVIEW Total assets increased by $1.2 billion, or 19.3%, to

$7.6 billion at September 30, 2006 from year-end 2005 of $6.4

billion. The increase in total assets was represented primarily by

loan growth and investment securities increase funded by growth of

deposits and borrowings. At April 6, 2006, the closing date of the

tender offer for GEB, the total fair value of GEB's assets was

approximately $332.5 million excluding intangible assets. The

growth of gross loans to $5.5 billion as of September 30, 2006,

from $4.6 billion as of December 31, 2005, represents an increase

of $873.3 million, or 18.8%, of which $216.9 million resulted from

the acquisition of GEB on April 7, 2006. The changes in the loan

composition from December 31, 2005, are presented below: September

30, December 31, % Type of Loans: 2006 2005 Change (Dollars in

thousands) Commercial $1,155,113 $1,110,401 4 Residential mortgage

398,174 326,249 22 Commercial mortgage 3,156,284 2,590,752 22

Equity lines 111,497 105,040 6 Real estate construction 683,625

500,027 37 Installment 13,671 13,662 0 Other 2,721 1,684 62 Gross

loans and leases $5,521,085 $4,647,815 19 Allowance for loan losses

(64,380) (60,251) 7 Unamortized deferred loan fees (14,018)

(12,733) 10 Total loans and leases, net $5,442,687 $4,574,831 19

Total deposits increased $551.2 million, or 11.2%, to $5.5 billion

from December 31, 2005, of $4.9 billion, of which $294.0 million

resulted from the acquisition of GEB on April 7, 2006. The changes

in the deposit composition from December 31, 2005, are presented

below: September 30, December 31, % Deposits 2006 2005 Change

(Dollars in thousands) Non-interest-bearing demand $783,902

$726,722 8 NOW 223,776 240,885 (7) Money market 609,072 523,076 16

Savings 352,799 364,793 (3) Time deposits under $100,000 957,625

641,411 49 Time deposits of $100,000 or more 2,540,414 2,419,463 5

Total deposits $5,467,588 $4,916,350 11 At September 30, 2006,

brokered deposits included in time deposits under $100,000 in table

above totaled $232.6 million compared to no brokered deposits at

December 31, 2005. Advances from the Federal Home Loan Bank

increased $380.2 million to $595.2 million at September 30, 2006,

compared to $215.0 million at December 31, 2005. Securities sold

under agreement to repurchase increased from $200.0 million at

December 31, 2005, to $400.0 million at September 30, 2006. On

September 29, 2006, the Bank issued $50 million of subordinated

debt which qualifies as Tier 2 capital and has a final maturity of

ten years. Federal funds purchased decreased $109.0 million to

$10.0 million at September 30, 2006, from $119.0 million at

December 31, 2005. ASSET QUALITY REVIEW Non-performing assets to

gross loans and other real estate owned was 0.57% at September 30,

2006, compared to 0.39% at December 31, 2005. Total non-performing

assets increased $13.7 million to $31.6 million at September 30,

2006, compared with $17.9 million at December 31, 2005, due to a

$4.4 million increase in other real estate owned, a $7.3 million

increase in non-accrual loans, and a $2.0 million increase in

accruing loans past due 90 days or more. The allowance for loan

losses amounted to $64.4 million at September 30, 2006, and

represented the amount that the Company believes to be sufficient

to absorb loan losses inherent in the Company's loan portfolio. The

allowance for loan losses represented 1.17% of period-end gross

loans and 237% of non-performing loans at September 30, 2006. The

comparable ratios were 1.30% of gross loans and 337% of

non-performing loans at December 31, 2005. Results of the changes

to the Company's non-performing assets and troubled debt

restructurings are highlighted below: September 30, December 31,

(Dollars in thousands) 2006 2005 % Change Non-performing assets

Accruing loans past due 90 days or more $4,110 $2,106 95

Non-accrual loans 23,111 15,799 46 Total non-performing loans

27,221 17,905 52 Other real estate owned 4,347 0 100 Total

non-performing assets $31,568 $17,905 76 Troubled debt

restructurings $5,848 $3,088 89 Trouble debt restructurings

increased $2.7 million to $5.8 million at September 30, 2006 from

$3.1 million at December 31, 2005. CAPITAL ADEQUACY REVIEW At

September 30, 2006, the Tier 1 risk-based capital ratio of 9.47%,

total risk-based capital ratio of 11.14%, and Tier 1 leverage

capital ratio of 8.91%, continue to place the Company in the "well

capitalized" category, which is defined as institutions with a Tier

1 risk-based capital ratio equal to or greater than six percent, a

total risk-based capital ratio equal to or greater than ten

percent, and a Tier 1 leverage capital ratio equal to or greater

than five percent. At December 31, 2005, the Company's Tier 1

risk-based capital ratio was 10.61%, the total risk-based capital

ratio was 11.72%, and Tier 1 leverage capital ratio was 9.80%. No

shares were repurchased during the third quarter of 2006. At

September 30, 2006, 451,703 shares remain under the Company's

latest stock buyback authorization which was announced on March 18,

2005. YEAR-TO-DATE REVIEW Net income was $87.0 million, or $1.69

per diluted share for the nine months ended September 30, 2006, an

increase of $9.6 million, or 12.5%, in net income over the $77.4

million, or $1.52 per diluted share for the same period a year ago

due primarily to an increase in net interest income. The net

interest margin for the nine months ended September 30, 2006,

decreased 2 basis points to 4.22% compared to 4.24% in the same

period a year ago. Return on average stockholders' equity was

13.83% and return on average assets was 1.62% for the nine months

of 2006, compared to a return on average stockholders' equity of

14.09% and a return on average assets of 1.69% for the nine months

of 2005. The efficiency ratio for the nine months ended September

30, 2006 was 37.55% compared to 36.76% during the same period a

year ago. ABOUT CATHAY GENERAL BANCORP Cathay General Bancorp is

the holding company for Cathay Bank, a California state-chartered

bank. Founded in 1962, Cathay Bank offers a wide range of financial

services. Cathay Bank currently operates thirty branches in

California, nine branches in New York State, three branches in

Chicago, Illinois, one in Massachusetts, one in Houston, Texas, two

in Washington State, a loan production office in Dallas, Texas, and

representative offices in Taipei, Hong Kong, and Shanghai. Cathay

Bank's website is found at http://www.cathaybank.com/.

FORWARD-LOOKING STATEMENTS AND OTHER NOTICES Statements made in

this press release, other than statements of historical fact, are

forward-looking statements within the meaning of the applicable

provisions of the Private Securities Litigation Reform Act of 1995

regarding management's beliefs, projections, and assumptions

concerning future results and events. These forward-looking

statements may include, but are not limited to, such words as

"believes," "expects," "anticipates," "intends," "plans,"

"estimates," "may," "will," "should," "could," "predicts,"

"potential," "continue," or the negative of such terms and other

comparable terminology or similar expressions. Forward-looking

statements are not guarantees. They involve known and unknown

risks, uncertainties, and other factors that may cause the actual

results, performance, or achievements of Cathay General Bancorp to

be materially different from any future results, performance, or

achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties and other factors include,

but are not limited to, adverse developments or conditions related

to or arising from: expansion into new market areas; acquisitions

of other banks, if any; fluctuations in interest rates; demographic

changes; earthquake or other natural disasters; competitive

pressures; deterioration in asset or credit quality; changes in the

availability of capital; legislative and regulatory developments;

changes in business strategy, including the formation of a real

estate investment trust; general economic or business conditions in

California and other regions where the Bank has operations. These

and other factors are further described in Cathay General Bancorp's

Annual Report on Form 10-K for the year ended December 31, 2005,

its reports and registration statements filed with the Securities

and Exchange Commission ("SEC") and other filings it makes in the

future with the SEC from time to time. Cathay General Bancorp has

no intention and undertakes no obligation to update any

forward-looking statements or to publicly announce the results of

any revision of any forward-looking statement to reflect future

developments or events. Cathay General Bancorp's filings with the

SEC are available to the public from commercial document retrieval

services and at the website maintained by the SEC at

http://www.sec.gov/, or by request directed to Cathay General

Bancorp, 777 N. Broadway, Los Angeles, CA 90012, Attention:

Investor Relations (213) 625-4749. CATHAY GENERAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) (Dollars in

thousands, except per Three months ended September 30, share data)

2006 2005 % Change FINANCIAL PERFORMANCE Net interest income before

provision for loan losses $70,683 $60,058 18 (Reversal)/provision

for loan losses (1,000) (1,000) -- Net interest income after

(reversal)/ provision for loan losses 71,683 61,058 17 Non-interest

income 5,404 5,853 (8) Non-interest expense 29,383 24,989 18 Income

before income tax expense 47,704 41,922 14 Income tax expense

17,046 15,237 12 Net income $30,658 $26,685 15 Net income per

common share: Basic $0.60 $0.53 13 Diluted $0.59 $0.53 11 Cash

dividends paid per common share $0.09 $0.09 -- SELECTED RATIOS

Return on average assets 1.60% 1.74% (8) Return on average

stockholders' equity 13.76% 14.22% (3) Efficiency ratio 38.62%

37.91% 2 Dividend payout ratio 15.12% 16.90% (11) YIELD ANALYSIS

(Fully taxable equivalent) Total interest-earning assets 7.42%

6.33% 17 Total interest-bearing liabilities 4.01% 2.54% 58 Net

interest spread 3.41% 3.79% (10) Net interest margin 4.06% 4.28%

(5) (Dollars in thousands, except per Nine months ended September

30, share data) 2006 2005 % Change FINANCIAL PERFORMANCE Net

interest income before provision for loan losses $206,875 $178,010

16 (Reversal)/provision for loan losses 2,000 (500) (500) Net

interest income after (reversal)/ provision for loan losses 204,875

178,510 15 Non-interest income 16,229 17,305 (6) Non-interest

expense 83,779 71,796 17 Income before income tax expense 137,325

124,019 11 Income tax expense 50,279 46,640 8 Net income $87,046

$77,379 12 Net income per common share: Basic $1.71 $1.53 12

Diluted $1.69 $1.52 11 Cash dividends paid per common share $0.27

$0.27 -- SELECTED RATIOS Return on average assets 1.62% 1.69% (4)

Return on average stockholders' equity 13.83% 14.09% (2) Efficiency

ratio 37.55% 36.76% 2 Dividend payout ratio 15.84% 17.63% (10)

YIELD ANALYSIS (Fully taxable equivalent) Total interest-earning

assets 7.23% 6.04% 20 Total interest-bearing liabilities 3.62%

2.22% 63 Net interest spread 3.61% 3.82% (5) Net interest margin

4.22% 4.24% (0) CAPITAL RATIOS September September December 30,

2006 30, 2005 31, 2005 Tier 1 risk-based capital ratio 9.47% 10.68%

10.61% Total risk-based capital ratio 11.14% 11.86% 11.72% Tier 1

leverage capital ratio 8.91% 9.61% 9.80% CATHAY GENERAL BANCORP

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) September 30,

December 31, 2006 2005 % change (In thousands, except share and per

share data) Assets Cash and due from banks $108,649 $109,275 (1)

Securities available-for-sale (amortized cost of $1,465,688 at

September 30, 2006 and $1,240,308 at December 31, 2005) 1,444,425

1,217,438 19 Loans 5,521,085 4,647,815 19 Less: Allowance for loan

losses (64,380) (60,251) 7 Unamortized deferred loan fees, net

(14,018) (12,733) 10 Loans, net 5,442,687 4,574,831 19 Federal Home

Loan Bank stock 35,140 29,698 18 Other real estate owned, net 4,347

-- 100 Affordable housing investments, net 75,899 80,211 (5)

Premises and equipment, net 65,148 30,290 115 Customers' liability

on acceptances 26,923 16,153 67 Accrued interest receivable 34,351

24,767 39 Goodwill 303,491 239,527 27 Other intangible assets, net

43,258 41,508 4 Other assets 47,248 33,805 40 Total assets

$7,631,566 $6,397,503 19 Liabilities and Stockholders' Equity

Deposits Non-interest-bearing demand deposits $783,902 $726,722 8

Interest-bearing deposits: NOW deposits 223,776 240,885 (7) Money

market deposits 609,072 523,076 16 Savings deposits 352,799 364,793

(3) Time deposits under $100,000 957,625 641,411 49 Time deposits

of $100,000 or more 2,540,414 2,419,463 5 Total deposits 5,467,588

4,916,350 11 Federal funds purchased 10,000 119,000 (92) Securities

sold under agreement to repurchase 400,000 200,000 100 Advances

from the Federal Home Loan Bank 595,180 215,000 177 Other

borrowings from financial institutions 35,000 20,000 75 Other

borrowings from affordable housing investments 20,011 20,507 (2)

Long-term debt 104,125 53,976 93 Acceptances outstanding 26,923

16,153 67 Minority interest in consolidated subsidiaries 8,500

8,500 -- Other liabilities 61,429 54,400 13 Total liabilities

6,728,756 5,623,886 20 Commitments and contingencies -- -- -- Total

stockholders' equity 902,810 773,617 17 Total liabilities and

stockholders' equity $7,631,566 $6,397,503 19 Book value per share

$17.51 $15.41 14 Number of common stock shares outstanding

51,548,829 50,191,089 CATHAY GENERAL BANCORP CONDENSED CONSOLIDATED

STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Unaudited) Three

months ended Nine months ended September 30, September 30, 2006

2005 2006 2005 (In thousands, except share and per share data)

INTEREST AND DIVIDEND INCOME Loan receivable, including loan fees

$110,321 $74,468 $304,566 $202,989 Securities available-for- sale -

taxable 17,779 13,464 46,305 46,998 Securities available-for- sale

- nontaxable 687 884 2,116 2,828 Federal Home Loan Bank stock 383

-- 1,100 626 Agency preferred stock 295 201 799 504 Federal funds

sold and securities purchased under agreements to resell 30 9 160

220 Deposits with banks 105 101 259 281 Total interest and dividend

income 129,600 89,127 355,305 254,446 INTEREST EXPENSE Time

deposits of $100,000 or more 27,983 17,349 73,810 40,203 Other

deposits 15,376 8,033 37,983 23,489 Securities sold under

agreements to repurchase 4,658 -- 11,183 14 Advances from Federal

Home Loan Bank 8,621 2,073 19,315 8,978 Long-term debt 1,207 917

3,359 2,544 Short-term borrowings 1,072 697 2,780 1,208 Total

interest expense 58,917 29,069 148,430 76,436 Net interest income

before provision for loan losses 70,683 60,058 206,875 178,010

(Reversal)/provision for loan losses (1,000) (1,000) 2,000 (500)

Net interest income after (reversal)/provision for loan losses

71,683 61,058 204,875 178,510 Securities gains 206 169 236 1,291

Letters of credit commissions 1,441 1,057 4,046 3,090 Depository

service fees 1,138 1,450 3,630 4,348 Gains on sale of premises and

equipment -- -- -- 958 Other operating income 2,619 3,177 8,317

7,618 Total non-interest income 5,404 5,853 16,229 17,305 Salaries

and employee benefits 15,949 13,393 46,060 38,834 Occupancy expense

2,637 2,433 7,444 6,610 Computer and equipment expense 1,876 1,672

5,544 5,247 Professional services expense 2,176 2,200 5,396 5,586

FDIC and State assessments 259 249 761 745 Marketing expense 723

483 2,328 1,638 Other real estate owned expense (income) 16 92 513

(10) Operations of affordable housing investments 1,429 1,025 4,027

2,990 Amortization of core deposit intangibles 1,801 1,404 4,778

4,550 Other operating expense 2,517 2,038 6,928 5,606 Total

non-interest expense 29,383 24,989 83,779 71,796 Income before

income tax expense 47,704 41,922 137,325 124,019 Income tax expense

17,046 15,237 50,279 46,640 Net income 30,658 26,685 87,046 77,379

Other comprehensive gain (loss), net of tax 12,048 (8,848) 931

(13,666) Total comprehensive income $42,706 $17,837 $87,977 $63,713

Net income per common share: Basic $0.60 $0.53 $1.71 $1.53 Diluted

$0.59 $0.53 $1.69 $1.52 Cash dividends paid per common share $0.09

$0.09 $0.27 $0.27 Basic average common shares outstanding

51,507,434 50,128,113 51,046,270 50,441,988 Diluted average common

shares outstanding 52,111,032 50,540,463 51,637,975 50,870,362

CATHAY GENERAL BANCORP AVERAGE BALANCES - SELECTED CONSOLIDATED

FINANCIAL INFORMATION (Unaudited) For the three months ended, (In

thousands) September 30, 2006 September 30, 2005 Average Average

Yield/ Yield/ Average Rate Average Rate Interest-earning assets

Balance (1)(2) Balance (1)(2) Loans and leases (1) $5,478,956 7.99%

$4,217,559 7.00% Taxable securities available-for- sale 1,345,854

5.24% 1,264,303 4.23% Tax-exempt securities available-for- sale (2)

83,368 6.96% 101,784 6.38% FHLB & FRB stock 34,974 4.34% 29,353

0.00% Federal funds sold and securities purchased under agreements

to resell 2,293 5.19% 1,084 3.29% Deposits with banks 10,837 3.84%

8,918 4.49% Total interest-earning assets $6,956,282 7.42%

$5,623,001 6.33% Interest-bearing liabilities Interest-bearing

demand deposits $228,854 1.26% $248,526 0.64% Money market 606,914

2.84% 508,296 1.40% Savings deposits 375,043 0.96% 384,064 0.55%

Time deposits 3,409,896 4.35% 3,022,360 2.97% Total

interest-bearing deposits $4,620,707 3.72% $4,163,246 2.42% Federal

funds purchased 39,359 5.35% 54,212 3.54% Securities sold under

agreements to repurchase 415,652 4.45% -- 0.00% Other borrowed

funds 695,321 5.23% 277,550 3.27% Long-term debt 55,101 8.69%

53,952 6.74% Total interest-bearing liabilities 5,826,140 4.01%

4,548,960 2.54% Non-interest-bearing demand deposits 767,217

704,934 Total deposits and other borrowed funds $6,593,357

$5,253,894 Total average assets $7,579,065 $6,071,519 Total average

stockholders' equity $883,822 $744,368 For the three months ended,

(In thousands) June 30, 2006 Average Interest-earning assets

Average Balance Yield/Rate (1)(2) Loans and leases (1) $5,285,231

7.90% Taxable securities available-for-sale 1,289,299 4.79%

Tax-exempt securities available-for-sale (2) 85,393 7.01% FHLB

& FRB stock 30,171 4.91% Federal funds sold and securities

purchased under agreements to resell 9,723 4.21% Deposits with

banks 17,235 2.02% Total interest-earning assets $6,717,052 7.26%

Interest-bearing liabilities Interest-bearing demand deposits

$245,933 1.25% Money market 577,276 2.65% Savings deposits 405,519

0.92% Time deposits 3,258,591 3.89% Total interest-bearing deposits

$4,487,319 3.32% Federal funds purchased 45,357 4.98% Securities

sold under agreements to repurchase 400,000 4.02% Other borrowed

funds 593,262 4.91% Long-term debt 53,997 8.25% Total

interest-bearing liabilities 5,579,935 3.60% Non-interest-bearing

demand deposits 776,203 Total deposits and other borrowed funds

$6,356,138 Total average assets $7,308,866 Total average

stockholders' equity $850,843 For the nine months ended, (In

thousands) September 30, 2006 September 30, 2005 Average Average

Yield/ Yield/ Average Rate Average Rate Interest-earning assets

Balance (1)(2) Balance (1)(2) Loans and leases $5,203,293 7.83%

$4,066,114 6.67% Taxable securities available-for-sale 1,257,303

4.92% 1,449,956 4.34% Tax-exempt securities available-for-sale (1)

85,160 6.84% 104,856 6.39% FHLB & FRB stock 31,653 4.64% 29,140

2.88% Federal funds sold and securities purchased under agreements

to resell 4,878 4.39% 10,125 2.91% Deposits with banks 15,773 2.20%

8,702 4.32% Total interest-earning assets $6,598,060 7.23%

$5,668,893 6.04% Interest-bearing liabilities Interest-bearing

demand deposits $239,033 1.15% $247,383 0.52% Money market deposits

586,764 2.60% 542,092 1.22% Savings deposits 379,516 0.89% 396,852

0.44% Time deposits 3,255,741 3.93% 2,886,329 2.61% Total

interest-bearing deposits $4,461,054 3.35% $4,072,656 2.09% Federal

funds purchased 43,227 4.94% 41,636 3.09% Securities sold under

agreements to repurchase 365,714 4.09% 857 2.18% Other borrowed

funds 558,969 4.90% 441,332 2.79% Long-term debt 54,364 8.26%

53,937 6.31% Total interest-bearing liabilities 5,483,328 3.62%

4,610,418 2.22% Non-interest-bearing demand deposits 753,855

695,378 Total deposits and other borrowed funds $6,237,183

$5,305,796 Total average assets $7,176,789 $6,120,783 Total average

stockholders' equity $841,425 $734,294 (1) Yields and interest

earned include net loan fees. Non-accrual loans are included in the

average balance. (2) The average yield has been adjusted to a fully

taxable-equivalent basis for certain securities of states and

political subdivisions and other securities held using a statutory

Federal income tax rate of 35%. DATASOURCE: Cathay General Bancorp

CONTACT: Heng W. Chen of Cathay General Bancorp, +1-213-625-4752

Web site: http://www.cathaybank.com/

Copyright

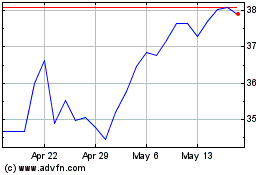

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jun 2024 to Jul 2024

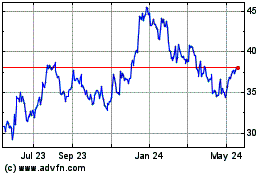

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jul 2023 to Jul 2024