CareCloud, Inc. (the “Company”) (Nasdaq: CCLD, CCLDO, CCLDP), a

leader in healthcare technology solutions for medical practices and

health systems nationwide, today announced that it continues to

solicit proxies from the holders (the “Series A Preferred

Shareholders”) of its 11% Series A Cumulative Redeemable Perpetual

Preferred Stock (the “Series A Preferred Stock”) to approve an

amendment to the Company’s Certificate of Designations, Preferences

and Rights of its Series A Preferred Stock (the “Preferred Stock

Proposal”). With approximately 11% of the shares of Series A

Preferred Stock having provided their voting instructions by proxy

to date, the Company’s Board of Directors is encouraged to see that

approximately 72% of these shares are in favor of the changes

recommended in the Preferred Stock Proposal.

“This is an important vote for Series A

Preferred Shareholders,” said Stephen Snyder, President of

CareCloud. “To become effective, the proposal needs the affirmative

vote of at least two-thirds of the shares of all outstanding Series

A Preferred Stock – or about 3 million of the outstanding 4.5

million shares. Series A Preferred Shareholders who would like to

submit their voting instructions can do so now through August 21,

2024, by calling 844-874-6164, by visiting www.aalvote.com/ccld, or

by mailing back the completed proxy card received from the Company.

If you vote by phone or over the internet, you will need your

control number from your proxy card. However, those who would

instead prefer to attend the Special Meeting in person can do so by

following the instructions contained in the Definitive Proxy

materials filed with the SEC.”

If the Preferred Stock Proposal is ultimately

approved, holders of Series A Preferred Stock would receive similar

change of control protections to those afforded to holders of the

Company’s Series B 8.75% Cumulative Redeemable Perpetual Preferred

Stock (the “Series B Preferred Stock”). Also, the dividend of

Series A Preferred Stock would mirror that of the Series B

Preferred Stock, and the Company would, going forward, have the

right to exchange the shares of Series A Preferred Stock for common

stock at the liquidation preference value of the $25/share, plus

accrued and unpaid dividends.

If the Preferred Stock Proposal is not approved,

the terms remain the same as when the Series A Preferred Stock was

issued as previously disclosed in the prospectus. Accordingly, a

potential acquirer of the Company could acquire the common stock of

the Company, while leaving the Series A Preferred Stock outstanding

as a security of a public reporting company. As an example of

securities remaining outstanding after an acquisition, investors

may find New Fortress Energy’s (Nasdaq: NFE) acquisition of Golar

LNG Partners (Nasdaq: GMLP) to be a helpful, albeit somewhat

different and distinguishable, reference point.

Proxy solicitation is ongoing and the Company

cannot predict future proxy or voting results, which could be more

or less favorable than the trends seen to date. Any shares that are

not voted will be deemed “no” votes, making it more difficult for

the Company to achieve the minimum two-thirds vote in favor of the

Preferred Stock Proposal.

The information contained in this press release

is a summary of certain relevant portions of the Definitive Proxy

Statement and other materials filed with the SEC. It is important

that Series A Preferred Shareholders review the entirety of the

filings, which are available on the SEC’s website and on

https://ir.carecloud.com/series-a-special-proxy.

About

CareCloud

CareCloud brings disciplined innovation to the

business of healthcare. Our suite of technology-enabled solutions

helps clients increase financial and operational performance,

streamline clinical workflows and improve the patient experience.

More than 40,000 providers count on CareCloud to help them improve

patient care while reducing administrative burdens and operating

costs. Learn more about our products and services including revenue

cycle management (RCM), practice management (PM), electronic health

records (EHR), business intelligence, patient experience management

(PXM) and digital health at www.carecloud.com.

Follow CareCloud on LinkedIn, Twitter and

Facebook.

Important Additional Information and

Where To Find It. CareCloud filed with the SEC a

definitive proxy statement on Schedule 14A on July 8, 2024,

with respect to its future solicitation of proxies for the Special

Meeting of Series A Preferred Stock shareholders (including any and

all adjournments, postponements, continuations, and reschedulings

thereof, the "Special Meeting"). The information contained in this

press release is merely a summary of certain relevant portions of

the Proxy Statement and it is important that Series A Preferred

Stock shareholders review the entirety of the filing.

SERIES A PREFERRED STOCK SHAREHOLDERS ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER

AMENDMENTS OR SUPPLEMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT CARECLOUD'S FILING. Investors and security holders

may obtain copies of these documents and other documents filed with

the SEC by CareCloud free of charge through the website

maintained by the SEC at www.sec.gov. The Notice of

the Special Meeting of Series A Preferred Stockholders and our

Proxy Statement for the Special Meeting, the Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and our

Quarterly Report on Form 10-Q for the quarterly period

ended March 31, 2024 are available at www.sec.gov.

Forward-Looking

Statements

This press release contains various

forward-looking statements within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These statements relate to anticipated future events, future

results of operations or future financial performance. In some

cases, you can identify forward-looking statements by terminology

such as “may,” “might,” “will,” “shall,” “should,” “could”,

“intends,” “expects,” “plans,” “goals,” “projects,” “anticipates,”

“believes,” “seeks,” “estimates,” “predicts,” “possible,”

“potential,” “target,” or “continue” or the negative of these terms

or other comparable terminology.

Our operations involve risks and uncertainties,

many of which are outside our control, and any one of which, or a

combination of which, could materially affect our results of

operations and whether the forward-looking statements ultimately

prove to be correct. Forward-looking statements in this press

release include, without limitation, statements reflecting

management's expectations for future financial performance and

operating expenditures, expected growth, profitability and business

outlook, the impact of pandemics on our financial performance and

business activities, and the expected results from the integration

of our acquisitions.

These forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are only predictions, are uncertain and involve substantial

known and unknown risks, uncertainties and other factors which may

cause our (or our industry’s) actual results, levels of activity or

performance to be materially different from any future results,

levels of activity or performance expressed or implied by these

forward-looking statements. We do not have an ongoing obligation to

update shareholders regarding future proxy or vote trends, even if

they are materially different from those experienced to date. New

risks and uncertainties emerge from time to time, and it is not

possible for us to predict all of the risks and uncertainties that

could have an impact on the forward- looking statements, including

without limitation, risks and uncertainties relating to the

Company’s ability to manage growth, migrate newly acquired

customers and retain new and existing customers, maintain

cost-effective global operations, increase operational efficiency

and reduce operating costs, predict and properly adjust to changes

in reimbursement and other industry regulations and trends, retain

the services of key personnel, develop new technologies, upgrade

and adapt legacy and acquired technologies to work with evolving

industry standards, compete with other companies products and

services competitive with ours, and other important risks and

uncertainties referenced and discussed under the heading titled

“Risk Factors” in the Company’s filings with the Securities and

Exchange Commission.

The statements in this press release are made as

of the date of this press release, even if subsequently made

available by the Company on its website or otherwise. The Company

does not assume any obligations to update the forward-looking

statements provided to reflect events that occur or circumstances

that exist after the date on which they were made.

SOURCE CareCloud

Company Contact: Norman Roth

Interim Chief Financial Officer and Corporate Controller CareCloud,

Inc. nroth@carecloud.com

Investor Contact:Bill

KornCareCloud, Inc. ir@carecloud.com

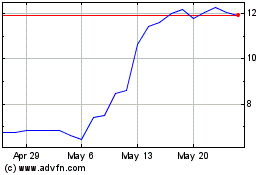

CareCloud (NASDAQ:CCLDO)

Historical Stock Chart

From Oct 2024 to Nov 2024

CareCloud (NASDAQ:CCLDO)

Historical Stock Chart

From Nov 2023 to Nov 2024