CareCloud, Inc. (the “Company”) (Nasdaq: CCLD, CCLDO, CCLDP), a

leader in healthcare technology solutions for medical practices and

health systems nationwide, today announced that Glass Lewis, a

leading proxy voting advisory firm, has analyzed CareCloud’s Series

A Preferred Stock Proposals (the “Preferred Stock Proposals”) and

recommends a “yes” vote for the proposals at the upcoming special

meeting of the holders of CareCloud’s 11% Series A Cumulative

Redeemable Perpetual Preferred Stock (“Series A Preferred

Shareholders”).

“We recommend that shareholders

vote FOR [the Preferred Stock Proposals],”

concluded Glass Lewis in its report dated July 31, 2024. Its report

also provides an analysis of CareCloud’s capital structure, an

overview of the proposals, the Board’s thought process in making

the recommendations, and Glass Lewis’ conclusion that the amendment

will not have a negative impact on shareholders.

Glass Lewis provides proxy voting advisory

services to more than 1,300 clients, including most of the world’s

largest pension plans, mutual funds and asset managers. Glass Lewis

clients collectively manage more than $40 trillion in assets.

“We are pleased that Glass Lewis took the time

to analyze CareCloud’s Preferred Stock Proposal and to recommend

that our Series A Preferred Shareholders vote “yes” on the

proposals,” said Stephen Snyder, President of CareCloud. “This is

an important vote and we encourage our shareholders to take the

time to consider the proposal and vote their shares – either by

calling 844-874-6164, visiting www.aalvote.com/ccld, or by mailing

back the completed proxy card.”

Pursuant to the Preferred Stock Proposals,

holders of CareCloud’s 11% Series A Cumulative Redeemable Perpetual

Preferred Stock (the “Series A Preferred Stock”) are being asked to

approve an amendment to the Company’s Certificate of Designations,

Preferences and Rights of its’ Series A Preferred Stock. If the

Preferred Stock Proposals are ultimately approved, holders of

Series A Preferred Stock would receive similar change of control

protections to those afforded to holders of the Company’s Series B

8.75% Cumulative Redeemable Perpetual Preferred Stock (the “Series

B Preferred Stock”). Further, the dividend of Series A Preferred

Stock would mirror that of the Series B Preferred Stock, and the

Company would, going forward, have the right to exchange the shares

of Series A Preferred Stock for common stock at the liquidation

preference value of $25/share, plus accrued and unpaid

dividends.

The information contained in this press release

is a summary of certain relevant portions of the Definitive Proxy

Statement and other materials filed with the SEC. It is important

that Series A Preferred Shareholders review the entirety of the

filings, which are available on the SEC’s website and on

https://ir.carecloud.com/series-a-special-proxy.

About

CareCloudCareCloud brings disciplined innovation

to the business of healthcare. Our suite of technology-enabled

solutions helps clients increase financial and operational

performance, streamline clinical workflows and improve the patient

experience. More than 40,000 providers count on CareCloud to help

them improve patient care while reducing administrative burdens and

operating costs. Learn more about our products and services

including revenue cycle management (RCM), practice management (PM),

electronic health records (EHR), business intelligence, patient

experience management (PXM) and digital health at

www.carecloud.com.

Follow CareCloud on LinkedIn, Twitter and

Facebook.

Important Additional Information and

Where To Find It. CareCloud filed with the SEC a

definitive proxy statement on Schedule 14A on July 8, 2024,

with respect to its future solicitation of proxies for the Special

Meeting of Series A Preferred Stock shareholders (including any and

all adjournments, postponements, continuations, and reschedulings

thereof, the "Special Meeting"). The information contained in this

press release is merely a summary of certain relevant portions of

the Proxy Statement and it is important that Series A Preferred

Stock shareholders review the entirety of the filing.

SERIES A PREFERRED STOCK SHAREHOLDERS ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER AMENDMENTS

OR SUPPLEMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

CARECLOUD'S FILING. Investors and security holders may

obtain copies of these documents and other documents filed with

the SEC by CareCloud free of charge through the website

maintained by the SEC at www.sec.gov. The Notice of

the Special Meeting of Series A Preferred Stockholders and our

Proxy Statement for the Special Meeting, the Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and our

Quarterly Report on Form 10-Q for the quarterly period

ended March 31, 2024 are available at www.sec.gov.

Forward-Looking

StatementsThis press release contains various

forward-looking statements within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These statements relate to anticipated future events, future

results of operations or future financial performance. In some

cases, you can identify forward-looking statements by terminology

such as “may,” “might,” “will,” “shall,” “should,” “could”,

“intends,” “expects,” “plans,” “goals,” “projects,” “anticipates,”

“believes,” “seeks,” “estimates,” “predicts,” “possible,”

“potential,” “target,” or “continue” or the negative of these terms

or other comparable terminology.

Our operations involve risks and uncertainties,

many of which are outside our control, and any one of which, or a

combination of which, could materially affect our results of

operations and whether the forward-looking statements ultimately

prove to be correct. Forward-looking statements in this press

release include, without limitation, statements reflecting

management's expectations for future financial performance and

operating expenditures, expected growth, profitability and business

outlook, the impact of pandemics on our financial performance and

business activities, and the expected results from the integration

of our acquisitions.

These forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are only predictions, are uncertain and involve substantial

known and unknown risks, uncertainties and other factors which may

cause our (or our industry’s) actual results, levels of activity or

performance to be materially different from any future results,

levels of activity or performance expressed or implied by these

forward-looking statements. We do not have an ongoing obligation to

update shareholders regarding future proxy or vote trends, even if

they are materially different from those experienced to date. New

risks and uncertainties emerge from time to time, and it is not

possible for us to predict all of the risks and uncertainties that

could have an impact on the forward- looking statements, including

without limitation, risks and uncertainties relating to the

Company’s ability to manage growth, migrate newly acquired

customers and retain new and existing customers, maintain

cost-effective global operations, increase operational efficiency

and reduce operating costs, predict and properly adjust to changes

in reimbursement and other industry regulations and trends, retain

the services of key personnel, develop new technologies, upgrade

and adapt legacy and acquired technologies to work with evolving

industry standards, compete with other companies products and

services competitive with ours, and other important risks and

uncertainties referenced and discussed under the heading titled

“Risk Factors” in the Company’s filings with the Securities and

Exchange Commission.

The statements in this press release are made as

of the date of this press release, even if subsequently made

available by the Company on its website or otherwise. The Company

does not assume any obligations to update the forward-looking

statements provided to reflect events that occur or circumstances

that exist after the date on which they were made.

SOURCE CareCloud

Company

Contact:Norman RothInterim Chief Financial Officer

and Corporate ControllerCareCloud, Inc. nroth@carecloud.com

Investor Contact:Bill

KornCareCloud, Inc. ir@carecloud.com

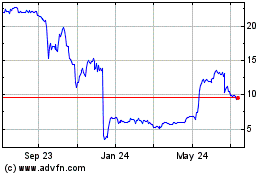

CareCloud (NASDAQ:CCLDO)

Historical Stock Chart

From Oct 2024 to Nov 2024

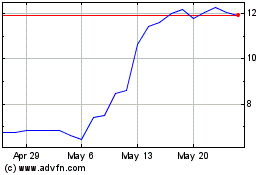

CareCloud (NASDAQ:CCLDO)

Historical Stock Chart

From Nov 2023 to Nov 2024