CDW Corporation (Nasdaq:CDW) today announced updates related to the

novel coronavirus, COVID-19.

“Our mission at CDW is to help our customers

navigate change and be successful in an ever-evolving world.

This mission is even more relevant during the current COVID-19

crisis,” said Christine A. Leahy, chief executive officer, CDW.

“First quarter demand was strong as customers looked to CDW to meet

urgent needs for greater technology capabilities. CDW teams

have worked tirelessly to safeguard the health and well-being of

each other and to continue delivering for our customers at this

time of great need.”

“Given the depth and duration of the pandemic is

unknown, it is too early to predict the full impact of COVID-19 on

our business. We are committed to deliver on our mission by

providing the essential technology required across all sectors of

the economy – from vital healthcare, education and government

entities to businesses of all sizes – as organizations strive to

achieve their goals during this pandemic,” concluded

Leahy.

Business UpdateFor the first

quarter, preliminary Net sales are expected to be $4.39 billion,

Operating income is expected to be $246 million and Non-GAAP

operating income is expected to be $304 million. Net income

per diluted share is expected to be $1.16 and Non-GAAP net income

per diluted share is expected to be $1.38. Non-GAAP operating

income and Non-GAAP net income per diluted share are measures that

are not based on accounting principles generally accepted in the

United States (“GAAP”). Reconciliations to the most directly

comparable GAAP measures are included in the attached

schedules. These preliminary results have not been reviewed,

audited or subjected to any agreed-upon procedures by our

independent registered public accounting firm. Final results

for the first quarter may ultimately differ from these preliminary

results.

CDW is focused on the well-being and safety of

its coworkers, leveraging standing crisis management protocols and

following guidelines from public health authorities. CDW

implemented precautions to help keep its coworkers healthy and

safe, including activating a cross-functional response team led by

Executive Committee members, moving to remote working for its

office coworkers, and implementing safety protocols at its

distribution centers, including social distancing measures,

segmented shifts, additional personal protective equipment,

enhanced facility cleanings, and temperature screening for anyone

entering the facilities. In recent weeks, to limit the virus

spread after a few coworkers tested positive for COVID-19, CDW

decided to close its Vernon Hills, Illinois distribution center for

several days and to require a shift of configuration center

coworkers to self-isolate. CDW has continued to pay its

affected coworkers their wages. These actions have not had a

material impact to date as the company leveraged flexibility in its

distribution and configuration capabilities where possible, and

where not, shipping times modestly increased.

2020 Targets and Related 2020 Financial

Information As a result of COVID-19 and the adoption of

current and potential future measures to prevent its spread, CDW is

withdrawing its 2020 targets and related 2020 financial information

that were previously issued on February 6, 2020. While CDW

has a balanced portfolio of customer end-markets and a full suite

of solutions and services that address customer priorities across

the IT landscape, the impact of COVID-19 on CDW’s businesses could

be material with some customer end-markets impacted more

significantly than others or due to operational measures taken to

safeguard its coworkers or issues with its supply chain. CDW

is unable at this time to predict the impact of COVID-19 on its

operations, liquidity, and financial results, and, depending on the

magnitude and duration of the COVID-19 pandemic, such impact may be

material.

LiquidityThe company remains

confident in its liquidity position. CDW’s primary liquidity

sources are operating cash flow, cash and cash equivalents, and

borrowings under its revolving credit facilities. As of March

31, 2020, CDW had cash and cash equivalents of $214 million and

$3.47 billion of total debt outstanding, plus the capacity to

borrow an additional $1.0 billion under its revolving credit

facilities. The company has no debt maturities due in 2020

and $57 million (£46 million) of debt maturing in August

2021. The company has taken measures to enhance liquidity,

including implementing cost savings initiatives and suspending

share repurchases.

The company will provide an update in its first

quarter earnings release and on its first quarter earnings

call.

About CDWCDW Corporation

(Nasdaq:CDW) is a leading multi-brand technology solutions provider

to business, government, education and healthcare customers in the

United States, the United Kingdom and Canada. A Fortune 500 company

and a member of the S&P 500 Index, CDW was founded in 1984 and

employs almost 10,000 coworkers. For the year ended December 31,

2019, the company generated Net sales over $18 billion. For more

information about CDW, please visit www.CDW.com.

Forward-Looking

StatementsStatements in this release that are not

statements of historical fact are forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including, without limitation,

statements regarding (i) the impact of COVID-19 on its business,

operations and liquidity, (ii) its preliminary and future financial

results, and (iii) other strategic plans of CDW. These

statements involve risks and uncertainties that could cause actual

results to differ materially from those described in such

statements. Although CDW believes that the expectations reflected

in such forward-looking statements are reasonable, it can give no

assurance that such expectations will prove to have been correct.

Reference is made to a more complete discussion of forward-looking

statements and applicable risks contained under the captions

"Forward-Looking Statements" and "Risk Factors" in CDW's Annual

Report on Form 10-K for the year ended December 31, 2019 and

subsequent filings with the SEC. Our actual results may

differ from those described in forward-looking statements due to

the risks and uncertainties described in these filings as well as

risks related to COVID-19, including disruptions in the supply or

distribution of products, and postponements or reductions in

spending on technology products or services related to the

pandemic’s economic impacts. CDW undertakes no obligation to update

or revise any of its forward-looking statements, whether as a

result of new information, future events or otherwise, unless

required by law.

Non-GAAP Financial Information

Non-GAAP operating income excludes, among other things, charges

related to the amortization of acquisition-related intangible

assets, equity-based compensation and related payroll taxes, and

acquisition and integration expenses. Non-GAAP net income per

diluted share and Non-GAAP net income exclude, among other things,

charges related to acquisition-related intangible asset

amortization, equity-based compensation, acquisition and

integration expenses, and the associated tax effects of each.

Generally, a non-GAAP financial measure is a numerical measure of a

company’s performance or financial position that either excludes or

includes amounts that are not normally included or excluded in the

most directly comparable measure calculated and presented in

accordance with GAAP. The financial statement tables include

a reconciliation of non-GAAP financial measures to the applicable

most comparable GAAP financial measures.

CDW believes these measures provide analysts,

investors and management with helpful information regarding the

underlying operating performance of CDW’s business, as they remove

the impact of items that management believes are not reflective of

underlying operating performance. CDW uses these measures to

evaluate period-over-period performance as management believes they

provide a more comparable measure of the underlying business.

Non-GAAP measures used by CDW may differ from similar measures used

by other companies, even when similar terms are used to identify

such measures.

Investor InquiriesBrittany A. SmithVice

President, Investor Relations and Financial Planning and

Analysis847-968-0238investorrelations@cdw.com

Media InquiriesSara GranackVice President,

Corporate Communications847-419-7411mediarelations@cdw.com

CDW CORPORATION AND

SUBSIDIARIES

PRELIMINARY NON-GAAP OPERATING

INCOME (dollars in millions)(unaudited)

| |

| |

Three MonthsEndedMarch 31, 2020 |

| |

|

|

Operating income |

$ |

246 |

|

| Amortization of

intangibles |

45 |

|

| Equity-based compensation |

9 |

|

| Other adjustments |

4 |

|

| Non-GAAP operating income |

$ |

304 |

|

| |

|

|

|

PRELIMINARY NON-GAAP NET

INCOMEAND NON-GAAP NET INCOME PER DILUTED

SHARE(dollars and shares in millions, except per-share

amounts)(unaudited)

| |

| |

Three MonthsEndedMarch 31, 2020 |

| |

|

|

Net income |

$ |

168 |

|

| Amortization of

intangibles |

45 |

|

| Equity-based compensation |

9 |

|

| Other adjustments |

4 |

|

| Aggregate adjustment for

income taxes |

(26 |

) |

| Non-GAAP net income |

$ |

200 |

|

| |

|

|

| GAAP net income per diluted

share |

$ |

1.16 |

|

| Non-GAAP net income per

diluted share |

$ |

1.38 |

|

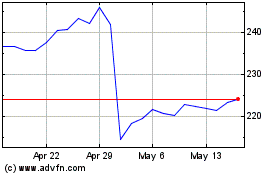

CDW (NASDAQ:CDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

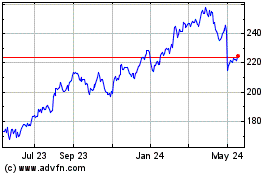

CDW (NASDAQ:CDW)

Historical Stock Chart

From Apr 2023 to Apr 2024