Altice in Advanced Talks to Buy Cablevision

17 September 2015 - 3:20PM

Dow Jones News

Altice SA is in advanced talks to buy Cablevision Systems Corp.,

the latest move by the European cable company to build a

communications empire in the U.S.

A deal between the two companies could be announced as soon as

Thursday, according to people familiar with the matter. Altice is

expected to pay $34.90 a share, one of the people said. That would

value Cablevision, which has a market value of $7.9 billion, at

roughly $18 billion including its heavy debt load. The deal would

rank as one of the larger takeovers in a roaring year for mergers

and acquisitions. Cablevision's stock rose 16% in after-hours

trading on The Wall Street Journal's report of a possible deal.

As always with M&A, it is possible the deal could fall apart

at the last minute.

Altice, run by billionaire investor Patrick Drahi, has become a

prolific consolidator on both sides of the Atlantic. After

completing a series of deals in Europe including the $23 billion

takeover of France's second-biggest wireless-phone operator SFR,

Mr. Drahi in May opened a new frontier in the U.S. by inking a $9

billion deal to buy cable company Suddenlink Communications. Altice

then quickly turned its attention to Time Warner Cable Inc., which

was in the process of negotiating a sale to Charter Communications

Inc. Charter beat Altice to that prize, with a $55 billion deal to

buy TWC that is pending. But people close to Mr. Drahi made it

clear then that he wasn't done building a presence in the U.S.

Altice, which is based in Luxembourg and has operations from

France to Israel, has a market capitalization of €24 billion ($27.1

billion). The company has built a reputation for aggressive deal

making and cost-cutting.

In Europe, Mr. Drahi has been able to cut costs by bundling four

products: TV, high-speed Internet and fixed- and mobile-phone

services. That so-called quadruple-play model doesn't yet exist on

a large scale in the U.S.

"My vision is to do the same in the U.S., but bigger," Mr. Drahi

said in an interview with The Wall Street Journal over the

summer.

Mr. Drahi is scheduled to speak at an investor conference in New

York on Thursday.

Cablevision, the fifth-largest U.S. cable company and

eighth-largest provider of pay-TV services, has been widely seen as

a potential acquisition target in a fast-consolidating industry

where a few heavyweights are in dominant positions. AT&T Inc.

became the No. 1 pay-TV provider when it closed its purchase of

DirecTV in July. Comcast Corp. is the largest broadband provider,

and Charter will leap to the top ranks if regulators approve its

proposed takeover of TWC.

Bethpage, N.Y.-based Cablevision serves 3.1 million customers

across its TV, voice and high-speed data services throughout the

New York metropolitan area. It generated $6.5 billion in revenue in

2014, with net income of $311 million. The Dolan family controls

Cablevision with a 72.3% voting stake, according to the company's

proxy filing, and owns cable-network company AMC Networks Inc. as

well as Madison Square Garden Co. Like other cable operators,

Cablevision has been gradually shedding video consumers as they

"cut the cord."

For years, merger advisers and media executives speculated that

Cablevision could be an acquisition target, but doing a deal with

the Dolans was seen as difficult because of the high valuation they

have attached to their assets. Chuck Dolan founded Cablevision in

1973 in Long Island. Mr. Dolan is now 88 years old and the company

is run by his son James, who is CEO, with a lot of other family

members in various executive roles. In 2007, the Dolan family made

a $10.6 billion offer to take Cablevision private, an effort that

was rejected by shareholders.

For Altice, securing Cablevision's footprint in New York would

be a major step toward its goal of becoming a big player in the

media-and-telecommunications business in the U.S. But there are

plenty of challenges too. For one, Cablevision has a high

penetration of its territory, leaving limited room for growth, and

it faces a stiff regional competitor in Verizon Communications

Inc.'s FiOS offering.

James Dolan has said he wants to transform the cable operator

away from its television roots into a "connectivity" company.

Mr. Dolan has banked on the future of the higher-margin

broadband service to make up for dwindling video customers and has

said that there may come a day when Cablevision stops offering

cable-TV service completely.

At an investor conference in June, Mr. Dolan said the number of

customers paying for the traditional big bundle of cable TV

channels is going to shrink by about 20% to 25% over the next five

years, as consumers opt instead for smaller packages of channels or

online-video options. In April, Cablevision launched low-cost,

cord-cutter TV packages with broadband service and a free digital

antenna to pick up local TV signals.

The cable operator also reached a deal with streaming-video

service Hulu to offer on-demand shows and movies, becoming the

first cable or satellite TV provider to strike such a

partnership.

Write to Dana Mattioli at dana.mattioli@wsj.com, Ryan Knutson at

ryan.knutson@wsj.com and Shalini Ramachandran at

shalini.ramachandran@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 17, 2015 01:05 ET (05:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

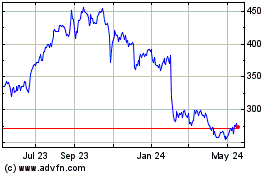

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

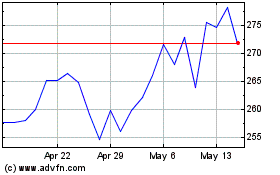

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024