Verizon Exploring Combination With Cable Firm Charter Communications -- Update

27 January 2017 - 1:55AM

Dow Jones News

By Shalini Ramachandran, Ryan Knutson and Dana Mattioli

Verizon Communications Inc. is exploring a combination with

Charter Communications Inc. that would unite two giants in search

of growth in a rapidly consolidating media and telecom landscape,

according to people familiar with the matter.

Verizon CEO Lowell McAdam has made a preliminary approach to

officials close to Charter and Verizon is working with advisers to

study a potential transaction, the people said, though there's no

guarantee a deal will materialize.

It is unclear whether Charter executives, including Chief

Executive Tom Rutledge, would be open to a transaction. The effort

could be complicated by Charter's ownership structure, which

includes cable tycoon John Malone and the Newhouse family.

A combination would bring together Verizon's more than 114

million wireless subscribers and what remains of its landline

business with Charter's cable network, which provides television to

17 million customers and broadband connections to 21 million.

Verizon has a market capitalization of $194 billion and more

than $100 billion in debt, while Charter ended Wednesday's session

valued at about $85 billion.

Both Verizon and Charter face challenges to their core

businesses. Growth in the U.S. wireless market has slowed and

pricing pressure has chipped away at profits. Furthermore, the

cable-TV business is threatened by cord-cutters and over-the-top

video services.

Any transaction would face a close regulatory review, given the

sheer size of the businesses and some overlapping services. Both

companies provide home broadband and television services in certain

markets, including the greater New York area. On its fiber-optics

network, known as Fios, Verizon has about 5.7 million high-speed

internet customers and 4.7 million TV subscribers, primarily in the

Northeast.

It would pose a big test for new antitrust enforcers under the

administration of President Donald Trump, who during the campaign

expressed concerns about media consolidation. In October, he vowed

to block AT&T Inc.'s $85.4 billion purchase of Time Warner

Inc., saying it put too much power in the hands of too few, but he

hasn't spoken publicly on the transaction since the election.

Many deal makers are hopeful a more traditional Republican

administration will be merger friendly. Mr. Trump recently

appointed Ajit Pai, a Republican, as chairman of the Federal

Communications Commission, which oversees telecom mergers in

addition to the Justice Department.

In his testimony before the Senate, Mr. Trump's selection for

Attorney General, Sen. Jeff Sessions, said he wouldn't have a

problem blocking mergers deemed anticompetitive. "I have no

hesitation to enforce antitrust law," Sen. Sessions said on Jan.

10. "There will not be political influence in that process."

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com,

Ryan Knutson at ryan.knutson@wsj.com and Dana Mattioli at

dana.mattioli@wsj.com

(END) Dow Jones Newswires

January 26, 2017 09:40 ET (14:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

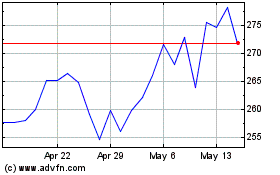

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

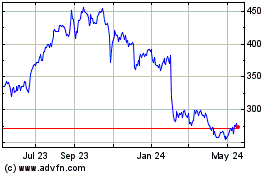

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024