false

0001862150

0001862150

2024-09-09

2024-09-09

0001862150

CING:CommonStockParValue0.0001PerShareMember

2024-09-09

2024-09-09

0001862150

CING:WarrantsExercisableForOneShareOfCommonStockMember

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

September

9, 2024

CINGULATE

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40874 |

|

86-3825535 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1901

W. 47th Place

Kansas

City, KS 66205

(Address

of principal executive offices) (Zip Code)

(913)

942-2300

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

CING |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

| Warrants,

exercisable for one share of common stock |

|

CINGW |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

On

September 9, 2024, the Compensation Committee of the Board of Directors (the “Compensation Committee”) of Cingulate Inc.

(the “Company”) approved the reinstatement of Chief Executive Officer Shane Schaffer’s

annual base salary of $503,000, Chief Operating Officer Laurie Myer’s annual base salary of $424,000 and Chief Financial Officer

Jennifer Callahan’s annual base salary of $350,000. These salaries had previously been reduced by 55%, 50%, and 40%, respectively,

pursuant to cost containment measures implemented by the Company in late 2023.

Item

7.01. Regulation FD Disclosure.

On

September 12, 2024, the Company issued a press release announcing that it had commenced its final FDA-required study, which is a food

effect study, for CTx-301 (dexmethylphenidate) for the treatment of Attention Deficit Hyperactivity Disorder (“ADHD”). A

copy of the press release is furnished as Exhibit 99.1 hereto and shall not be deemed “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended,

except as shall be expressly set forth by specific reference in such a filing.

Item

8.01. Other Events.

The

Compensation Committee approved the reinstatement of 2023 base salaries for all employees. The Company continues to operate under a reduced

headcount of approximately 40% as compared to 2023. The cost containment measures implemented in late 2023 have resulted in cumulative

cash savings to date of approximately $1.45 million.

On

September 12, 2024, the Company announced that it had commenced its final FDA-required study, which is a food effect study, for CTx-301

(dexmethylphenidate) for the treatment of ADHD. A data readout from the study is expected by the end of 2024. Additionally, Cingulate

has raised over $10 million in additional capital since the middle of August 2024 and has received notification from Nasdaq that it is

now in compliance with Nasdaq listing requirements.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CINGULATE

INC. |

| |

|

|

| Dated:

September 12, 2024 |

By: |

/s/

Shane J. Schaffer |

| |

Name: |

Shane

J. Schaffer |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Cingulate

Initiates Final Study for Lead ADHD Asset CTx-1301

$10

Million of additional Capital Recently Raised Strengthening Balance Sheet

KANSAS

CITY, Kan., September 12, 2024 Cingulate Inc. (NASDAQ:

CING), a biopharmaceutical company utilizing its proprietary Precision Timed Release™ (PTR™) drug delivery platform technology

to build and advance a pipeline of next-generation pharmaceutical products, announced today that it has commenced its final FDA-required

study, which is a food effect study, for CTx-1301 (dexmethylphenidate) for the treatment of Attention Deficit Hyperactivity Disorder

(ADHD). A data readout from the study is expected by the end of 2024.

Additionally,

Cingulate has raised over $10 million in additional capital since the middle of August 2024, 58% of this amount from its at the market

facility, and has received notification from Nasdaq that Cingulate is now in compliance with Nasdaq listing requirements.

“We

are pleased to have raised additional substantial capital, which allows us to focus on advancing the final activities required for NDA

submission of our lead asset, CTx-1301, which is targeted for mid 2025. Initiating the final study for CTx-1301 is a key milestone moving

us one step closer to NDA submission,” said Cingulate Chairman and CEO Shane J. Schaffer.

About

the Fast Fed Study

The

study is an assessment of the effect of food on the absorption of the highest dose of CTx-1301. An open-label, randomized, single-dose,

two-period, two-treatment (Fed vs. Fasted), two-sequence, crossover study In Healthy adult subjects to assess the effect of food on the

bioavailability of CTx-1301 (dexmethylphenidate) of the highest dose.

About

Attention Deficit/Hyperactivity Disorder (ADHD)

ADHD

is a chronic neurobiological and developmental disorder that affects millions of children and often continues into adulthood. The condition

is marked by an ongoing pattern of inattention and/or hyperactivity-impulsivity that interferes with functioning or development. In the

U.S., approximately 6.4 million children and adolescents (11 percent) aged under the age of 18 have been diagnosed with ADHD. Among this

group, approximately 80 percent receive treatment, with 65-90 percent demonstrating clinical ADHD symptoms that persist into adulthood.

Adult ADHD prevalence is estimated at approximately 11 million patients (4.4 percent), almost double the size of the child and adolescent

segment combined. However, only an estimated 20 percent receive treatment.

About

CTx-1301

Cingulate’s

lead candidate, CTx-1301, utilizes Cingulate’s proprietary PTR drug delivery platform to create a breakthrough, multi-core formulation

of the active pharmaceutical ingredient dexmethylphenidate, a compound approved by the FDA for the treatment of ADHD. Dexmethylphenidate

is part of the stimulant class of medicines and increases norepinephrine and dopamine activity in the brain to affect attention and behavior.

While stimulants are the gold standard of ADHD treatment due to their efficacy and safety, the long-standing challenge continues to be

providing patients with an entire active-day duration of action. CTx-1301 is designed to precisely deliver three releases of medication

at the predefined time, ratio, and style of release to optimize patient care in one tablet. The result is a rapid onset and entire active-day

efficacy, with the third dose being released around the time when other extended-release stimulant products begin to wear off.

About

Precision Timed Release™ (PTR™) Platform Technology

Cingulate

is developing ADHD and anxiety disorder product candidates capable of achieving true once-daily dosing using Cingulate’s innovative

PTR drug delivery platform technology. It incorporates a proprietary Erosion Barrier Layer (EBL) providing control of drug release at

precise, pre-defined times with no release of drug prior to the intended release. The EBL technology is enrobed around a drug-containing

core to give a tablet-in-tablet dose form. It is designed to erode at a controlled rate until eventually the drug is released from the

core tablet. The EBL formulation, Oralogik™, is licensed from BDD Pharma. Cingulate intends to utilize its PTR technology to expand

and augment its clinical-stage pipeline by identifying and developing additional product candidates in other therapeutic areas in addition

to Anxiety and ADHD where one or more active pharmaceutical ingredients need to be delivered several times a day at specific, predefined

time intervals and released in a manner that would offer significant improvement over existing therapies. To see Cingulate’s PTR

Platform, click here.

About

Cingulate Inc.

Cingulate

Inc. (NASDAQ: CING), is a biopharmaceutical company utilizing its proprietary PTR drug delivery platform technology to build and

advance a pipeline of next-generation pharmaceutical products, designed to improve the lives of patients suffering from frequently

diagnosed conditions characterized by burdensome daily dosing regimens and suboptimal treatment outcomes. With an initial focus on

the treatment of ADHD, Cingulate is identifying and evaluating additional therapeutic areas where PTR technology may be employed to

develop future product candidates, including to treat anxiety disorders. Cingulate is headquartered in Kansas City. For more

information, visit Cingulate.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include all statements, other than

statements of historical fact, regarding our current views and assumptions with respect to future events regarding our business, including

statements with respect to our plans, assumptions, expectations, beliefs and objectives with respect to product development, clinical

studies, clinical and regulatory timelines, market opportunity, competitive position, business strategies, potential growth opportunities

and other statements that are predictive in nature. These statements are generally identified by the use of such words as “may,”

“could,” “should,” “would,” “believe,” “anticipate,” “forecast,”

“estimate,” “expect,” “intend,” “plan,” “continue,” “outlook,”

“will,” “potential” and similar statements of a future or forward-looking nature. Readers are cautioned that

any forward-looking information provided by us or on our behalf is not a guarantee of future performance. Actual results may differ materially

from those contained in these forward-looking statements as a result of various factors disclosed in our filings with the Securities

and Exchange Commission (SEC), including the “Risk Factors” section of our Annual Report on Form 10-K filed with the SEC

on March 10, 2023. All forward-looking statements speak only as of the date on which they are made, and we undertake no duty to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required

by law.

Investor

& Public Relations:

Thomas

Dalton

Vice

President, Investor & Public Relations, Cingulate

tdalton@cingulate.com

(913)

942-2301

Matt

Kreps

Darrow

Associates

mkreps@darrowir.com

(214)

597-8200

v3.24.2.u1

Cover

|

Sep. 09, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 09, 2024

|

| Entity File Number |

001-40874

|

| Entity Registrant Name |

CINGULATE

INC.

|

| Entity Central Index Key |

0001862150

|

| Entity Tax Identification Number |

86-3825535

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1901

W. 47th Place

|

| Entity Address, City or Town |

Kansas

City

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66205

|

| City Area Code |

(913)

|

| Local Phone Number |

942-2300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

CING

|

| Security Exchange Name |

NASDAQ

|

| Warrants, exercisable for one share of common stock |

|

| Title of 12(b) Security |

Warrants,

exercisable for one share of common stock

|

| Trading Symbol |

CINGW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CING_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CING_WarrantsExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

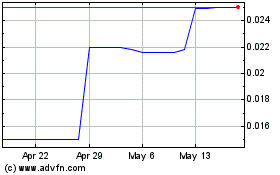

Cingulate (NASDAQ:CINGW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cingulate (NASDAQ:CINGW)

Historical Stock Chart

From Feb 2024 to Feb 2025