Mobix Labs, Inc. (“Mobix Labs” or the “Company”), an innovative

provider of next generation wireless mmWave 5G and connectivity

solutions, and Chavant Capital Acquisition Corp. (Nasdaq: CLAY)

(“Chavant”), a publicly-traded special purpose acquisition company,

announced today the filing by Chavant with the U.S. Securities and

Exchange Commission (“SEC“) of a registration statement on Form S-4

(the “Registration Statement”) on April 7, 2023, relating to the

previously announced proposed business combination of Chavant and

Mobix Labs.

The Registration Statement contains a

preliminary proxy statement/prospectus in connection with the

previously announced business combination between Mobix Labs

and Chavant. Although the Registration Statement has not yet become

effective and the information contained therein is subject to

change, it provides important information about Mobix Labs and

Chavant, as well as the proposed business combination.

Upon the closing of the transaction, Mobix Labs

will become a publicly listed company, with the combined company

named Mobix Labs, Inc., and its common stock and warrants are

expected to be listed on the Nasdaq Stock Market (the

“Nasdaq”).

On November 15, 2022, Chavant entered into a

business combination agreement with Mobix Labs, which agreement was

subsequently amended on April 7, 2023. Completion of the

transaction, which is expected to occur in the third quarter of

2023, is subject to approval by Chavant’s shareholders, the

Registration Statement being declared effective by the SEC, and

other customary closing conditions. Mobix Labs will be

based in Irvine, CA and will continue to be led by James Peterson,

Executive Chairman, Fabian Battaglia, Chief Executive Officer, and

Keyvan Samini, President and Chief Financial Officer.

About Mobix Labs

Based in Irvine, California, Mobix Labs is a fabless

semiconductor company developing disruptive next generation

wireless and connected solutions that are designed to cater to a

broad range of applications in markets including 5G infrastructure,

satellite communications, automotive, consumer electronics,

e-mobility, healthcare, infrastructure and defense. The Company

believes its pipeline of current and potential customers and

strategic partnerships presents a significant potential for a

growing addressable market. Its portfolio of intellectual property

is protected by extensive trade secrets and over 90 issued and

pending patents.

About Chavant

Chavant is a blank check company whose business purpose is to

effect a merger, capital stock exchange, asset acquisition, stock

purchase, reorganization, or similar transaction or business

combination with one or more businesses. Chavant is led by Dr.

Jiong Ma, Chief Executive Officer and President, Dr. André-Jacques

Auberton-Hervé, Chairman of the board of directors, and Michael

Lee, Chief Financial Officer. Chavant’s board of directors includes

Dr. Patrick Ennis, a Venture Partner at Madrona Venture Group, Dr.

Karen Kerr, founder and Managing Director of Exposition Ventures,

and Dr. Bernhard Stapp, President of CS-management GmbH.

Important Information About the Proposed Transaction and

Where to Find It

This communication relates to the proposed transaction between

Mobix Labs and Chavant pursuant to a Business Combination

Agreement, dated as of November 15, 2022, as amended by Amendment

No. 1 to the Business Combination Agreement, dated as of April 7,

2023, by and among Chavant, CLAY Merger Sub II, Inc. and Mobix

Labs. Chavant has filed the Registration Statement with the SEC,

which includes a preliminary prospectus and proxy statement of

Chavant in connection with the proposed transaction, referred to as

a proxy statement/prospectus. A proxy statement/prospectus will be

sent to all Chavant shareholders as of a record date to be

established for voting on the transaction. Chavant also will file

other documents regarding the proposed transaction with the

SEC.

Before making any voting decision, investors and security

holders of Chavant are urged to read the Registration Statement,

the proxy statement/prospectus, and amendments thereto, and the

definitive proxy statement/prospectus in connection with Chavant’s

solicitation of proxies for its shareholders’ meeting to be held to

approve the transaction, and all other relevant documents filed or

that will be filed with the SEC in connection with the proposed

transaction as they become available because they will contain

important information about Chavant, Mobix Labs and the proposed

Transaction.

Investors and securityholders will be able to obtain free copies

of the Registration Statement, the proxy statement/prospectus and

all other relevant documents filed or that will be filed with the

SEC by Chavant through the website maintained by the SEC at

www.sec.gov.

The documents filed by Chavant with the SEC also may be obtained

free of charge at Chavant’s website at www.chavantcapital.com or

upon written request to: Chavant Capital Acquisition Corp., 445

Park Avenue, 9th Floor New York, NY 10022.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS

APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS

COMMUNICATION, PASSED UPON THE MERITS OR FAIRNESS OF THE

TRANSACTION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THE DISCLOSURE IN THIS COMMUNICATION. ANY

REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of the United States Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements other

than statements of historical fact contained in this press release,

including statements regarding the benefits of the proposed

transaction, the anticipated timing of the completion of the

proposed transaction, the products offered by the Company and the

markets in which it operates, the expected total addressable

markets for the products offered by the Company, the advantages of

the Company’s technology, the Company’s competitive landscape and

positioning, and the Company’s growth plans, strategies and

projected future results, are forward-looking statements. Some of

these forward-looking statements can be identified by the use of

forward-looking words, including “may,” “should,” “expect,”

“intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,”

“plan,” “targets,” “projects,” “could,” “would,” “continue,”

“forecast” or the negatives of these terms or variations of them or

similar expressions. All forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. All forward-looking statements are

based upon estimates, forecasts and assumptions that, while

considered reasonable by Chavant and its management, and the

Company and its management, as the case may be, are inherently

uncertain and many factors may cause the actual results to differ

materially from current expectations which include, but are not

limited to:

- the risk that the proposed

transaction may not be completed in a timely manner or at all,

which may adversely affect the price of Chavant’s securities;

- the risk that the proposed

transaction may not be completed by Chavant’s deadline for the

proposed transaction and the potential failure to obtain an

extension of the deadline for the proposed transaction if sought by

Chavant;

- the failure to satisfy the

conditions to the consummation of the proposed transaction,

including the adoption of the business combination agreement by the

shareholders of Chavant, the satisfaction of the minimum cash

amount following redemptions by Chavant’s public shareholders;

- the lack of a third party valuation

in determining whether or not to pursue the proposed

transaction;

- the occurrence of any event, change

or other circumstance that could give rise to the termination of

the business combination agreement;

- the effect of the announcement or

pendency of the proposed transaction on the Company’s business

relationships, performance, and business generally;

- risks that the proposed transaction

disrupts current plans of the Company and potential difficulties in

the Company’s employee retention as a result of the proposed

transaction;

- the outcome of any legal proceedings

that may be instituted against the Company or against Chavant

related to the business combination agreement or the proposed

transaction;

- failure to realize the anticipated

benefits of the proposed transaction;

- the inability to meet and maintain

the listing of Chavant’s securities (or the securities of the

post-combination company) on Nasdaq;

- the risk that the price of Chavant’s

securities may be volatile due to a variety of factors, including

changes in the highly competitive industries in which the Company

plans to operate, variations in performance across competitors,

changes in laws, regulations, technologies including transition to

5G, global supply chain, U.S./China trade or national security

tensions, and macro-economic and social environments affecting the

Company’s business and changes in the combined capital

structure;

- the inability to implement business

plans, forecasts, and other expectations after the completion of

the proposed transaction, and identify and realize additional

opportunities;

- the risk that Mobix Labs is unable

to successfully commercialize its semiconductor products and

solutions, or experience significant delays in doing so;

- the risk that the Company may never

achieve or sustain profitability;

- the risk that the Company will need

to raise additional capital to execute its business plan, which may

not be available on acceptable terms or at all;

- the risk that the post-combination

company experiences difficulties in managing its growth and

expanding operations;

- the risks relating to long sales

cycles, concentration of customers, consolidation and vertical

integration of customers, and dependence on manufacturers and

channel partners;

- the risk that the Company may not be

able to consummate planned strategic acquisitions, or fully realize

anticipated benefits from past or future acquisitions or

investments;

- the risk that the Company’s patent

applications may not be approved or may take longer than expected,

and the Company may incur substantial costs in enforcing and

protecting its intellectual property;

- inability to complete the PIPE

investment in connection with the proposed transaction; and

- other risks and uncertainties set

forth in the sections entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in Chavant’s Annual Report on

Form 10-K for the year ended December, 31, 2022, which was filed

with the SEC on March 31, 2023 (the “2022 Form 10-K”), as such

factors may be updated from time to time in Chavant’s filings with

the SEC, the Registration Statement and the proxy

statement/prospectus contained therein. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements.

Nothing in this press release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Neither Chavant nor

the Company gives any assurance that either Chavant, the Company or

the combined company will achieve its expected results. Neither

Chavant nor the Company undertakes any duty to update these

forward-looking statements, except as otherwise required by

law.

Participants in the Solicitation

The Company and Chavant and their respective directors and

officers and other members of management may, under SEC rules, be

deemed to be participants in the solicitation of proxies from

Chavant’s stockholders with the proposed transaction and the other

matters set forth in the Registration Statement. Information about

Chavant’s directors and executive officers is set forth in

Chavant’s filings with the SEC, including Chavant’s 2022 Form 10-K

and the Registration Statement. Additional information regarding

the direct and indirect interests, by security holdings or

otherwise, of those persons and other persons who may be deemed

participants in the proposed transaction may be obtained by reading

the proxy statement/prospectus regarding the proposed transaction

when it becomes available. You may obtain free copies of these

documents as described above under “Important Information About the

Proposed Transaction and Where to Find It.”

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the proposed transaction and is not intended to and

does not constitute an offer to sell or the solicitation of an

offer to buy, sell or solicit any securities or any proxy, vote or

approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be deemed to be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act.

Contacts:

Media Contact and Investor Relations

Contact

Mike Anderson / Jessie Barker

mobix@blueshirtgroup.com

Chavant Capital Acquisit... (NASDAQ:CLAYW)

Historical Stock Chart

From Mar 2024 to Apr 2024

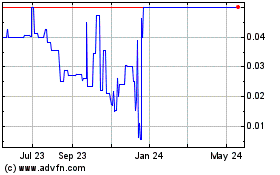

Chavant Capital Acquisit... (NASDAQ:CLAYW)

Historical Stock Chart

From Apr 2023 to Apr 2024