LSE Highlights Merger Appeal With Robust Results

05 March 2016 - 12:10AM

Dow Jones News

LONDON—London Stock Exchange Group PLC Friday reported a 85%

rise in full-year net profit and raised its dividend, highlighting

its merger appeal amid a potential bidding battle for the

group.

LSE is in talks about a potential merger with Deutsche Bö rse

AG, the owner of the Frankfurt bourse, in a combination which would

create Europe's biggest securities-markets operator.

But on Tuesday U.S. rival Intercontinental Exchange Inc. said it

is considering making an offer for LSE. Chicago's CME Group Inc.

might also be in the running, according to a person familiar with

the matter. Hong Kong Exchanges & Clearing Ltd. has said it is

closely watching the discussions between LSE and Deutsche Bö

rse.

The LSE said net profit rose to £ 336.1 million ($474 million)

in the year ended Dec. 31 from £ 182.1 million the previous year on

a 49% jump in revenue to £ 1.32 billion.

The proposed final dividend of 25.2 pence a share takes the

full-year dividend to 36 pence, up 20% from the previous full-year

payout.

The group said it benefited from growth across its main

businesses and good cost control. Chief Executive Xavier Rolet

highlighted the LSE's global stock indexes business and

over-the-counter derivatives clearing by its LCH. Clearnet

unit.

"Across all of our businesses, we are well positioned with a

number of growth opportunities," Mr. Rolet said.

Any deal involving the LSE faces likely intense regulatory

scrutiny because of the overlap of its operations with its

suitors', making some business lines possibly too large for the

liking of antitrust authorities or, in the case of their clearing

houses, leading to one party amassing too much power or housing too

much risk.

Deutsche Bö rse and ICE own derivatives clearinghouses. But

Deutsche Bö rse focuses on listed products, while the LSE's focus

is on over-the-counter swaps. ICE's European clearing operation,

ICE Clear Europe, is dominant in credit, energy and commodity

derivatives, which also includes financial futures, after its

purchase of London's Liffe exchange.

CME, which in the U.S. accounts for around 40% of swaps clearing

with the remainder processed by LCH, has also made a push into

Europe.

Write to Rory Gallivan at rory.gallivan@wsj.com

(END) Dow Jones Newswires

March 04, 2016 07:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

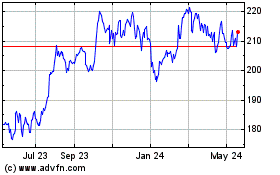

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

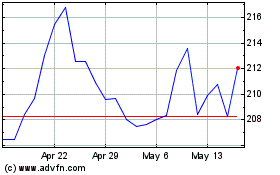

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024