true000091114700009111472023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2023

CENTURY CASINOS, INC.

(Exact Name of Registrant as specified in its charter)

| | |

Delaware | 0-22900 | 84-1271317 |

(State or other jurisdiction | (Commission | (I.R.S. Employer |

of incorporation) | File Number) | Identification Number) |

| |

455 E. Pikes Peak Ave., Suite 210, Colorado Springs, Colorado | 80903 |

(Address of principal executive offices) | (Zip Code) |

| |

Registrant’s telephone number, including area code: | 719-527-8300 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

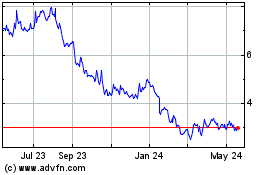

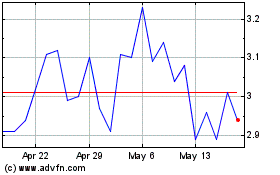

Common Stock, $0.01 Per Share Par Value | CNTY | Nasdaq Capital Market, Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

This Amendment No. 1 on Form 8-K/A (the “Amendment No. 1”) amends and supplements the Current Report on Form 8-K of Century Casinos, Inc. (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) on July 25, 2023 (the “Original Form 8-K”). On July 25, 2023, the Company completed its previously announced acquisition (the “Acquisition”) of the operations of Evitts Resort, LLC dba Rocky Gap Casino Resort (“Rocky Gap”), located in Flintstone, Maryland from Lakes Maryland Development, LLC, a subsidiary of Golden Entertainment Inc, subject to terms and conditions set forth in the Equity Purchase Agreement, dated August 24,2022.

This Amendment No. 1 amends the Original Form 8-K to include the financial statements of Rocky Gap and the pro forma financial information required by Item 9.01 of Form 8-K. The pro forma financial information included in this Amendment No. 1 has been presented for informational purposes only. It does not purport to represent the actual results of operations that the Company and Rocky Gap would have achieved had the companies been combined during the periods presented in the pro forma financial information and is not intended to project the future results of operations that the combined company may achieve after the consummation of the Acquisition.

Forward-Looking Statements

All of the pro forma and other information and other statements included in this Form 8-K/A, other than historical information or statements of historical fact, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management. Such forward-looking statements include, but are not limited to, certain plans, expectations, goals, projections, and statements about the benefits of Rocky Gap. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements including: the integration of the businesses and assets acquired; the financial performance of Rocky Gap; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the transaction; the possibility that the anticipated operating results and other benefits of the transaction are not realized when expected or at all; local risks including proximate competition, potential competition, legislative or regulatory risks, and local relationships; risks associated with increased leverage from the transaction; and other risks described in the section entitled “Risk Factors” under Item 1A in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and in subsequent periodic and current SEC filings the Company may make. The Company disclaims any obligation to revise or update any forward-looking statement that may be made from time to time by it or on its behalf.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of businesses acquired. The audited financial statements of Evitts Resort, LLC as of and for the years ended December 31, 2022 and 2021 are filed as Exhibit 99.1 and are herein incorporated by reference. The unaudited financial statements of Evitts Resort, LLC as of March 31, 2023 and December 31, 2022 and for the three months ended March 31, 2023 and 2022 are filed as Exhibit 99.2 and are herein incorporated by reference.

(b) Pro forma financial information. The unaudited pro forma condensed consolidated combined balance sheet as of March 31, 2023 and the unaudited pro forma condensed consolidated statement of combined operations for the three months ended March 31, 2023 and year ended December 31, 2022 (collectively the “Unaudited Pro Forma Financial Statements”) are filed as Exhibit 99.3 hereto and incorporated herein by reference. The Unaudited Pro Forma Financial Statements give effect to the Acquisition and related transactions.

(d) Exhibits

| | |

| | |

Exhibit No. | | Description |

23.1 | | Consent of Ernst & Young LLP |

99.1 | | Audited Financial Statements of Evitts Resort, LLC as of and for the years ended December 31, 2022 and 2021. |

99.2 | | Unaudited Financial Statements of Evitts Resort, LLC as of March 31, 2023 and December 31, 2022 and for the three months ended March 31, 2023 and 2022. |

99.3 | | Unaudited Pro Forma Condensed Combined Balance Sheet of Century Casinos, Inc. as of March 31, 2023 and Unaudited Pro Forma Condensed Statement of Combined Operations for the three months ended March 31, 2023 and year ended December 31, 2022. |

104 | | Cover Page Interactive Data File, formatted in Inline XBRL |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Century Casinos, Inc.

Date: October 4, 2023

By: /s/ Margaret Stapleton

Margaret Stapleton

Chief Financial Officer

Consent of Independent Auditors

We consent to the incorporation by reference in Registration Statement No. 333-272437 on Form S-3 and Registration Statement No. 333-216669 on Form S-8 of Century Casinos, Inc. of our report dated March 17, 2023, relating to the financial statements of Evitts Resort, LLC as of and for the years ended December 31, 2022 and 2021 appearing in this Current Report on Form 8-K/A of Century Casinos, Inc.

/s/ Ernst & Young LLP

Las Vegas, Nevada

October 4, 2023

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS’ REPORT

as of and for the years ended December 31, 2022 and 2021

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

INDEX TO FINANCIAL STATEMENTS

As of and for the years ended December 31, 2022 and 2021

Independent Auditor’s Report

To the Member and the Board of Directors of

Evitts Resort LLC dba Rocky Gap Casino and Resort

Opinion

We have audited the financial statements of Evitts Resort LLC dba Rocky Gap Casino and Resort (“the “Company”), which comprise the balance sheets as of December 31, 2022 and 2021, and the related statements of operations, member’s equity and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a

material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgement made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

|

·

| |

Exercise professional judgement and maintain professional skepticism throughout the audit. |

|

·

| |

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud, or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. |

|

·

| |

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. |

|

·

| |

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. |

|

·

| |

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ Ernst & Young LLP

March 17, 2023

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2022

|

|

2021

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

5,145

|

|

$

|

6,987

|

|

Accounts receivable, net

|

|

|

2,354

|

|

|

2,052

|

|

Prepaid expenses

|

|

|

539

|

|

|

395

|

|

Inventories

|

|

|

548

|

|

|

438

|

|

Other

|

|

|

46

|

|

|

75

|

|

Total current assets

|

|

|

8,632

|

|

|

9,947

|

|

Property and equipment, net

|

|

|

22,925

|

|

|

24,351

|

|

Operating lease right-of-use assets, net

|

|

|

5,943

|

|

|

5,915

|

|

Intangible assets, net

|

|

|

1,011

|

|

|

1,169

|

|

Other assets

|

|

|

9

|

|

|

20

|

|

Total assets

|

|

|

38,520

|

|

|

41,402

|

|

LIABILITIES AND MEMBER'S EQUITY

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Current portion of finance leases

|

|

$

|

103

|

|

$

|

101

|

|

Current potion of operating leases

|

|

|

437

|

|

|

410

|

|

Accounts payable

|

|

|

1,195

|

|

|

1,579

|

|

Accrued payroll and related

|

|

|

1,071

|

|

|

1,394

|

|

Accrued liabilities

|

|

|

1,972

|

|

|

2,043

|

|

Total current liabilities

|

|

|

4,778

|

|

|

5,527

|

|

Non-current finance leases

|

|

|

204

|

|

|

302

|

|

Non-current operating leases

|

|

|

5,310

|

|

|

5,309

|

|

Total liabilities

|

|

|

10,292

|

|

|

11,138

|

|

Commitments and contingencies (Note 9)

|

|

|

|

|

|

|

|

Member's equity

|

|

|

|

|

|

|

|

Member's equity

|

|

|

992

|

|

|

992

|

|

Retained earnings

|

|

|

27,236

|

|

|

29,272

|

|

Total member's equity

|

|

|

28,228

|

|

|

30,264

|

|

Total liabilities and member's equity

|

|

$

|

38,520

|

|

$

|

41,402

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

STATEMENTS OF OPERATIONS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

2022

|

|

2021

|

|

Revenues

|

|

|

|

|

|

|

|

Gaming

|

|

$

|

59,553

|

|

$

|

60,797

|

|

Food and beverage

|

|

|

8,440

|

|

|

7,932

|

|

Rooms

|

|

|

7,787

|

|

|

7,224

|

|

Other

|

|

|

2,230

|

|

|

2,202

|

|

Total revenues

|

|

|

78,010

|

|

|

78,155

|

|

Expenses

|

|

|

|

|

|

|

|

Gaming

|

|

|

30,647

|

|

|

30,578

|

|

Food and beverage

|

|

|

4,922

|

|

|

4,657

|

|

Rooms

|

|

|

2,939

|

|

|

2,726

|

|

Other

|

|

|

1,179

|

|

|

1,190

|

|

Selling, general and administrative

|

|

|

13,060

|

|

|

12,347

|

|

Depreciation and amortization

|

|

|

3,428

|

|

|

3,963

|

|

Loss on disposal of assets

|

|

|

—

|

|

|

492

|

|

Total expenses

|

|

|

56,175

|

|

|

55,953

|

|

Operating income

|

|

|

21,835

|

|

|

22,202

|

|

Non-operating expenses

|

|

|

|

|

|

|

|

Interest expense

|

|

|

16

|

|

|

20

|

|

Net income

|

|

$

|

21,819

|

|

$

|

22,182

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

STATEMENTS OF MEMBER’S EQUITY

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Member's

Equity

|

|

Balance, January 1, 2021

|

|

$

|

31,474

|

|

Net income

|

|

|

22,182

|

|

Distributions

|

|

|

(23,392)

|

|

Balance, December 31, 2021

|

|

$

|

30,264

|

|

Net income

|

|

|

21,819

|

|

Distributions

|

|

|

(23,855)

|

|

Balance, December 31, 2022

|

|

$

|

28,228

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

2022

|

|

2021

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Net income

|

|

$

|

21,819

|

|

$

|

22,182

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

3,428

|

|

|

3,963

|

|

Non-cash lease expense

|

|

|

(1)

|

|

|

(1)

|

|

Loss on disposal of assets

|

|

|

—

|

|

|

492

|

|

Provision for credit losses

|

|

|

87

|

|

|

20

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(389)

|

|

|

(1,162)

|

|

Prepaid expenses, inventories and other current assets

|

|

|

(227)

|

|

|

323

|

|

Other assets

|

|

|

13

|

|

|

(20)

|

|

Accounts payable and other accrued expenses

|

|

|

(778)

|

|

|

563

|

|

Net cash provided by operating activities

|

|

|

23,952

|

|

|

26,360

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Purchases of property and equipment, net change in construction payables

|

|

|

(1,878)

|

|

|

(1,447)

|

|

Proceeds from disposal of property and equipment

|

|

|

34

|

|

|

95

|

|

Net cash used in investing activities

|

|

|

(1,844)

|

|

|

(1,352)

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Distribution to Parent

|

|

|

(23,855)

|

|

|

(23,392)

|

|

Principal payments under finance leases

|

|

|

(95)

|

|

|

(94)

|

|

Net cash used in financing activities

|

|

|

(23,950)

|

|

|

(23,486)

|

|

Cash and cash equivalents

|

|

|

|

|

|

|

|

Change in cash and cash equivalents

|

|

|

(1,842)

|

|

|

1,522

|

|

Balance, beginning of period

|

|

|

6,987

|

|

|

5,465

|

|

Balance, end of period

|

|

$

|

5,145

|

|

$

|

6,987

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow disclosures

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

16

|

|

$

|

20

|

|

Non-cash investing and financing activities

|

|

|

|

|

|

|

|

Payables incurred for capital expenditures

|

|

|

20

|

|

|

21

|

|

Operating lease right-of-use assets obtained in exchange for lease obligations

|

|

|

124

|

|

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of this financial statement.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

(A WHOLLY-OWNED SUBSIDIARY OF GOLDEN ENTERTAINMENT, INC.)

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2022 and 2021

Note 1 – Nature of Business

The accompanying financial statements include the accounts of Evitts Resort, LLC, dba Rocky Gap Casino & Resort (the “Company” or “Rocky Gap”), a wholly owned subsidiary of Golden Entertainment, Inc. (the “Parent” or “Member”). The Company’s casino resort is situated on approximately 270 acres in the Rocky Gap State Park, which are leased from the Maryland Department of Natural Resources (the “Maryland DNR”) under a 40-year ground lease expiring in 2052 with an option to review for an additional 20 years. As of December 31, 2022, Rocky Gap offered 630 video lottery terminals (“VLTs”), 16 table games, two casino bars, three restaurants, a spa and the only Jack Nicklaus signature golf course in Maryland. Rocky Gap is a AAA Four Diamond Award® winning resort with 198 hotel rooms and includes an event and conference center. The Parent owns and operates a diversified entertainment platform, consisting of a portfolio of gaming assets that focus on casino and distributed gaming operations (including gaming in its branded taverns).

On August 24, 2022, the Parent entered into definitive agreements to sell Rocky Gap to Century Casinos, Inc. (“Century”) and VICI Properties, L.P. (“VICI”), an affiliate of VICI Properties Inc., for aggregate consideration of $260.0 million (the “Rocky Gap Transactions”). Specifically, Century agreed to acquire the operations of Rocky Gap from the Parent for $56.1 million in cash (subject to adjustment based on Rocky Gap’s working capital and cage cash at closing), subject to the conditions and terms set forth therein, and VICI agreed to acquire the real estate assets relating to Rocky Gap from the Parent for $203.9 million in cash, subject to the conditions and terms set forth therein. The Rocky Gap Transactions are required by their terms to close concurrently and are expected to close during the second quarter of 2023, subject to the satisfaction or waiver of customary regulatory approvals and closing conditions.

Impact of COVID-19

As of December 31, 2022, the Company was no longer subject to COVID-19 operating restrictions, since COVID-19 mitigation measures were eased and subsequently removed in 2021, which created a pent-up demand for gaming and entertainment and reflected positively on the operating results of the property. Despite the resurgence of Omicron variants during 2022, the Company continued to experience positive trends during 2022. Future COVID-19 variants, mandates, restrictions or mitigation measures imposed by governmental authorities or regulatory bodies are uncertain and could have a significant impact on the Company’s future operations.

Note 2 – Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the balance sheet dates and reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

Basis of Presentation

The accompanying financial statements have been prepared from the Company’s financial records and may not necessarily be indicative of the conditions that would have existed, or indicative of the results of operations, if Rocky Gap had operated as an independent entity unaffiliated with the Parent.

Fair Value of Financial Instruments

The carrying amount of the Company’s financial instruments approximate their estimated fair values either because of the short maturity of certain instruments (cash, accounts receivable, due to/from Parent and accounts payable), or because the interest rates are comparable to those of instruments with similar terms currently available in the marketplace.

Statements of Cash Flows

Payments made by the Parent on behalf of the Company and reimbursed by the Company are presented as advances to Parent in financing activities on the statement of cash flows, if any. Cash transferred to the Parent is presented as distributions to Parent in financing activities on the statement of cash flows.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and in banks and highly-liquid investments with original maturities of three months or less. Although these balances may at times exceed the federal insured deposit limit, the Company believes such risk is mitigated by the quality of the institutions holding such deposits.

Accounts Receivable

Accounts receivable consist primarily of gaming, hotel and other receivables, net of allowance for credit losses. Accounts receivable are non-interest bearing and are initially recorded at cost. An estimated allowance for credit losses is maintained to reduce the Company’s accounts receivable to their expected net realizable value based on specific reviews of customer accounts, the age of such accounts, management’s assessment of the customer’s financial condition, historical and current collection experience and management’s expectations of future collection trends based on the current and forecasted economic and business conditions. Accounts are written off when management deems them to be uncollectible. Recoveries of accounts previously written off are recorded when received. Historically, the Company’s estimated allowance for credit losses has been consistent with such losses.

Inventories

Inventories consist primarily of food and beverage and retail items and are stated at the lower of cost or net realizable value. Cost is determined using the first-in, first-out and the average cost inventory methods.

Property and Equipment

Property and equipment is stated at cost less accumulated depreciation. Assets held under finance lease agreements are stated at the lower of the present value of the future minimum lease payments or fair value at the inception of the lease. Expenditures for major additions, renewals and improvements are capitalized while costs of routine repairs and maintenance are expensed when incurred. Depreciation of property and equipment is computed using the straight-line method over the following estimated useful lives:

|

|

|

|

|

Building and land improvements

|

|

10 - 40 years

|

|

Furniture and equipment

|

|

3 - 15 years

|

The Company reviews the carrying amounts of its long-lived assets for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability is evaluated by comparing the estimated future cash flows of the asset, on an undiscounted basis, to its carrying amount. If the undiscounted estimated future cash flows exceed the carrying amount, no impairment is indicated. If the undiscounted estimated future cash flows do not exceed the carrying amount, impairment is recorded based on the difference between the asset’s estimated fair value and its carrying amount. To estimate fair values, the Company generally uses market comparables, when available, or a discounted cash flow model. The estimation of fair value requires significant judgement and is based on assumptions about future cash flows, including future growth rates, operating margins, economic and business conditions, and discount rate, all of which are unpredictable and inherently uncertain. The Company concluded that there was no impairment of the Company’s long-lived assets as of December 31, 2022 and 2021.

Assets to be disposed of are carried at the lower of their carrying amount or fair value less costs of disposal. The fair value of assets to be disposed of is generally estimated based on comparable asset sales, solicited offers or a discounted cash flow model. Sales and other disposals of property and equipment are recorded by removing the related cost and accumulated depreciation from the accounts with gains or losses on sales and other disposals recorded in the Company’s statements of operations.

Finite-Lived Intangible Assets

Intangible assets discussed in “Note 5 - Intangible Assets” are amortized over their estimated useful lives using the straight-line method. The Company periodically evaluates the remaining useful lives of its finite-lived intangible assets to determine whether events and circumstances warrant a revision to the remaining period of amortization.

The Company reviews the carrying amounts of its finite-lived intangible assets for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable following the same approach as for its assessment of the long-lived assets for recoverability as discussed in “Property and Equipment” section. The Company concluded that there was no impairment of the Company’s finite-lived intangible assets as of December 31, 2022 and 2021.

Leases

The Company determines whether an arrangement is or contains a lease at inception or modification of a contract. An arrangement is or contains a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The right to control the use of the identified asset means the lessee has both the right to obtain substantially all economic benefits from the use of the asset and the right to direct the use of the asset.

Operating lease right-of-use (“ROU”) assets and liabilities are recognized at the commencement date for the arrangements with a term of 12 months or longer and are initially measured based on the present value of lease payments over the defined lease term. The measurement of the operating lease ROU assets also includes any prepaid lease payments made and is net of lease incentives. If the implicit interest rate to be applied to the determination of the present value of lease payments over the lease term is not readily determinable, the Company estimates the incremental borrowing rate based on the information available at the commencement date. The Company’s lease terms may include options to extend or terminate the lease. The Company assesses these options using a threshold of reasonably certain. For leases the Company is reasonably certain to renew, those option periods are included within the lease term and, therefore, the measurement of the ROU asset and lease liability. For operating leases, lease expense for lease payments is recognized on a straight-line basis over the leas term. For finance leases, the ROU asset depreciates on a straight-line basis over the shorter of the lease term or useful life of the ROU asset and the lease liability accretes interest based on the interest method using the discount rate determined at lease commencement.

Revenue Recognition

Revenue from contracts with customers primarily consists of casino wagers, room sales, food and beverage transactions and entertainment sales.

Casino gaming revenues are the aggregate of gaming wins and losses. The commissions rebated to premium players for cash discounts and other cash incentives to patrons related to gaming play are recorded as a reduction to casino gaming revenues. Gaming contracts include a performance obligation to honor the patron’s wager and typically include a performance obligation to provide a product or service to the patron on a complimentary basis to incentivize gaming or in exchange for points earned under the Company’s True Rewards® loyalty program.

Wagering contracts that include complimentary products and services provided by the Company to incentivize gaming, such as complimentary food, beverage, rooms, entertainment, merchandise and other discretionary complimentaries, and wagering contracts that include products and services provided to a patron in exchange for points earned under the Company’s loyalty program contain more than one performance obligation. The transaction price is allocated to each performance obligation in the gaming wagering contract. The amount allocated to loyalty points earned is based on an estimate of the standalone selling price of the loyalty points, which is determined by the redemption value less an estimate for points not expected to be redeemed. The amount allocated to discretionary complimentaries is the standalone selling price of the underlying goods or services, which is determined using the retail price at which those goods or services would be sold separately in similar transactions. The remaining amount of the transaction price is allocated to wagering activity using the residual approach as the standalone selling price for gaming wagers is highly variable due to wide disparity of wagering options available to the Company’s patrons. The amount wagered, frequency of wagering, patron betting habits, and outcomes of the games of chance are unpredictable. As a result, no stand-alone selling price of a gaming transaction is determinable and the residual approach is utilized to represent the net revenue ascribed to the gaming wager.

For wagering contracts that include discretionary complimentaries, the Company allocates the stand-alone selling price of each product and service to the respective revenue type. Complimentary products or services provided under the Company’s control and discretion that are supplied by third parties are recorded as an operating expense in the consolidated statements of operations. For wagering contracts that include products and services provided to a patron in exchange for points earned under the Company’s loyalty program, the Company allocates the estimated stand-alone selling price of the points earned to the loyalty program liability. The loyalty program liability is a deferral of revenue until redemption occurs under Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers. Upon redemption of loyalty program points for Company-owned products and services, the stand-alone selling price of each product or service is allocated to the respective revenue type. For redemptions of points with third parties, the redemption amount is deducted from the loyalty program liability and paid directly to the third party. Any discounts received by the Company from the third party in connection with this transaction are recorded to other revenue in the Company’s consolidated statements of operations. The Company’s performance obligation related to its loyalty program is generally completed within one year, as participants’ points expire after thirteen months of no activity.

After allocation to the other revenue types for products and services provided to patrons as part of a wagering contract, the residual amount is recorded to casino gaming revenue as soon as the wager is settled. As all wagers have similar characteristics, the Company accounts for its gaming contracts collectively on a portfolio basis. Gaming contracts are typically completed daily based on the outcome of the wagering transaction and include a distinct performance obligation to provide gaming activities.

Food, beverage, and retail revenues are recorded at the time of sale. Room revenue is recorded at the time of occupancy. Sales taxes and surcharges collected from customers and remitted to governmental authorities are presented on a net basis.

Contract and Contract Related Liabilities

The Company provides numerous products and services to its customers. There is often a timing difference between the cash payment by the customers and recognition of revenue for each of the associated performance obligations. The Company generally has three types of liabilities related to contracts with customers:

|

·

| |

Outstanding Chip Liability – The outstanding chip liability represents the collective amounts owed to customers in exchange for gaming chips in their possession. Outstanding chips are expected to be recognized as revenue or redeemed for cash within one year of being purchased. |

|

·

| |

Loyalty Program – The Company’s Parent offers its consolidated True Rewards loyalty program at all of its casino properties, as well as at all of its branded taverns and other participating distributed gaming locations. Members of the Parent’s True Rewards loyalty program earn points based on gaming activity and food and beverage purchases at the Parent’s casino properties, taverns and participating distributed gaming locations. Loyalty points are redeemable for complimentary slot play, promotional table game chips, food and beverages and grocery gift cards. All points earned in the loyalty program roll up into a single account balance which is redeemable at over 140 participating locations. |

The Company records a liability based on the value of points earned less an estimate for points not expected to be redeemed. This liability represents a deferral of revenue until such time as the participant redeems the points earned. Redemption history at the Parent’s casinos and taverns is used to assist in the determination of the estimated accruals. Loyalty program points are expected to be redeemed and recognized as revenue within one year of being earned, since participants’ points expire after thirteen months of no activity. The True Rewards points accruals are included in current liabilities on the Company’s consolidated balance sheets. Changes in the program, increases in membership and changes in the redemption patterns of the participants can impact this liability.

|

·

| |

Customer Deposits and Other – Customer deposits and other deferred revenue represent cash deposits made by customers for future non-gaming services to be provided by the Company. The majority of these customer deposits and other deferred revenue are expected to be recognized as revenue or refunded to the customer within one year of the date the deposit was recorded. |

The following table summarizes the Company’s activity for contract and contract related liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding Chip Liability

|

|

Loyalty Program

|

|

Customer Deposits and Other

|

|

(In thousands)

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

Balance at January 1

|

|

$

|

125

|

|

$

|

84

|

|

$

|

255

|

|

$

|

266

|

|

$

|

719

|

|

$

|

608

|

|

Balance at December 31

|

|

|

112

|

|

|

125

|

|

|

304

|

|

|

255

|

|

|

452

|

|

|

719

|

|

Increase (decrease)

|

|

$

|

(13)

|

|

$

|

41

|

|

$

|

49

|

|

$

|

(11)

|

|

$

|

(267)

|

|

$

|

111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Departmental and Other Expenses

Certain indirect expenses such as utilities, maintenance and depreciation and amortization of long-lived assets are not allocated to departmental expenses and, except for depreciation and amortization, are included in other selling, general and administrative expense.

Gaming Taxes

The Company is subject to gaming taxes based on gross gaming revenues and also pays an annual flat tax based on the number of table games and video lottery terminals in operation during the year. These gaming taxes are recorded as gaming expenses in the statements of operations. Total gaming taxes were $24.7 million and $24.8 million for the years ended December 31, 2022 and 2021, respectively.

Advertising Expense

The Company expenses advertising, marketing and promotional costs as incurred. Advertising costs included in selling, general and administrative expenses in the statements of operations were $1.2 million and $1.3 million for the years ended December 31, 2022 and 2021, respectively.

Income Taxes

As a limited liability company (LLC), which is a “pass-through” entity under the Internal Revenue Code, any taxable income (or loss) of the Company is taxed to (or benefits) its sole member directly. Accordingly, no provision or liability for federal income tax has been included in the accompanying financial statements. However, in the unlikely event any tax or tax-related interest or penalty is assessed against the Company, such amounts would be included in administrative or interest expense in the statement of operations.

Recent Accounting Pronouncements

Changes to GAAP are established by the Financial Accounting Standards Board (“FASB”), in the form of Accounting Standards Updates (“ASUs”), to the FASB’s ASC. The Company considers the applicability and impact of all ASUs. While management continues to assess the possible impact of the adoption of new accounting standards and the future adoption of the new accounting standards that are not yet effective on the Company’s financial statements, management does not believe that any of the recently issued accounting standards are likely to have a material impact on the Company’s financial statements.

Note 3 – Distributions to Parent

The Company distributed cash of $23.9 million and $23.4 million to its Parent for the years ended December 31, 2022 and 2021, respectively.

Note 4 – Property and Equipment

Property and equipment, net, consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

(In thousands)

|

|

2022

|

|

2021

|

|

Building and land improvements

|

|

$

|

28,948

|

|

$

|

28,397

|

|

Furniture and equipment

|

|

|

24,996

|

|

|

24,123

|

|

Construction in progress

|

|

|

20

|

|

|

141

|

|

Property and equipment

|

|

|

53,964

|

|

|

52,661

|

|

Accumulated depreciation

|

|

|

(31,039)

|

|

|

(28,310)

|

|

Property and equipment, net

|

|

$

|

22,925

|

|

$

|

24,351

|

|

|

|

|

|

|

|

|

Depreciation expense was $3.2 million and $3.8 million for the years ended December 31, 2022 and 2021, respectively. Furniture and equipment includes $0.6 million of assets under finance lease obligations at December 31, 2022 and 2021, respectively. Accumulated depreciation associated with these assets was $0.3 million and $0.2 million at December 31, 2022 and 2021, respectively.

Note 5 – Intangible Assets

Intangible assets, net, consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2022

|

|

(In thousands)

|

|

Useful Life

(Years)

|

|

Gross

Carrying

Value

|

|

Cumulative

Amortization

|

|

Intangible

Assets, Net

|

|

Gaming license

|

|

15

|

|

$

|

2,100

|

|

$

|

(1,350)

|

|

$

|

750

|

|

Other intangible assets

|

|

25

|

|

|

448

|

|

|

(187)

|

|

|

261

|

|

Total intangible assets

|

|

|

|

$

|

2,548

|

|

$

|

(1,537)

|

|

$

|

1,011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2021

|

|

(In thousands)

|

|

Useful Life

(Years)

|

|

Gross

Carrying

Value

|

|

Cumulative

Amortization

|

|

Intangible

Assets, Net

|

|

Gaming license

|

|

15

|

|

$

|

2,100

|

|

$

|

(1,210)

|

|

$

|

890

|

|

Other intangible assets

|

|

25

|

|

|

448

|

|

|

(169)

|

|

|

279

|

|

Total intangible assets

|

|

|

|

$

|

2,548

|

|

$

|

(1,379)

|

|

$

|

1,169

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization expense was $0.2 million for each of the years ended December 31, 2022 and 2021. Future amortization is $0.2 million each year from 2023 through 2027, and $0.2 million thereafter.

Note 6 – Accrued Liabilities

Accrued liabilities consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

(In thousands)

|

|

2022

|

|

2021

|

|

Gaming liabilities

|

|

$

|

884

|

|

$

|

1,045

|

|

Accrued taxes, other than income taxes

|

|

|

559

|

|

|

567

|

|

Player loyalty program liabilities

|

|

|

304

|

|

|

255

|

|

Deposits

|

|

|

225

|

|

|

153

|

|

Other accrued liabilities

|

|

|

—

|

|

|

23

|

|

Total current accrued liabilities

|

|

$

|

1,972

|

|

$

|

2,043

|

|

|

|

|

|

|

|

|

Note 7 – Employee Benefit Plan

The Company participates in the Parent’s qualified defined contribution employee savings plan (the “Plan”). The Plan allows eligible participants to participate in the Company 401(k) plan on the first of the month following six months of employment or on the first day of the month following their effective date to transfer, whichever is later; or if already 401(k) plan participation-eligible, continued eligibility – whichever is applicable. Rocky Gap will offer a discretionary annual company match equal to 25% of your contributions up to the first 4% with a $500 annual cap. Employees must be employed on December 31st of the plan year to be eligible to receive the match (requirement waived if deceased, disabled, or retired). The contributions are vested over a five-year schedule. The Company contributed less than $0.1 million in contributions to the Plan for each of the years ended December 31, 2022 and 2021.

Note 8 – Leases

The Company is a lessee under non-cancelable operating and finance leases for land, vehicles, slot machines and equipment. The Company’s slot machine lease agreements with gaming equipment manufacturers are short-term in nature with majority of such leases being under variable rent structure, with amounts determined based on the performance of the leased machines. Certain other short-term slot machine lease agreements are under fixed fee payment structure.

The Company’s operating leases, excluding land, have remaining lease terms of less than three years. The Company’s finance leases for golf carts and related equipment have remaining lease terms of approximately three years.

The Company has an operating ground lease with the Maryland Department of Natural Resources for approximately 270 acres in the Rocky Gap State Park on which Rocky Gap is situated. Under the lease, rent payments are due and payable annually in the amount that is greater of $275,000, or 0.9% of any gross operator share of gaming revenue (as defined in the lease), plus the greater of $150,000 or the surcharge revenue. Surcharge revenue consists of amounts billed to and collected from guests and are $3.00 per room per night and $1.00 per round of golf. Rent expense associated with the lease was $0.4 million for each of the years ended December 31, 2022 and 2021.

The Company’s lease agreements for land with lease and non-lease components are accounted for separately. The lease and non-lease components of certain vehicle and equipment leases are accounted for as a single lease component. The Company’s lease agreements do not contain any material residual value guarantees, restrictions or covenants.

The components of lease expense were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

(In thousands)

|

|

Classification

|

|

2022

|

|

2021

|

|

Operating lease cost

|

|

|

|

|

|

|

|

|

|

Operating lease cost

|

|

Operating and SG&A expenses

|

|

$

|

458

|

|

$

|

457

|

|

Variable lease cost

|

|

Operating and SG&A expenses

|

|

|

1,874

|

|

|

1,976

|

|

Short-term lease cost

|

|

Operating and SG&A expenses

|

|

|

242

|

|

|

179

|

|

Total operating lease cost

|

|

|

|

$

|

2,574

|

|

$

|

2,612

|

|

|

|

|

|

|

|

|

|

|

|

Finance lease cost

|

|

|

|

|

|

|

|

|

|

Amortization of leased assets

|

|

Depreciation and amortization

|

|

$

|

106

|

|

$

|

106

|

|

Interest on lease liabilities

|

|

Interest expense, net

|

|

|

16

|

|

|

20

|

|

Total finance lease cost

|

|

|

|

$

|

122

|

|

$

|

126

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information related to leases was as follows:

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

(In thousands)

|

|

2022

|

|

2021

|

|

Cash paid for amounts included in the measurement of lease liabilities:

|

|

|

|

|

|

|

|

Operating cash flows for operating leases

|

|

$

|

458

|

|

$

|

457

|

|

Operating cash flows for finance leases

|

|

|

11

|

|

|

14

|

|

Financing cash flows for finance leases

|

|

|

95

|

|

|

94

|

|

|

|

|

|

|

|

|

Supplemental balance sheet information related to leases was as follows:

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

(In thousands)

|

|

2022

|

|

2021

|

|

Operating leases

|

|

|

|

|

|

|

|

Operating lease right-of-use assets, gross

|

|

$

|

6,039

|

|

$

|

6,007

|

|

Accumulated amortization

|

|

|

(96)

|

|

|

(92)

|

|

Operating lease right-of-use assets, net

|

|

$

|

5,943

|

|

$

|

5,915

|

|

|

|

|

|

|

|

|

|

Current portion of operating leases

|

|

$

|

437

|

|

$

|

410

|

|

Non-current operating leases

|

|

|

5,310

|

|

|

5,309

|

|

Total operating lease liabilities

|

|

$

|

5,747

|

|

$

|

5,719

|

|

|

|

|

|

|

|

|

|

Finance leases

|

|

|

|

|

|

|

|

Property and equipment, gross

|

|

$

|

559

|

|

$

|

559

|

|

Accumulated depreciation

|

|

|

(257)

|

|

|

(152)

|

|

Property and equipment, net

|

|

$

|

302

|

|

$

|

407

|

|

|

|

|

|

|

|

|

|

Current portion of finance leases

|

|

$

|

103

|

|

$

|

101

|

|

Non-current finance leases

|

|

|

204

|

|

|

302

|

|

Total finance lease liabilities

|

|

$

|

307

|

|

$

|

403

|

|

|

|

|

|

|

|

|

The following presents additional information related to the Company’s leases as of December 31, 2022:

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2022

|

|

2021

|

|

Weighted Average Remaining Lease Term

|

|

|

|

|

|

|

|

Operating leases

|

|

|

29.0 years

|

|

|

30.4 years

|

|

Finance leases

|

|

|

2.9 years

|

|

|

3.9 years

|

|

|

|

|

|

|

|

|

|

Weighted Average Discount Rate

|

|

|

|

|

|

|

|

Operating leases

|

|

|

6.4%

|

|

|

6.4%

|

|

Finance leases

|

|

|

4.4%

|

|

|

4.4%

|

|

|

|

|

|

|

|

|

Maturities of Lease Liabilities

As of December 31, 2022, maturities of lease liabilities were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands)

|

|

Operating

Leases

|

|

Finance

Leases

|

|

Total

|

|

2023

|

|

$

|

472

|

|

$

|

111

|

|

$

|

583

|

|

2024

|

|

|

471

|

|

|

111

|

|

|

582

|

|

2025

|

|

|

451

|

|

|

105

|

|

|

556

|

|

2026

|

|

|

425

|

|

|

—

|

|

|

425

|

|

2027

|

|

|

425

|

|

|

—

|

|

|

425

|

|

Thereafter

|

|

|

10,200

|

|

|

—

|

|

|

10,200

|

|

Total lease payments

|

|

|

12,444

|

|

|

327

|

|

|

12,771

|

|

Amount of interest

|

|

|

(6,697)

|

|

|

(20)

|

|

|

(6,717)

|

|

Present value of lease liabilities

|

|

$

|

5,747

|

|

$

|

307

|

|

$

|

6,054

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2022, the Company does not have any leases that have not yet commenced but that create significant rights and obligations.

Note 9 – Commitments and Contingencies

Miscellaneous Legal Matters

The Company is subject to various claims and litigation in the normal course of business. In management’s opinion, all pending legal matters are either adequately covered by insurance or, if not insured, will not have a material adverse effect on the financial statements.

Note 10 – Subsequent Events

The Company has evaluated all events or transactions that occurred after December 31, 2022. During this period, up to the date the financial statements were available to be issued, March 17, 2023, the Company did not identify any subsequent events, the effects of which would require adjustment to the financial position as of December 31, 2022, or to the results of operations, retained earnings, cash flows or disclosure in the financial statements for the year ended December 31, 2022.

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

FINANCIAL STATEMENTS FOR THE QUARTERLY PERIOD ENDED

MARCH 31, 2023

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

INDEX TO FINANCIAL STATEMENTS

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

December 31,

|

|

|

|

2023

|

|

2022

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

6,389

|

|

$

|

5,145

|

|

Accounts receivable, net

|

|

|

1,929

|

|

|

2,354

|

|

Prepaid expenses

|

|

|

431

|

|

|

539

|

|

Inventories

|

|

|

642

|

|

|

548

|

|

Other

|

|

|

169

|

|

|

46

|

|

Total current assets

|

|

|

9,560

|

|

|

8,632

|

|

Property and equipment, net

|

|

|

22,219

|

|

|

22,925

|

|

Operating lease right-of-use assets, net

|

|

|

5,916

|

|

|

5,943

|

|

Intangible assets, net

|

|

|

972

|

|

|

1,011

|

|

Other assets

|

|

|

5

|

|

|

9

|

|

Total assets

|

|

|

38,672

|

|

|

38,520

|

|

LIABILITIES AND MEMBER'S EQUITY

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Current portion of finance leases

|

|

$

|

103

|

|

$

|

103

|

|

Current potion of operating leases

|

|

|

437

|

|

|

437

|

|

Accounts payable

|

|

|

1,293

|

|

|

1,195

|

|

Accrued payroll and related

|

|

|

1,090

|

|

|

1,071

|

|

Accrued liabilities

|

|

|

2,414

|

|

|

1,972

|

|

Total current liabilities

|

|

|

5,337

|

|

|

4,778

|

|

Non-current finance leases

|

|

|

193

|

|

|

204

|

|

Non-current operating leases

|

|

|

5,388

|

|

|

5,310

|

|

Total liabilities

|

|

|

10,918

|

|

|

10,292

|

|

Commitments and contingencies (Note 6)

|

|

|

|

|

|

|

|

Member's equity

|

|

|

|

|

|

|

|

Member's equity

|

|

|

992

|

|

|

992

|

|

Retained earnings

|

|

|

26,762

|

|

|

27,236

|

|

Total member's equity

|

|

|

27,754

|

|

|

28,228

|

|

Total liabilities and member's equity

|

|

$

|

38,672

|

|

$

|

38,520

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

STATEMENTS OF OPERATIONS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

2023

|

|

2022

|

|

Revenues

|

|

|

|

|

|

|

|

Gaming

|

|

$

|

14,514

|

|

$

|

14,457

|

|

Food and beverage

|

|

|

1,866

|

|

|

1,647

|

|

Rooms

|

|

|

1,545

|

|

|

1,474

|

|

Other

|

|

|

203

|

|

|

314

|

|

Total revenues

|

|

|

18,128

|

|

|

17,892

|

|

Expenses

|

|

|

|

|

|

|

|

Gaming

|

|

|

7,665

|

|

|

7,350

|

|

Food and beverage

|

|

|

1,217

|

|

|

1,051

|

|

Rooms

|

|

|

722

|

|

|

699

|

|

Other

|

|

|

141

|

|

|

158

|

|

Selling, general and administrative

|

|

|

3,369

|

|

|

3,172

|

|

Depreciation and amortization

|

|

|

745

|

|

|

970

|

|

Total expenses

|

|

|

13,859

|

|

|

13,400

|

|

Operating income

|

|

|

4,269

|

|

|

4,492

|

|

Non-operating expenses

|

|

|

|

|

|

|

|

Interest expense

|

|

|

3

|

|

|

4

|

|

Net income

|

|

$

|

4,266

|

|

$

|

4,488

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

STATEMENTS OF MEMBER’S EQUITY

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Member's

Equity

|

|

Balance, January 1, 2022

|

|

$

|

30,264

|

|

Net income

|

|

|

4,488

|

|

Distributions

|

|

|

(4,510)

|

|

Balance, March 31, 2022

|

|

$

|

30,242

|

|

|

|

|

|

|

Balance, January 1, 2023

|

|

$

|

28,228

|

|

Net income

|

|

|

4,266

|

|

Distributions

|

|

|

(4,740)

|

|

Balance, March 31, 2023

|

|

$

|

27,754

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

2023

|

|

2022

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Net income

|

|

$

|

4,266

|

|

$

|

4,488

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

745

|

|

|

970

|

|

Non-cash lease expense

|

|

|

106

|

|

|

106

|

|

Provision for credit losses

|

|

|

25

|

|

|

2

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

401

|

|

|

73

|

|

Prepaid expenses, inventories and other current assets

|

|

|

(109)

|

|

|

(200)

|

|

Other assets

|

|

|

3

|

|

|

3

|

|

Accounts payable and other accrued expenses

|

|

|

579

|

|

|

(102)

|

|

Net cash provided by operating activities

|

|

|

6,016

|

|

|

5,340

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Purchases of property and equipment, net change in construction payables

|

|

|

(21)

|

|

|

(370)

|

|

Net cash used in investing activities

|

|

|

(21)

|

|

|

(370)

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Distribution to Parent

|

|

|

(4,740)

|

|

|

(4,510)

|

|

Principal payments under finance leases

|

|

|

(11)

|

|

|

(9)

|

|

Net cash used in financing activities

|

|

|

(4,751)

|

|

|

(4,519)

|

|

Cash and cash equivalents

|

|

|

|

|

|

|

|

Change in cash and cash equivalents

|

|

|

1,244

|

|

|

451

|

|

Balance, beginning of period

|

|

|

5,145

|

|

|

6,987

|

|

Balance, end of period

|

|

$

|

6,389

|

|

$

|

7,438

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow disclosures

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

3

|

|

$

|

4

|

|

Non-cash investing and financing activities

|

|

|

|

|

|

|

|

Payables incurred for capital expenditures

|

|

|

—

|

|

|

271

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of this financial statement.

|

EVITTS RESORT, LLC (dba ROCKY GAP CASINO & RESORT)

NOTES TO FINANCIAL STATEMENTS

Note 1 – Nature of Business and Basis of Presentation

Overview