Noventiq and Corner Growth Acquisition Corp. Sign Letter of Intent for a Business Combination

10 February 2023 - 1:15AM

Business Wire

Noventiq (LSE: SFTL) (Noventiq, or the Company), the global

digital transformation and cybersecurity solutions and services

provider headquartered in London and currently operating in almost

60 countries, and Corner Growth Acquisition Corp. (Nasdaq: COOL)

(“Corner Growth”), a special purpose acquisition company backed by

veteran technology investors, today announced the signing of a

letter of intent (“LOI”) and an exclusive term sheet to proceed

with a potential business combination that would result in the

combined company being publicly-listed on the Nasdaq.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230209005474/en/

Noventiq and Corner Growth expect to finalize their definitive

Business Combination Agreement in the coming weeks and plan to

announce additional details at that time.

Noventiq has been engaged in a process of evaluating long-term

options with the aim to deliver greater value, transparency,

certainty, and liquidity to shareholders. The Company’s board of

directors (“Board”) believes that a listing on the Nasdaq in the

United States, by way of a business combination with Corner Growth,

is a positive and natural next step for the Company, and is in the

best interests of its shareholders. The recent announcement to

re-domicile the Company in the Cayman Islands is also intended to

ensure that the transaction can be completed in a timely manner and

is structured in a manner customary to international investors.

The Board believes that the current price of Noventiq’s listed

Global Depository Receipt (GDRs) is not a fair reflection of the

value of the Noventiq Group and that there continues to be very

limited trading volume in Noventiq GDRs on the London Stock

Exchange. Nasdaq is a leading global stock market with a respected

technology heritage, which Noventiq and Corner Growth believe is

the strongest fit for Noventiq as it continues to strengthen its

position as a leading global digital transformation and

cybersecurity provider.

Jacques Guers, Chairman of the Board of Directors of Noventiq

Group noted:

“Today’s announcement is a significant step towards our

objective to realise the true fundamental value of Noventiq for all

of our stakeholders. We have built a great company with a very

strong track record for growth, and a partnership with Corner

Growth is an exciting move as we look ahead to a potential listing

on Nasdaq. Corner Growth’s team has a strong history with companies

in the emerging markets, helping to generate added sales channels,

contract opportunities, and access to significant customer networks

at the highest levels."

Marvin Tien, Co-Chairman & CEO of Corner Growth

said:

“Noventiq fits perfectly within our investment strategy to back

leading global technology companies. Corner Growth’s relationships

in the Asia-Pacific region, over two decades of investment

experience, and its acute understanding of the risks, benefits, and

successful execution of cross-border transactions both validate our

reputation as a leading technology investor and position this

transaction to close successfully, adding significant value as a

long-term partner to Noventiq.”

Additional Information

Noventiq’s related supporting materials, including the recent

announcement to re-domicile the company to the Cayman Islands, are

published in the Investor Relations section of Noventiq’s website

at https://noventiq.com/investor-relations

About Noventiq

Noventiq is the brand name of Softline Holding plc, a leading

global solutions and services provider in digital transformation

and cybersecurity, headquartered in London. Noventiq enables,

facilitates and accelerates the digital transformation of its

customers' businesses, connecting over 75,000 organisations from

all industries with hundreds of best-in-class IT vendors, and

delivering its own services and solutions.

The Company delivered turnover of approximately US$1.1 billion

in the fiscal year of 2021. The Company´s c. 5,700 employees work

in almost 60 countries throughout Asia, Latin America, Europe, The

Middle East and Africa – with a focus on markets with significant

growth potential.

Additional information about the Company can be found here:

https://noventiq.com/investor-relations

About Corner Growth Acquisition Corp.

Corner Growth Acquisition Corp. (Nasdaq: COOL) is a special

purpose acquisition company (SPAC) focused on partnering with a

high growth technology company. Corner Growth’s mission is to

deliver value to its investors by providing a compelling

alternative to a traditional public offering. Corner Growth is

uniquely positioned to deliver on its value-add approach given its

management team’s history, experience, relationships, leadership

and track record in identifying and investing in disruptive

technology companies across all technology verticals.

Corner Growth also brings a group of highly respected investment

professionals, with strong track records and deep individual

experience in SPAC and de-SPAC processes, a rolodex of premier

public market investors, and a team of advisors who offer

experience and access to networks across a broad functional and

physical geography.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230209005474/en/

Noventiq Contacts: Steven Salter Global Investor

Relations VP ir@noventiq.com Rocio Herraiz Global Head of

Communications pr@noventiq.com Corner Growth Contacts: Kevin

Tanaka, Director of Corporate Development Corner Growth Acquisition

Corp. kevin@cornercapitalmgmt.com Brian Ruby, ICR

Brian.ruby@icrinc.com

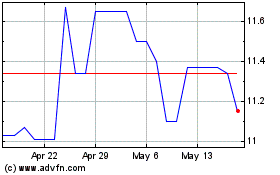

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Feb 2025 to Mar 2025

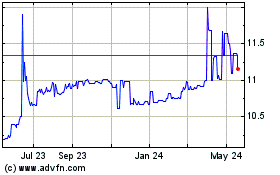

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Mar 2025