Filed Pursuant to Rule 424(b)(3)

Registration No. 333-282703

PROSPECTUS

Creative Realities, Inc.

3,156,984 Shares of Common Stock

This prospectus relates to the proposed resale or other disposition from time to time of up to 3,156,984 shares of common stock, $0.01 par value per share, of Creative Realities, Inc. (the “Company”), by the selling shareholders identified in this prospectus. We are not selling any shares of common stock under this prospectus and will not receive any of the proceeds from the sale or other disposition of common stock by the selling shareholders.

The selling shareholders and their pledgees, assignees or successors-in-interest may offer and sell or otherwise dispose of the shares of common stock described in this prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling shareholders will bear all commissions and discounts, if any, attributable to the sales of such shares. We will bear all other costs, expenses and fees in connection with the registration of such shares. See “Plan of Distribution” beginning on page 6 for more information about how the selling shareholders may sell or dispose of its shares of common stock.

Our common stock is listed on The NASDAQ Capital Market under the symbol “CREX.” The last reported per share price for our common stock was $4.61, as quoted on The NASDAQ Capital Market on October 16, 2024.

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks that we have described on page 3 of this prospectus under the caption “Risk Factors” and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 24, 2024.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”), pursuant to which the selling shareholders may, from time to time, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the information incorporated by reference into this prospectus, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find More Information” and “Important Information Incorporated by Reference” in this prospectus.

Neither we nor the selling shareholders have authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

We further note that the representations, warranties and covenants made in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context requires otherwise or unless otherwise indicated, all references to “Creative Realities,” the “Company,” “we,” “our,” or “us” refer to Creative Realities, Inc.

This prospectus does not constitute, and any prospectus supplement or other offering materials related to an offering of securities described in this prospectus will not constitute, an offer to sell, or a solicitation of an offer to purchase, the offered securities in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation in such jurisdiction.

PROSPECTUS SUMMARY

The following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus. We urge you to read this entire prospectus, including the more detailed financial statements, notes to the financial statements and other information incorporated by reference from our other filings with the SEC. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. You should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

Company Overview

Creative Realities provides digital solutions to enhance communications in a wide-ranging variety of out-of-home environments by providing innovative digital signage solutions for key market segments and use cases, including:

| |

●

|

Entertainment and Sports Venues

|

| |

●

|

Restaurants, including quick-serve restaurants (QSR)

|

| |

●

|

Medical and Healthcare Facilities

|

| |

●

|

Corporate Communications, Employee Experience

|

| |

●

|

Digital out of Home (DOOH) Advertising Networks

|

We serve market-leading companies, so there is a good chance that if you leave your home today to shop, work, eat or play, you will encounter one or more of our digital signage experiences. Our solutions are increasingly visible because we help our enterprise clients achieve a wide range of business objectives including:

| |

●

|

Increased brand awareness/engagement

|

| |

●

|

Improved customer support

|

| |

●

|

Enhanced employee productivity and satisfaction

|

| |

●

|

Increased revenue and profitability

|

| |

●

|

Improved guest experience

|

| |

●

|

Increased customer/guest engagement

|

Through a combination of organically grown platforms and a series of strategic acquisitions, the Company assists clients to design, deploy, manage, and monetize their digital signage networks. The Company sources leads and opportunities for its solutions through its digital and content marketing initiatives, close relationships with key industry partners, equipment manufacturers, and the direct efforts of its in-house industry sales experts. Client engagements focus on consultative conversations that ensure the Company’s solutions are positioned to help clients achieve their business objectives in the most cost-effective manner possible.

Corporate Organization

Our principal offices are located at 13100 Magisterial Drive, Ste 100, Louisville, Kentucky 40223, and our telephone number at that office is (502) 791-8800.

We originally incorporated and organized as a Minnesota corporation under the name “Wireless Ronin Technologies, Inc.” in March 2003 and focused on our expertise in digital media marketing solutions, including digital signage, interactive kiosks, mobile, social media and web-based media solutions. We acquired the interactive marketing technology business that we currently operate in a 2014 merger with Creative Realities, LLC. Shortly after that merger, we changed our corporate name from “Wireless Ronin Technologies, Inc.” to “Creative Realities, Inc.” On October 15, 2015, we acquired the systems integration and marketing technology business of ConeXus World Global, LLC. On November 20, 2018, we acquired Allure, an enterprise software development company. On February 17, 2022, we acquired Reflect Systems, Inc.

Selling Shareholders

Slipstream Communications, LLC and Slipstream Funding, LLC (collectively, “Slipstream”) initially acquired our common stock in 2014 when the Company merged with Creative Realities, LLC. Slipstream has also participated in the Company’s prior offerings of convertible notes, preferred stock and common stock offerings. Slipstream was the Company’s senior secured lender from 2016 until 2024. As lender, Slipstream acquired certain warrants to purchase common stock of the Company. While some of these warrants have expired, Slipstream is the current holder of a warrant issued October 17, 2024 to purchase up to 1,731,499 shares of Company common stock (the “Warrant”). The Company is registering for resale the shares of common stock issuable upon exercise of the Warrant in addition to the other shares of common stock beneficially owned by Slipstream.

The Warrant was originally issued on February 17, 2022 in connection with the Company and its subsidiaries’ refinancing of their current debt facilities with Slipstream, pursuant to a Second Amended and Restated Credit and Security Agreement. The Warrant was amended and restated on June 30, 2022 and thereafter on October 17, 2024.

The exercise price of the Warrant is $6.00 per share. The Warrant is currently exercisable and expires on February 17, 2028. In certain circumstances, upon a fundamental transaction of the Company, the holders of the Warrant will have the right to require the Company to repurchase the Warrant at fair value using a Black Scholes option pricing formula; provided that such holder may not require the Company or its successor entity to repurchase the Warrant for the Black Scholes value in connection with a fundamental transaction that is not approved by the Company’s Board of Directors, and therefore not within the Company’s control.

The foregoing summary descriptions of the Warrant does not purport to be complete and is qualified in its entirety by reference to the full text of the Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part and is incorporated by reference herein.

On February 2, 2023 and May 1, 2023, we received unsolicited proposals from Pegasus Capital Advisors, L.P., on behalf of itself and certain of its affiliates, including Slipstream (collectively, “Pegasus”), to acquire all of the outstanding shares of common stock of the Company that are not owned by Pegasus for purchase prices of $0.83 per share in cash (or, as a result of our 1-for-3 reverse stock split effectuated in March 2023, $2.49 per share), and $2.85 per share in cash, respectively. Pegasus is the beneficial owner of our common stock owned of record by Slipstream. The Special Committee of the Company’s Board of Directors (the “Special Committee”) concluded that each proposal undervalued the Company based on the Special Committee’s views of the intrinsic value of the Company’s existing business and current and future prospects, and was not in the best interests of the Company’s existing shareholders. Consequently, the Special Committee advised Pegasus that it rejected each proposal, and since May 1, 2023, Pegasus has not made any subsequent acquisition proposal or indicated that it intends to make any further proposals.

Risk Factors

Our business is subject to numerous risks. For a discussion of the risks you should consider before purchasing shares of our common stock, see “Risk Factors” on page 3 of this prospectus.

The Offering

This prospectus relates to the proposed resale or other disposition from time to time of up to 3,156,984 shares of our common stock, $0.01 par value per share, by the selling shareholders identified in this prospectus. See “Selling Shareholders” and “Plan of Distribution.”

The selling shareholders may offer to sell the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices. Our common stock is listed on the Nasdaq Capital Market under the symbol “CREX.”

We will not receive any of the proceeds from the sale of shares of our common stock in this offering.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before purchasing the securities offered by this prospectus, you should carefully consider the risks, uncertainties and additional information (i) contained herein or in any applicable prospectus supplement, (ii) set forth in our most recent Annual Report on Form 10-K filed with the SEC on March 21, 2024, as amended on April 26, 2024, which is incorporated by reference into this prospectus, and (iii) set forth in our future filings with the SEC that are incorporated by reference into this prospectus.

For a description of these reports and documents, and information about where you can find them, see “Where You Can Find More Information” and “Important Information Incorporated by Reference.” The risks and uncertainties in this prospectus and in the documents incorporated by reference in this prospectus are those that we currently believe may materially impact the Company and could result in the loss of all or a portion of your investment in our common stock. Additional risks not presently known or are currently deemed immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain, and any prospectus supplement may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical facts contained in this prospectus and the documents incorporated by reference herein contain, and any prospectus supplement, are forward-looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

| |

●

|

the adequacy of funds for future operations;

|

| |

●

|

future expenses, revenue and profitability;

|

| |

●

|

trends affecting financial condition and results of operations;

|

| |

●

|

the ability to convert proposals into customer orders, including our ability to realize the revenues included in our future guidance and backlog reports;

|

| |

●

|

general economic conditions and outlook, including those as a result of the COVID-19 pandemic;

|

| |

●

|

the ability of customers to pay for products and services received;

|

| |

●

|

the ability to satisfy our upcoming debt obligations and other liabilities;

|

| |

●

|

the impact of changing customer requirements upon revenue recognition;

|

| |

●

|

customer cancellations;

|

| |

●

|

the availability and terms of additional capital;

|

| |

●

|

industry trends and the competitive environment;

|

| |

●

|

the impact of the Company’s financial condition upon customer and prospective customer relationships;

|

| |

●

|

potential litigation and regulatory actions directed toward our industry in general;

|

| |

●

|

the ability of our largest shareholder, Slipstream, to exercise control of our management and our Board of Directors;

|

| |

●

|

our reliance on certain key personnel in the management of our businesses;

|

| |

●

|

employee and management turnover;

|

| |

●

|

the existence of material weaknesses in internal controls over financial reporting;

|

| |

●

|

the inability to successfully integrate the operations of acquired companies; and

|

| |

●

|

the ability to remain listed on the Nasdaq Capital Market.

|

In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “could”, “would”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “projects”, “predicts”, “potential” “propose,” and similar expressions (or the negative versions of such words or expressions) intended to identify forward-looking statements.

These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail in our reports filed from time to time under the Securities Act and/or the Exchange Act. We encourage you to read these filings as they are made. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

You should read this prospectus, the documents incorporated by reference herein, and any prospectus supplement that we have authorized for use in connection with this offering completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of shares of our common stock in this offering. The selling shareholders will receive all of the proceeds from this offering.

SELLING SHAREHOLDERS

We are registering shares of common stock in order to permit the selling shareholders to offer the shares for resale from time to time. The shares of common stock being offered by the selling shareholders are those previously issued to the selling shareholders and those issuable to the selling shareholders upon exercise of the Warrant for a total of 3,156,984 shares of common stock.

For additional information regarding the issuances of those shares of common stock and the Warrant, see “Prospectus Summary – Selling Shareholders” above. Except as described in “Prospectus Summary – Selling Shareholders” above, the selling shareholders have not had any material relationship with us within the past three years.

The table below lists the selling shareholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling shareholders. The second column lists the number of shares of common stock beneficially owned by each selling shareholder, based on its ownership of the shares of common stock and warrants, as of October 16, 2024, assuming the full exercise of the Warrant held by the selling shareholders on that date, without regard to any limitations on exercise.

The third column lists the shares of common stock being offered by this prospectus by the selling shareholders.

This prospectus generally covers the resale of all of the shares of common stock beneficially owned by the selling shareholders, including the maximum number of shares of common stock issuable to the selling shareholders upon exercise of the Warrant described in “Prospectus Summary—Selling Shareholders” above, determined as if the Warrant was exercised in full as of the trading day immediately preceding the date the registration statement of which this prospectus is a part was initially filed with the SEC, without regard to any limitations on the exercise of the Warrant. The fourth column assumes the sale of all of the shares offered by the selling shareholders pursuant to this prospectus.

The selling shareholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

|

Selling Shareholders

|

|

Number of Shares of

Common Stock

Owned Prior to

Offering

|

|

|

Maximum Number of

Shares of Common

Stock to be Sold

Pursuant to this

Prospectus

|

|

|

Number of Shares of

Common Stock

Owned After

Offering

|

|

|

Slipstream Funding, LLC(1)

|

|

|

317,455 |

|

|

|

317,455 |

|

|

|

0 |

(4) |

|

Slipstream Communications, LLC(2)

|

|

|

2,839,529 |

(3) |

|

|

2,839,529 |

|

|

|

0 |

(4) |

|

(1)

|

Investment and voting power over shares owned by Slipstream Funding, LLC is held by Slipstream Communications, LLC, its sole member, and may deemed to be directly or indirectly controlled by Craig Cogut, Chairman and Chief Executive Officer of Pegasus Capital Advisors, L.P. See table footnote 2 for further information regarding Slipstream Communications, LLC.

|

|

(2)

|

Slipstream Communications, LLC (“Slipstream Communications”) is the sole member of Slipstream Funding, LLC (“Slipstream Funding”). BCOM Holdings, LP (“BCOM Holdings”) is the managing member of Slipstream Communications. BCOM GP LLC (“BCOM GP”) is the general partner of BCOM Holdings. Business Services Holdings, LLC (“Business Services Holdings”) is the sole member of BCOM GP. PP IV BSH, LLC (“PP IV BSH”), Pegasus Investors IV, L.P. (“Pegasus Investors”) and Pegasus Partners IV (AIV), L.P. (“Pegasus Partners (AIV)”) are the members of Business Services Holdings. Pegasus Partners IV, L.P. (“Pegasus Partners”) is the sole member of PP IV BSH. Pegasus Investors IV, L.P. (“Pegasus Investors”) is the general partner of each of Pegasus Partners (AIV) and Pegasus Partners and Pegasus Investors IV GP, L.L.C. (“Pegasus Investors GP”) is the general partner of Pegasus Investors. Pegasus Investors GP is wholly owned by Pegasus Capital, LLC (“Pegasus Capital”). Pegasus Capital may be deemed to be directly or indirectly controlled by Craig Cogut.

|

|

(3)

|

Includes 1,731,499 shares issuable upon the exercise of the Warrant that is currently exercisable.

|

|

(4)

|

Assumes the sale of all shares offered by this prospectus by each selling shareholder.

|

PLAN OF DISTRIBUTION

The selling shareholders and any of their pledgees, donees, transferees, assignees or other successors-in-interest may sell all or a portion of the shares of common stock held by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling shareholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

| |

●

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, including the Nasdaq Capital Market;

|

| |

●

|

in the over-the-counter market;

|

| |

●

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

| |

●

|

through the writing or settlement of options, whether such options are listed on an options exchange or otherwise;

|

| |

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| |

●

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| |

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

| |

●

|

privately negotiated transactions;

|

| |

●

|

short sales made after the date this registration statement is declared effective by the SEC;

|

| |

●

|

broker-dealers may agree with a selling shareholder to sell a specified number of such shares at a stipulated price per share;

|

| |

●

|

a combination of any such methods of sale; and

|

| |

●

|

any other method permitted pursuant to applicable law.

|

We are not a party to any arrangement with any selling shareholder or any broker-dealer therewith with respect to sales of shares of common stock by the selling shareholders; therefore, we will not receive any proceeds from the sale of shares of common stock by the selling shareholders.

The selling shareholders may also sell shares of common stock under Rule 144 promulgated under the Securities Act, if available, rather than under this prospectus. If the selling shareholders effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling shareholders or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). The selling shareholders may also loan or pledge shares of common stock to broker-dealers that in turn may sell such shares.

Broker-dealers engaged by the selling shareholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440 or the successor to such FINRA rules.

The selling shareholders may pledge or grant a security interest in some or all of the shares of common stock owned by them and, if the selling shareholders default in their performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer and donate the shares of common stock in other circumstances in which case the pledgees, assignees or successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

To the extent required by the Securities Act and the rules and regulations thereunder, the selling shareholders and any broker-dealer participating in the distribution of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement, if required, will be distributed, which will set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling shareholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that the selling shareholders will sell any or all of the shares of common stock registered pursuant to the registration statement, of which this prospectus is a part.

The selling shareholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the selling shareholders and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of common stock.

Once sold under the registration statement, of which this prospectus is a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

The validity of the shares of common stock offered from time to time by this prospectus and any related prospectus supplement will be passed upon by Taft Stettinius & Hollister LLP.

EXPERTS

The financial statements of Creative Realities, Inc. and subsidiaries as of December 31, 2023 and 2022, and for each of the two years in the period ended December 31, 2023, incorporated by reference in this prospectus by reference to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as amended, have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC, including us. The address of the SEC website is www.sec.gov.

The representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were made as of an earlier date. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We maintain an Internet site at http://www.cri.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus or part of any prospectus supplement.

IMPORTANT INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC:

| |

●

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 21, 2024, as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on April 26, 2024;

|

| |

●

|

Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, filed with the SEC on May 10, 2024, and for the fiscal quarter ended June 30, 2024, filed with the SEC on August 14, 2024; and

|

| |

●

|

All other reports filed with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, since the end of the fiscal year covered by the Annual Report on Form 10-K referenced above; and

|

| |

●

|

The description of the Company’s common stock set forth in the Company’s Registration Statement on Form 8-A, filed with the SEC on November 14, 2018 by reference to the description under the caption “Description of Securities – Common Stock” in the prospectus forming a part of the Company’s Registration Statement on Form S-1, as amended (Registration No. 333-225876), filed with the SEC on October 31, 2018.

|

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the common stock made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

We will provide at no cost to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the documents that are incorporated by reference in this prospectus but not delivered with this prospectus, including exhibits that are specifically incorporated by reference in such documents. You may request a copy of such documents by writing or telephoning us at the following address or telephone number:

Creative Realities, Inc.

Attention: Corporate Secretary

13100 Magisterial Drive, Suite 100

Louisville, KY 40223

(502) 791-8800

PROSPECTUS

Dated October 24, 2022

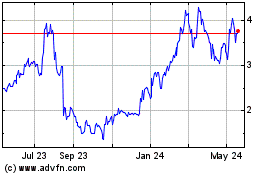

Creative Realities (NASDAQ:CREX)

Historical Stock Chart

From Dec 2024 to Jan 2025

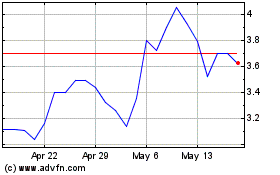

Creative Realities (NASDAQ:CREX)

Historical Stock Chart

From Jan 2024 to Jan 2025