Capital Southwest Receives “Green Light” Letter from the U.S. Small Business Administration to Submit Its Second SBIC License Application

11 December 2024 - 9:41AM

Capital Southwest Corporation (“Capital Southwest” or the

“Company”; Nasdaq: CSWC), an internally managed business

development company focused on providing flexible financing

solutions to support the acquisition and growth of middle market

businesses, today announced that the U.S. Small Business

Administration (the “SBA”) has issued a “green light” letter

inviting Capital Southwest to submit its application to obtain a

license to operate a second Small Business Investment Company

(“SBIC”) subsidiary.

“Our partnership with the SBIC program continues

to be an important strategic priority for Capital Southwest and a

natural fit with our core lower middle market investment strategy,”

said Michael Sarner, Chief Financial Officer of Capital Southwest.

“Access to additional SBA debentures will continue to diversify our

sources of attractive long-term capital and enable Capital

Southwest to maintain balance sheet funding flexibility through

capital market cycles. We look forward to continuing to work with

the SBA to complete this process.”

Upon approval, Capital Southwest would receive

its second SBIC license which would provide the Company with access

to up to an additional $175 million of growth capital through

SBA-guaranteed debentures, bringing Capital Southwest’s combined

borrowing capacity through the SBIC program to a total of $350

million. SBA debentures have maturities of ten years and have fixed

interest rates tied to the U.S. 10 Year Treasury rate. Receipt of a

green light letter from the SBA does not assure an applicant that

the SBA will ultimately issue an SBIC license, and Capital

Southwest has received no assurance or indication from the SBA that

it will receive an SBIC license, or of the timeframe in which it

would receive a license, should one be granted.

The SBA program has played a pivotal role within

Capital Southwest’s lower middle market investment strategy since

receiving its first SBIC license in April 2021. Capital Southwest

received exemptive relief from the Securities and Exchange

Commission that allows for the exclusion of SBIC leverage from the

Company’s applicable asset coverage limits.

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.5 billion in investments at fair

value as of September 30, 2024. Capital Southwest is a middle

market lending firm focused on supporting the acquisition and

growth of middle market businesses with $5 million to $50 million

investments across the capital structure, including first lien,

second lien and non-control equity co-investments. As a public

company with a permanent capital base, Capital Southwest has the

flexibility to be creative in its financing solutions and to invest

to support the growth of its portfolio companies over long periods

of time.

Forward-Looking Statements

This press release contains “forward-looking”

statements, as that term is defined under the federal securities

laws, including the potential benefits of obtaining a license to

operate a wholly owned SBIC subsidiary. Forward-looking statements

are statements that are not historical statements and can often be

identified by words such as "will," "believe," "expect" and similar

expressions and variations or negatives of these words. These

statements are based on management's current expectations,

assumptions and beliefs. They are not guarantees of future results

and are subject to numerous risks, uncertainties and assumptions

that could cause actual results to differ materially from those

stated or implied in forward-looking statements due to a number of

factors. These risks include risks related to: whether the SBA

ultimately issues the SBIC license and the timing thereof; changes

in the markets in which Capital Southwest invests; changes in the

financial and lending markets; regulatory changes; tax treatment

and general economic and business conditions; and the other

risks detailed in Capital Southwest’s Form 10-K filed with the SEC

for the year ended March 31, 2024, in Capital Southwest’s quarterly

report on Form 10-Q for the quarter ended September 30, 2024 and in

other filings and reports that Capital Southwest may file from time

to time with the SEC. The forward-looking statements included in

this press release represent Capital Southwest’s views as of the

date of this press release. Capital Southwest anticipates that

subsequent events and developments will cause Capital Southwest’s

views to change. Capital Southwest undertakes no intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Forward-looking statements should not be relied upon as

representing Capital Southwest’s views as of any date subsequent to

the date of this press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial

Officer214-884-3829

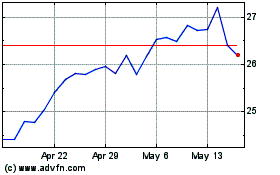

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Nov 2024 to Dec 2024

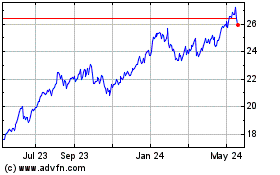

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2023 to Dec 2024